UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

| | |

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

| |

o | Preliminary Proxy Statement |

| |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | Definitive Proxy Statement |

| |

o | Definitive Additional Materials |

| |

o | Soliciting Material under §240.14a-12 |

|

| | |

THERMON GROUP HOLDINGS, INC. |

(Name of Registrant as Specified in its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

|

| | |

x | No fee required. |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

|

| (2) | Aggregate number of securities to which transaction applies: |

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| (4) | Proposed maximum aggregate value of transaction: |

|

| (5) | Total fee paid: |

|

| | |

o | Fee paid previously with preliminary materials. |

|

| | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

|

| (2) | Form, Schedule or Registration Statement No.: |

|

| (3) | Filing Party: |

|

| (4) | Date Filed: |

|

Thermon Group Holdings, Inc.

100 Thermon Drive

San Marcos, Texas 78666

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

July 25, 2018

To the stockholders of Thermon Group Holdings, Inc.:

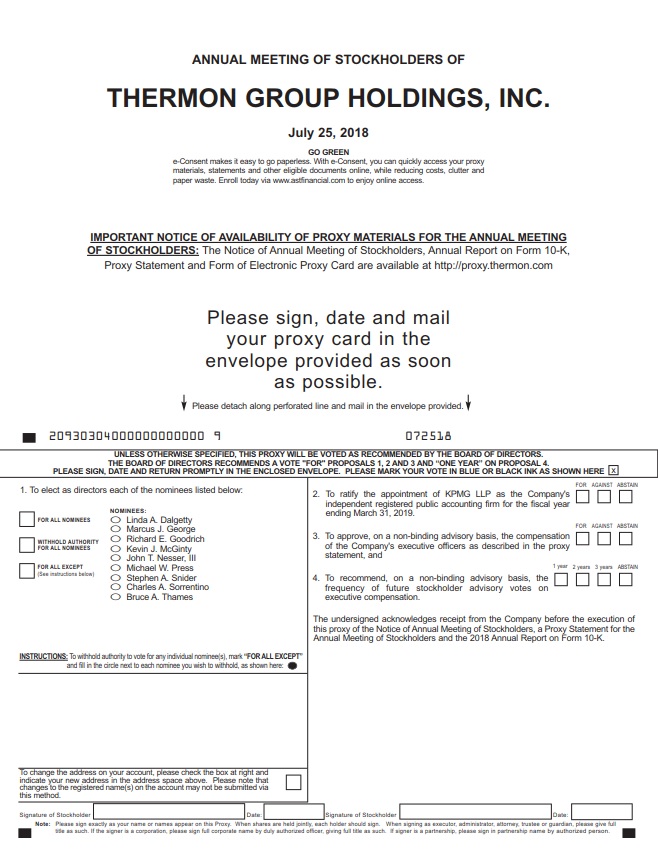

Notice is hereby given that the 2018 Annual Meeting of Stockholders (the "2018 Annual Meeting") of Thermon Group Holdings, Inc., a Delaware corporation (the "Company," "Thermon," "we" or "our"), will be held on Wednesday, July 25, 2018, at 11:30 a.m. Central Time, at the Marriott Hotel at George Bush Intercontinental Airport, 18700 John F. Kennedy Blvd, Houston, Texas 77032 for the following purposes, as more fully described in the accompanying proxy statement (the "Proxy Statement"):

| |

(1) | to elect the nine director nominees named in the Proxy Statement, each for a term of one year; |

| |

(2) | to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2019; |

| |

(3) | to approve, on a non‑binding advisory basis, the compensation of our Named Executive Officers, as described in the Proxy Statement; |

| |

(4) | to recommend, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our Named Executive Officers; and |

| |

(5) | to transact such other business that may properly come before the 2018 Annual Meeting and any postponement or adjournment thereof. |

We are pleased to continue utilizing the Securities and Exchange Commission's "notice and access" rules. Accordingly, we are providing stockholders access to our proxy materials over the Internet, which reduces the cost and environmental impact of the 2018 Annual Meeting. On or about June 15, 2018, we began mailing a Notice of Internet Availability of Proxy Materials (the "Notice") to all stockholders of record as of June 1, 2015 (the "Record Date"). The Notice contains instructions on how to access our proxy materials as well as information on how to vote your shares. Only holders of record of our common stock as of the close of business on the "Record Date" are entitled to receive notice of, attend and vote at the 2018 Annual Meeting.

It is important that your shares are represented and voted at the meeting and, whether or not you expect to attend in person, we encourage you to vote as promptly as possible to ensure that your vote is counted. Thank you for your continued support.

Very truly yours,

|

| |

Charles A. Sorrentino | Bruce A. Thames |

Chairman of the Board | President and Chief Executive Officer |

San Marcos, Texas

June 15, 2018

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE 2018 ANNUAL MEETING, WE ENCOURAGE YOU TO READ THE PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTE INSTRUCTIONS AS SOON AS POSSIBLE SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND SO THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. YOUR PROMPT ACTION WILL AID THE COMPANY IN REDUCING THE EXPENSE OF PROXY SOLICITATION.

|

|

Important Notice Regarding the Availability of Proxy Materials

for the 2018 Annual Meeting of Stockholders of Thermon Group Holdings, Inc. to be Held Wednesday, July 25, 2018: |

As permitted by rules adopted by the Securities and Exchange Commission, rather than mailing a full paper set of these proxy materials, we are mailing to many of our stockholders only a notice of Internet availability of proxy materials containing instructions on how to access these proxy materials and submit proxy votes online. |

The Notice, Proxy Statement and 2018 Annual Report are available at: http://proxy.thermon.com |

Thermon Group Holdings, Inc.

100 Thermon Drive

San Marcos, Texas 78666

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD JULY 25, 2018

GENERAL INFORMATION

This proxy statement ("Proxy Statement") is being furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of Thermon Group Holdings, Inc. (the "Company," "Thermon," "we," "our," "us" and similar terms) on the Company's behalf for use at the 2018 Annual Meeting of Stockholders of the Company to be held at the Marriott Hotel at George Bush Intercontinental Airport, 18700 John F. Kennedy Blvd, Houston, Texas 77032 on Wednesday, July 25, 2018 at 11:30 a.m. Central Time, and any adjournment or postponement thereof (the "2018 Annual Meeting").

Pursuant to provisions of our Second Amended and Restated Bylaws (the "Bylaws") and by action of our Board, the close of business on June 1, 2018 was established as the time and record date for determining the stockholders entitled to receive notice of, attend and vote at the 2018 Annual Meeting (the "Record Date").

As permitted by the rules adopted by the Securities and Exchange Commission (the "SEC"), we have elected to provide access to our proxy materials primarily via the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders of record as of the Record Date who are entitled to vote at the 2018 Annual Meeting. Instructions on how to access and review these proxy materials electronically, request hard copies of these materials and submit proxy votes online are stated in the Notice.

We began mailing the Notice to stockholders of record on or about June 15, 2018. We first made this Proxy Statement available to our stockholders at http://proxy.thermon.com on or about June 15, 2018, along with our Annual Report on Form 10-K/A for the fiscal year ended March 31, 2018, as filed with the SEC on June 8, 2018 (the "2018 Annual Report"). We encourage you to read the 2018 Annual Report. It includes our audited financial statements and provides information about our business.

How can I attend the 2018 Annual Meeting?

