Consolidated financial statements of

CCI Thermal Technologies Inc.

July 31, 2017, July 31, 2016 and July 31, 2015

CCI Thermal Technologies Inc.

July 31, 2017, July 31, 2016 and July 31, 2015

Table of contents

Independent Auditor’s Report ............................................................................................................................ 1-2

Consolidated statements of financial position ....................................................................................................... 3

Consolidated statements of income and comprehensive income ......................................................................... 4

Consolidated statements of changes in shareholders’ equity ............................................................................... 5

Consolidated statements of cash flows ................................................................................................................. 6

Notes to the consolidated financial statements ................................................................................................ 7-27

Member of Deloitte Touche Tohmatsu Limited

Deloitte LLP

2000 Manulife Place

10180 - 101 Street

Edmonton AB T5J 4E4

Canada

Tel: 780-421-3611

Fax: 780-421-3782

www.deloitte.ca

Independent Auditor’s Report

To the Directors of

CCI Thermal Technologies Inc.

We have audited the accompanying consolidated financial statements of CCI Thermal Technologies

Inc. and its subsidiaries (the “Company”), which comprise the consolidated statements of financial

position as of July 31, 2017 and 2016, and the related consolidated statements of income and

comprehensive income, consolidated statements of changes in shareholders’ equity and consolidated

statements of cash flows for each of the three years in the period ended July 31, 2017, and the

related notes to the consolidated financial statements.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial

statements in accordance with International Financial Reporting Standards as issued by the

International Accounting Standards Board; this includes the design, implementation, and maintenance

of internal control relevant to the preparation of consolidated financial statements that are free from

material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our

audits. We conducted our audits in accordance with auditing standards generally accepted in the

United States of America. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the consolidated financial statements are free from material

misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures

in the consolidated financial statements. The procedures selected depend on the auditor’s judgment,

including the assessment of the risks of material misstatement of the consolidated financial

statements, whether due to fraud or error. In making those risk assessments, the auditor considers

internal control relevant to the Company’s preparation and fair presentation of the consolidated

financial statements in order to design audit procedures that are appropriate in the circumstances, but

not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of

accounting policies used and the reasonableness of significant accounting estimates made by

management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis

for our audit opinion.

Page 2

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of CCI Thermal Technologies Inc. and its subsidiaries as of July 31,

2017 and 2016, and their financial performance and their cash flows for each of the three years in the

period ended July 31, 2017, in accordance with International Financial Reporting Standards as issued

by the International Accounting Standards Board.

Chartered Professional Accountants

January 15, 2018

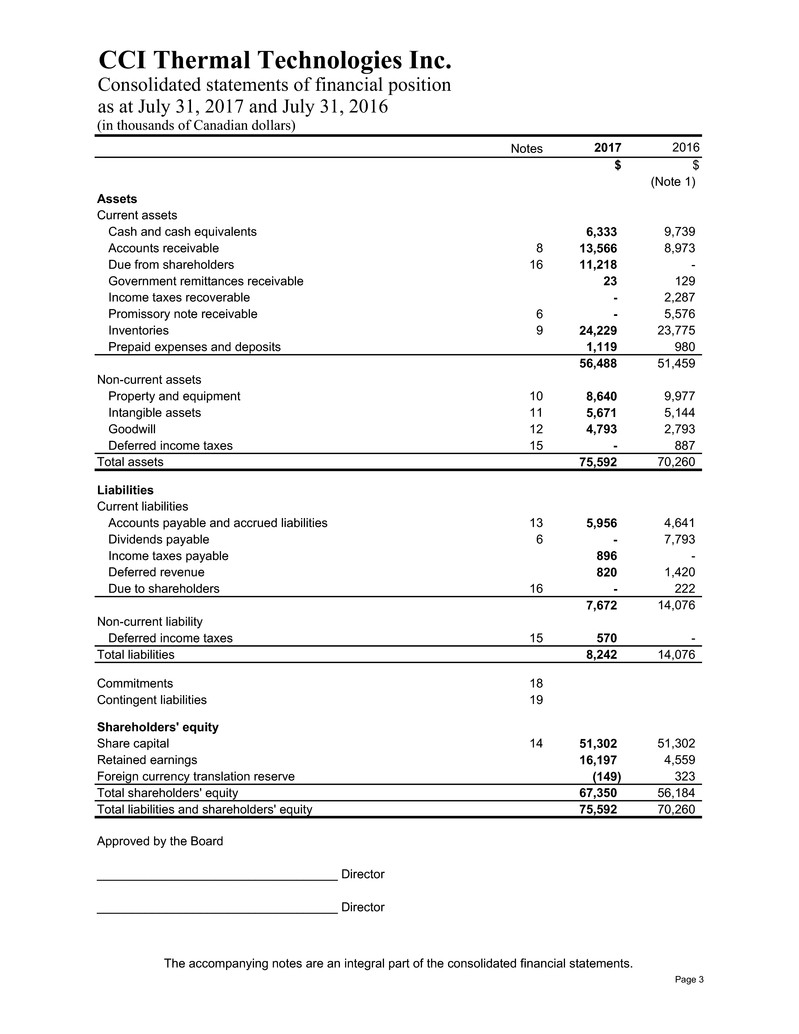

CCI Thermal Technologies Inc.

Consolidated statements of financial position

as at July 31, 2017 and July 31, 2016

(in thousands of Canadian dollars)

Notes 2017 2016

$ $

(Note 1)

Assets

Current assets

Cash and cash equivalents 6,333 9,739

Accounts receivable 8 13,566 8,973

Due from shareholders 16 11,218 -

Government remittances receivable 23 129

Income taxes recoverable - 2,287

Promissory note receivable 6 - 5,576

Inventories 9 24,229 23,775

Prepaid expenses and deposits 1,119 980

56,488 51,459

Non-current assets

Property and equipment 10 8,640 9,977

Intangible assets 11 5,671 5,144

Goodwill 12 4,793 2,793

Deferred income taxes 15 - 887

Total assets 75,592 70,260

Liabilities

Current liabilities

Accounts payable and accrued liabilities 13 5,956 4,641

Dividends payable 6 - 7,793

Income taxes payable 896 -

Deferred revenue 820 1,420

Due to shareholders 16 - 222

7,672 14,076

Non-current liability

Deferred income taxes 15 570 -

Total liabilities 8,242 14,076

Commitments 18

Contingent liabilities 19

Shareholders' equity

Share capital 14 51,302 51,302

Retained earnings 16,197 4,559

Foreign currency translation reserve (149) 323

Total shareholders' equity 67,350 56,184

Total liabilities and shareholders' equity 75,592 70,260

Approved by the Board

___________________________________ Director

___________________________________ Director

The accompanying notes are an integral part of the consolidated financial statements.

Page 3

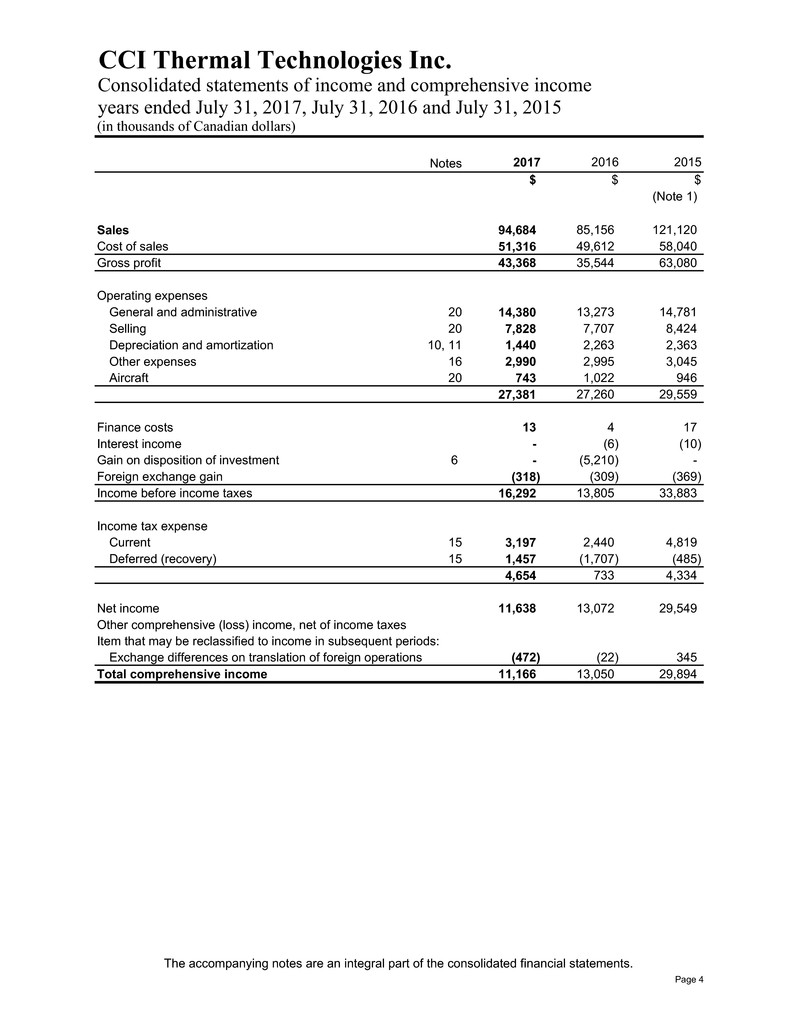

CCI Thermal Technologies Inc.

Consolidated statements of income and comprehensive income

years ended July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Notes

2017

2016

2015

$ $ $

(Note 1)

Sales 94,684 85,156 121,120

Cost of sales 51,316 49,612 58,040

Gross profit 43,368 35,544 63,080

Operating expenses

General and administrative 20 14,380 13,273 14,781

Selling 20 7,828 7,707 8,424

Depreciation and amortization 10, 11 1,440 2,263 2,363

Other expenses 16 2,990 2,995 3,045

Aircraft 20 743 1,022 946

27,381 27,260 29,559

Finance costs 13 4 17

Interest income - (6) (10)

Gain on disposition of investment 6 - (5,210) -

Foreign exchange gain (318) (309) (369)

Income before income taxes 16,292 13,805 33,883

Income tax expense

Current 15 3,197 2,440 4,819

Deferred (recovery) 15 1,457 (1,707) (485)

4,654 733 4,334

Net income 11,638 13,072 29,549

Other comprehensive (loss) income, net of income taxes

Item that may be reclassified to income in subsequent periods:

Exchange differences on translation of foreign operations (472) (22) 345

Total comprehensive income 11,166 13,050 29,894

The accompanying notes are an integral part of the consolidated financial statements.

Page 4

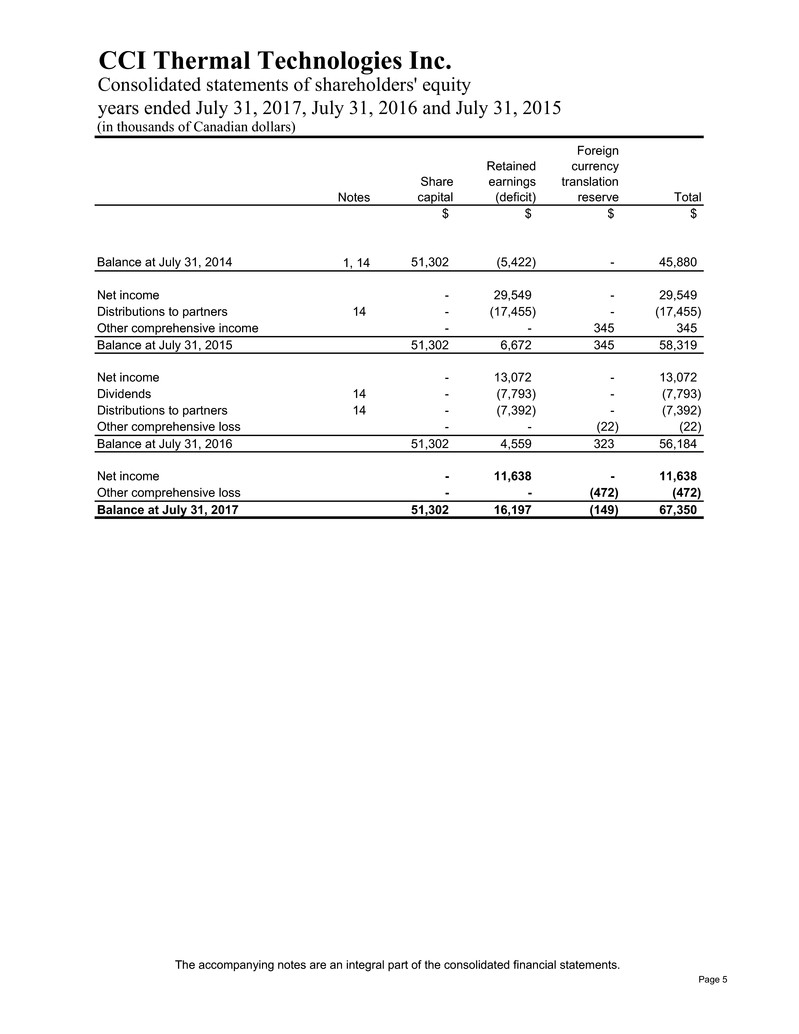

CCI Thermal Technologies Inc.

