UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

THERMON GROUP HOLDINGS, INC. | ||

(Name of Registrant as Specified in its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box): | ||

þ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

Thermon Group Holdings, Inc.

7171 Southwest Parkway

Building 300 | Suite 200

Austin, Texas 78735

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held on July 22, 2020

To the stockholders of Thermon Group Holdings, Inc.:

Notice is hereby given that the 2020 Annual Meeting of Stockholders (the "2020 Annual Meeting") of Thermon Group Holdings, Inc., a Delaware corporation (the "Company," "Thermon," "we" or "our"), will be held on Wednesday, July 22, 2020, at 11:30 a.m. Central Time, at 100 Thermon Drive, San Marcos, Texas 78666 for the following purposes, as more fully described in the accompanying proxy statement (the "Proxy Statement"):

(1) | to elect the eight director nominees named in the Proxy Statement; |

(2) | to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2021; |

(3) | to approve, on a non‑binding advisory basis, the compensation of our Named Executive Officers, as described in the Proxy Statement; |

(4) | to approve the Thermon Group Holdings, Inc. 2020 Long‑Term Incentive Plan; and |

(5) | to transact such other business that may properly come before the 2020 Annual Meeting and any postponement or adjournment thereof. |

We are pleased to continue utilizing the United States Securities and Exchange Commission's "notice and access" rules. Accordingly, we are providing stockholders access to our proxy materials over the Internet, which reduces the cost and environmental impact of the 2020 Annual Meeting. On or about June 12, 2020, we began mailing a Notice of Internet Availability of Proxy Materials (the "Notice") to all stockholders of record as of June 1, 2020 (the "Record Date"). The Notice contains instructions on how to access our proxy materials as well as information on how to vote your shares. Only holders of record of our common stock as of the close of business on the Record Date are entitled to receive notice of, attend and vote at the 2020 Annual Meeting.

It is important that your shares are represented and voted at the meeting and, whether or not you expect to attend in person, we encourage you to vote as promptly as possible to ensure that your vote is counted. Thank you for your continued support.

Very truly yours,

John Nesser | Bruce Thames |

Chairman of the Board | President and Chief Executive Officer |

Austin, Texas

June 12, 2020

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE 2020 ANNUAL MEETING, WE ENCOURAGE YOU TO READ THE PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTE INSTRUCTIONS AS SOON AS POSSIBLE SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND SO THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. YOUR PROMPT ACTION WILL AID THE COMPANY IN REDUCING THE EXPENSE OF PROXY SOLICITATION.

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Stockholders of Thermon Group Holdings, Inc. to be Held on Wednesday, July 22, 2020: |

As permitted by rules adopted by the Securities and Exchange Commission, rather than mailing a full paper set of these proxy materials, we are mailing to many of our stockholders only a notice of Internet availability of proxy materials containing instructions on how to access these proxy materials and submit proxy votes online. |

The Notice, Proxy Statement and 2020 Annual Report are available at: http://www.proxyvote.com |

TABLE OF CONTENTS

Thermon Group Holdings, Inc.

7171 Southwest Parkway

Building 300 | Suite 200

Austin, Texas 78735

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 22, 2020

GENERAL INFORMATION

This proxy statement ("Proxy Statement") is being furnished in connection with the solicitation of proxies by the board of directors (the "Board") of Thermon Group Holdings, Inc. (the "Company," "Thermon," "we," "our," "us" and similar terms) on the Company's behalf for use at the 2020 Annual Meeting of Stockholders of the Company to be held at the 100 Thermon Drive, San Marcos, Texas 78666 on Wednesday, July 22, 2020 at 11:30 a.m. Central Time, and any adjournment or postponement thereof (the "2020 Annual Meeting").

Pursuant to provisions of our Second Amended and Restated Bylaws (the "Bylaws") and by action of our Board, the close of business on June 1, 2020 was established as the time and record date for determining the stockholders entitled to receive notice of, attend and vote at the 2020 Annual Meeting (the "Record Date").

As permitted by the rules adopted by the United States Securities and Exchange Commission (the "SEC"), we have elected to provide access to our proxy materials primarily via the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders of record as of the Record Date who are entitled to vote at the 2020 Annual Meeting. Instructions on how to access and review these proxy materials electronically, request hard copies of these materials and submit proxy votes online are stated in the Notice.

We began mailing the Notice to stockholders of record on or about June 12, 2020. We first made this Proxy Statement available to our stockholders at http://www.proxyvote.com on or about June 12, 2020, along with our Annual Report on Form 10-K for the fiscal year ended March 31, 2020, as filed with the SEC on June 1, 2020 (the "2020 Annual Report"). We encourage you to read the 2020 Annual Report. It includes our audited financial statements and provides information about our business.

How can I attend the 2020 Annual Meeting?

Only stockholders as of the Record Date are entitled to attend the 2020 Annual Meeting, which will be held on Wednesday, July 22, 2020 at the 100 Thermon Drive, San Marcos, Texas 78666. Doors will open at 11:00 a.m., Central Time, and the meeting will begin promptly at 11:30 a.m., Central Time.

What is the Company’s fiscal year?

The Company's fiscal year ends on March 31. In this Proxy Statement, we refer to the fiscal years ended March 31, 2018, 2019, 2020, 2021 and 2022 as "Fiscal 2018," "Fiscal 2019," "Fiscal 2020," "Fiscal 2021" and "Fiscal 2022," respectively. Unless otherwise stated, all financial information presented in this Proxy Statement is based on the Company’s fiscal calendar.

What items will be voted on at the 2020 Annual Meeting?

Stockholders may vote on the following proposals at the 2020 Annual Meeting:

• | the election to the Board of the eight director nominees named in this Proxy Statement; |

• | ratification of the appointment of KPMG LLP ("KPMG") as the Company’s independent registered public accounting firm for Fiscal 2021; |

1

• | the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers, as described in this Proxy Statement; and |

• | the approval of the Thermon Group Holdings, Inc. 2020 Long‑Term Incentive Plan (the "2020 LTIP"). |

The Company is not aware of any other business to be presented for a vote of the stockholders at the 2020 Annual Meeting. If any other matters are properly presented, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment. The chairman of the 2020 Annual Meeting may refuse to allow presentation of a proposal or nominee for the Board if the proposal or nominee was not properly submitted.

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

• | "FOR" the election to the Board of each of the eight director nominees named in this Proxy Statement; |

• | "FOR" ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for Fiscal 2021; and |

• | "FOR" the resolution to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in this Proxy Statement. |

• | "FOR" the resolution to approve the 2020 LTIP, as described in this Proxy Statement. |

Who may vote at the 2020 Annual Meeting?

Holders of our common stock on the Record Date are entitled to one vote for each share of the Company’s common stock held on the Record Date. As of the Record Date, there were 33,004,508 shares of the Company’s common stock issued and outstanding and approximately 15 stockholders of record.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If, on the Record Date, your shares were registered directly in your name with the Company’s transfer agent, Broadridge Financial Solutions, Inc. ("Broadridge"), you are considered the stockholder of record with respect to those shares, and the Notice was sent directly to you by Broadridge at the Company's request. If you request printed copies of the proxy materials by mail, you will receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If, on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in "street name," and the Notice was sent to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the 2020 Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Those instructions are contained in a "vote instruction form" to be sent to you by the organization that holds your shares.

What is the quorum requirement for the 2020 Annual Meeting?