Only stockholders as of the Record Date are entitled to attend the 2018 Annual Meeting, which will be held on Wednesday, July 25, 2018 at the Marriott Hotel at George Bush Intercontinental Airport, 18700 John F. Kennedy Blvd, Houston, Texas 77032. Doors will open at 11:00 a.m., Central Time, and the meeting will begin promptly at 11:30 a.m., Central Time.

What is the Company’s fiscal year?

The Company's fiscal year ends on March 31. In this Proxy Statement, we refer to the fiscal years ended March 31, 2016, 2017 and 2018 and the fiscal years ending March 31, 2019 and 2020 as "Fiscal 2016," "Fiscal 2017," "Fiscal 2018," "Fiscal 2019," and "Fiscal 2020," respectively. Unless otherwise stated, all financial information presented in this Proxy Statement is based on the Company’s fiscal calendar.

What items will be voted on at the 2018 Annual Meeting?

Stockholders may vote on the following proposals at the 2018 Annual Meeting:

| |

• | the election to the Board of the nine director nominees named in this Proxy Statement, each for a term of one year; |

| |

• | ratification of the appointment of KPMG LLP ("KPMG") as the Company’s independent registered public accounting firm for Fiscal 2019; |

| |

• | the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers, as described in this Proxy Statement; and |

| |

• | the recommendation, on a non-binding advisory basis, regarding the frequency of future stockholder advisory votes on the compensation of our Named Executive Officers. |

The Company is not aware of any other business to be presented for a vote of the stockholders at the 2018 Annual Meeting. If any other matters are properly presented, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment. The chairman of the 2018 Annual Meeting may refuse to allow presentation of a proposal or nominee for the Board if the proposal or nominee was not properly submitted.

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

| |

• | "FOR" the election to the Board of each of the nine director nominees named in this Proxy Statement; |

| |

• | "FOR" ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for Fiscal 2019; |

| |

• | "FOR" the resolution to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in this Proxy Statement; and |

| |

• | "1 YEAR" for the proposal to recommend, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our Named Executive Officers. |

Who may vote at the 2018 Annual Meeting?

Holders of our common stock on the Record Date are entitled to one vote for each share of the Company’s common stock held on the Record Date. As of the Record Date, there were 32,497,992 shares of the Company’s common stock issued and outstanding and approximately 15 stockholders of record.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If, on the Record Date, your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer and Trust Company, LLC ("AST"), you are considered the stockholder of record with respect to those shares, and the Notice was sent directly to you by AST at the Company's request. If you request printed copies of the proxy materials by mail, you will receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If, on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in "street name," and the Notice was sent to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the 2018 Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Those instructions are contained in a "vote instruction form" to be sent to you by the organization that holds your shares.

What is the quorum requirement for the 2018 Annual Meeting?

The presence in person or by proxy of the holders of stock having a majority of the votes which could be cast by the holders of all outstanding stock entitled to vote at the 2018 Annual Meeting is required for the transaction of business. This is called a "quorum." If you (i) are present and vote in person at the 2018 Annual Meeting, or (ii) have voted on the Internet, by telephone or by properly submitting a proxy card or vote instruction form by mail, your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against or abstained. Broker non-votes, as described below, will also be counted for purposes of determining whether a quorum is present. If a quorum is not present, the 2018 Annual Meeting will be adjourned until a quorum is obtained.

If I am a stockholder of record of the Company’s shares, how do I vote?

If you are a stockholder of record, there are four ways to vote:

| |

• | In person. You may vote in person at the 2018 Annual Meeting. The Company will give you a ballot when you arrive. |

| |

• | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice. |

| |

• | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the proxy card. |

| |

• | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided. |

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, there are four ways to vote:

| |

• | In person. If you wish to vote in person at the 2018 Annual Meeting, you must obtain a "legal proxy" from the organization that holds your shares. A legal proxy is a written document that authorizes you to vote your shares held in street name at the 2018 Annual Meeting. Please contact that organization for instructions regarding obtaining a legal proxy. You must bring a copy of the legal proxy to the 2018 Annual Meeting and ask for a ballot from an usher when you arrive. You must also bring valid photo identification such as a driver's license or passport. In order for your vote to be counted, you must hand both the copy of the legal proxy and your completed ballot to an usher to be provided to the inspector of election. |

| |

• | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the vote instruction form to be sent to you by the organization that holds your shares. The availability of Internet voting may depend on the voting process of the organization that holds your shares. |

| |

• | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the vote instruction form. The availability of telephone voting may depend on the voting process of the organization that holds your shares. |

| |

• | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the vote instruction form and sending it back in the envelope provided. |

Can I change my vote?

You may revoke your proxy and change your vote at any time prior to the vote at the 2018 Annual Meeting. Prior to the applicable cutoff time, you may enter a new vote by using the Internet or the telephone or by mailing a new proxy card or new vote instruction form bearing a later date (which will automatically revoke your earlier voting instructions). If you are a stockholder of record, you may accomplish this by granting a new proxy or by voting in person at the 2018 Annual Meeting. If you are a beneficial owner of shares held in street name, you may change your vote by submitting new voting instructions to your broker or nominee.

How are proxies voted?

All shares represented by valid proxies received prior to the 2018 Annual Meeting will be voted, and where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the 2018 Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the broker or nominee that holds your shares with specific voting instructions, the broker or nominee that holds your shares may generally vote your shares on "routine" matters but cannot vote your shares on "non-routine" matters. If the broker or nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, it will inform

the inspector of election that it does not have the authority to vote on such matter with respect to your shares. This occurrence is referred to as a "broker non-vote." The only routine matter scheduled to be voted upon at the 2018 Annual Meeting is Proposal No. 2 (to ratify the appointment of the Company’s independent registered public accounting firm for Fiscal 2019). All other matters scheduled to be voted upon are non-routine and therefore broker non-votes may exist in connection with Proposals No. 1 (to elect the nine director nominees named in this Proxy Statement), No. 3 (to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in this Proxy Statement) and No. 4 (to recommend, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our Named Executive Officers). Therefore, if you hold your shares in street name through a broker or other nominee, it is critical that you instruct your broker or other nominee how to vote on Proposals No. 1, No. 3 and No. 4 if you want your vote to count.

What is the vote required for each proposal and how are abstentions and broker non-votes treated?

Proposal No. 1 (to elect the nine director nominees named in this Proxy Statement): Directors will be elected by a plurality of the votes cast at the 2018 Annual Meeting. The nine director nominees named in this Proxy Statement receiving the greatest number of affirmative votes of the shares entitled to be voted will be elected as directors to serve until the next annual meeting of stockholders. Broker non-votes are not considered votes cast on the matter and will have no effect on the outcome of this proposal. Our Corporate Governance Guidelines require any incumbent director who receives a greater number of votes "withheld" than votes "for" in an uncontested election to promptly submit a written offer of resignation to the Nominating and Corporate Governance Committee (the "N&CG Committee"), which will review and evaluate the offer of resignation and recommend to the Board whether to accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision and, if it rejects the resignation, the rationale behind such decision, within 90 days after the election results for the 2018 Annual Meeting are certified.

Proposal No. 2 (to ratify the appointment of the Company's independent registered public accounting firm): Approval of Proposal No. 2 will require the affirmative vote by the holders of stock having a majority of the votes which could be cast by holders of shares (i) present in person or by proxy at the 2018 Annual Meeting and (ii) entitled to vote on such matter. Abstentions will have the same practical effect as votes against the proposal. Proposal No. 2 is considered a routine matter; therefore, no broker non-votes are expected in connection with this proposal.