Consolidated statements of shareholders' equity

years ended July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Notes

Share

capital

Retained

earnings

(deficit)

Foreign

currency

translation

reserve Total

$ $ $ $

Balance at July 31, 2014 1, 14 51,302 (5,422) - 45,880

Net income - 29,549 - 29,549

Distributions to partners 14 - (17,455) - (17,455)

Other comprehensive income - - 345 345

Balance at July 31, 2015 51,302 6,672 345 58,319

Net income - 13,072 - 13,072

Dividends 14 - (7,793) - (7,793)

Distributions to partners 14 - (7,392) - (7,392)

Other comprehensive loss - - (22) (22)

Balance at July 31, 2016 51,302 4,559 323 56,184

Net income - 11,638 - 11,638

Other comprehensive loss - - (472) (472)

Balance at July 31, 2017 51,302 16,197 (149) 67,350

The accompanying notes are an integral part of the consolidated financial statements.

Page 5

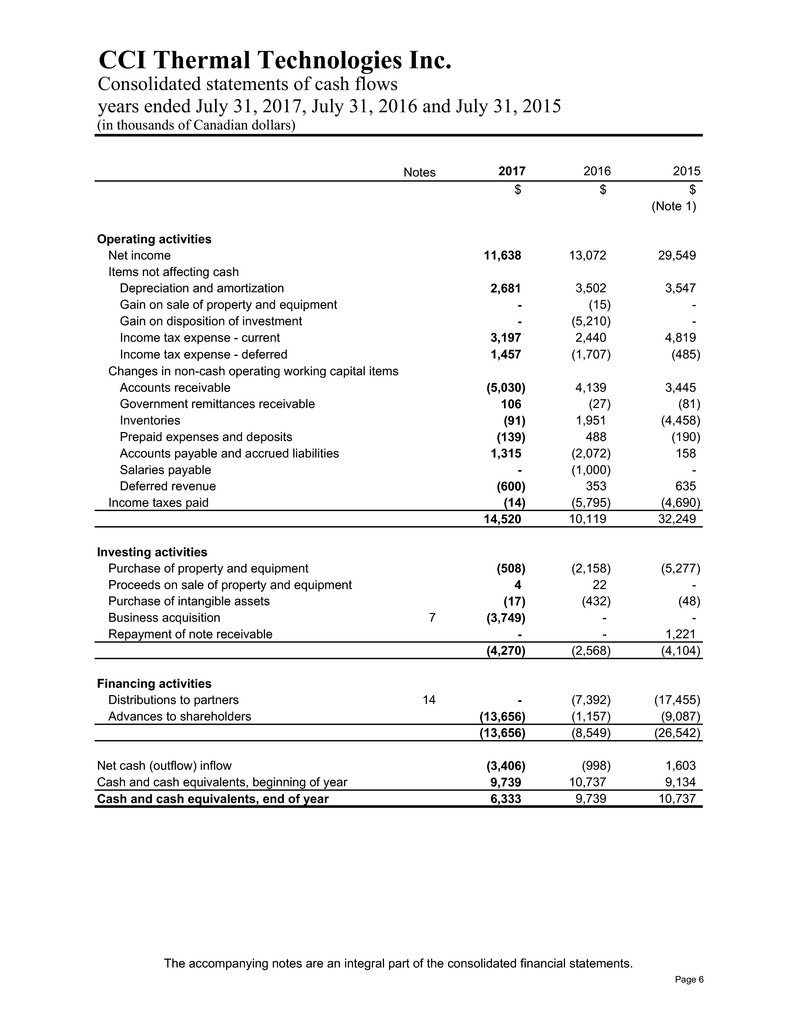

CCI Thermal Technologies Inc.

Consolidated statements of cash flows

years ended July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Notes 2017 2016 2015

$ $ $

(Note 1)

Operating activities

Net income 11,638 13,072 29,549

Items not affecting cash

Depreciation and amortization 2,681 3,502 3,547

Gain on sale of property and equipment - (15) -

Gain on disposition of investment - (5,210) -

Income tax expense - current 3,197 2,440 4,819

Income tax expense - deferred 1,457 (1,707) (485)

Changes in non-cash operating working capital items

Accounts receivable (5,030) 4,139 3,445

Government remittances receivable 106 (27) (81)

Inventories (91) 1,951 (4,458)

Prepaid expenses and deposits (139) 488 (190)

Accounts payable and accrued liabilities 1,315 (2,072) 158

Salaries payable - (1,000) -

Deferred revenue (600) 353 635

Income taxes paid (14) (5,795) (4,690)

14,520 10,119 32,249

Investing activities

Purchase of property and equipment (508) (2,158) (5,277)

Proceeds on sale of property and equipment 4 22 -

Purchase of intangible assets (17) (432) (48)

Business acquisition 7 (3,749) - -

Repayment of note receivable - - 1,221

(4,270) (2,568) (4,104)

Financing activities

Distributions to partners 14 - (7,392) (17,455)

Advances to shareholders (13,656) (1,157) (9,087)

(13,656) (8,549) (26,542)

Net cash (outflow) inflow (3,406) (998) 1,603

Cash and cash equivalents, beginning of year 9,739 10,737 9,134

Cash and cash equivalents, end of year 6,333 9,739 10,737

The accompanying notes are an integral part of the consolidated financial statements.

Page 6

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 7

1. Description of business and reorganization

CCI Thermal Technologies Inc. (the “Company”) was incorporated on November 19, 1991 under the

Alberta Business Corporations Act and is primarily engaged in investing.

The address of the Company’s registered office and principal place of business is 5918 Roper Rd NW,

Edmonton, Alberta, Canada T6B 3E1.

The Company was the general partner of CCI Thermal Technologies Partnership (the “Partnership”), up

to and including July 31, 2016. Effective August 1, 2016, the Company and the Partnership completed a

reorganization whereby the limited partners of the Partnership, CCI Thermal Technologies

Employees Inc. (“Employees”) and Camary Holdings Ltd. (“Camary”), each exchanged their interest in

the Partnership for an equivalent interest in the Company, on a tax deferred basis under Section 85 of

the Income Tax Act (Canada). As a result, the Partnership was dissolved and the net assets and

business of the Partnership were transferred to the Company. Employees and Camary exchanged their

interests in the Partnership for common shares of the Company. Refer to Note 14 for details on the

reorganization transaction.

Prior to August 1, 2016, the Company was wholly owned by Rocor Holdings Ltd. (“Rocor”). Subsequent

to August 1, 2016, Employees, Camary and Rocor own 150 Class A common shares, 425 Class A

common shares and 425 Class A common shares of the Company, respectively.

Management has determined that IFRS 3, Business Combinations, does not apply as the reorganization

transaction is considered a common control transaction whereby the entities included in the

reorganization (i.e. the Company and the Partnership) are ultimately controlled by the same parties

before and after the reorganization and there has been no substantive change in ownership. Instead,

management has applied the continuity of business method whereby the assets and liabilities of the

entities included in the reorganization are recorded at their existing carrying values rather than fair value,

no goodwill is recorded and the comparative periods have been restated (except for number of shares)

as if the reorganization had taken place at the beginning of the earliest comparative period presented.

The Company and its subsidiaries are primarily engaged in engineering and manufacturing a wide array

of heating and filtration products for industrial and hazardous area applications.

2. Basis of preparation and statement of compliance

a) Statement of compliance

These consolidated financial statements have been prepared in accordance with International

Financial Reporting Standards (“IFRS”), and the accounting policies set out below have been

applied consistently to all periods presented. These consolidated financial statements comply with

IFRS as issued by the International Accounting Standards Board (“IASB”).

These consolidated financial statements were approved by the Board of Directors (the “Directors”)

on January 15, 2018.

b) Basis of measurement

The Company’s consolidated financial statements have been prepared on a going concern basis,

under the historical cost model, except for certain financial instruments measured at fair value.

c) Functional and presentation currency

These consolidated financial statements are presented in Canadian dollars, which is the Company’s

functional and presentation currency.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 8

2. Basis of preparation and statement of compliance (continued)

c) Functional and presentation currency (continued)

In preparing the financial statements of each subsidiary within the group, transactions in currencies

other than the entity's functional currency (foreign currencies) are recognized at the rates of

exchange prevailing at the dates of the transactions. At the end of each reporting period, monetary

items denominated in foreign currencies are retranslated at the rates prevailing at that date. Non-

monetary items carried at fair value that are denominated in foreign currencies are retranslated at

the rates prevailing at the date when the fair value was determined. Non-monetary items that are

measured in terms of historical cost in a foreign currency are not retranslated.

For the purposes of presenting these consolidated financial statements, the assets and liabilities of

the Company’s operations in the U.S. are translated into Canadian dollars using exchange rates

prevailing at the end of each reporting period. Income and expense items are translated at the

average exchange rates for the period, unless exchange rates fluctuate significantly during that

period, in which case the exchange rates at the dates of the transactions are used. Exchange

differences arising, if any, are recognized in other comprehensive income and accumulated in

equity.

d) Principles of consolidation

These consolidated financial statements include the results of the Company and its subsidiaries.

Subsidiaries are all entities over which the Company has control. The Company controls an entity

when the Company is exposed to, or has rights to, variable returns from its involvement with the

entity and has the ability to affect those returns through its power over the entity. Subsidiaries are

fully consolidated from the date on which control is transferred to the Company and continue to be

consolidated until the date control ceases. All intercompany transactions, balances, income and

expenses are eliminated on consolidation.

These consolidated financial statements include the results of the Company and its wholly owned

subsidiaries, CCI Thermal Technologies Delaware, Inc., CCI Thermal Technologies Texas, Inc. and

CCI Thermal Technologies Colorado Inc. The Company has applied uniform accounting policies

throughout all consolidated entities and reporting dates of the subsidiaries are all consistent with the

Company.

e) Use of estimates and judgments

The preparation of consolidated financial statements requires management to make judgments,

estimates and assumptions that may affect the reported amounts of assets, liabilities, income,

expenses and disclosure of contingent assets and liabilities reported each period. Actual results

could differ from those estimates. Significant estimates and judgments are outlined in Note 5.

3. Significant accounting policies

a) Cash and cash equivalents

Cash and cash equivalents include cash in the bank, less outstanding cheques, and short-term

investments with original maturities of three months or less.

b) Business combinations

Acquisitions of businesses are accounted for using the acquisition method. The consideration

transferred in a business combination is measured at fair value, which is calculated as the sum of

the acquisition-date fair values of the assets transferred by the Company, liabilities incurred by the

Company to the former owners of the acquiree and the equity interest issued by the Company in

exchange for control of the acquiree. Acquisition-related costs are generally recognized in profit or

loss as incurred.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 9

3. Significant accounting policies (continued)

c) Inventories

Raw materials, work-in-progress and finished goods are valued at the lower of cost and net

realizable value. Cost is determined on a weighted average cost basis. The cost of work-in-progress

includes the cost of raw materials, direct labour and an appropriate portion of fixed and variable

manufacturing overhead. Net realizable value represents the estimated selling price less all

estimated costs of completion and costs necessary to make the sale.

d) Property and equipment

Property and equipment are stated at historical cost, net of accumulated depreciation and

accumulated impairment losses, if any. Historical cost includes expenditures directly attributable to

the acquisition of the asset. The costs of major refurbishments, overhauls or replacements are

capitalized when it is probable the future economic benefits will be realized by the Company and the

associated carrying amount of the replaced component is derecognized. All other repair and

maintenance costs are recognized in the consolidated statements of income and comprehensive

income as incurred.