The presence in person or by proxy of the holders of stock having a majority of the votes which could be cast by the holders of all outstanding stock entitled to vote at the 2020 Annual Meeting is required for the transaction of business. This is called a "quorum." If you: (i) are present and vote in person at the 2020 Annual Meeting, or (ii) have voted on the Internet, by telephone or by properly submitting a proxy card or vote instruction form by mail, your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against or abstained. Broker non-votes, as described below, will also be counted for purposes of determining whether a quorum is present. If a quorum is not present, the 2020 Annual Meeting will be adjourned until a quorum is obtained.

If I am a stockholder of record of the Company’s shares, how do I vote?

If you are a stockholder of record, there are four ways to vote:

• | In person. You may vote in person at the 2020 Annual Meeting. The Company will give you a ballot when you arrive. |

2

• | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice. |

• | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the proxy card. |

• | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided. |

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, there are four ways to vote:

• | In person. If you wish to vote in person at the 2020 Annual Meeting, you must obtain a "legal proxy" from the organization that holds your shares. A legal proxy is a written document that authorizes you to vote your shares held in street name at the 2020 Annual Meeting. Please contact that organization for instructions regarding obtaining a legal proxy. You must bring a copy of the legal proxy to the 2020 Annual Meeting and ask for a ballot from an usher when you arrive. You must also bring valid photo identification such as a driver's license or passport. In order for your vote to be counted, you must hand both the copy of the legal proxy and your completed ballot to an usher to be provided to the inspector of election. |

• | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the vote instruction form to be sent to you by the organization that holds your shares. The availability of Internet voting may depend on the voting process of the organization that holds your shares. |

• | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the vote instruction form. The availability of telephone voting may depend on the voting process of the organization that holds your shares. |

• | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the vote instruction form and sending it back in the envelope provided. |

Can I change my vote?

You may revoke your proxy and change your vote at any time prior to the vote at the 2020 Annual Meeting. Prior to the applicable cutoff time, you may enter a new vote by using the Internet or the telephone or by mailing a new proxy card or new vote instruction form bearing a later date (which will automatically revoke your earlier voting instructions). If you are a stockholder of record, you may accomplish this by granting a new proxy or by voting in person at the 2020 Annual Meeting. If you are a beneficial owner of shares held in street name, you may change your vote by submitting new voting instructions to your broker or nominee.

How are proxies voted?

All shares represented by valid proxies received prior to the 2020 Annual Meeting will be voted, and where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the 2020 Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the broker or nominee that holds your shares with specific voting instructions, the broker or nominee that holds your shares may generally vote your shares on "routine" matters but cannot vote your shares on "non-routine" matters. If the broker or nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, it will inform the inspector of election that it does not have the authority to vote on such matter with respect to your shares. This occurrence is referred to as a "broker non-vote." The only routine matter scheduled to be voted upon at the 2020 Annual Meeting is Proposal

3

No. 2 (to ratify the appointment of the Company’s independent registered public accounting firm for Fiscal 2021). All other matters scheduled to be voted upon are non-routine and therefore broker non-votes may exist in connection with Proposals No. 1 (to elect the eight director nominees named in this Proxy Statement), No. 3 (to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in this Proxy Statement), and No. 4 (to approve the 2020 LTIP, as described in this Proxy Statement). Therefore, if you hold your shares in street name through a broker or other nominee, it is critical that you instruct your broker or other nominee how to vote on Proposals No. 1, No. 3 and No. 4 if you want your vote to count.

What is the vote required for each proposal and how are abstentions and broker non-votes treated?

Proposal No. 1 (to elect the eight director nominees named in this Proxy Statement): Directors will be elected by a plurality of the votes cast at the 2020 Annual Meeting. The eight director nominees named in this Proxy Statement receiving the greatest number of affirmative votes of the shares entitled to be voted will be elected as directors to serve until the next annual meeting of stockholders, until his or her successor is elected and qualified or until his or her earlier death, resignation or removal. Broker non-votes are not considered votes cast on the matter and will have no effect on the outcome of this proposal. Our Corporate Governance Guidelines require any incumbent director who receives a greater number of votes "withheld" than votes "for" in an uncontested election to promptly submit a written offer of resignation to the Nominating and Corporate Governance Committee (the "N&CG Committee"), which will review and evaluate the offer of resignation and recommend to the Board whether to accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision and, if it rejects the resignation, the rationale behind such decision, within ninety (90) days after the election results for the 2020 Annual Meeting are certified.

Proposal No. 2 (to ratify the appointment of the Company's independent registered public accounting firm): Approval of Proposal No. 2 will require the affirmative vote by the holders of stock having a majority of the votes which could be cast by holders of shares: (i) present in person or by proxy at the 2020 Annual Meeting and (ii) entitled to vote on such matter. Abstentions will have the same practical effect as votes against the proposal. Proposal No. 2 is considered a routine matter; therefore, no broker non-votes are expected in connection with this proposal.

Proposal No. 3 (to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in this Proxy Statement): Approval of Proposal No. 3 will require the affirmative vote by the holders of stock having a majority of the votes which could be cast by the holders of shares: (i) present in person or by proxy at the 2020 Annual Meeting and (ii) entitled to vote on such matter. Abstentions will have the same practical effect as votes against the proposal. Broker non-votes are not considered entitled to vote on the matter and will have no effect on the outcome of this proposal.

Proposal No. 4 (to approve the 2020 LTIP, as described in this Proxy Statement): Approval of Proposal No. 4 will require the affirmative vote by the holders of stock having a majority of the votes which could be cast by the holders of shares: (i) present in person or by proxy at the 2020 Annual Meeting and (ii) entitled to vote on such matter. Abstentions will have the same practical effect as votes against the proposal. Broker non-votes are not considered entitled to vote on the matter and will have no effect on the outcome of this proposal.

Who will serve as the inspector of election?

Our Corporate Secretary or his designee will act as the inspector of election.

Where can I find the voting results of the 2020 Annual Meeting?

The preliminary voting results will be announced at the 2020 Annual Meeting. The final voting results will be tallied by the inspector of election and published in a Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the 2020 Annual Meeting.

Who is paying for the cost of this proxy solicitation?

The Company is paying the costs of the solicitation of proxies. In addition to solicitation by mail, proxies may be solicited personally or by telephone, facsimile, email or other means by our directors, officers or regular employees on the Company’s behalf. Upon request, we will also reimburse brokerage firms, banks, broker-dealers or other similar organizations and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for sending proxy and solicitation materials to beneficial owners of stock.

4

What is householding?

SEC rules allow us to deliver a single Notice to one physical address shared by two or more of our stockholders. This delivery method is referred to as "householding" and can result in significant cost savings. To take advantage of this opportunity, we will deliver only one Notice to multiple stockholders who share an address, unless we have received different instructions from the affected stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate Notice, as requested, to any stockholder at the shared address to which a single copy was delivered. If you prefer to receive a separate copy of the Notice, contact: Thermon Group Holdings, Inc., 7171 Southwest Parkway, Building 300, Suite 200, Austin, Texas 78735, Attention: General Counsel, Telephone: (512) 690-0600.

Will any other matters be acted on at the 2020 Annual Meeting?

As of the date these proxy materials were mailed, we are not aware of any other matters to be presented at the 2020 Annual Meeting other than the proposals described herein. If you grant a proxy, the persons named as proxy holders will vote your shares on any additional matters properly presented for a vote at the meeting as recommended by the Board or, if no recommendation is given, in their own discretion.