Proposal No. 3 (to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in this Proxy Statement): Approval of Proposal No. 3 will require the affirmative vote by the holders of stock having a majority of the votes which could be cast by the holders of shares (i) present in person or by proxy at the 2018 Annual Meeting and (ii) entitled to vote on such matter. Abstentions will have the same practical effect as votes against the proposal. Broker non-votes are not considered entitled to vote on the matter and will have no effect on the outcome of this proposal.

Proposal No. 4 (to recommend, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our Named Executive Officers): For Proposal No. 4, stockholders may vote to hold such a vote every year, every two years or every three years, or stockholders may abstain from voting on this matter. The option among those choices that receives the highest number of votes from the holders of shares (i) present in person or by proxy at the 2018 Annual Meeting and (ii) entitled to vote on such matters will be deemed to be the frequency recommended by the stockholders. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Who will serve as the inspector of election?

Our General Counsel and Secretary or her designee will act as the inspector of election.

Where can I find the voting results of the 2018 Annual Meeting?

The preliminary voting results will be announced at the 2018 Annual Meeting. The final voting results will be tallied by the inspector of election and published in a Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the 2018 Annual Meeting.

Who is paying for the cost of this proxy solicitation?

The Company is paying the costs of the solicitation of proxies. In addition to solicitation by mail, proxies may be solicited personally or by telephone, facsimile, email or other means by our directors, officers or regular employees on the Company’s behalf.

Upon request, we will also reimburse brokerage firms, banks, broker-dealers or other similar organizations and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for sending proxy and solicitation materials to beneficial owners of stock.

What is householding?

SEC rules allow us to deliver a single Notice to one physical address shared by two or more of our stockholders. This delivery method is referred to as "householding" and can result in significant cost savings. To take advantage of this opportunity, we will deliver only one Notice to multiple stockholders who share an address, unless we have received different instructions from the affected stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate Notice, as requested, to any stockholder at the shared address to which a single copy was delivered. If you prefer to receive a separate copy of the Notice, contact: Thermon Group Holdings, Inc., 100 Thermon Drive, San Marcos, Texas 78666, Attention: General Counsel, Telephone: (512) 396-5801.

Will any other matters be acted on at the 2018 Annual Meeting?

As of the date these proxy materials were mailed, we are not aware of any other matters to be presented at the 2018 Annual Meeting other than the proposals described herein. If you grant a proxy, the persons named as proxy holders will vote your shares on any additional matters properly presented for a vote at the meeting as recommended by the Board or, if no recommendation is given, in their own discretion.

Whom should I call with other questions?

If you have additional questions about these proxy materials or the 2018 Annual Meeting, please contact: Thermon Group Holdings, Inc., 100 Thermon Drive, San Marcos, Texas 78666, Attention: General Counsel, Telephone: (512) 396-5801.

DIRECTORS AND EXECUTIVE OFFICERS

Directors

Our Board currently consists of nine directors with each term expiring at the 2018 Annual Meeting. The authorized number of directors is presently fixed at nine. Effective May 1, 2018, the Board appointed Linda A. Dalgetty as a director.

Upon the recommendation of the N&CG Committee, the Board has nominated Linda A. Dalgetty for election and Marcus J. George, Richard E. Goodrich, Kevin J. McGinty, John T. Nesser, III, Michael W. Press, Stephen A. Snider, Charles A. Sorrentino and Bruce A. Thames for re-election at the 2018 Annual Meeting. Each of the directors elected at the 2018 Annual Meeting will serve a one-year term expiring at the 2019 Annual Meeting of Stockholders (the "2019 Annual Meeting").

|

| | | | | | | | |

Name | | Position | | Age(1) | | Director

Since | | Tenure(1) |

Linda A. Dalgetty | | Director | | 56 | | 2018 | | 0.2 |

Marcus J. George | | Director | | 48 | | 2010 | | 8.2 |

Richard E. Goodrich | | Director | | 74 | | 2010 | | 8.2 |

Kevin J. McGinty | | Director | | 69 | | 2012 | | 6.1 |

John T. Nesser, III | | Director | | 69 | | 2012 | | 6.1 |

Michael W. Press | | Director | | 71 | | 2011 | | 7.2 |

Stephen A. Snider | | Director | | 70 | | 2011 | | 7.2 |

Charles A. Sorrentino | | Chairman of the Board | | 73 | | 2010 | | 8.2 |

Bruce A. Thames | | Director, President and Chief Executive Officer | | 55 | | 2016 | | 2.3 |

(1) Age and tenure presented in number of years as of the date of the 2018 Annual Meeting.

Each of the nominees has indicated his or her willingness to serve, if elected, but if any of the nominees should be unable or unwilling to serve at the time of the 2018 Annual Meeting, the Board may either reduce its size, or designate or not designate a substitute nominee. If the Board designates a substitute nominee, proxies that would have been cast for the original nominee will be cast for the substitute nominee, unless instructions are given to the contrary. The biographies below describe the skills,

qualifications, attributes and experience of each of the nominees that led the Board to determine that it is appropriate to nominate each director.

Linda A. Dalgetty has served as a director since May 2018. Ms. Dalgetty is currently Vice President, Finance and Services at the University of Calgary, a public research university, a position she has held since July 2014. In her role at the University of Calgary, she has direct responsibility for a large portfolio of university departments, including finance, human resources, information technology, risk, ancillary operations and internal audit. Prior to joining the University of Calgary in 2014, Ms. Dalgetty served as Senior Vice President and Chief Financial Officer of Saxon Energy Services, Inc. from 2013 to 2014, during which time she was responsible for all of the financial functions of a global organization, including reporting, planning, operational accounting and information technology. Prior to her role at Saxon, Ms. Dalgetty served from 1995 to 2013 in various roles of increasing responsibility at Nutrien Ltd. (NYSE:NTR) (formerly, Agrium Inc. ("Agrium")) and Agroservicios Pampeanos SA (a wholly-owned Argentinian subsidiary of Agrium), with her final role being Agrium's Chief Information Officer. Ms. Dalgetty began her early career working as an audit manager with Ernst & Young LLP from 1989 to 1995. Ms. Dalgetty holds a bachelor of commerce degree from the Haskayne School of Business at the University of Calgary. She is also a chartered accountant and earned an associate diploma in agribusiness from the University of Guelph. Ms. Dalgetty brings broad-based North American and international financial expertise and business experience to the Board. In addition, Ms. Dalgetty has led crisis management efforts related to cybersecurity matters.

Marcus J. George has served as a director since April 2010. In 2015, Mr. George co-founded and is currently a partner at Onward Capital LLC ("Onward Capital"), a private equity firm focused on investing in and growing lower middle market industrial businesses. Mr. George has served on the board of directors of Domaille Engineering LLC, a privately held technology company providing creative engineering, manufacturing and supply chain management solutions for many different markets, since November 2016. Mr. George previously served as a partner at the private equity firm CHS Capital LLC ("CHS") until March 2015. CHS is one of our former private equity sponsors. Mr. George joined CHS in 1997 and was promoted to partner in 2007. He also served as a partner at Shorehill Capital, LLC, a private equity firm focused on control investments in middle market industrial and distribution companies from 2013 to 2014. Prior to joining CHS, Mr. George was employed by Heller Financial, Inc. in the corporate finance group. He was also an associate at KPMG from 1991 to 1993. Mr. George previously served as a director of GSE Holdings, Inc. ("GSE"), a global provider of engineered geosynthetic containment solutions for environmental protection and confinement applications, from June 2011 to August 2014, Dura-Line Holdings, Inc., Waddington North America, Inc. and KB Alloys, LLC. Mr. George holds a B.B.A. from the University of Notre Dame and an M.B.A. from the University of Chicago. We believe that Mr. George's substantial experience in private equity investments focused on infrastructure and industrial products and financial and capital markets matters bring important and valuable skills to the Board.