Leases that transfer substantially all the benefits and risks of ownership are recorded as finance

lease assets within property and equipment. Land is measured at cost, less any accumulated

impairment losses.

Depreciation is recorded by the Company at rates determined to depreciate the cost of property and

equipment over their estimated useful lives as follows:

Aircraft 25% declining balance

Automotive 30% declining balance

Building 4% declining balance

Computer hardware 30% declining balance

Furniture and fixtures 20%-30% declining balance

Leasehold improvements Straight-line over term of the lease

Shop equipment 20%-30% declining balance

Tools and dies 50% straight-line

The estimated useful lives and methods of depreciation are reviewed at the end of each reporting

period, with the effect of any changes in estimate being accounted for on a prospective basis.

e) Intangible assets

Intangible assets with finite useful lives are recorded at historical cost, net of accumulated

amortization and accumulated impairment losses, if any. Amortization is recorded by the Company

at rates determined to amortize the cost of intangible assets over their estimated useful lives as

follows:

Patent - Caloritech Straight-line over 180 months

Patents - 3L Filters Straight-line over various terms ranging from 149 to 192 months

Patents - Fastrax Straight-line over 180 months

Trademark - 3L Filters Straight-line over 120 months

Trademark - Ruffneck Straight-line over 120 months

Trademark - Flo-Dri Straight-line over 120 months

Trademark - Fastrax Straight-line over 120 months

Trademark - Hovey Straight-line over 120 months

Computer software 30% declining balance

The estimated useful lives and methods of amortization are reviewed at the end of each reporting

period, with the effect of any changes in estimate being accounted for on a prospective basis.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 10

3. Significant accounting policies (continued)

f) Goodwill

Goodwill is measured as the excess of the fair value of the purchase price of a business acquisition

over the estimated fair value of the net identifiable assets of the acquired business, at the date of

acquisition. Goodwill arising on an acquisition of a business is carried at cost as established at the

date of acquisition of the business less accumulated impairment losses, if any.

For the purposes of impairment testing, goodwill is allocated to each of the Company’s cash-

generating units (or groups of cash-generating units) that is expected to benefit from the synergies

of the combination.

A cash-generating unit to which goodwill has been allocated is tested for impairment annually, or

more frequently when there is an indication that the unit may be impaired. If the recoverable amount

of the cash-generating unit is less than its carrying amount, the impairment loss is allocated first to

reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the

unit pro rata based on the carrying amount of each asset in the unit. Any impairment loss for

goodwill is recognized directly in profit or loss.

Goodwill is tested for impairment annually as at July 31 and when circumstances indicate that the

carrying value may be impaired. Impairment is determined for goodwill by assessing the recoverable

amount of each group of CGUs to which goodwill relates. The groups of CGUs represent the lowest

level within the Company at which goodwill is monitored for internal management purposes and are

not larger than an operating segment. When the recoverable amount of a group of CGUs is less

than its carrying amount, an impairment loss is recognized. Impairment losses relating to goodwill

are not reversed in future periods.

g) Impairment of non-financial assets

The carrying amounts of the Company’s non-financial assets, excluding goodwill, primarily consist

of property and equipment and finite life intangible assets, and are reviewed at each reporting date

to determine whether there is an indication that an asset may be impaired. Internal factors, such as

budgets and forecasts, as well as external factors such as expected future prices, costs and other

market factors, are monitored to determine if indications of impairment exist.

An impairment loss is the amount equal to the excess of the carrying amount over the recoverable

amount. An asset's recoverable amount is the higher of the fair value less costs of disposal and its

value in use. In determining fair value less costs of disposal, recent market transactions are taken

into account. If no such transactions can be identified, an appropriate valuation model is used.

Value in use is assessed using the present value of the expected future cash flows of the relevant

asset.

The recoverable amount is determined for an individual asset unless the asset does not generate

cash inflows that are largely independent of those from other assets or groups of assets. A cash-

generating unit (“CGU”) is the smallest identifiable group of assets that generates cash inflows that

are largely independent of the cash inflows from other assets or groups of assets. When the

carrying amount of an asset or CGU exceeds its recoverable amount, the asset is considered

impaired and is written down to its recoverable amount. Impairment losses, if any, are recognized in

the consolidated statements of income and comprehensive income.

Non-financial assets, excluding goodwill, are assessed at each reporting date to determine whether

there is a possible reversal of previously recognized impairment losses.

h) Financial instruments

All financial assets and financial liabilities are recognized on the consolidated statements of financial

position when the Company becomes a party to the contractual provisions of a financial instrument.

All financial instruments are initially recognized at fair value. Subsequent measurements of financial

instruments are based on their classification.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 11

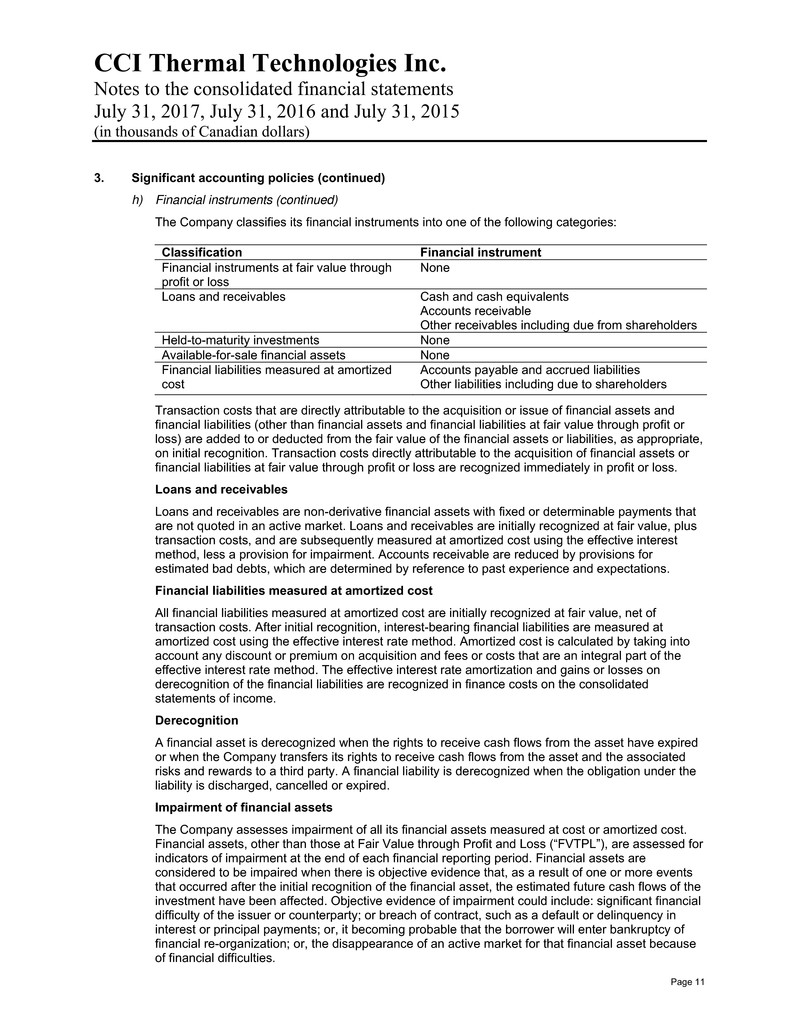

3. Significant accounting policies (continued)

h) Financial instruments (continued)

The Company classifies its financial instruments into one of the following categories:

Transaction costs that are directly attributable to the acquisition or issue of financial assets and

financial liabilities (other than financial assets and financial liabilities at fair value through profit or

loss) are added to or deducted from the fair value of the financial assets or liabilities, as appropriate,

on initial recognition. Transaction costs directly attributable to the acquisition of financial assets or

financial liabilities at fair value through profit or loss are recognized immediately in profit or loss.

Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that

are not quoted in an active market. Loans and receivables are initially recognized at fair value, plus

transaction costs, and are subsequently measured at amortized cost using the effective interest

method, less a provision for impairment. Accounts receivable are reduced by provisions for

estimated bad debts, which are determined by reference to past experience and expectations.

Financial liabilities measured at amortized cost

All financial liabilities measured at amortized cost are initially recognized at fair value, net of

transaction costs. After initial recognition, interest-bearing financial liabilities are measured at

amortized cost using the effective interest rate method. Amortized cost is calculated by taking into

account any discount or premium on acquisition and fees or costs that are an integral part of the

effective interest rate method. The effective interest rate amortization and gains or losses on

derecognition of the financial liabilities are recognized in finance costs on the consolidated

statements of income.

Derecognition

A financial asset is derecognized when the rights to receive cash flows from the asset have expired

or when the Company transfers its rights to receive cash flows from the asset and the associated

risks and rewards to a third party. A financial liability is derecognized when the obligation under the

liability is discharged, cancelled or expired.

Impairment of financial assets

The Company assesses impairment of all its financial assets measured at cost or amortized cost.

Financial assets, other than those at Fair Value through Profit and Loss (“FVTPL”), are assessed for

indicators of impairment at the end of each financial reporting period. Financial assets are

considered to be impaired when there is objective evidence that, as a result of one or more events

that occurred after the initial recognition of the financial asset, the estimated future cash flows of the

investment have been affected. Objective evidence of impairment could include: significant financial

difficulty of the issuer or counterparty; or breach of contract, such as a default or delinquency in

interest or principal payments; or, it becoming probable that the borrower will enter bankruptcy of

financial re-organization; or, the disappearance of an active market for that financial asset because

of financial difficulties.

Classification Financial instrument

Financial instruments at fair value through

profit or loss

None

Loans and receivables Cash and cash equivalents

Accounts receivable

Other receivables including due from shareholders

Held-to-maturity investments None

Available-for-sale financial assets None

Financial liabilities measured at amortized

cost

Accounts payable and accrued liabilities

Other liabilities including due to shareholders

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 12

3. Significant accounting policies (continued)

h) Financial instruments (continued)

Impairment of financial assets (continued)

For financial assets carried at amortized cost, the amount of impairment loss recognized is the

difference between the asset’s carrying amount and the present value of estimated future cash

flows, discounted at the financial asset’s original effective interest rate. If in a subsequent period the

amount of the impairment loss decreases and the decrease can be related objectively to an event

occurring after the impairment was recognized, the previously recognized impairment loss is

reversed through profit or loss to the extent that the carrying amount of the investment at the date

the impairment is reversed does not exceed what the amortized cost would have been had the

impairment not been recognized.

For financial assets that are carried at cost, the amount of the impairment loss is measured as the

difference between the asset’s carrying amount and the present value of the estimated future cash

flows discounted at the current market rate of return for a similar financial asset. Such impairment

loss will not be reversed in subsequent periods.

i) Fair value measurement

The Company determines the fair value of items classified as fair value according to the following

hierarchy based on the amount of observable inputs used to value the instrument.

Level 1 Quoted prices are available in active markets for identical assets or liabilities as of

the reporting date. Active markets are those in which transactions occur in

sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2 Pricing inputs are other than quoted prices in active markets included in Level 1.

Prices in Level 2 are either directly or indirectly observable as of the reporting date.

Level 2 valuations are based on inputs, including quoted forward prices for

commodities, time value and volatility factors, which can be substantially observed

or corroborated in the marketplace.

Level 3 Valuations in this level are those with inputs for the asset or liability that are not

based on observable market data.

Currently no items are classified as fair value through profit or loss.

j) Revenue recognition

Revenue is measured at the fair value of the consideration received or receivable for goods and

services provided, net of trade discounts and sales based taxes.