Whom should I call with other questions?

If you have additional questions about these proxy materials or the 2020 Annual Meeting, please contact: Thermon Group Holdings, Inc., 7171 Southwest Parkway, Building 300, Suite 200, Austin, Texas 78735, Attention: General Counsel, Telephone: (512) 690-0600.

5

DIRECTORS AND EXECUTIVE OFFICERS

Directors

Our Board currently consists of nine directors with each director serving a one-year term expiring at the 2020 Annual Meeting. The authorized number of directors is presently fixed at nine (9) and will be reduced to eight (8) following the conclusion of the 2020 Annual Meeting. Mr. Sorrentino will not stand for re-election at the 2020 Annual Meeting in compliance with the mandatory retirement provisions of the Company's corporate governance guidelines (the "Director Retirement Policy"). Our Board historically has maintained a composition of eight (8) directors, subject to expansion in order to permit the orderly succession of directors.

Upon the recommendation of the N&CG Committee, the Board has nominated each of John U. Clarke, Linda A. Dalgetty, Roger L. Fix, Marcus J. George, Kevin J. McGinty, John T. Nesser, III, Michael W. Press and Bruce A. Thames for re-election at the 2020 Annual Meeting. Each of the directors elected at the 2020 Annual Meeting will serve a one-year term expiring at the 2021 Annual Meeting of Stockholders (the "2021 Annual Meeting") and will hold office until his or her successor has been elected and qualified or until the director's earlier death, resignation or removal.

Name | Position | Age1 | Director Since | Tenure1 | ||||

John U. Clarke | Director | 67 | 2019 | 1 | ||||

Linda A. Dalgetty | Director | 58 | 2018 | 2.2 | ||||

Roger L. Fix | Director | 67 | 2019 | 1 | ||||

Marcus J. George | Director | 50 | 2010 | 10.3 | ||||

Kevin J. McGinty | Director | 71 | 2012 | 8.2 | ||||

John T. Nesser, III | Director | 71 | 2012 | 8.2 | ||||

Michael W. Press | Director | 73 | 2011 | 9.2 | ||||

Bruce A. Thames | Director, President and Chief Executive Officer | 57 | 2016 | 4.3 | ||||

(1) | Age and tenure presented in number of years as of the date of the 2020 Annual Meeting. |

Each of the nominees has indicated his or her willingness to serve, if elected, but if any of the nominees should be unable or unwilling to serve at the time of the 2020 Annual Meeting, the Board may either reduce its size, or designate or not designate a substitute nominee. If the Board designates a substitute nominee, proxies that would have been cast for the original nominee will be cast for the substitute nominee, unless instructions are given to the contrary. The biographies below describe the skills, qualifications, attributes and experience of each of the nominees that led the Board to determine that it is appropriate to nominate each director.

John U. Clarke has served as director since July 2019. Mr. Clarke currently serves as a partner of Turnbridge Capital, LLC, a private equity firm investing in companies focused primarily on energy services and equipment and infrastructure, a position that he has held since 2011. From 2004 through 2009, Mr. Clarke served as the chief executive officer and executive chairperson of NATCO Group, Inc. (“NATCO”), a publicly traded oilfield equipment manufacturer and related services provider. During a two decade period beginning in the mid-1970s, Mr. Clarke served as the Chief Financial Officer or otherwise as a senior executive in several large, publicly traded, energy-related companies, including Transco Energy Company, Cabot Oil & Gas Corp., and Dynegy Inc. Mr. Clarke also served as a Managing Director of Simmons & Company from 1996 to 1997. Previously, Mr. Clarke has served as a director of Glori Energy, Inc. from 2011 to 2015, Tesco Corporation from 2011 to 2013 and Penn Virginia Corporation from 2009 to 2016. Mr. Clarke earned a B.A. in Economics from The University of Texas and a M.B.A. from Southern Methodist University. Mr. Clarke brings to the Board a wealth of managerial experience in publicly traded companies, including as both a chief executive officer and chief financial officer.

Linda A. Dalgetty has served as a director since May 2018. Ms. Dalgetty is currently Vice President, Finance and Services at the University of Calgary, a position she has held since July 2014. In her role at the University of Calgary, she has direct responsibility for a large portfolio of university departments, including finance, human resources, information technology, risk, ancillary operations and internal audit. Prior to joining the University of Calgary in 2014, Ms. Dalgetty served as Senior Vice President and Chief Financial Officer of Saxon Energy Services, Inc. from 2013 to 2014, during which time she was responsible for all of the financial functions of a global organization, including reporting, planning, operational accounting and information technology. Prior to her role at Saxon, Ms. Dalgetty served from 1995 to 2013 in various roles of increasing responsibility at Nutrien Ltd. (NYSE:NTR) (formerly, Agrium Inc. ("Agrium")) and Agroservicios Pampeanos SA (a wholly-owned Argentinian subsidiary of

6

Agrium), with her final role being Agrium's Chief Information Officer. Ms. Dalgetty began her early career working as an audit manager with Ernst & Young LLP from 1989 to 1995. Ms. Dalgetty holds a bachelor of commerce degree from the Haskayne School of Business at the University of Calgary. She is also a chartered accountant and earned an associate diploma in agribusiness from the University of Guelph. Ms. Dalgetty brings broad-based North American and international financial expertise and business experience to the Board. In addition, Ms. Dalgetty has led crisis management efforts related to cybersecurity matters.

Roger L. Fix has served as director since July 2019. Mr. Fix currently serves as the non-executive chairman of the board of Flowserve Corporation (“Flowserve”), an international supplier of engineered pumps, valves, automation, and services to the oil, gas, chemical, power and other general industries, a position he has held since 2017. Mr. Fix served as the President and Chief Executive Officer of Standex International Corporation (“Standex”), a publicly traded diversified manufacturing and marketing company from 2003 until his retirement in 2014. He was Standex’s Chief Operating Officer from 2001 to 2002. Mr. Fix served on the Standex board of directors from 2001 to 2017 and was non-executive chairman of Standex from 2014 to 2016. Before joining Standex, he was employed by Outboard Marine Corporation, a marine manufacturing company, as Chief Executive Officer and President from 2000 to 2001 and Chief Operating Officer and President during 2000. He served as Chief Executive Officer of John Crane Inc., a global manufacturer of mechanical seals for pump and compressor applications in the process industry, from 1998 to 2000 and as its President - North America from 1996 to 1998. He was President of Xomox Corporation, a manufacturer of process control valves and actuators, from 1993 to 1996. Mr. Fix has served as a director of Commercial Vehicle Group, Inc. since 2014 and of Flowserve since 2006. Mr. Fix holds a M.S. in Mechanical Engineering from The University of Texas at Austin and a B.S. in Mechanical Engineering from the University of Nebraska. Mr. Fix brings a wealth of experience in industrial manufacturing and international business to the Board as well as significant experience as a chief executive officer of a publicly traded company.