Richard E. Goodrich has served as a director since April 2010. He is a retired executive vice president and chief financial officer of Chicago Bridge & Iron Company N.V. (NYSE:CBI), an engineering, procurement and construction company that provides services to customers in the chemicals and energy industries. Prior to retiring, he served as executive vice president and chief financial officer of CBI from 2001 to 2005 and as acting chief financial officer until June 2006. Mr. Goodrich served as a director of Chart Industries, Inc. (NASDAQ:GTLS) from 2006 until May 2018 and GSE from June 2011 to August 2014. He is a Certified Public Accountant having been certified in the District of Columbia in November 1970 (license inactive). Mr. Goodrich brings to the Board financial and strategic expertise as well as the experience and international operations insight of a chief financial officer of a large multinational company.

Kevin J. McGinty has served as a director since June 2012. Mr. McGinty joined the private investment firm Ursula Capital Partners as a special limited partner in 2017. He is also a retired senior advisor of Peppertree Capital Management, Inc. ("Peppertree"), a private equity fund management firm from which he retired in 2015. Prior to founding Peppertree in January 2000, he served as a managing director of Primus Venture Partners from 1990 to 1999. In both organizations, Mr. McGinty was involved in private equity investing, both as a principal and as a limited partner. From 1970 to 1990, Mr. McGinty was employed by Society National Bank, now KeyBank, N.A., where in his final position he was an executive vice president. Mr. McGinty has over 40 years of experience in the banking and private equity industries, including 20 years as an officer of a bank and 20 years serving in the role of managing director for a variety of private equity firms. Mr. McGinty previously served as a director of Marlin Business Services, Inc. (NASDAQ:MRLN) from February 1998 to 2014. He also has 25 years of experience serving as a director of privately held companies. Mr. McGinty has also held leadership positions with various cultural and community organizations. Mr. McGinty received his undergraduate degree in economics from Ohio Wesleyan University and his M.B.A. in finance from Cleveland State University. The Board views Mr. McGinty’s independence, his banking experience, his experience in private equity, capital markets and mergers and acquisitions, as well as his experience as a director of other companies and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience for serving as a director.

John T. Nesser, III has served as a director since June 2012. Since July 2013, Mr. Nesser has served as the co-founder, manager, co-chief executive officer and director of All Coast, LLC ("All Coast"). Following its acquisition of Hercules Offshore Domestic

Liftboat Fleet in July 2013, All Coast owns and operates the largest fleet of liftboats for the offshore oil and gas market in the Gulf of Mexico. Mr. Nesser retired as executive vice president and chief operating officer of McDermott International, Inc. (NYSE:MDR) ("McDermott") in 2011. He joined McDermott, a global engineering, procurement, construction and installation company with a focus on the energy industry, as associate general counsel in 1998 and spent over ten years in various senior management roles, including as general counsel, chief administrative officer and chief legal officer. Previously, he served as a managing partner of Nesser, King & LeBlanc, a New Orleans law firm, which he co-founded in 1985. Mr. Nesser has served as a director of Layne Christensen Company (NASDAQ:LAYN) since August 2013 and is currently the chair of its compensation committee and a member of the audit and nominating and corporate governance committees. Mr. Nesser is a member of the Texas and Louisiana Bar Associations (inactive) and is also a member of the Louisiana State University Law Center Board of Trustees. Mr. Nesser holds a B.S. in Business Administration, majoring in finance, and a J.D. from Louisiana State University. We believe that Mr. Nesser’s significant prior experience in the roles of chief operating officer and general counsel and his legal, corporate governance and operational backgrounds make a significant contribution to the Board’s current mix of skills and experience and qualify him to be a director.

Michael W. Press has served as a director since the completion of the Company's initial public offering of common stock ("IPO") in May 2011. He is a retired chief executive officer of KBC Advanced Technologies PLC (LSE:KBC), a publicly traded international petroleum and petrochemicals consulting and software firm, a position he held from 1997 to 2001. Since 2001, Mr. Press has served on various boards of directors and worked with a number of private equity backed companies in the United States, Europe and Asia, often in preparation for a public listing or sale. He served on the board of directors of Chart Industries, Inc. (NASDAQ:GTLS) from 2006 to 2016. He also served on the board of directors of Lamprell plc (LSE:LAM), a provider of diversified engineering and contracting services to the onshore and offshore oil & gas and renewable energy industries, from 2013 to 2015. Mr. Press previously served as a director and senior independent director of Petrofac, Ltd. (LSE:PFC) from 2002 to 2010. He holds a B.S. from Colorado College, an M.S. from Columbia University and an Advanced Management Program degree from Stanford University. Mr. Press brings to the Board substantial experience as a director and executive officer of publicly held companies and over 30 years of international energy industry experience, including senior executive positions at The Standard Oil Company, British Petroleum plc, BP America and Amerada Hess Corporation. He also has significant manufacturing, operations, finance, corporate governance and corporate development experience gained from serving on 18 public and private boards both in the United States and internationally.

Stephen A. Snider has served as a director since June 2011. Mr. Snider is a retired chief executive officer and director of Exterran Holdings, Inc. (NYSE:EXH), a global natural gas compression services company, from August 2007 to June 2009, and was Chief Executive Officer and Chairman of the general partner of Exterran Partners, L.P. (NASDAQ:EXLP), a domestic natural gas contract compression services business, from August 2007 to June 2009. Both companies are publicly traded and headquartered in Houston, Texas. Prior to that, Mr. Snider was President, Chief Executive Officer and director of Universal Compression Holdings Inc. ("Universal") from 1998 until Universal merged with Hanover Compressor Company in 2007 to form Exterran Corporation. Mr. Snider has over 30 years of experience in senior management of operating companies. He served as a director of TETRA Technologies, Inc. (NYSE:TTI) from July 2015 through May 2018, of Dresser-Rand Group Inc. (NYSE:DRC) from 2009 through its merger with Siemens AG in July 2015, and of Energen Corporation (NYSE:EGN) from May 2000 through May 2017. Mr. Snider holds a B.S. in Civil Engineering from the University of Detroit and an M.B.A. from the University of Colorado at Denver. Mr. Snider brings to the Board leadership experience, including as a public company chief executive officer and director, and extensive experience in the energy industry, including more than 25 years dedicated to natural gas compression and processing.

Charles A. Sorrentino has served as a director since April 2010 and as our independent Chairman of the Board ("Chairman") since the completion of our IPO in May 2011. Mr. Sorrentino also served as the President and Chief Executive Officer of GSE, a position he was first appointed to on an interim basis in July 2013 and then on an extended basis from November 2013 through November 2014. Mr. Sorrentino also served as a director of GSE from June 2011 through August 2014. In May 2014, in connection with a restructuring support agreement entered into with its lenders, GSE voluntarily filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code. The U.S. Bankruptcy Court in Delaware approved GSE’s reorganization plan in July 2014. Mr. Sorrentino served as President and Chief Executive Officer of Houston Wire & Cable Co. (NASDAQ:HWCC), a leading provider of wire and cable and related services from 1998 until his retirement in 2011. He previously served as President of Pameco Corporation ("Pameco") (NYSE:PCN), a national heating, ventilation, air conditioning and refrigeration distributor, from 1994 to 1998. Pameco was a $600 million distributor that was listed on the NYSE following an IPO in 1997 and was later merged into a larger company. After completing college, he served nine years with PepsiCo, Inc. (NYSE:PEP) and twelve years with United Technologies (NYSE:UTX) (formerly Sundstrand Corporation) in a variety of engineering, sales, marketing and executive management functions. Mr. Sorrentino earned a B.S. in Mechanical Engineering from Southern Illinois University and an M.B.A. from the University of Chicago. He also served in the United States Marine Corps. Mr. Sorrentino has served as an executive of several large manufacturing companies and brings a diversity of managerial experience from both publicly and privately held companies to the Board.