The Company recognizes revenue when significant risks and rewards of ownership of goods have

transferred to the buyer, normally being when delivery has occurred, the Company retains no

continuing managerial involvement or control over the goods, the price to the buyer is determinable

and collection is reasonably assured.

Revenue on contracts that extend beyond one year are recognized upon delivery using the

percentage-of-completion method which is measured by the percentage-of-costs incurred to date to

the total estimated costs for each of the contracts.

Any billings in excess of revenue calculated by the percentage-of-completion method are deemed

unearned and are recorded as deferred revenue on the consolidated statements of financial

position.

Cost of sales includes all direct material labour, subcontract costs and indirect costs related to

contract performance, such as indirect labour, supplies, small tools and repairs. Provisions for

estimated losses on contracts are made in the period in which such losses are determined.

Changes in job performance and job conditions may result in revisions to revenues and costs and

are recognized in the period in which the revisions are determined.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 13

3. Significant accounting policies (continued)

k) Income taxes

Corporate income taxes are accounted for using the deferred income taxes method. Deferred tax is

recognized on temporary differences between the carrying amounts of assets and liabilities in the

consolidated financial statements and the corresponding tax bases used in the computation of

taxable profit. Deferred tax liabilities are generally recognized for all taxable temporary differences.

Deferred tax assets are generally recognized for all deductible temporary differences to the extent

that it is probable that taxable profits will be available against which those deductible temporary

differences can be utilized. Such deferred tax assets and liabilities are not recognized if the

temporary difference arises from the initial recognition (other than in a business combination) of

assets and liabilities in a transaction that affects neither the taxable profit nor the accounting profit.

In addition, deferred tax liabilities are not recognized if the temporary difference arise from the initial

recognition of goodwill.

The carrying amount of deferred tax assets is reviewed at the end of each reporting period and

reduced to the extent that it is no longer probable that sufficient taxable profits will be available to

allow all or part of the asset to be recovered.

Deferred tax liabilities and assets are measured at the tax rates that are expected to apply in the

period in which the liability is settled or the asset realized, based on tax rates (and tax laws) that

have been enacted or substantively enacted by the end of the reporting period.

The measurement of deferred tax liabilities and assets reflects the consequences that would follow

from the manner in which the Company expects, at the end of the reporting period, to recover or

settle the carrying amount of its assets and liabilities.

Current and deferred tax are recognized in profit or loss, except when they relate to items that are

recognized in other comprehensive income or directly in equity, in which case, the current and

deferred tax are also recognized in other comprehensive income or directly in equity, respectively.

Where current tax or deferred tax arise from the initial accounting for a business combination, the

tax effect is included in the accounting for business combination.

l) Leases

Leases are classified as either operating or finance based on the substance of the arrangement at

the inception of the lease.

A lease that transfers substantially all the risks and rewards incidental to ownership to the Company

is classified as a finance lease. Finance leases are capitalized at lease commencement at the lower

of the asset fair value and the present value of the minimum lease payments. Lease payments are

apportioned between finance charges and reduction of the lease liability so as to achieve a constant

rate of interest on the remaining balance of the liability. Finance charges are recognized in finance

costs in the consolidated statements of income and comprehensive income. Finance lease

obligations are included in long-term liabilities.

Operating leases are leases other than a finance lease. Operating lease payments are recognized

as an operating expense in the consolidated statements of income and comprehensive income on a

straight-line basis over the lease term.

m) Provisions

Provision are recognized when the Company has a present legal or constructive obligation as a

result of past events, it is more likely than not that an outflow of resources will be required to settle

the obligation and the amount can be reliably estimated. The timing or amount of the outflow may

still be uncertain. Provisions are measured at management’s best estimate of the expenditure

required to settle the obligation at the end of the reporting period. Each obligation is discounted to

present value using the expected future cash flow at a rate that reflects current market assessments

of the time value of money and the risks specific to the liability.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 14

4. Future accounting standard pronouncements

The following new standards have been issued by the IASB, but are not effective for the fiscal year

ended July 31, 2017, and accordingly, have not been applied in preparing these consolidated financial

statements.

IFRS 9, Financial Instruments

IFRS 9 - Financial Instruments (“IFRS 9”), was issued by the IASB on July 24, 2014, and will replace

IAS 39 - Financial Instruments: Recognition and Measurement (“IAS 39”). IFRS 9 utilizes a single

approach to determine whether a financial asset is measured at amortized cost or fair value and a new

mixed measurement model for debt instruments having only two categories: amortized cost and fair

value. The approach in IFRS 9 is based on how an entity manages its financial instruments in the

context of its business model and the contractual cash flow characteristics of the financial assets. Final

amendments released on July 24, 2014, also introduce a new expected loss impairment model and

limited changes to the classification and measurement requirements for financial assets. IFRS 9 is

effective for annual periods beginning on or after January 1, 2018. The Company is currently evaluating

the impact of this standard and amendments on its consolidated financial statements.

IFRS 15, Revenue from Contracts with Customers

IFRS 15 - Revenue from Contracts and Customers (“IFRS 15”), was issued by the IASB on May 24,

2014, and will replace IAS 18 – Revenue, IAS 11, Construction Contracts and related interpretations on

revenue. IFRS 15 sets out the requirements for recognizing revenue that apply to all contracts and

customers, except for contracts that are within the scope of the standard on leases, insurance contracts

and financial instruments. IFRS 15 uses a control based approach to recognize revenue which is a

change from the risk and reward approach under the current standard. Specifically, IFRS 15 introduces

a 5-step approach to revenue recognition:

i. Identify the contract with a customer;

ii. Identify the performance obligation in the contract;

iii. Determine the transaction price;

iv. Allocate the transaction price to the performance obligations in the contract;

v. Recognize revenue when (or as) the entity satisfies a performance obligation.

Companies can elect to use either a full or modified retrospective approach when adopting this standard

and it is effective for annual periods beginning on or after January 1, 2018. The Company is currently

evaluating the impact of this standard on its consolidated financial statements.

IFRS 16, Leases

IFRS 16 - Leases (“IFRS 16”), was issued by the IASB on January 13, 2016, and will replace IAS 17 -

Leases. IFRS 16 will bring most leases on-balance sheet for lessees under a single model, eliminating

the distinction between operating and financing leases. Lessor accounting however remains largely

unchanged and the distinction between operating and finance leases is retained. The new standard is

effective for annual periods beginning on or after January 1, 2019, with early adoption permitted if

IFRS 15 has also been applied. The Company is currently evaluating the impact of this standard on its

consolidated financial statements.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 15

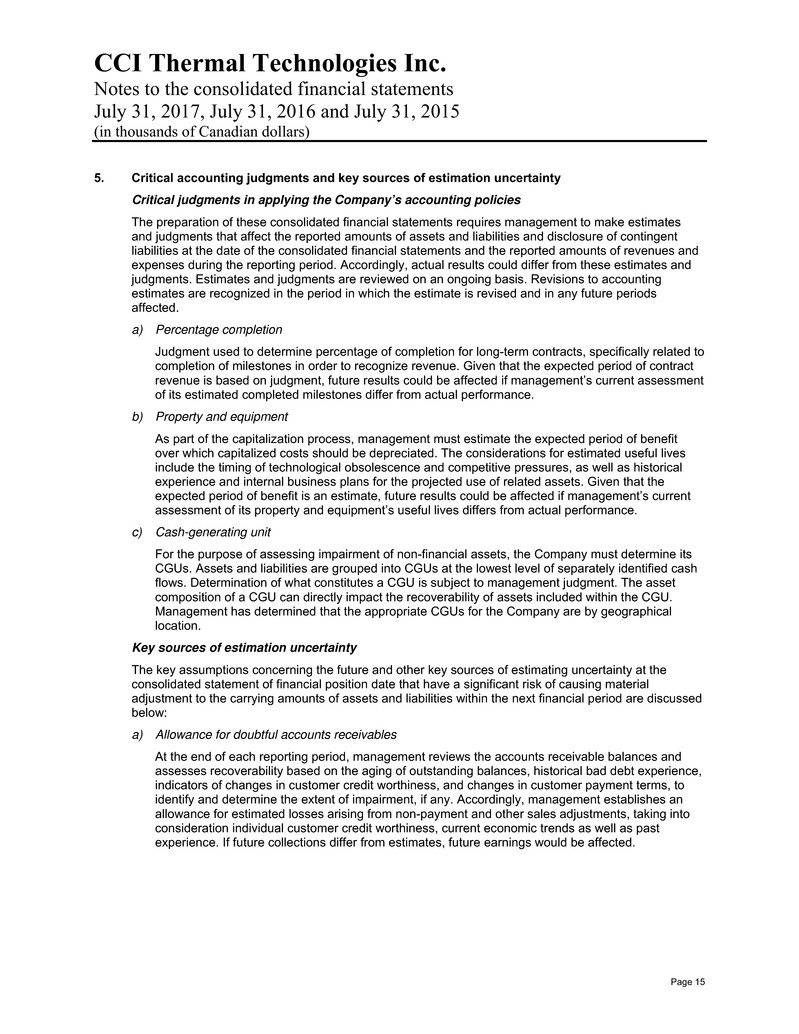

5. Critical accounting judgments and key sources of estimation uncertainty

Critical judgments in applying the Company’s accounting policies

The preparation of these consolidated financial statements requires management to make estimates

and judgments that affect the reported amounts of assets and liabilities and disclosure of contingent

liabilities at the date of the consolidated financial statements and the reported amounts of revenues and

expenses during the reporting period. Accordingly, actual results could differ from these estimates and

judgments. Estimates and judgments are reviewed on an ongoing basis. Revisions to accounting

estimates are recognized in the period in which the estimate is revised and in any future periods

affected.

a) Percentage completion

Judgment used to determine percentage of completion for long-term contracts, specifically related to

completion of milestones in order to recognize revenue. Given that the expected period of contract

revenue is based on judgment, future results could be affected if management’s current assessment

of its estimated completed milestones differ from actual performance.

b) Property and equipment

As part of the capitalization process, management must estimate the expected period of benefit

over which capitalized costs should be depreciated. The considerations for estimated useful lives

include the timing of technological obsolescence and competitive pressures, as well as historical

experience and internal business plans for the projected use of related assets. Given that the

expected period of benefit is an estimate, future results could be affected if management’s current

assessment of its property and equipment’s useful lives differs from actual performance.

c) Cash-generating unit

For the purpose of assessing impairment of non-financial assets, the Company must determine its

CGUs. Assets and liabilities are grouped into CGUs at the lowest level of separately identified cash

flows. Determination of what constitutes a CGU is subject to management judgment. The asset

composition of a CGU can directly impact the recoverability of assets included within the CGU.

Management has determined that the appropriate CGUs for the Company are by geographical

location.