Marcus J. George has served as a director since April 2010. In 2015, Mr. George co-founded and is currently a partner at Onward Capital LLC ("Onward Capital"), a private equity firm focused on investing in and growing lower middle market industrial businesses. Mr. George has served on the board of directors of Domaille Engineering LLC, a privately held technology company providing creative engineering, manufacturing and supply chain management solutions for many different markets, since November 2016. Mr. George previously served as a partner at the private equity firm CHS Capital LLC ("CHS") until March 2015. CHS is one of our former private equity sponsors. Mr. George joined CHS in 1997 and was promoted to partner in 2007. Prior to joining CHS, Mr. George was employed by Heller Financial, Inc. in the corporate finance group. He was also an associate at KPMG from 1991 to 1993. Mr. George previously served as a director of GSE Holdings, Inc. ("GSE"), a global provider of engineered geosynthetic containment solutions for environmental protection and confinement applications, from June 2011 to August 2014, Dura-Line Holdings, Inc., Waddington North America, Inc. and KB Alloys, LLC. Mr. George holds a B.B.A. from the University of Notre Dame and a M.B.A. from the University of Chicago. We believe that Mr. George's substantial experience in private equity investments focused on infrastructure and industrial products and financial and capital markets matters bring important and valuable skills to the Board.

Kevin J. McGinty has served as a director since June 2012. Mr. McGinty currently serves the private investment firm Ursula Capital Partners as a special limited partner, a position that he has held since 2017. He is also a retired senior advisor of Peppertree Capital Management, Inc. ("Peppertree"), a private equity fund management firm from which he retired in 2015. Prior to founding Peppertree in January 2000, he served as a managing director of Primus Venture Partners from 1990 to 1999. In both organizations, Mr. McGinty was involved in private equity investing, both as a principal and as a limited partner. From 1970 to 1990, Mr. McGinty was employed by Society National Bank, now KeyBank, N.A., where in his final position he was an executive vice president. Mr. McGinty has over 40 years of experience in the banking and private equity industries, including 20 years as an officer of a bank and 20 years serving in the role of managing director for a variety of private equity firms. Mr. McGinty previously served as a director of Marlin Business Services, Inc. (NASDAQ:MRLN) from February 1998 to 2014. He also has 25 years of experience serving as a director of privately held companies. Mr. McGinty has also held leadership positions with various cultural and community organizations. Mr. McGinty received his undergraduate degree in economics from Ohio Wesleyan University and his M.B.A. in finance from Cleveland State University. The Board views Mr. McGinty’s independence, his banking experience, his experience in private equity, capital markets and mergers and acquisitions, as well as his experience as a director of other companies and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience for serving as a director.

John T. Nesser, III has served as a director since June 2012 and has been our independent chairman of the Board ("Chairman") since July 2019. Since July 2013, Mr. Nesser has served as the co-founder, manager, co-chief executive officer and director of All Coast, LLC ("All Coast"). Following its acquisition of Hercules Offshore Domestic Liftboat Fleet in July 2013, All Coast owns and operates the largest fleet of liftboats for the offshore oil and gas market in the Gulf of Mexico. Mr. Nesser retired as executive vice president and chief operating officer of McDermott International, Inc. (NYSE:MDR) ("McDermott") in 2011. He joined McDermott, a global engineering, procurement, construction and installation company, with a focus on the energy industry, as associate general counsel in 1998 and spent over ten years in various senior management roles, including as general counsel,

7

chief administrative officer and chief legal officer. Previously, he served as a managing partner of Nesser, King & LeBlanc, a New Orleans law firm, which he co-founded in 1985. Mr. Nesser served as a director of Layne Christensen Company (NASDAQ:LAYN) from August 2013 until its acquisition by Granite in June 2018. Mr. Nesser is a member of the Texas and Louisiana Bar Associations (inactive) and is also a member of the Louisiana State University Law Center Board of Trustees. Mr. Nesser holds a B.S. in Business Administration, majoring in finance, and a J.D. from Louisiana State University. We believe that Mr. Nesser’s significant prior experience in the roles of chief operating officer and general counsel and his legal, corporate governance and operational backgrounds make a significant contribution to the Board’s current mix of skills and experience and qualify him to be a director.

Michael W. Press has served as a director since the completion of the Company's initial public offering of common stock ("IPO") in May 2011. He is a retired chief executive officer of KBC Advanced Technologies PLC (LSE:KBC), a publicly traded international petroleum and petrochemicals consulting and software firm, a position he held from 1997 to 2001. Since 2001, Mr. Press has served on various boards of directors and worked with a number of private equity backed companies in the United States, Europe and Asia, often in preparation for a public listing or sale. He served on the board of directors of Chart Industries, Inc. (NASDAQ:GTLS) from 2006 to 2016. He also served on the board of directors of Lamprell plc (LSE:LAM), a provider of diversified engineering and contracting services to the onshore and offshore oil & gas and renewable energy industries, from 2013 to 2015. Mr. Press previously served as a director and senior independent director of Petrofac, Ltd. (LSE:PFC) from 2002 to 2010. He holds a B.S. from Colorado College, a M.S. from Columbia University and an Advanced Management Program degree from Stanford University. Mr. Press brings to the Board substantial experience as a director and executive officer of publicly held companies and over 30 years of international energy industry experience, including senior executive positions at The Standard Oil Company, British Petroleum plc, BP America and Amerada Hess Corporation. He also has significant manufacturing, operations, finance, corporate governance and corporate development experience gained from serving on 18 public and private boards both in the United States and internationally.

Bruce A. Thames joined the Company in April 2015 as Executive Vice President and Chief Operating Officer. He was promoted to President and Chief Executive Officer and appointed as a member of the Board on April 1, 2016. Prior to joining Thermon, Mr. Thames was Senior Vice President and Chief Operating Officer of TD Williamson in Tulsa, Oklahoma, a position he held since 2012. TD Williamson manufactures and delivers a portfolio of solutions to the owners and operators of pressurized piping systems for onshore and offshore applications. He joined TD Williamson in 2005 as Vice President, North America and also served as Vice President and General Manager, Eastern Hemisphere from 2010 to 2012. Mr. Thames began his career with Cooper Industries (formerly Intool), where he spent twelve years in various roles within the product engineering, marketing and operations groups. Mr. Thames then joined GE Energy (formerly Dresser Flow Solutions) ("Dresser") and served primarily as the Director of North American Operations and Product Director for Ball Valves globally for Dresser's Valve Group during his tenure from 2002 to 2005. Mr. Thames holds a B.S. in Mechanical Engineering from The University of Texas at Austin. Mr. Thames brings extensive leadership skills, international acumen, product innovation and industry knowledge to the Board.

8

Executive Officers

The following table and biographies set forth certain information about our current executive officers (collectively, the "Executive Officers"). Information pertaining to Mr. Thames, who is currently both a director and an executive officer of the Company, may be found in the section above entitled "Directors and Executive Officers — Directors."

Executive Officer | Title | Age as of the 2020 Annual Meeting | ||

Bruce Thames | President & Chief Executive Officer | 57 | ||

Jay Peterson | Chief Financial Officer | 63 | ||

David Buntin | Senior Vice President, Thermon Heat Tracing | 50 | ||

Thomas Cerovski | Senior Vice President, Global Sales | 48 | ||

Kevin Fox | Vice President, Corporate Development | 36 | ||

Candace Harris-Peterson | Vice President, Human Resources | 41 | ||

James Pribble | Senior Vice President, Thermon Heating Systems | 45 | ||

Mark Roberts | Senior Vice President, Global Engineering and Project Services | 59 | ||

Johannes (René) van der Salm | Senior Vice President, Global Operations | 56 | ||

Ryan Tarkington | General Counsel & Corporate Secretary | 39 | ||

Jay Peterson joined the Company in July 2010 as Chief Financial Officer and Senior Vice President, Finance. Prior to joining Thermon, Mr. Peterson held positions as Chief Financial Officer, Vice President of Finance, Senior Director of Finance, Secretary and Treasurer at Asure Software, Inc. (NASDAQ:ASUR) (formerly Forgent Networks, Inc.) ("Forgent"). Mr. Peterson started with Forgent in 1995 and was named Chief Financial Officer in 2001. Before joining Forgent, Mr. Peterson was Assistant Controller in Dell Computer Corporation’s $1 billion Direct division. He also spent 11 years in various financial management positions with IBM Corporation (NYSE:IBM). Mr. Peterson holds a B.A. and a M.B.A. from the University of Wisconsin.