Bruce A. Thames joined Thermon in April 2015 as Executive Vice President and Chief Operating Officer. He was promoted to President and Chief Executive Officer and appointed as a member of the Board on April 1, 2016. Prior to joining Thermon, Mr. Thames was Senior Vice President and Chief Operating Officer of TD Williamson in Tulsa, Oklahoma, a position he held since 2012. TD Williamson manufactures and delivers a portfolio of solutions to the owners and operators of pressurized piping systems for onshore and offshore applications. He joined TD Williamson in 2005 as Vice President, North America and also served as Vice President and General Manager, Eastern Hemisphere from 2010 to 2012. Mr. Thames began his career with Cooper Industries (formerly Intool), where he spent twelve years in various roles within the product engineering, marketing and operations groups. Mr. Thames then joined GE Energy (formerly Dresser Flow Solutions) ("Dresser") and served primarily as the Director of North American Operations and Product Director for Ball Valves globally for Dresser's Valve Group during his tenure from 2002 to 2005. Mr. Thames holds a B.S. in Mechanical Engineering from the University of Texas at Austin. Mr. Thames brings extensive leadership skills, international acumen, product innovation and industry knowledge to the Board.

Executive Officers

The following table and biographies set forth certain information about our executive officers. Information pertaining to Mr. Thames, who is currently both a director and an executive officer of the Company, may be found in the section above entitled "Directors." Throughout this Proxy Statement, we refer to Messrs. Thames, Peterson, Reitler, and van der Salm collectively as our "Named Executive Officers" for Fiscal 2018.

|

| | | | |

Name | | Title | | Age as of the 2018 Annual Meeting |

Jay C. Peterson | | Chief Financial Officer; Senior Vice President, Finance; Assistant Secretary; Assistant Treasurer | | 61 |

Eric C. Reitler(1) | | Senior Vice President, Global Sales | | 50 |

Johannes (René) van der Salm | | Senior Vice President, Global Operations | | 54 |

| |

(1) | Mr. Reitler voluntarily submitted his resignation in Fiscal 2019, with a target effective date of August 31, 2018. |

Jay C. Peterson joined Thermon in July 2010 as Chief Financial Officer and Senior Vice President, Finance. Prior to joining Thermon, Mr. Peterson held positions as Chief Financial Officer, Vice President of Finance, Senior Director of Finance, Secretary and Treasurer at Asure Software, Inc. (NASDAQ:ASUR) (formerly Forgent Networks, Inc.) ("Forgent"). Mr. Peterson started with Forgent in 1995 and was named Chief Financial Officer in 2001. Before joining Forgent, Mr. Peterson was Assistant Controller in Dell Computer Corporation’s $1 billion Direct division. He also spent 11 years in various financial management positions with IBM Corporation (NYSE:IBM). Mr. Peterson holds a B.A. and an M.B.A. from the University of Wisconsin.

Eric C. Reitler joined Thermon in June 1998 as a regional sales manager in the midwestern United States and was instrumental in building and solidifying Thermon's market share in the region for over 15 years. In September 2013, he was promoted to Vice President, Global Sales and relocated from Michigan to the Company's headquarters in San Marcos, Texas. In April 2015, Mr. Reitler assumed responsibility for the Company's global sales efforts in the role of Senior Vice President, Global Sales. Prior to joining Thermon, Mr. Reitler served in various engineering, project management and operations positions in the power, oil and gas industries. Mr. Reitler holds a B.S. in Mechanical Engineering from the Georgia Institute of Technology.

Johannes (René) van der Salm joined Thermon in October 2001 as European Logistics Manager based at the Company's European headquarters in Pijnacker, the Netherlands. In 2006, Mr. van der Salm was promoted to Vice President, Manufacturing and Logistics. During that period, he divided his time between the Company's offices in the United States and Europe. In 2007, Mr. van der Salm was promoted to Senior Vice President, Operations and permanently relocated to the Company's headquarters in San Marcos, Texas. He was instrumental in the global implementation of the Company’s enterprise resource planning software. In 2011, Mr. van der Salm was promoted to Senior Vice President, Global Operations. After completing his undergraduate studies and a period of military service, Mr. van der Salm worked as sales engineer, project manager and production manager in supplying the petrochemical industry prior to joining Thermon. Mr. van der Salm holds a B.S. in Mechanical Engineering from Amsterdam Technical University.

CORPORATE GOVERNANCE

The Board oversees the Company’s Chief Executive Officer and other senior management in the competent and ethical operation of the Company and works to serve the long-term interests of stockholders. The key practices and procedures of the Board are outlined in the Corporate Governance Guidelines and the Code of Business Conduct and Ethics, both available on the Company’s

website at http://ir.thermon.com/corporate-governance. Stockholders can also obtain a free copy by writing to the General Counsel, Thermon Group Holdings, Inc., 100 Thermon Drive, San Marcos, Texas 78666.

During Fiscal 2018, the full Board met seven times. Each member of the Board attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board (held during the period for which such person has been a director); (ii) the total number of subcommittee meetings of the Board or one of its committees on which such person served; and (iii) the total number of meetings held by all committees of the Board on which such person served (during the periods that such person served) during Fiscal 2018.

Our Corporate Governance Guidelines require any incumbent director who receives a greater number of votes "withheld" than votes "for" in an uncontested election to promptly submit a written offer of resignation to the N&CG Committee, which will review and evaluate the offer of resignation and recommend to the Board whether to accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision and, if it rejects the resignation, the rationale behind such decision, within 90 days after the election results for the 2018 Annual Meeting are certified.

We recognize the importance of new ideas, perspectives, independence and skills with respect to the Board and recognize the importance of utilizing Board refreshment to achieve such goals. In January 2018, in furtherance of these goals, the Board approved amendments to our Corporate Governance Guidelines implementing a mandatory retirement age and maximum tenure for non-executive directors. Non-executive directors shall submit an offer of resignation to the N&CG Committee to become effective immediately prior to the Company's annual stockholder meeting following the director's attainment of age 75 or following 15 years of service to the Board, whichever comes earlier. The Board will generally not nominate such directors for re-election; however, on the recommendation of the N&CG Committee, the Board may reject such offers of resignation on a case-by-case basis if the Board determines an exception is in the best interests of the Company and its stockholders. The Board also believes that these amendments to the Corporate Governance Guidelines will promote orderly succession planning for our non-executive directors.

There are no family relationships between any director, executive officer or person nominated by the Board to become a director or executive officer.

Board Leadership Structure and Executive Sessions

In connection with the completion of our IPO in May 2011, the Board appointed Mr. Sorrentino as its independent Chairman. The Board believes that its current leadership structure best serves the objectives of the Board’s oversight of management, the ability of the Board to carry out its roles and responsibilities on behalf of the stockholders and the Company’s overall corporate governance. The Board also believes that the current separation of the Chairman and Chief Executive Officer roles allows the Chief Executive Officer to focus his time and energy on operating and managing the Company and leverage the experience and perspectives of the Chairman. However, the Board periodically reviews our leadership structure and may make changes in the future.