Key sources of estimation uncertainty

The key assumptions concerning the future and other key sources of estimating uncertainty at the

consolidated statement of financial position date that have a significant risk of causing material

adjustment to the carrying amounts of assets and liabilities within the next financial period are discussed

below:

a) Allowance for doubtful accounts receivables

At the end of each reporting period, management reviews the accounts receivable balances and

assesses recoverability based on the aging of outstanding balances, historical bad debt experience,

indicators of changes in customer credit worthiness, and changes in customer payment terms, to

identify and determine the extent of impairment, if any. Accordingly, management establishes an

allowance for estimated losses arising from non-payment and other sales adjustments, taking into

consideration individual customer credit worthiness, current economic trends as well as past

experience. If future collections differ from estimates, future earnings would be affected.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 16

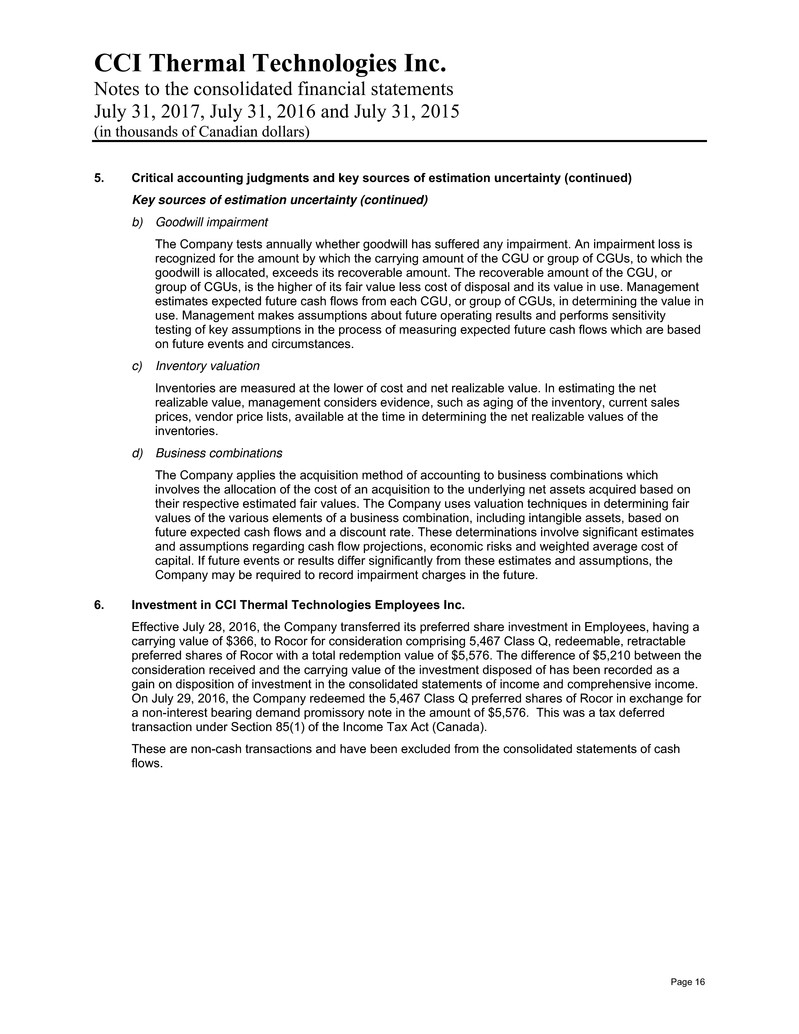

5. Critical accounting judgments and key sources of estimation uncertainty (continued)

Key sources of estimation uncertainty (continued)

b) Goodwill impairment

The Company tests annually whether goodwill has suffered any impairment. An impairment loss is

recognized for the amount by which the carrying amount of the CGU or group of CGUs, to which the

goodwill is allocated, exceeds its recoverable amount. The recoverable amount of the CGU, or

group of CGUs, is the higher of its fair value less cost of disposal and its value in use. Management

estimates expected future cash flows from each CGU, or group of CGUs, in determining the value in

use. Management makes assumptions about future operating results and performs sensitivity

testing of key assumptions in the process of measuring expected future cash flows which are based

on future events and circumstances.

c) Inventory valuation

Inventories are measured at the lower of cost and net realizable value. In estimating the net

realizable value, management considers evidence, such as aging of the inventory, current sales

prices, vendor price lists, available at the time in determining the net realizable values of the

inventories.

d) Business combinations

The Company applies the acquisition method of accounting to business combinations which

involves the allocation of the cost of an acquisition to the underlying net assets acquired based on

their respective estimated fair values. The Company uses valuation techniques in determining fair

values of the various elements of a business combination, including intangible assets, based on

future expected cash flows and a discount rate. These determinations involve significant estimates

and assumptions regarding cash flow projections, economic risks and weighted average cost of

capital. If future events or results differ significantly from these estimates and assumptions, the

Company may be required to record impairment charges in the future.

6. Investment in CCI Thermal Technologies Employees Inc.

Effective July 28, 2016, the Company transferred its preferred share investment in Employees, having a

carrying value of $366, to Rocor for consideration comprising 5,467 Class Q, redeemable, retractable

preferred shares of Rocor with a total redemption value of $5,576. The difference of $5,210 between the

consideration received and the carrying value of the investment disposed of has been recorded as a

gain on disposition of investment in the consolidated statements of income and comprehensive income.

On July 29, 2016, the Company redeemed the 5,467 Class Q preferred shares of Rocor in exchange for

a non-interest bearing demand promissory note in the amount of $5,576. This was a tax deferred

transaction under Section 85(1) of the Income Tax Act (Canada).

These are non-cash transactions and have been excluded from the consolidated statements of cash

flows.

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 17

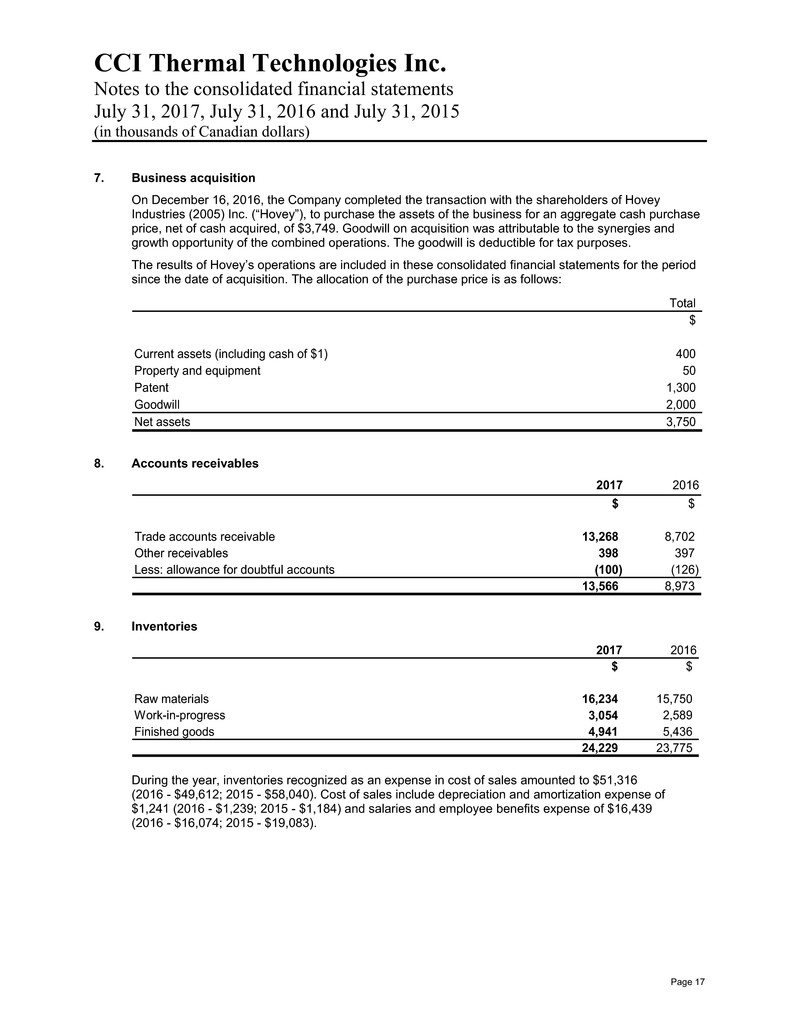

7. Business acquisition

On December 16, 2016, the Company completed the transaction with the shareholders of Hovey

Industries (2005) Inc. (“Hovey”), to purchase the assets of the business for an aggregate cash purchase

price, net of cash acquired, of $3,749. Goodwill on acquisition was attributable to the synergies and

growth opportunity of the combined operations. The goodwill is deductible for tax purposes.

The results of Hovey’s operations are included in these consolidated financial statements for the period

since the date of acquisition. The allocation of the purchase price is as follows:

Total

$

Current assets (including cash of $1) 400

Property and equipment 50

Patent 1,300

Goodwill 2,000

Net assets 3,750

8. Accounts receivables

2017 2016

$ $

Trade accounts receivable 13,268 8,702

Other receivables 398 397

Less: allowance for doubtful accounts (100) (126)

13,566 8,973

9. Inventories

2017 2016

$ $

Raw materials 16,234 15,750

Work-in-progress 3,054 2,589

Finished goods 4,941 5,436

24,229 23,775

During the year, inventories recognized as an expense in cost of sales amounted to $51,316

(2016 - $49,612; 2015 - $58,040). Cost of sales include depreciation and amortization expense of

$1,241 (2016 - $1,239; 2015 - $1,184) and salaries and employee benefits expense of $16,439

(2016 - $16,074; 2015 - $19,083).

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 18

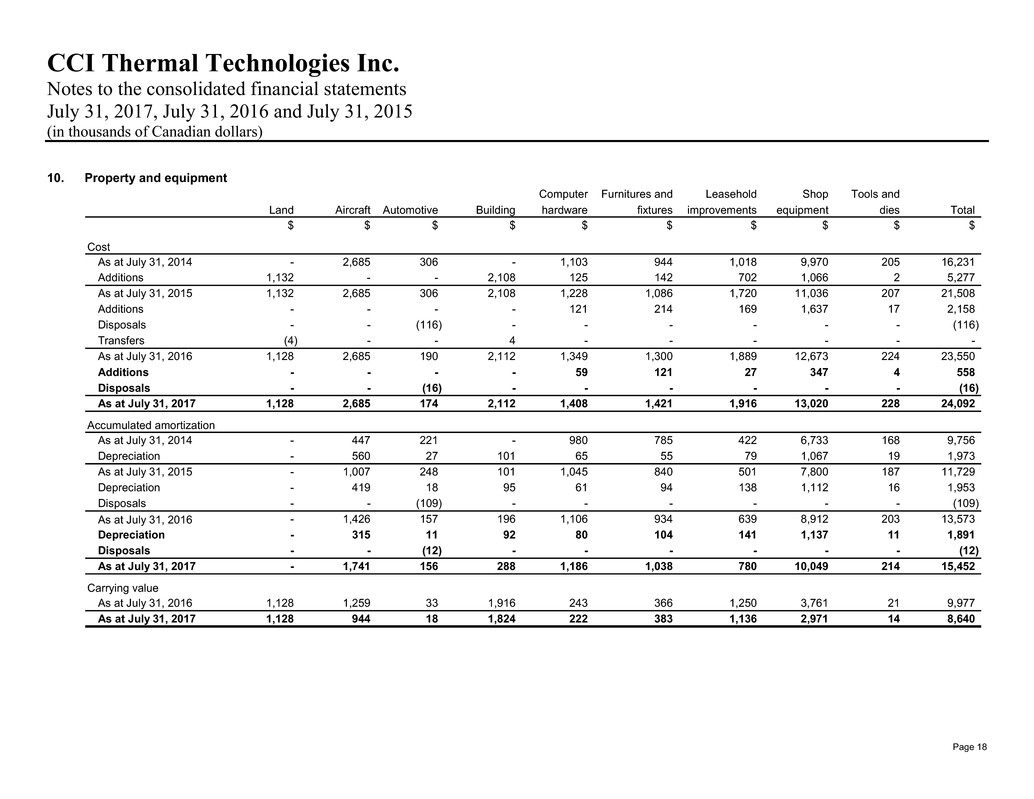

10. Property and equipment

Computer Furnitures and Leasehold Shop Tools and

Land Aircraft Automotive Building hardware fixtures improvements equipment dies Total

$ $ $ $ $ $ $ $ $ $

Cost

As at July 31, 2014 - 2,685 306 - 1,103 944 1,018 9,970 205 16,231

Additions 1,132 - - 2,108 125 142 702 1,066 2 5,277

As at July 31, 2015 1,132 2,685 306 2,108 1,228 1,086 1,720 11,036 207 21,508

Additions - - - - 121 214 169 1,637 17 2,158

Disposals - - (116) - - - - - - (116)

Transfers (4) - - 4 - - - - - -

As at July 31, 2016 1,128 2,685 190 2,112 1,349 1,300 1,889 12,673 224 23,550

Additions - - - - 59 121 27 347 4 558

Disposals - - (16) - - - - - - (16)

As at July 31, 2017 1,128 2,685 174 2,112 1,408 1,421 1,916 13,020 228 24,092

Accumulated amortization

As at July 31, 2014 - 447 221 - 980 785 422 6,733 168 9,756

Depreciation - 560 27 101 65 55 79 1,067 19 1,973

As at July 31, 2015 - 1,007 248 101 1,045 840 501 7,800 187 11,729

Depreciation - 419 18 95 61 94 138 1,112 16 1,953

Disposals - - (109) - - - - - - (109)

As at July 31, 2016 - 1,426 157 196 1,106 934 639 8,912 203 13,573

Depreciation - 315 11 92 80 104 141 1,137 11 1,891

Disposals - - (12) - - - - - - (12)

As at July 31, 2017 - 1,741 156 288 1,186 1,038 780 10,049 214 15,452

Carrying value

As at July 31, 2016 1,128 1,259 33 1,916 243 366 1,250 3,761 21 9,977

As at July 31, 2017 1,128 944 18 1,824 222 383 1,136 2,971 14 8,640

CCI Thermal Technologies Inc.