David Buntin joined the Company in January 2017 as Senior Vice President, Research and Development. In May 2019, Mr. Buntin was promoted to Senior Vice President, Thermon Heat Tracing. Prior to joining the Company, from 2007 to 2016, Mr. Buntin served first as Vice President, Engineering and R&D, and then as Chief Operating Officer for Enovation Controls, Inc., a company that provides instrumentation, displays, controls, and fuel systems for natural gas engines and compressors as well as industrial and marine equipment. Before joining Enovation Controls, Inc., from 1998 to 2007, Mr. Buntin served as the Vice President of Engineering for SecureLogix Corporation, a successful high-tech startup providing telephony and voice-over-IP security solutions. Prior to SecureLogix Corporation, from 1994 to 1998, Mr. Buntin served in various engineering roles of increasing responsibility with Southwest Research Institute. Mr. Buntin holds a B.S. in electrical engineering from Baylor University and a M.S. in electrical engineering from Texas A&M University.

Thomas Cerovski joined the Company in January 2019 as Senior Vice President, Global Sales, where Mr. Cerovski manages the Company's profit and loss business units and commercial organization. Prior to joining the Company, from 2018 until 2019, Mr. Cerovski was the Senior Vice President, Global Sales and Business Development for Trojan Battery Company, a leading manufacturer of deep-cycle batteries. From 2013 through 2018, Mr. Cerovski held various positions at Dover Corporation, a conglomerate manufacturer of industrial products, including Vice President and General Manager, Dispenser Business Unit, and Vice President, Product and Technology Services, Wayne Fueling Systems. Prior to joining Dover Corporation, Mr. Cerovski served for fourteen (14) years in various positions with General Electric Company. Mr. Cerovski began his career at the Nuclear Regulatory Commission. Mr. Cerovski brings more than twenty-five (25) years of energy industry leadership experience in positions ranging from engineering, product management, sales, business development, and business unit management. Mr. Cerovski holds a B.S. from Montana State University, a M.S from Purdue University, and a M.B.A. from George Washington University.

Kevin Fox joined the Company in March 2019 as Vice President, Corporate Development. In this role, Mr. Fox manages the Corporate Development, Investor Relations and the global Marketing activities of the Company. Prior to joining Thermon, Mr. Fox served in various roles of increasing responsibility in strategy, corporate development and finance with General Electric Company from 2006 to 2019. Mr. Fox holds a B.A. from Boston College and a M.B.A. from Northwestern University’s Kellogg School of Management.

Candace Harris-Peterson joined the Company in January 2017 as Vice President of Human Resources. Prior to joining the Company, from 2006 to 2016, Ms. Harris-Peterson was the Senior Business Partner, Global Sales and Services for TD Williamson,

9

Inc., a global solutions provider to the owners and operators of pressurized piping systems for onshore and offshore applications. Ms. Harris-Peterson holds a B.A. in organizational leadership from Chapman University in Orange, California.

James Pribble joined the Company in May 2016 as Senior Vice President of Global Corporate Development, where Mr. Pribble led the Company's mergers and acquisitions, product management, and marketing functions. In 2017, Mr. Pribble was promoted to Senior Vice President, Thermon Heating Systems. Prior to joining the Company, from 2011 to 2016, Mr. Pribble served in various roles at FMC Technologies, Inc., a global market leader in subsea systems, including President and General Manager of Direct Drive Systems, Inc., a wholly-owned subsidiary of FMC Technologies, Inc., and the Director of Strategy and Business Development for FMC Technologies Emerging Technologies Businesses. Prior to joining FMC Technologies, Inc., Mr. Pribble was a U.S. Naval Officer and pilot. Mr. Pribble holds a B.S. in marine transportation from the U.S. Merchant Marine Academy and a M.B.A. from Duke University's Fuqua School of Business.

Mark Roberts joined the Company in October 2016 as Vice President of Global Engineering and Project Services. Prior to joining the Company, from September 2011 to September 2015, Mr. Roberts served as Vice President, Executive Vice President and President of Audubon Engineering Company, LLC, a professional Engineering Firm. During his thirty-five (35) year career in the energy industry, Mr. Roberts has held executive and management positions within technical sales, business development, engineering and business unit management. Mr. Roberts holds a B.S. in chemical engineering from The University of Texas at Austin.

Johannes (René) van der Salm joined the Company in October 2001 as European Logistics Manager based at the Company's European headquarters in Pijnacker, the Netherlands. In 2006, Mr. van der Salm was promoted to Vice President, Manufacturing and Logistics. During that period, he divided his time between the Company's offices in the United States and Europe. In 2007, Mr. van der Salm was promoted to Senior Vice President, Operations and permanently relocated to Texas. He was instrumental in the global implementation of the Company’s enterprise resource planning software. In 2011, Mr. van der Salm was promoted to Senior Vice President, Global Operations. After completing his undergraduate studies and a period of military service, Mr. van der Salm worked in a number of positions within the petrochemical industry prior to joining Thermon, including as a sales engineer, a project manager and a production manager. Mr. van der Salm holds a B.S. in mechanical engineering from Amsterdam Technical University.

Ryan Tarkington joined the Company in February 2019 as General Counsel and Corporate Secretary. Prior to joining the Company, from 2011 to 2019, Mr. Tarkington served in various capacities with several international companies in the offshore drilling industry, including as Senior Counsel for Rowan Companies plc from 2017 through 2019, as Associate General Counsel for Paragon Offshore plc from 2014 through 2017 and as Senior Counsel for Transocean Ltd. from 2011 through 2014. Mr. Tarkington began his career at the law firm of Vinson & Elkins L.L.P. Mr. Tarkington holds a B.A. from Rice University and a J.D. from The University of Texas School of Law.

10

CORPORATE GOVERNANCE

The Board oversees the Company’s Chief Executive Officer and other senior management in the competent and ethical operation of the Company and works to serve the long-term interests of stockholders. The key practices and procedures of the Board are outlined in the Corporate Governance Guidelines and the Code of Business Conduct and Ethics, both available on the Company’s website at http://ir.thermon.com/corporate-governance. Stockholders can also obtain a free copy of either document by writing to the General Counsel, Thermon Group Holdings, Inc., 7171 Southwest Parkway, Building 300, Suite 200, Austin, Texas 78735.

During Fiscal 2020, the full Board met five (5) times. Each member of the Board attended or participated in 75% or more of the aggregate of: (i) the total number of meetings of the Board (held during the period for which such person has been a director); (ii) the total number of subcommittee meetings of the Board or one of its committees on which such person served; and (iii) the total number of meetings held by all committees of the Board on which such person served (during the periods that such person served) during Fiscal 2020.

Our Corporate Governance Guidelines require any incumbent director who receives a greater number of votes "withheld" than votes "for" in an uncontested election to promptly submit a written offer of resignation to the N&CG Committee, which will review and evaluate the offer of resignation and recommend to the Board whether to accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision and, if it rejects the resignation, the rationale behind such decision, within ninety (90) days after the election results for the 2020 Annual Meeting are certified.