In accordance with the listing standards of the NYSE and our Corporate Governance Guidelines, the independent directors meet in regularly scheduled executive sessions, generally following each quarterly Board meeting and at other times as necessary. The executive sessions are chaired by the Chairman.

Director Independence

The Board reviews the independence of each director annually. In determining the independence of our directors, the Board considered Section 303A of the NYSE rules, applicable SEC rules as well as all relevant facts and circumstances, including, among other things, the types and amounts of commercial dealings between the Company and companies and organizations with which the directors are affiliated. Based on the foregoing criteria, the Board has affirmatively determined that Ms. Dalgetty and Messrs. George, Goodrich, McGinty, Nesser, Press, Snider and Sorrentino are independent.

In examining director independence for Fiscal 2017, the Board examined the relationship between the Company and Onward Capital, of which Mr. George is co-founder and partner. On June 15, 2016, the Company engaged Onward Capital as financial advisor to advise the Company with respect to certain potential strategic acquisition opportunities. The Company's engagement of Onward Capital ended on July 31, 2016 and the Company paid Onward Capital a total of $40,000 for services provided. The engagement of Onward Capital was pre-approved by the Audit Committee in accordance with the Company's Statement of Policy Regarding Transactions with Related Parties. The Board considered the relationship with Onward Capital to be an arm's-

length transaction entered into in the ordinary course of business on terms and conditions that were at least as favorable to the Company as would be available in comparable transactions with or involving unaffiliated third parties and that the size and nature of the transaction was not material to the Company, Onward Capital or Mr. George. Therefore, the Board determined that the engagement of Onward Capital did not disqualify Mr. George's status as an independent director of the Company. However, due to the Company's engagement of Onward Capital, the Board determined that Mr. George no longer met certain heightened independence requirements for Audit and Compensation Committee service in Fiscal 2017. Accordingly, Mr. George submitted his resignation from each respective committee on June 15, 2016. During Fiscal 2018, the Nominating & Corporate Governance Committee again reviewed the relationship between the Company, Onward Capital and Mr. George and reaffirmed that the Company's brief engagement of Onward Capital did not disqualify Mr. George's status as an independent director and recommended that he be reappointed to the Audit and Compensation Committees effective July 1, 2017. On May 18, 2017, the Board accepted the recommendations of the N&CG Committee and affirmatively determined that Mr. George had maintained his status as an independent director despite the Company's brief engagement of Onward Capital and reappointed him to the Audit and Compensation Committees effective July 1, 2017.

Mr. Thames, the Company’s President and Chief Executive Officer, is not an independent director by virtue of his employment with the Company.

There were no other transactions, relationships or arrangements with respect to any independent director that required review by our Board for purposes of determining director independence. The Board found that none of the independent directors had a material or other disqualifying relationship with the Company. The Board's three standing committees, Audit, Compensation, and N&CG, were comprised solely of independent directors during Fiscal 2018, as discussed in further detail below.

Committees of the Board

The Board currently has three standing committees: the Audit Committee, the Compensation Committee and the N&CG Committee. The Audit Committee, Compensation Committee, and N&CG Committee operate under written charters adopted by the Board. Each committee charter is posted and available on the Company’s website at http://ir.thermon.com/corporate-governance. Current committee composition and the number of committee meetings held during Fiscal 2018 were as follows:

|

| | | | | | |

Director | | Audit

Committee | | Compensation

Committee | | Nominating and

Corporate Governance

Committee |

Linda A. Dalgetty | | Member (1) | | — | | Member (1) |

Marcus J. George | | Member (2) | | Member (2) | | — |

Richard E. Goodrich | | Chair | | Member | | — |

Kevin J. McGinty | | Member | | Member | | — |

John T. Nesser, III | | Member (3) | | Chair (4) | | Member |

Michael W. Press | | — | | Member | | Chair |

Stephen A. Snider | | — | | Member (5) | | Member |

Charles A. Sorrentino | | Member | | — | | Member |

Bruce A. Thames | | — | | — | | — |

| | | | | | |

Number of Committee Meetings Held(6) | | 7 | | 5 | | 6 |

| |

(1) | Ms. Dalgetty became a member of the Audit Committee and N&CG Committee upon her appointment to the Board on May 1, 2018. |

| |

(2) | Mr. George was reappointed to the Audit Committee and Compensation Committee effective July 1, 2017. |

| |

(3) | Mr. Nesser resigned as a member of the Audit Committee effective March 19, 2018. |

| |

(4) | Mr. Nesser was appointed to the Compensation Committee and named as its Chair effective January 30, 2018. |

| |

(5) | Mr. Snider resigned as the Chair of the Compensation Committee (but remained as a member of the Compensation Committee) effective January 30, 2018. |

| |

(6) | In addition to taking action at meetings, each committee and the Board may periodically act by written consent. |

The Audit Committee has responsibility for, among other things, reviewing our financial reporting and other internal control processes, our financial statements, the independent auditors’ qualifications and independence, the performance of our internal audit function and independent auditors, and our compliance with legal and regulatory requirements and our Code of Business Conduct and Ethics. The Board has determined that each of Ms. Dalgetty and Messrs. George, Goodrich, McGinty, Nesser and Sorrentino is financially literate and qualified to address any issues that are likely to come before the Audit Committee, including the evaluation of our financial statements and supervision of our independent auditors. The Board also determined that each of Ms. Dalgetty and Messrs. George, Goodrich, McGinty, Nesser and Sorrentino meets the additional criteria for independence of audit committee members under Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the rules of the NYSE. For Fiscal 2018, the Board determined that Mr. Goodrich qualified as an "audit committee financial expert" as such term is defined in Item 407(d)(5)(ii) of Regulation S-K based on his education and experience in his respective fields. For Fiscal 2019, the Board determined that Ms. Dalgetty also qualifies as an "audit committee financial expert" based on her education, experience and status as a chartered accountant.

The Compensation Committee has responsibility for, among other things, reviewing and recommending policies relating to compensation and benefits of our executive officers, including: reviewing and approving corporate goals and objectives relevant to the compensation of the Chief Executive Officer and the other Named Executive Officers, evaluating the performance of these officers in light of those goals and objectives and setting compensation of these officers based on such evaluations. The Compensation Committee also has responsibility for management succession planning. The Compensation Committee may delegate its authority to one or more subcommittees of the Compensation Committee. The Compensation Committee also oversees our equity and incentive-based plans and administers the issuance of stock options, restricted stock units ("RSUs"), performance stock units ("PSUs") and other awards with respect to our Named Executive Officers and other employees. The Compensation Committee also reviews and evaluates its performance and the performance of each of its members, including compliance of the Compensation Committee with its charter, and prepares any report required under SEC rules. The report of the Compensation Committee is included in this Proxy Statement. The Compensation Committee has the authority to engage independent advisors, such as compensation consultants, to assist it in carrying out its responsibilities. The Compensation Committee, at present, engages an outside consultant on a regular basis to advise the Compensation Committee on the Company's executive compensation program. The Board has determined that each of Messrs. George, Goodrich, McGinty, Nesser, Press and Snider is independent under the heightened independence standards applicable to Compensation Committee members under the NYSE rules and Rule 10C-1 under the Exchange Act. In addition, each member of the Compensation Committee also meets the definition of "outside director" under Section 162(m) of the Internal Revenue Code and "non-employee director" under Rule 16b-3 under the Exchange Act.