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 19

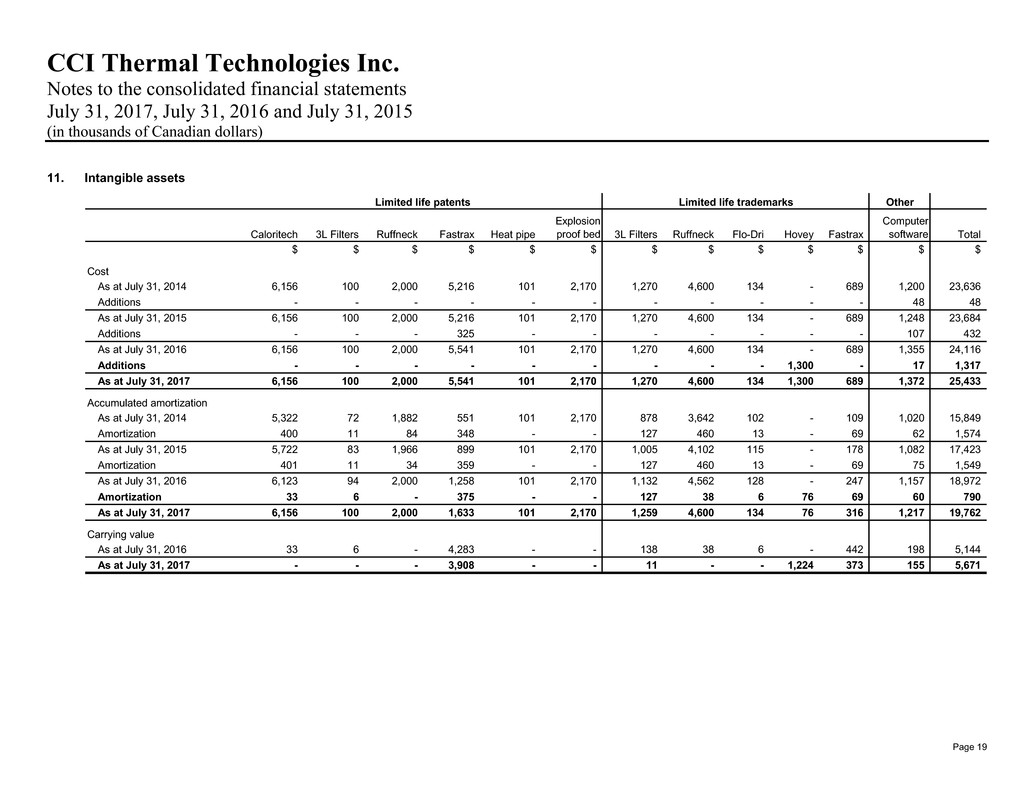

11. Intangible assets

Other

Caloritech 3L Filters Ruffneck Fastrax Heat pipe

Explosion

proof bed 3L Filters Ruffneck Flo-Dri Hovey Fastrax

Computer

software Total

$ $ $ $ $ $ $ $ $ $ $ $ $

Cost

As at July 31, 2014 6,156 100 2,000 5,216 101 2,170 1,270 4,600 134 - 689 1,200 23,636

Additions - - - - - - - - - - - 48 48

As at July 31, 2015 6,156 100 2,000 5,216 101 2,170 1,270 4,600 134 - 689 1,248 23,684

Additions - - - 325 - - - - - - - 107 432

As at July 31, 2016 6,156 100 2,000 5,541 101 2,170 1,270 4,600 134 - 689 1,355 24,116

Additions - - - - - - - - - 1,300 - 17 1,317

As at July 31, 2017 6,156 100 2,000 5,541 101 2,170 1,270 4,600 134 1,300 689 1,372 25,433

Accumulated amortization

As at July 31, 2014 5,322 72 1,882 551 101 2,170 878 3,642 102 - 109 1,020 15,849

Amortization 400 11 84 348 - - 127 460 13 - 69 62 1,574

As at July 31, 2015 5,722 83 1,966 899 101 2,170 1,005 4,102 115 - 178 1,082 17,423

Amortization 401 11 34 359 - - 127 460 13 - 69 75 1,549

As at July 31, 2016 6,123 94 2,000 1,258 101 2,170 1,132 4,562 128 - 247 1,157 18,972

Amortization 33 6 - 375 - - 127 38 6 76 69 60 790

As at July 31, 2017 6,156 100 2,000 1,633 101 2,170 1,259 4,600 134 76 316 1,217 19,762

Carrying value

As at July 31, 2016 33 6 - 4,283 - - 138 38 6 - 442 198 5,144

As at July 31, 2017 - - - 3,908 - - 11 - - 1,224 373 155 5,671

Limited life trademarksLimited life patents

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 20

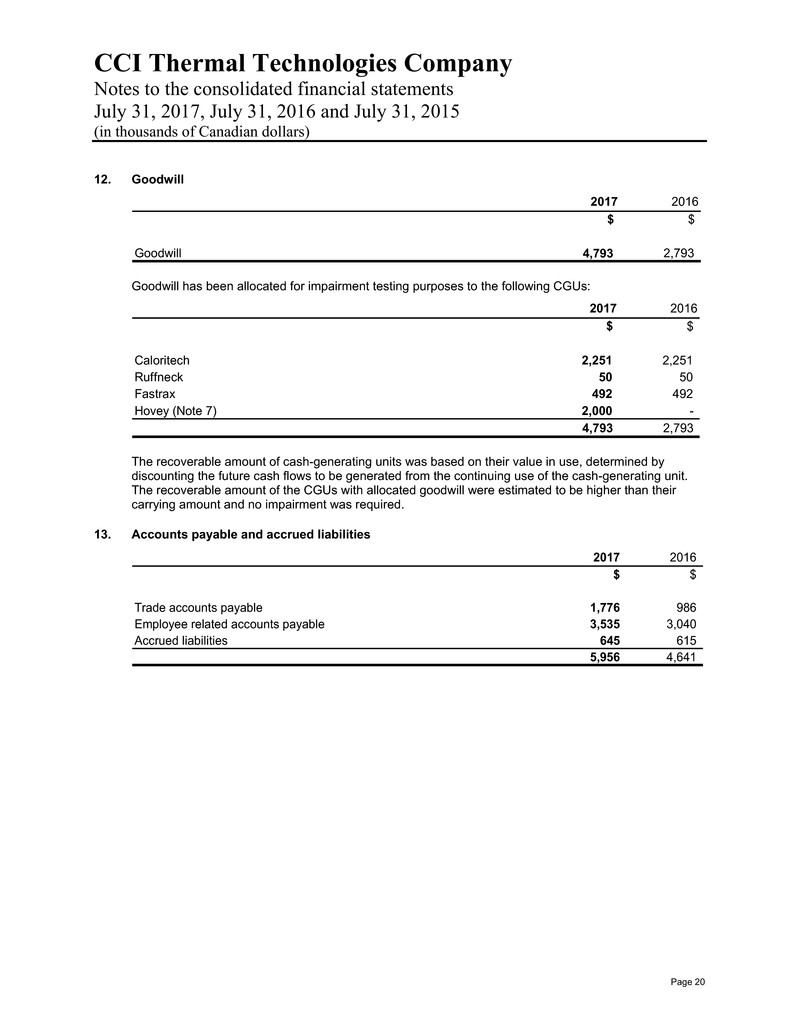

12. Goodwill

2017 2016

$ $

Goodwill 4,793 2,793

Goodwill has been allocated for impairment testing purposes to the following CGUs:

2017 2016

$ $

Caloritech 2,251 2,251

Ruffneck 50 50

Fastrax 492 492

Hovey (Note 7) 2,000 -

4,793 2,793

The recoverable amount of cash-generating units was based on their value in use, determined by

discounting the future cash flows to be generated from the continuing use of the cash-generating unit.

The recoverable amount of the CGUs with allocated goodwill were estimated to be higher than their

carrying amount and no impairment was required.

13. Accounts payable and accrued liabilities

2017 2016

$ $

Trade accounts payable 1,776 986

Employee related accounts payable 3,535 3,040

Accrued liabilities 645 615

5,956 4,641

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 21

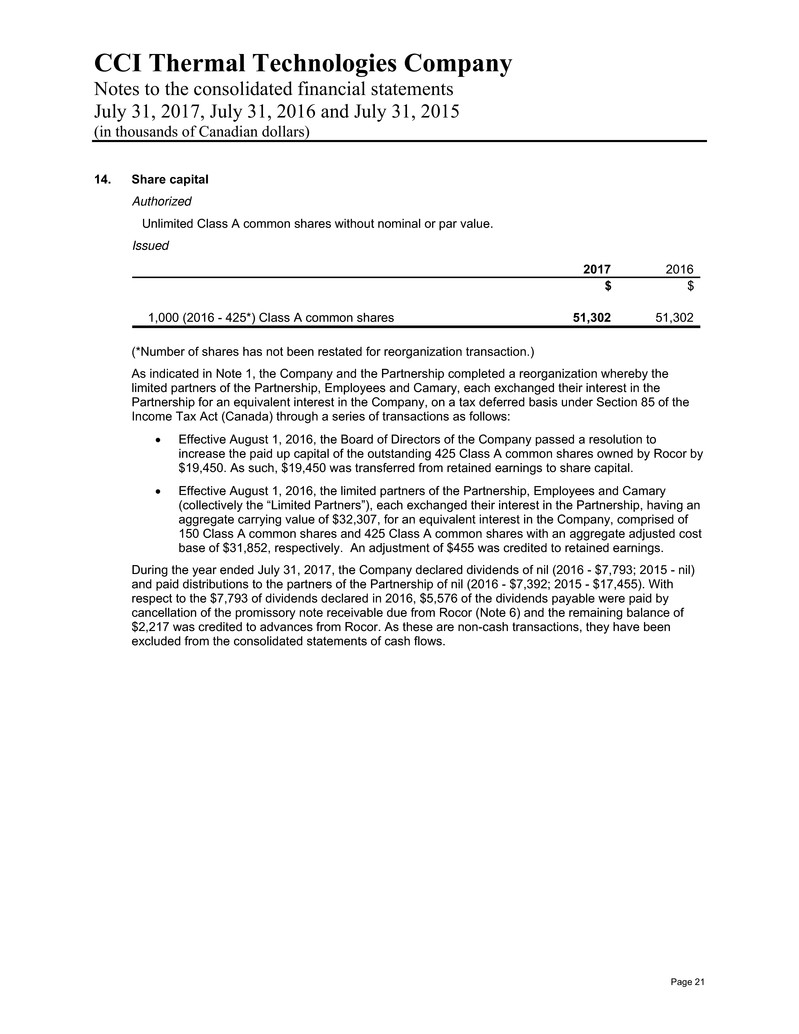

14. Share capital

Authorized

Unlimited Class A common shares without nominal or par value.

Issued

2017 2016

$ $

1,000 (2016 - 425*) Class A common shares 51,302 51,302

(*Number of shares has not been restated for reorganization transaction.)

As indicated in Note 1, the Company and the Partnership completed a reorganization whereby the

limited partners of the Partnership, Employees and Camary, each exchanged their interest in the

Partnership for an equivalent interest in the Company, on a tax deferred basis under Section 85 of the

Income Tax Act (Canada) through a series of transactions as follows:

Effective August 1, 2016, the Board of Directors of the Company passed a resolution to

increase the paid up capital of the outstanding 425 Class A common shares owned by Rocor by

$19,450. As such, $19,450 was transferred from retained earnings to share capital.