We recognize the importance of new ideas, perspectives, independence and skills with respect to the Board and recognize the importance of utilizing Board refreshment to achieve such goals. In January 2018, in furtherance of these goals, the Board approved amendments to our Corporate Governance Guidelines implementing a mandatory retirement age and maximum tenure for non-executive directors. Non-executive directors shall submit an offer of resignation to the N&CG Committee to become effective immediately prior to the Company's annual stockholder meeting following the director's attainment of age seventy-five (75) or following fifteen (15) years of service to the Board, whichever comes earlier. The Board will generally not nominate such directors for re-election; however, on the recommendation of the N&CG Committee, the Board may reject such offers of resignation on a case-by-case basis if the Board determines an exception is in the best interests of the Company and its stockholders. The Board also believes that these amendments to the Corporate Governance Guidelines will promote orderly succession planning for our non-executive directors.

There are no family relationships between any director, executive officer or person nominated by the Board to become a director or executive officer.

Board Leadership Structure and Executive Sessions

In July 2019, the Board appointed Mr. Nesser as its independent Chairman. The Board believes that its current leadership structure best serves the objectives of the Board’s oversight of management, the ability of the Board to carry out its roles and responsibilities on behalf of the stockholders and the Company’s overall corporate governance. The Board also believes that the current separation of the Chairman and Chief Executive Officer roles allows the Chief Executive Officer to focus his time and energy on operating and managing the Company while leveraging the experience and perspectives of the Chairman. However, the Board periodically reviews our leadership structure and may make changes in the future.

In accordance with the listing standards of The New York Stock Exchange (the "NYSE") and our Corporate Governance Guidelines, the independent directors meet in regularly scheduled executive sessions, generally following each quarterly Board meeting and at other times as necessary. The executive sessions are chaired by the Chairman.

Director Independence

The Board reviews the independence of each director annually. In determining the independence of our directors, the Board considered Section 303A of the NYSE rules, applicable SEC rules as well as all relevant facts and circumstances, including, among other things, the types and amounts of commercial dealings between the Company and companies and organizations with which the directors are affiliated. Based on the foregoing criteria, the Board has affirmatively determined that Ms. Dalgetty, and Messrs. Clarke, George, Fix, McGinty, Nesser, Press and Sorrentino are independent. Mr. Thames, the Company's President and Chief Executive Officer, is not an independent director by virtue of his employment with the Company.

11

There were no transactions, relationships or arrangements with respect to any independent director that required review by our Board for purposes of determining director independence. The Board found that none of the independent directors had a material or other disqualifying relationship with the Company. The Board's four standing committees, Audit, Compensation, Finance, and N&CG, were comprised solely of independent directors during Fiscal 2020, as discussed in further detail below.

In recommending that each director and nominee be deemed independent, the N&CG Committee, and the Board when making its determination, noted that certain of our directors have relationships with, serve on boards of directors of, or own minor interests in, entities with which we may do business. For example, Mr. Fix is a director of Flowserve Corporation, which purchases products from the Company in the ordinary course of business. The annual payments made by Flowserve to the Company constituted less than 1% of Flowserve’s gross revenues.

Committees of the Board

The Board currently has four standing committees: the Audit Committee, the Compensation Committee, the Finance Committee and the N&CG Committee. Each of the Audit, Compensation, Finance, and N&CG Committees operates under a written charter adopted by the Board. Each committee charter is posted and available on the Company’s website at http://ir.thermon.com/corporate-governance. Current committee composition and the number of committee meetings held during Fiscal 2020 are as follows:

Director | Audit Committee | Compensation Committee | Finance Committee9 | Nominating and Corporate Governance Committee | ||||

John U. Clarke1 | Member | Member | — | Chair | ||||

Linda A. Dalgetty | Chair | — | — | Member | ||||

Roger L. Fix2 | — | Member | Member | Member | ||||

Marcus J. George3 | — | Member | Chair | — | ||||

Kevin J. McGinty4 | — | Chair | Member | — | ||||

John T. Nesser, III5 | — | — | — | — | ||||

Michael W. Press6 | Member | — | Member | Member | ||||

Charles A. Sorrentino7 | Member | — | — | Member | ||||

Bruce A. Thames | — | — | — | — | ||||

Number of Committee Meetings Held8 | 12 | 5 | 3 | 5 | ||||

(1) | Mr. Clarke became a member of the Audit, Compensation and N&CG Committees upon his appointment to the Board on July 25, 2019. Mr. Clarke became the Chair of the N&CG Committee on May 21, 2020. |

(2) | Mr. Fix became a member of the Compensation, Finance and N&CG Committees upon his appointment to the Board on July 25, 2019. |

(3) | Mr. George served as a member of the Compensation Committee until July 25, 2019, and rejoined the Compensation Committee on May 21, 2020. Mr. George served as a Member of the Audit Committee until May 21, 2020. |

(4) | Mr. McGinty served as a member of the Audit Committee until July 25, 2019. Mr. McGinty joined the Finance Committee and became the Chair of the Compensation Committee on July 25, 2019. |

(5) | Mr. Nesser became Chairman on July 25, 2019. Mr. Nesser served as the Chair of the Compensation Committee and as a member of the N&CG Committee until July 25, 2019. |

(6) | Mr. Press served on the Compensation Committee until May 21, 2020. Mr. Press joined the Audit Committee on May 21, 2020. |

(7) | Mr. Sorrentino served as Chairman and as a member of the Compensation Committee and N&CG Committee until July 25, 2019. |

(8) | In addition to taking action at meetings, each committee and the Board may periodically act by written consent. |

(9) | The Finance Committee was formed by the Board on July 25, 2019. |

Audit Committee

The Audit Committee has responsibility for, among other things, reviewing our financial reporting and other internal control processes, our financial statements, the independent auditors’ qualifications and independence, the performance of our internal audit function and independent auditors, and our compliance with legal and regulatory requirements and our Code of Business Conduct and Ethics. The Board has determined that each of Ms. Dalgetty and Messrs. Clarke, George, Press and Sorrentino is financially literate and qualified to address any issues that are likely to come before the Audit Committee, including the evaluation of our financial statements and supervision of our independent auditors. The Board also determined that each of Ms. Dalgetty and Messrs. Clarke, George, Press and Sorrentino meets the additional criteria for independence of audit committee members under Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the rules of the

12

NYSE. For Fiscal 2020, the Board determined that Ms. Dalgetty qualified as an "audit committee financial expert" as such term is defined in Item 407(d)(5)(ii) of Regulation S-K based on her education, experience and status as a chartered accountant.

Compensation Committee

The Compensation Committee has responsibility for, among other things, reviewing and recommending policies relating to compensation and benefits of our executive officers, including: reviewing and approving corporate goals and objectives relevant to the compensation of the Chief Executive Officer and the other Executive Officers, evaluating the performance of these officers in light of those goals and objectives and setting compensation of these officers based on such evaluations. The Compensation Committee also has responsibility for management succession planning. The Compensation Committee may delegate its authority to one or more subcommittees of the Compensation Committee. The Compensation Committee also oversees our equity and incentive-based plans and administers the issuance of stock options, restricted stock units, performance stock units and other awards with respect to our Executive Officers and other employees. The Compensation Committee also reviews and evaluates its performance and the performance of each of its members, including compliance of the Compensation Committee with its charter, and prepares the Compensation Committee report required under SEC rules. The report of the Compensation Committee is included in this Proxy Statement. The Compensation Committee has the authority to engage independent advisors, such as compensation consultants, to assist it in carrying out its responsibilities. The Compensation Committee, at present, engages an outside consultant on a regular basis to advise the Compensation Committee on the Company's executive compensation program. The Board has determined that each of Messrs. Clarke, Fix, George, McGinty and Press is independent under the heightened independence standards applicable to Compensation Committee members under the NYSE rules and Rule 10C-1 under the Exchange Act. In addition, each member of the Compensation Committee also meets the definition of "non-employee director" under Rule 16b-3 under the Exchange Act.