The N&CG Committee has responsibility for, among other things, identifying, evaluating and recommending nominees for appointment or election as directors, including director nominees recommended by stockholders, developing and recommending a set of corporate governance guidelines, considering and approving director compensation and overseeing the evaluation of our Board and its committees. The N&CG Committee also oversees our equity plans and administers the issuance of equity awards with respect to our non-executive directors. In addition, the N&CG Committee has responsibility for non-executive director succession planning. The Board has determined that each of Ms. Dalgetty and Messrs. Nesser, Press, Snider and Sorrentino is independent under the rules of the NYSE.

Director Qualifications

The Company has not established specific minimum education, experience or skill requirements for potential board or committee members. In general, the N&CG Committee and the Board will consider, among other qualifications and characteristics, a candidate's work and other experience, character, background, ability to exercise sound judgment, integrity, ability to make independent analytical inquiries, problem-solving skills, diversity, age, demonstrated leadership, work ethic, other skills (including financial literacy), understanding of the Company’s business environment, willingness and capacity to devote adequate time to Board duties, independence and potential conflicts of interest. We expect that qualified candidates will have senior leadership experience in a complex and global organization and will be able to represent the interests of the stockholders as a whole and not just certain special interest groups or constituencies. Each individual is evaluated in the context of the Board as a whole with the objective of retaining a group with diverse and relevant experience that can best perpetuate the Company’s success and represent stockholder interests through sound judgment. When current Board members are considered for nomination for re-election, the N&CG Committee also takes into consideration their prior Board contributions, performance, meeting attendance and participation in continuing education activities.

The N&CG Committee may (but is not required to) identify nominees based upon suggestions by directors, management, outside consultants, including third-party search firms, and stockholders. Before considering any nominee, the N&CG Committee makes a preliminary determination as to the need for additional members of the Board. If a need is identified, members of the N&CG Committee discuss and evaluate possible candidates to explore in more depth and/or retain a third-party to conduct a search for qualified individuals. Once one (or more) candidate(s) is identified for further consideration, members of the N&CG Committee, as well as other members of the Board and management, as appropriate, interview the nominee(s). After completing this evaluation, the N&CG Committee makes a final recommendation and refers the nominee(s) to the full Board for consideration. The Board then makes a final determination as to director nominations and/or appointments.

The N&CG Committee and the Board will consider candidates recommended by stockholders in the same manner as other candidates. Stockholders may nominate candidates to serve as directors in accordance with the advance notice, proxy access and other procedures contained in our Bylaws.

During Fiscal 2018, the Board directed the N&CG Committee to initiate a search for a new director candidate for the purposes of Board refreshment, non-executive director succession planning and diversity enhancement. As chair of the N&CG Committee, Mr. Press led an orderly and well-defined process for selecting a new director, which culminated in the appointment of Ms. Dalgetty effective May 1, 2018. Prior to the selection of Ms. Dalgetty, an extensive pool of candidates was established by recommendations from members of management, non-executive directors and Russell Reynolds Associates ("Russell Reynolds"), a third-party search firm retained by the N&CG Committee. Ms. Dalgetty was identified by the N&CG Committee for inclusion in the pool of candidates. Russell Reynolds vetted the pool of candidates against a list of criteria established by the N&CG Committee in connection with the newly created vacancy, which included, among other things, an emphasis on diversity. Russell Reynolds was also tasked with verifying the experience, education and background of Ms. Dalgetty and certain other candidates.

Diversity

We are committed to cultivating a highly capable and diverse Board to represent the interests of our stockholders. Although the Board does not have a formal diversity policy, it construes diversity to mean a variety of opinions, perspectives, expertise, personal and professional experiences and backgrounds, including gender, race, age, culture and ethnicity, as well as other differentiating characteristics. The Board believes that diversity and variety of points of view contribute to a more effective decision-making process. When recommending director nominees for election, the Board and the N&CG Committee focus on how the experience and skill set of each director nominee complements those of fellow director nominees to create a balanced Board with diverse viewpoints and deep expertise.

In addition, the Board and its committees engage in annual self-evaluations that include evaluations of diversity as well as the overall effectiveness of the Board and its committees. The N&CG Committee also maintains an experience matrix to help identify potential gaps in skills, qualifications, experience or diversity across the Board as a whole.

Our Board currently includes one African-American member and one female member.

Proxy Access

On June 15, 2017, the Board approved the Second Amended and Restated Bylaws (the "Bylaws") of the Company, implementing proxy access. The Board believes that the majority of the Company's stockholders generally support the concept of proxy access; however, the Board recognizes that stockholders are not unanimous in this view nor the specific terms under which proxy access should be adopted. The Company's proxy access provisions permit a stockholder, or group of up to twenty (20) stockholders, owning an aggregate of three percent (3%) or more of the Company's outstanding common stock continuously for at least three (3) years to nominate director candidates for inclusion in the Company's proxy materials for an annual meeting of stockholders constituting up to the greater of (i) twenty percent (20%) of the Board or (ii) two individuals; provided the stockholder(s) and the nominee(s) satisfy the requirements specified in the Bylaws.

Attendance of Directors at the Annual Meeting of Stockholders

Directors are strongly encouraged to attend the Company's annual meeting of stockholders unless extenuating circumstances prevent them from attending, although the Company has no formal, written policy requiring such attendance. All of the Company's directors attended the 2017 Annual Meeting of Stockholders ("2017 Annual Meeting").

Communications with Directors

A stockholder or other interested party who wishes to communicate directly with the Board, one of its committees or with an individual director regarding matters related to the Company should send the communication, with a request to forward the communication to the intended recipient or recipients, to:

|

|

Thermon Group Holdings, Inc. |

Attention: General Counsel |

100 Thermon Drive |

San Marcos, Texas 78666 |

We will forward stockholder correspondence, as appropriate. Please note that we will not forward communications that are spam, junk mail or mass mailings, resumes and other forms of job inquiries, surveys and business solicitations or advertisements. Further, we will not forward any abusive, threatening or otherwise inappropriate materials.

Board Oversight of Risk Management

The Board believes that evaluating the ability of senior management to manage the various risks confronting the Company is one of its most important areas of oversight. In carrying out this responsibility, the Board has designated the Audit Committee with primary responsibility for overseeing enterprise risk management and risks related to financial reporting and internal controls. The Audit Committee makes periodic updates to the Board regarding the risks inherent to the business of the Company, including the identification, assessment, management and monitoring of those risks, and risk management decisions, practices and activities of the Company.

While the Audit Committee has primary responsibility for overseeing enterprise risk management, each of the other Board committees also considers risk within its area of responsibility. For example, the N&CG Committee reviews legal, regulatory and compliance risks as they relate to corporate governance structures and processes, and the Compensation Committee reviews risks related to compensation matters. The committee chairs periodically apprise the Board of significant risks and management’s response to those risks. While the Board and its committees oversee risk management strategy, senior management is responsible for implementing and supervising day-to-day risk management processes and reporting to the Board and its committees on such matters.

With respect to risks related to compensation matters, the Compensation Committee considers, in establishing and reviewing the Company’s executive compensation program, whether the program encourages unnecessary or excessive risk taking and has concluded that it does not. The base salaries of our employees, including our Named Executive Officers, are fixed in amount and thus do not encourage risk-taking. Short-term incentive opportunities for all employees, including our Named Executive Officers, are generally capped and are directly tied to overall corporate performance. The compensation provided to certain employees, including our Named Executive Officers, in the form of long-term equity awards helps further align key employees' interests with those of the Company’s stockholders.