Effective August 1, 2016, the limited partners of the Partnership, Employees and Camary

(collectively the “Limited Partners”), each exchanged their interest in the Partnership, having an

aggregate carrying value of $32,307, for an equivalent interest in the Company, comprised of

150 Class A common shares and 425 Class A common shares with an aggregate adjusted cost

base of $31,852, respectively. An adjustment of $455 was credited to retained earnings.

During the year ended July 31, 2017, the Company declared dividends of nil (2016 - $7,793; 2015 - nil)

and paid distributions to the partners of the Partnership of nil (2016 - $7,392; 2015 - $17,455). With

respect to the $7,793 of dividends declared in 2016, $5,576 of the dividends payable were paid by

cancellation of the promissory note receivable due from Rocor (Note 6) and the remaining balance of

$2,217 was credited to advances from Rocor. As these are non-cash transactions, they have been

excluded from the consolidated statements of cash flows.

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 22

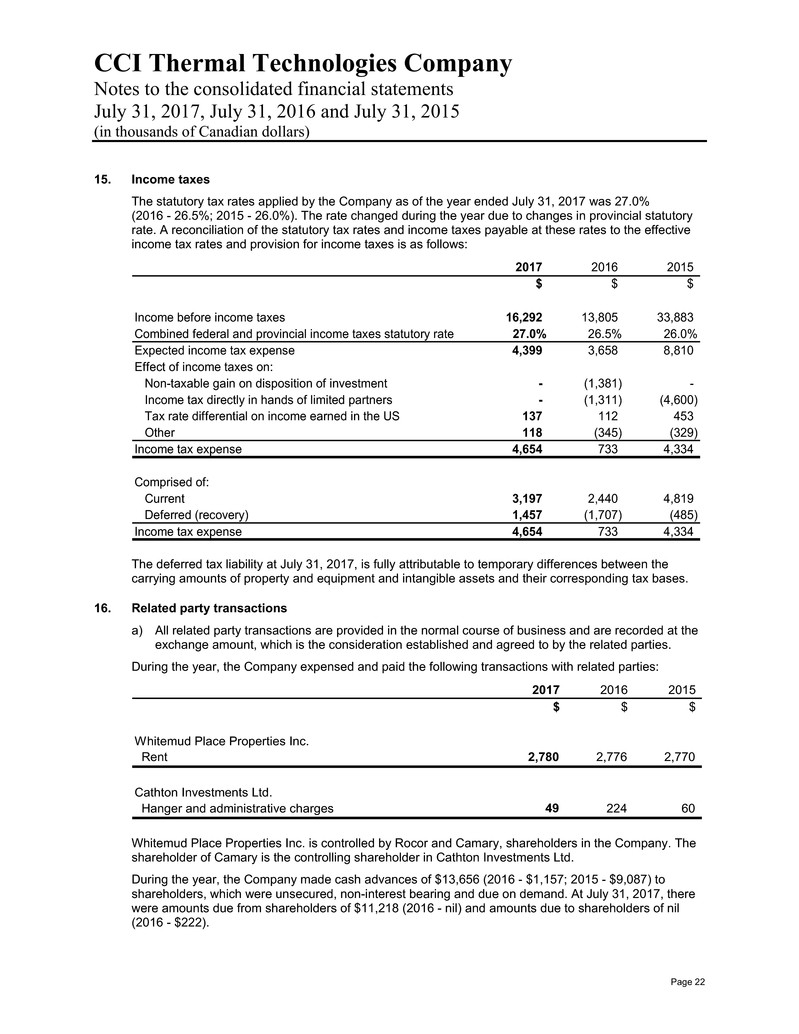

15. Income taxes

The statutory tax rates applied by the Company as of the year ended July 31, 2017 was 27.0%

(2016 - 26.5%; 2015 - 26.0%). The rate changed during the year due to changes in provincial statutory

rate. A reconciliation of the statutory tax rates and income taxes payable at these rates to the effective

income tax rates and provision for income taxes is as follows:

2017 2016 2015

$ $ $

Income before income taxes 16,292 13,805 33,883

Combined federal and provincial income taxes statutory rate 27.0% 26.5% 26.0%

Expected income tax expense 4,399 3,658 8,810

Effect of income taxes on:

Non-taxable gain on disposition of investment - (1,381) -

Income tax directly in hands of limited partners - (1,311) (4,600)

Tax rate differential on income earned in the US 137 112 453

Other 118 (345) (329)

Income tax expense 4,654 733 4,334

Comprised of:

Current 3,197 2,440 4,819

Deferred (recovery) 1,457 (1,707) (485)

Income tax expense 4,654 733 4,334

The deferred tax liability at July 31, 2017, is fully attributable to temporary differences between the

carrying amounts of property and equipment and intangible assets and their corresponding tax bases.

16. Related party transactions

a) All related party transactions are provided in the normal course of business and are recorded at the

exchange amount, which is the consideration established and agreed to by the related parties.

During the year, the Company expensed and paid the following transactions with related parties:

2017 2016 2015

$ $ $

Whitemud Place Properties Inc.

Rent 2,780 2,776 2,770

Cathton Investments Ltd.

Hanger and administrative charges 49 224 60

Whitemud Place Properties Inc. is controlled by Rocor and Camary, shareholders in the Company. The

shareholder of Camary is the controlling shareholder in Cathton Investments Ltd.

During the year, the Company made cash advances of $13,656 (2016 - $1,157; 2015 - $9,087) to

shareholders, which were unsecured, non-interest bearing and due on demand. At July 31, 2017, there

were amounts due from shareholders of $11,218 (2016 - nil) and amounts due to shareholders of nil

(2016 - $222).

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 23

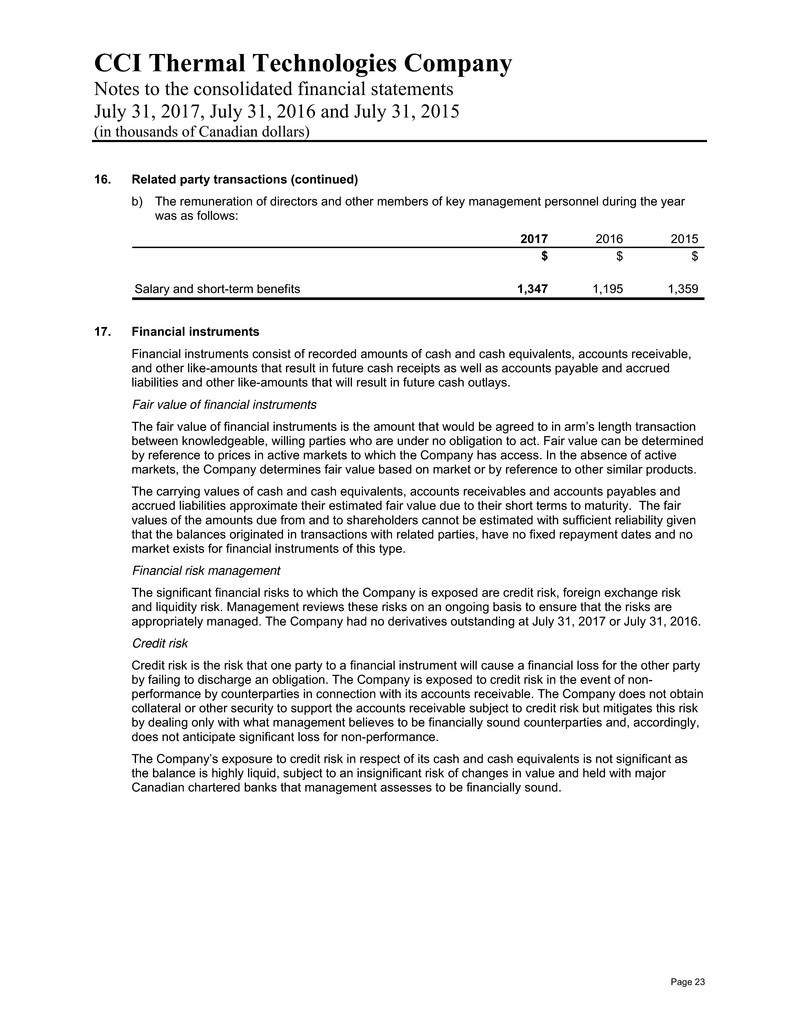

16. Related party transactions (continued)

b) The remuneration of directors and other members of key management personnel during the year

was as follows:

2017 2016 2015

$ $ $

Salary and short-term benefits 1,347 1,195 1,359

17. Financial instruments

Financial instruments consist of recorded amounts of cash and cash equivalents, accounts receivable,

and other like-amounts that result in future cash receipts as well as accounts payable and accrued

liabilities and other like-amounts that will result in future cash outlays.

Fair value of financial instruments

The fair value of financial instruments is the amount that would be agreed to in arm’s length transaction

between knowledgeable, willing parties who are under no obligation to act. Fair value can be determined

by reference to prices in active markets to which the Company has access. In the absence of active

markets, the Company determines fair value based on market or by reference to other similar products.

The carrying values of cash and cash equivalents, accounts receivables and accounts payables and

accrued liabilities approximate their estimated fair value due to their short terms to maturity. The fair

values of the amounts due from and to shareholders cannot be estimated with sufficient reliability given

that the balances originated in transactions with related parties, have no fixed repayment dates and no

market exists for financial instruments of this type.

Financial risk management

The significant financial risks to which the Company is exposed are credit risk, foreign exchange risk

and liquidity risk. Management reviews these risks on an ongoing basis to ensure that the risks are

appropriately managed. The Company had no derivatives outstanding at July 31, 2017 or July 31, 2016.

Credit risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party

by failing to discharge an obligation. The Company is exposed to credit risk in the event of non-

performance by counterparties in connection with its accounts receivable. The Company does not obtain

collateral or other security to support the accounts receivable subject to credit risk but mitigates this risk

by dealing only with what management believes to be financially sound counterparties and, accordingly,

does not anticipate significant loss for non-performance.

The Company’s exposure to credit risk in respect of its cash and cash equivalents is not significant as

the balance is highly liquid, subject to an insignificant risk of changes in value and held with major

Canadian chartered banks that management assesses to be financially sound.

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 24

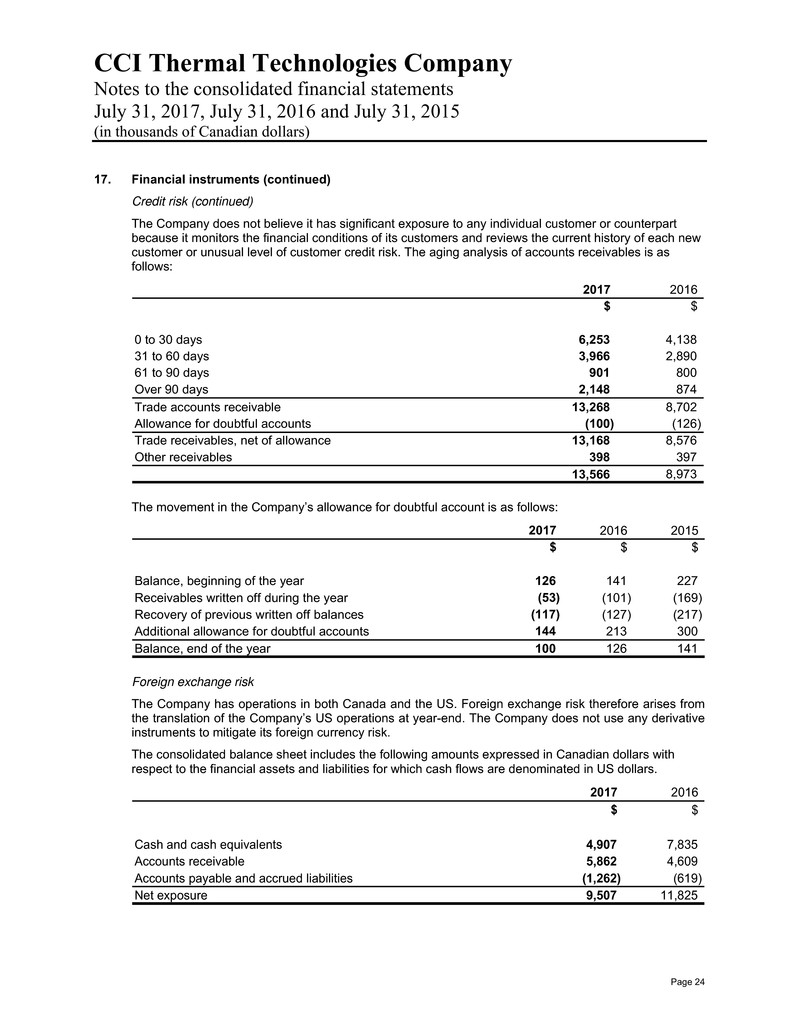

17. Financial instruments (continued)

Credit risk (continued)

The Company does not believe it has significant exposure to any individual customer or counterpart

because it monitors the financial conditions of its customers and reviews the current history of each new

customer or unusual level of customer credit risk. The aging analysis of accounts receivables is as

follows:

2017 2016

$ $

0 to 30 days 6,253 4,138

31 to 60 days 3,966 2,890

61 to 90 days 901 800

Over 90 days 2,148 874

Trade accounts receivable 13,268 8,702

Allowance for doubtful accounts (100) (126)

Trade receivables, net of allowance 13,168 8,576

Other receivables 398 397

13,566 8,973

The movement in the Company’s allowance for doubtful account is as follows:

2017 2016 2015

$ $ $

Balance, beginning of the year 126 141 227

Receivables written off during the year (53) (101) (169)

Recovery of previous written off balances (117) (127) (217)

Additional allowance for doubtful accounts 144 213 300

Balance, end of the year 100 126 141

Foreign exchange risk

The Company has operations in both Canada and the US. Foreign exchange risk therefore arises from

the translation of the Company’s US operations at year-end. The Company does not use any derivative

instruments to mitigate its foreign currency risk.