Finance Committee

The Board formed the Finance Committee in July 2019. The Finance Committee has responsibility for, among other things, reviewing the Company’s financial affairs; providing advice and counsel to the Company’s management regarding potential major transactions, such as mergers, acquisitions, reorganizations or divestitures; making recommendations to the Board regarding dividend, financing and financial policies; reviewing the financial exposure of the Company together with risk mitigation strategies; monitoring the Company’s investor relations program; and assisting the Board in fulfilling its oversight responsibilities with respect to the review of major transactions. The Board has determined that each of Messrs. Fix, George, McGinty and Press is independent under the rules of the NYSE.

Nominating & Corporate Governance Committee

The N&CG Committee has responsibility for, among other things, identifying, evaluating and recommending nominees for appointment or election as directors, including director nominees recommended by stockholders, developing and recommending a set of corporate governance guidelines, considering and approving director compensation and overseeing the evaluation of our Board and its committees. The N&CG Committee also oversees our equity plans and administers the issuance of equity awards with respect to our non-executive directors. In addition, the N&CG Committee has responsibility for non-executive director succession planning. The Board has determined that each of Ms. Dalgetty and Messrs. Clarke, Fix, Press and Sorrentino is independent under the rules of the NYSE.

Director Qualifications

The Company has not established specific minimum education, experience or skill requirements for potential Board or committee members. In general, the N&CG Committee and the Board will consider, among other qualifications and characteristics, a candidate's work and other experience, character, background, ability to exercise sound judgment, integrity, ability to make independent analytical inquiries, problem-solving skills, diversity, age, demonstrated leadership, work ethic, other skills (including financial literacy), understanding of the Company’s business environment, willingness and capacity to devote adequate time to Board duties, independence and potential conflicts of interest. We expect that qualified candidates will have senior leadership experience in a complex and global organization and will be able to represent the interests of the stockholders as a whole and not just certain special interest groups or constituencies. Each individual is evaluated in the context of the Board as a whole with the objective of retaining a group with diverse and relevant experience that can best perpetuate the Company’s success and represent stockholder interests through sound judgment. The N&CG Committee actively maintains a director skills matrix to help monitor the current qualifications and characteristics of the Board as a whole. The N&CG Committee utilizes this skills matrix in identifying what skills, qualifications or characteristics are desirable in assessing new director candidates

13

and planning for director succession. When current Board members are considered for nomination for re-election, the N&CG Committee also takes into consideration their prior Board contributions, performance, meeting attendance and participation in continuing education activities.

The N&CG Committee may (but is not required to) identify nominees based upon suggestions by directors, management, outside consultants, including third-party search firms, and stockholders. Before considering any nominee, the N&CG Committee makes a preliminary determination as to the need for additional members of the Board. If a need is identified, members of the N&CG Committee discuss and evaluate possible candidates to explore in more depth and/or retain a third-party to conduct a search for qualified individuals. Once one (or more) candidate(s) is identified for further consideration, members of the N&CG Committee, as well as other members of the Board and management, as appropriate, interview the nominee(s). After completing this evaluation, the N&CG Committee makes a final recommendation and refers the nominee(s) to the full Board for consideration. The Board then makes a final determination as to director nominations and/or appointments.

The N&CG Committee and the Board will consider candidates recommended by stockholders in the same manner as other candidates. Stockholders may nominate candidates to serve as directors in accordance with the advance notice, proxy access and other procedures contained in our Bylaws.

Diversity

We are committed to cultivating a highly capable and diverse Board to represent the interests of our stockholders. Although the Board does not have a formal diversity policy, it construes diversity to mean a variety of opinions, perspectives, expertise, personal and professional experiences and backgrounds, including gender, race, age, culture and ethnicity, as well as other differentiating characteristics. The Board believes that diversity and variety of points of view contribute to a more effective decision-making process. When recommending director nominees for election, the Board and the N&CG Committee focus on how the experience and skill set of each director nominee complements those of fellow director nominees to create a balanced Board with diverse viewpoints and deep expertise. Our Board currently includes one African-American member and one female member. In selecting potential candidates for director succession purposes, our Board is committed to ensuring that the pool for director candidates includes candidates with diversity of race, ethnicity and gender in order to build on this diversity. The Board has begun a process for identifying gender diverse candidates for recruitment and intends to begin the recruitment of those identified diverse candidates for succession purposes in the next twelve to eighteen months.

In addition, the Board and its committees engage in annual self-evaluations that include evaluations of diversity as well as the overall effectiveness of the Board and its committees. The N&CG Committee also maintains an experience matrix to help identify potential gaps in skills, qualifications, experience or diversity across the Board as a whole.

Sustainability

Information about the Company’s sustainability efforts is available on our website located at http://ir.thermon.com/sustainability, which provides information on the Company's policies, social impact and environmental programs, as well as sustainability strategy, data and reporting. The information contained on, or that may be accessed through, the Company's websites is not incorporated by reference into, and is not a part of, this Proxy Statement.

Proxy Access

On June 15, 2017, the Board approved the Second Amended and Restated Bylaws (the "Bylaws") of the Company, implementing proxy access. The Board believes that the majority of the Company's stockholders generally support the concept of proxy access; however, the Board recognizes that stockholders are not unanimous in this view nor the specific terms under which proxy access should be adopted. The Company's proxy access provisions permit a stockholder, or group of up to twenty (20) stockholders, owning an aggregate of three percent (3%) or more of the Company's outstanding common stock continuously for at least three (3) years to nominate director candidates for inclusion in the Company's proxy materials for an annual meeting of stockholders constituting up to the greater of (i) twenty percent (20%) of the Board or (ii) two (2) individuals; provided the stockholder(s) and the nominee(s) satisfy the requirements specified in the Bylaws.

14

Attendance of Directors at the Annual Meeting of Stockholders

Directors are strongly encouraged to attend the Company's annual meeting of stockholders unless extenuating circumstances prevent them from attending, although the Company has no formal, written policy requiring such attendance. All of the Company's directors attended the 2019 Annual Meeting of Stockholders ("2019 Annual Meeting").

Communications with Directors

A stockholder or other interested party who wishes to communicate directly with the Board,its independent directors, one of its committees or with an individual director regarding matters related to the Company should send the communication, with a request to forward the communication to the intended recipient or recipients, to:

Thermon Group Holdings, Inc. |

Attention: General Counsel |

7171 Southwest Parkway |

Building 300 | Suite 200 |

Austin, Texas 78735 |

We will forward stockholder correspondence, as appropriate. Please note that we will not forward communications that are spam, junk mail or mass mailings, resumes and other forms of job inquiries, surveys and business solicitations or advertisements. Further, we will not forward any abusive, threatening or otherwise inappropriate materials.