The Compensation Committee has also reviewed the Company’s compensation programs for employees generally and has concluded that these programs do not create risks that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee believes that the Company’s annual short-term cash and long-term equity incentives provide an effective and appropriate mix of incentives to help ensure that the Company’s performance is focused on long-term stockholder value creation and does not encourage the taking of short-term risks at the expense of long-term results. In general, bonus opportunities for Company employees are discretionary and management has the authority to reduce bonus payments (or pay no bonus) based on individual or Company performance and any other factors it may determine to be appropriate in the circumstances. As with the compensation of our Named Executive Officers, the Company intends to continue to award a portion of the compensation of certain of its key employees in the form of equity awards that help further align the interests of employees with those of stockholders.

Clawback Policy

In May 2015, the Compensation Committee adopted a Policy on Recoupment of Incentive Compensation (the "clawback policy"), pursuant to which, to the extent permitted by governing law, the Company may require the return, repayment or forfeiture of any annual or long-term incentive compensation payment or award made or granted to any current or former executive officer during the three-year period preceding the filing with the SEC of Company financial statements that were restated due to the

material noncompliance of the Company with any financial reporting requirement under the securities laws to the extent that such incentive compensation was calculated based upon any financial result or performance metric impacted by such restatement. We believe that the adoption of the clawback policy further enhances the risk management features of our executive compensation program in a way that does not encourage unnecessary or excessive risk-taking.

Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (the "DGCL") provides that a corporation may indemnify its directors and officers against liabilities actually and reasonably incurred in such capacities, including attorneys’ fees, judgments, fines and amounts paid in settlement, with respect to any matter in which the director or officer acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. Our Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") provides that we will indemnify our directors and officers to the fullest extent authorized by the DGCL. Our Certificate of Incorporation provides that this right to indemnification is a contract right, and we may, from time to time, and in the ordinary course of business, enter into contracts under which our directors and officers are provided with such rights of indemnification against liability that they may incur in their capacities as such and in connection with activities performed under the terms of such contracts. We have entered into indemnification agreements with each of our directors and certain officers which require us, among other things, to indemnify them against certain liabilities which may arise by reason of his status or service as a director or officer (other than liabilities arising from willful misconduct of a culpable nature).

Our Bylaws further provide that we will indemnify and hold harmless, to the fullest extent permitted by law, any person who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was one of our directors or officers or is or was serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture or other enterprise, against any and all liability and loss (including judgments, fines, penalties and amounts paid in settlement) suffered or incurred and expenses reasonably incurred by such person; provided, however, that we will not be required to indemnify a person in connection with any action, suit or proceeding that is initiated by such person unless such action, suit or proceeding was authorized by our Board.

Our Certificate of Incorporation also eliminates the personal liability of our directors to the fullest extent permitted by Section 102 of the DGCL, which provides that a corporation may eliminate the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. Section 102 does not, however, permit a corporation to eliminate or limit liability for (i) any breach of the duty of loyalty to the corporation or its stockholders, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) liability of directors for unlawful payment of dividend or unlawful stock purchase or redemption or (iv) any transaction from which the director derived an improper personal benefit. We have purchased liability insurance covering our directors and officers and certain other management personnel.

Compensation Committee Interlocks and Insider Participation

At the beginning of Fiscal 2018, our Compensation Committee consisted of Stephen A. Snider (former chair), Richard E. Goodrich, Kevin J. McGinty and Michael W. Press. Mr. George was reappointed as a member of the Compensation Committee effective July 1, 2017. In addition, Mr. Nesser was appointed to the Compensation Committee and as its chair effective January 30, 2018. None of Messrs. Nesser, George, Goodrich, McGinty, Press or Snider is or has been an employee or officer of the Company. None of our Named Executive Officers has served on the board of directors or compensation committee (or other committee serving an equivalent function) of any other entity that has one or more of its executive officers serving as a member of our Board.

DIRECTOR COMPENSATION

The Board determines the form and amount of non-executive director compensation after its review of recommendations made by the N&CG Committee. In July 2017, the N&CG Committee retained Pearl Meyer & Partners, LLC ("Pearl Meyer") to review a benchmarking analysis of the Company's non-executive director compensation program compared to the non-executive director compensation programs of the same group of peer companies utilized in the Compensation Committee's review of the compensation of our Named Executive Officers, as discussed further in the section entitled "Executive Compensation—Compensation Discussion and Analysis." Following a review of the benchmarking analysis, Pearl Meyer noted that the Company's

total non-executive director compensation was below the median of the peer group and survey data compiled by Pearl Meyer. Accordingly, it recommended a $10,000 increase to director compensation during Fiscal 2018, split equally between the annual cash and equity retainers. The N&CG Committee recommended to the Board, and the Board subsequently approved, a $10,000 increase to the non-executive director compensation program, effective July 1, 2017, in the form of a $5,000 increase to each of the annual cash and equity retainers. In addition, the July equity grant date was moved up from the date of the Company's annual stockholder meeting to July 1st of each year.

The Company's current non-executive director compensation program, effective as of July 1, 2017, is set forth in the table below. In addition to these retainers, we reimburse our non-executive directors for actual reasonable out-of-pocket expenses upon presentation of documentation in accordance with the Company's typical expense reimbursement procedures.

|

| | | | | |

Type of Compensation(1) | | Recipient | | Amount($) |

Cash | | Board Member Retainer | | 50,000 |

|

Equity(2) | | Board Member Retainer | | 60,000 |

|

Cash | | Audit Committee Member Retainer | | 4,000 |

|

Cash | | Audit Committee Chair Retainer | | 14,000 |

|

Cash | | Compensation Committee Member Retainer | | 4,000 |

|

Cash | | Compensation Committee Chair Retainer | | 11,500 |

|

Cash | | N&CG Committee Member Retainer | | 4,000 |

|

Cash | | N&CG Committee Chair Retainer | | 11,500 |

|

Cash | | Independent Chairman Additional Retainer | | 52,500 |

|

| |

(1) | All annual retainers are paid in quarterly installments in advance and no additional meeting attendance fees were paid. |

| |

(2) | The annual equity retainer is paid in four equal installments on each of following dates: April 1, July 1, October 1 and January 1 (or, if any such date is not a trading day, the next trading day), with each equity award being 100% vested on the applicable grant date. |

The following table provides information regarding the compensation paid to non-executive directors during Fiscal 2018. The compensation paid to Mr. Thames is presented below under the section entitled "Executive Compensation." Mr. Thames did not receive any additional compensation for his service as a member of the Board during Fiscal 2018.

|

| | | | | | | | | |

Name | | Fees Earned or Paid In Cash ($) | | Stock Awards ($)(1) | | Total ($) |

Linda A. Dalgetty(2) | | — |

| | — |

| | — |

|

Marcus J. George | | 54,750 |

| | 58,729 |

| | 113,479 |

|

Richard E. Goodrich | | 66,750 |

| | 58,729 |

| | 125,479 |

|

Kevin J. McGinty | | 56,750 |

| | 58,729 |

| | 115,479 |

|

John T. Nesser, III | | 56,750 |

| | 58,729 |

| | 115,479 |

|

Michael W. Press | | 64,250 |

| | 58,729 |

| | 122,979 |

|

Stephen A. Snider | | 64,250 |

| | 58,729 |

| | 122,979 |

|

Charles A. Sorrentino(3) | | 109,250 |

| | 58,729 |

| | 167,979 |

|

| |