The consolidated balance sheet includes the following amounts expressed in Canadian dollars with

respect to the financial assets and liabilities for which cash flows are denominated in US dollars.

2017 2016

$ $

Cash and cash equivalents 4,907 7,835

Accounts receivable 5,862 4,609

Accounts payable and accrued liabilities (1,262) (619)

Net exposure 9,507 11,825

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 25

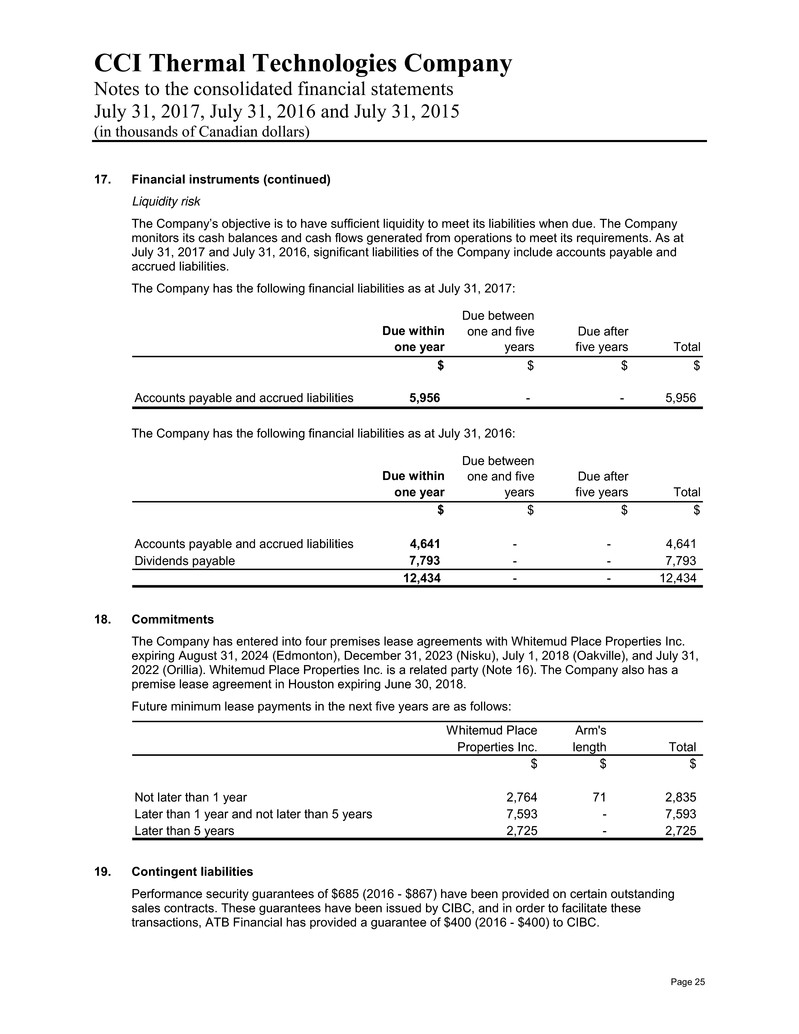

17. Financial instruments (continued)

Liquidity risk

The Company’s objective is to have sufficient liquidity to meet its liabilities when due. The Company

monitors its cash balances and cash flows generated from operations to meet its requirements. As at

July 31, 2017 and July 31, 2016, significant liabilities of the Company include accounts payable and

accrued liabilities.

The Company has the following financial liabilities as at July 31, 2017:

Due within

one year

Due between

one and five

years

Due after

five years Total

$ $ $ $

Accounts payable and accrued liabilities 5,956 - - 5,956

The Company has the following financial liabilities as at July 31, 2016:

Due within

one year

Due between

one and five

years

Due after

five years Total

$ $ $ $

Accounts payable and accrued liabilities 4,641 - - 4,641

Dividends payable 7,793 - - 7,793

12,434 - - 12,434

18. Commitments

The Company has entered into four premises lease agreements with Whitemud Place Properties Inc.

expiring August 31, 2024 (Edmonton), December 31, 2023 (Nisku), July 1, 2018 (Oakville), and July 31,

2022 (Orillia). Whitemud Place Properties Inc. is a related party (Note 16). The Company also has a

premise lease agreement in Houston expiring June 30, 2018.

Future minimum lease payments in the next five years are as follows:

Whitemud Place Arm's

Properties Inc. length Total

$ $ $

Not later than 1 year 2,764 71 2,835

Later than 1 year and not later than 5 years 7,593 - 7,593

Later than 5 years 2,725 - 2,725

19. Contingent liabilities

Performance security guarantees of $685 (2016 - $867) have been provided on certain outstanding

sales contracts. These guarantees have been issued by CIBC, and in order to facilitate these

transactions, ATB Financial has provided a guarantee of $400 (2016 - $400) to CIBC.

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 26

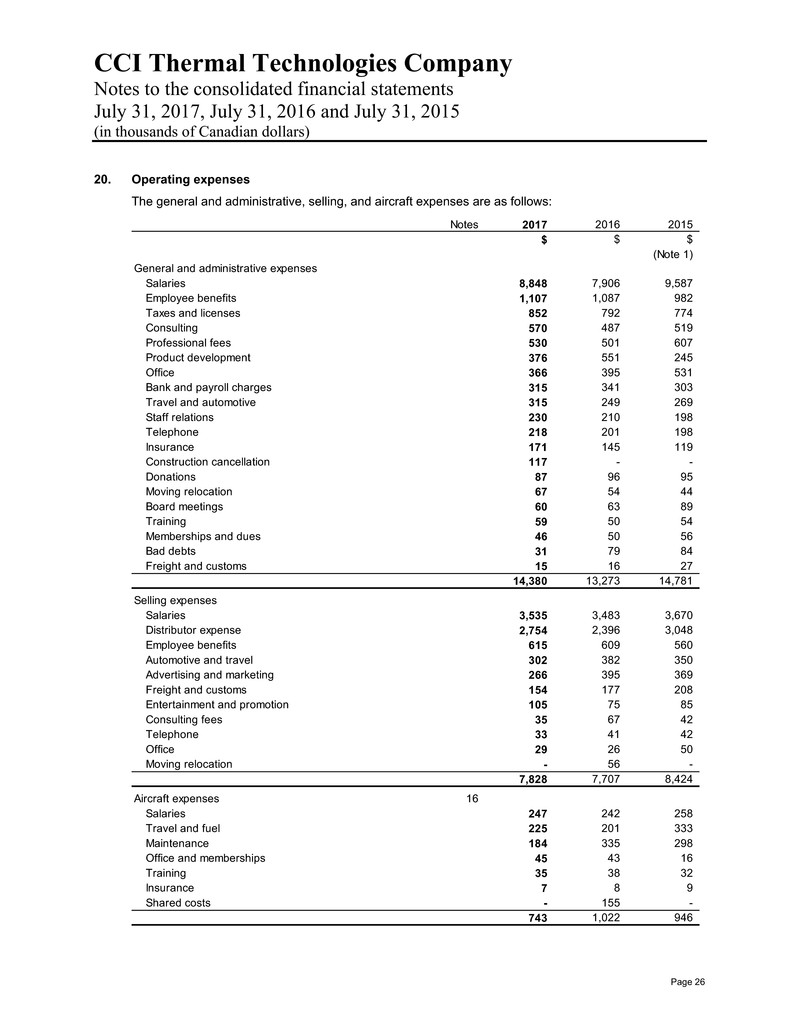

20. Operating expenses

The general and administrative, selling, and aircraft expenses are as follows:

Notes 2017 2016 2015

$ $ $

(Note 1)

General and administrative expenses

Salaries 8,848 7,906 9,587

Employee benefits 1,107 1,087 982

Taxes and licenses 852 792 774

Consulting 570 487 519

Professional fees 530 501 607

Product development 376 551 245

Office 366 395 531

Bank and payroll charges 315 341 303

Travel and automotive 315 249 269

Staff relations 230 210 198

Telephone 218 201 198

Insurance 171 145 119

Construction cancellation 117 - -

Donations 87 96 95

Moving relocation 67 54 44

Board meetings 60 63 89

Training 59 50 54

Memberships and dues 46 50 56

Bad debts 31 79 84

Freight and customs 15 16 27

14,380 13,273 14,781

Selling expenses

Salaries 3,535 3,483 3,670

Distributor expense 2,754 2,396 3,048

Employee benefits 615 609 560

Automotive and travel 302 382 350

Advertising and marketing 266 395 369

Freight and customs 154 177 208

Entertainment and promotion 105 75 85

Consulting fees 35 67 42

Telephone 33 41 42

Office 29 26 50

Moving relocation - 56 -

7,828 7,707 8,424

Aircraft expenses 16

Salaries 247 242 258

Travel and fuel 225 201 333

Maintenance 184 335 298

Office and memberships 45 43 16

Training 35 38 32

Insurance 7 8 9

Shared costs - 155 -

743 1,022 946

CCI Thermal Technologies Company

Notes to the consolidated financial statements

July 31, 2017, July 31, 2016 and July 31, 2015

(in thousands of Canadian dollars)

Page 27

21. Subsequent events

Effective August 1, 2017, the Company declared an eligible dividend of $11 per Class “A” common

share, totalling $11,000, which was paid by way of a credit to the shareholder loans.

Effective October 4, 2017, Thermon Group Holdings Inc., a publicly traded company in the United

States, announced the execution of a definitive agreement to acquire 100% of the equity interests of the

Company. The transaction closed on October 29, 2017.

On October 23, 2017, the Company sold its aircraft to a related party for a purchase price of $1,714.

22. Capital management

The Company’s objectives when managing capital are to safeguard its ability to continue as a going

concern, to provide an adequate return to partners and preserve financial flexibility in order to benefit

from potential opportunities that may arise. Protecting the ability to pay current and future liabilities

requires following the internally determined capital guideline based on risk management policies. For its

own purpose, the Company defines capital as shareholders’ equity.

The capital structure at July 31, 2017, was as follows:

2017 2016

$ $

Shareholders' equity 67,350 56,184

In managing the shareholders’ equity, adjustments may be made to the capital structure in light of

external influences such as changing economic conditions, externally-imposed capital requirements, or

the presence of opportunities for further development. The amount to be paid to shareholders and the

nature of financing of new assets are determinations made within the risk-based guidelines established.

There were no changes in the Company’s approach to capital management for all reporting periods

included in these consolidated financial statements.