Board Oversight of Risk Management

The Board believes that evaluating the ability of senior management to manage the various risks confronting the Company is one of its most important areas of oversight. In carrying out this responsibility, the Board has designated the Audit Committee with primary responsibility for overseeing enterprise risk management and risks related to financial reporting and internal controls. The Audit Committee makes periodic updates to the Board regarding the risks inherent to the business of the Company, including the identification, assessment, management and monitoring of those risks, and risk management decisions, practices and activities of the Company.

While the Audit Committee has primary responsibility for overseeing enterprise risk management, each of the other Board committees also considers risk within its area of responsibility. For example, the N&CG Committee reviews legal, regulatory and compliance risks as they relate to corporate governance structures and processes, the Finance Committee assesses risk with respect to the financial profile of the Company and in connection with major transactions, and the Compensation Committee reviews risks related to compensation matters. The committee chairs periodically apprise the Board of significant risks and management’s response to those risks. While the Board and its committees oversee risk management strategy, senior management is responsible for implementing and supervising day-to-day risk management processes and reporting to the Board and its committees on such matters.

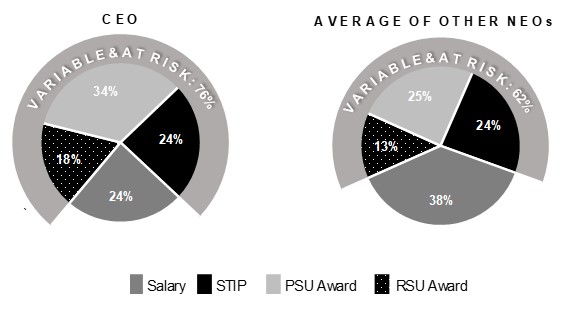

With respect to risks related to compensation matters, the Compensation Committee considers, in establishing and reviewing the Company’s executive compensation program, whether the program encourages unnecessary or excessive risk taking and has concluded that it does not. The base salaries of our employees, including our Executive Officers, are fixed in amount and thus do not encourage risk-taking. Short-term incentive opportunities for all employees, including our Executive Officers, are generally capped and are directly tied to overall corporate performance. The compensation provided to certain employees, including our Executive Officers, in the form of long-term equity awards helps further align key employees' interests with those of the Company’s stockholders.

The Compensation Committee has also reviewed the Company’s compensation programs for employees generally and has concluded that these programs do not create risks that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee believes that the Company’s annual short-term cash and long-term equity incentives provide an effective and appropriate mix of incentives to help ensure that the Company’s performance is focused on long-term stockholder value creation and does not encourage the taking of short-term risks at the expense of long-term results. In general, bonus opportunities for Company employees are discretionary and management has the authority to reduce bonus payments (or pay no bonus) based on individual or Company performance and any other factors it may determine to be appropriate in the circumstances. As with the compensation of our executive officers, the Company intends to continue to award a portion of the

15

compensation of certain of its key employees in the form of equity awards that help further align the interests of employees with those of stockholders.

Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (the "DGCL") provides that a corporation may indemnify its directors and officers against liabilities actually and reasonably incurred in such capacities, including attorneys’ fees, judgments, fines and amounts paid in settlement, with respect to any matter in which the director or officer acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. Our Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") provides that we will indemnify our directors and officers to the fullest extent authorized by the DGCL. Our Certificate of Incorporation provides that this right to indemnification is a contract right, and we may, from time to time, and in the ordinary course of business, enter into contracts under which our directors and officers are provided with such rights of indemnification against liability that they may incur in their capacities as such and in connection with activities performed under the terms of such contracts. We have entered into indemnification agreements with each of our directors and executive officers which require us, among other things, to indemnify them against certain liabilities which may arise by reason of his status or service as a director or officer (other than liabilities arising from willful misconduct of a culpable nature).

Our Bylaws further provide that we will indemnify and hold harmless, to the fullest extent permitted by law, any person who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was one of our directors or officers or is or was serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture or other enterprise, against any and all liability and loss (including judgments, fines, penalties and amounts paid in settlement) suffered or incurred and expenses reasonably incurred by such person; provided, however, that we will not be required to indemnify a person in connection with any action, suit or proceeding that is initiated by such person unless such action, suit or proceeding was authorized by our Board.

Our Certificate of Incorporation also eliminates the personal liability of our directors to the fullest extent permitted by Section 102 of the DGCL, which provides that a corporation may eliminate the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. Section 102 does not, however, permit a corporation to eliminate or limit liability for: (i) any breach of the duty of loyalty to the corporation or its stockholders, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) liability of directors for unlawful payment of dividend or unlawful stock purchase or redemption or (iv) any transaction from which the director derived an improper personal benefit. We have purchased liability insurance covering our directors and officers and certain other management personnel.

Compensation Committee Interlocks and Insider Participation

At the beginning of Fiscal 2020, our Compensation Committee consisted of Mr. Nesser as Chair and Messrs. George, McGinty and Press. In July 2019, Messrs. Clarke and Fix joined the Compensation Committee upon joining the Board, Messrs. George and Nesser stepped down from the Compensation Committee and Mr. McGinty assumed the role of Chair of the Compensation Committee. In May 2020, Mr. George re-joined the Compensation Committee and Mr. Press stepped down as a member of the Compensation Committee. None of Messrs. Clarke, Fix, George, Nesser, McGinty or Press is or has been an employee or officer of the Company. None of our Executive Officers has served on the board of directors or compensation committee (or other committee serving an equivalent function) of any other entity that has one or more of its executive officers serving as a member of our Board.

16

DIRECTOR COMPENSATION

The Board determines the form and amount of non-executive director compensation after its review of recommendations made by the N&CG Committee. In 2019, the N&CG Committee, with the assistance of the Company's independent compensation consultant, Pearl Meyer & Partners LLP ("Pearl Meyer"), completed a detailed benchmarking analysis of the Company's non-executive director compensation program compared to the non-executive director compensation programs of the same group of peer companies utilized in the Compensation Committee's review of the compensation of our Executive Officers, as discussed further in the section entitled "Executive Compensation—Compensation Discussion and Analysis."

Following a review of the benchmarking analysis, the Committee noted that both the cash and equity compensation awarded to directors was significantly below the market median. Accordingly, the N&CG Committee recommended an increase to the equity awards and cash retainers for both board members and committee chairs in order to bring the compensation paid to directors closer in line with the market median. In addition to raising these cash retainers, the N&CG Committee recommended removing non-chair committee fees. Of primary concern to the N&CG Committee in recommending this increase was the ability for the Board to attract and recruit new directors. The Board adopted these measures effective July 1, 2019. In adopting these changes, the Board recognized that it may need to revisit the compensation amounts at a future date to enable the Board to continue to attract, recruit and retain qualified directors or if it believes compensation levels have fallen below the competitive market.

The Company's current non-executive director compensation program for Fiscal 2020 is set forth in the table below. In addition to these retainers, we reimburse our non-executive directors for actual reasonable out-of-pocket expenses upon presentation of documentation in accordance with the Company's typical expense reimbursement procedures.

4/1/2019 | 7/1/2019 | |||||||||||||||

Type of Annual Retainer1 | Cash Amount | Equity Amount2 | Cash Amount | Equity Amount2 | ||||||||||||

Board Member | $ | 50,000 | $ | 60,000 | $ | 70,000 | $ | 95,000 | ||||||||

Audit Committee Member | $ | 4,000 | $ | — | $ | — | $ | — | ||||||||

Audit Committee Chair | $ | 15,000 | $ | — | $ | 20,000 | $ | — | ||||||||