R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

1

Thermon Group Holdings

Public-Side Lenders’ Presentation

October 11, 2017

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

2

Disclaimer

Certain statements in this presentation and responses to various questions may constitute forward-looking statements within the

meaning of the U.S. federal securities laws. These forward-looking statements include, without limitation, statements regarding Thermon

Group Holdings, Inc.’s (the “Company,” “Thermon,” “we,” “our” or “us”) industry, business strategy, plans, goals and expectations

concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other

financial and operating information. When used, the words “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “forecast,” “will,” “future” and similar terms and phrases are intended

to identify forward-looking statements. Forward-looking statements reflect our current expectations regarding future events, results or

outcomes. These expectations may or may not be realized. Some of these expectations may be based upon assumptions, data or

judgments that prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which

are beyond our control, which could result in our expectations not being realized or otherwise materially affect our financial condition,

results of operations and cash flows. Our forward-looking statements are based on management’s knowledge and reasonable

expectations on the date hereof and are not guarantees of future performance. Actual results and future performance may differ

materially from those suggested in any forward-looking statements due to a variety of factors, including those described under the

caption “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on or about May 31, 2017.

We do not intend to update these statements unless we are required to do so under applicable securities laws.

The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be

construed as an endorsement of the products or services of the Company.

The information and opinions contained in this document are provided as at the date of this presentation and are subject to change

without notice. This document has not been approved by any competent regulatory or supervisory authority.

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

3

Presenters

Bruce Thames

President and Chief Executive Officer

Jay Peterson

Chief Financial Officer, Senior Vice President – Finance

Jim Pribble

Senior Vice President – Corporate Development

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

4

Agenda

Transaction Overview

Company and Industry Overview

Key Credit Highlights

Historical Financial Performance

Appendix

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

5

Executive Summary

Thermon will combine with CCI Thermal, creating the world’s leader in industrial process heating

1

2

3

4

Thermon Group Holdings, Inc. (“Thermon”, “THR” or the “Company”), headquartered in San Marcos, TX and

publicly traded on the NYSE (NYSE: THR), engineers and manufactures engineered industrial process heating

solutions

The Company’s products provide an external heat source to pipes, vessels and instruments for the purposes of freeze

protection, temperature maintenance, environmental monitoring and surface snow and ice melting

Thermon signed a definitive agreement on October 4, 2017 to acquire 100% of CCI Thermal Technologies Inc. (“CCI

Thermal” or the “Target”), an Edmonton, AB based privately held company

CCI Thermal provides an assortment of market-leading brands in the process heating space where Thermon does not

currently play. While the business currently derives 95% of its revenue from Canada and the U.S., CCI Thermal has

obtained many global certifications (including EAC) – preparing the Target for sales in foreign markets

The all-cash purchase price will be CAD$258 million (USD$206 million based on USD/CAD exchange rate of 1.25 as of

10/10/2017), which represents an 11.2x purchase multiple based on Target LTM August 2017 adjusted EBITDA of

CAD$23 million (USD$18 million)

This translates to an 8.8x purchase multiple based on CCI’s forward 2018 budgeted adj. EBITDA of CAD$29 for the

period ending July 2018 (USD$23)

Thermon believes it will realize approximately USD$2 million of cost synergies. Further, the Company should realize

considerable revenue synergies through solution-selling and expanding CCI Thermal’s footprint into new

geographies where Thermon has a dedicated presence

Pro forma total net leverage will be 3.4x based on USD$61 million pro forma adjusted EBITDA

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

6

Transaction Overview

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

7

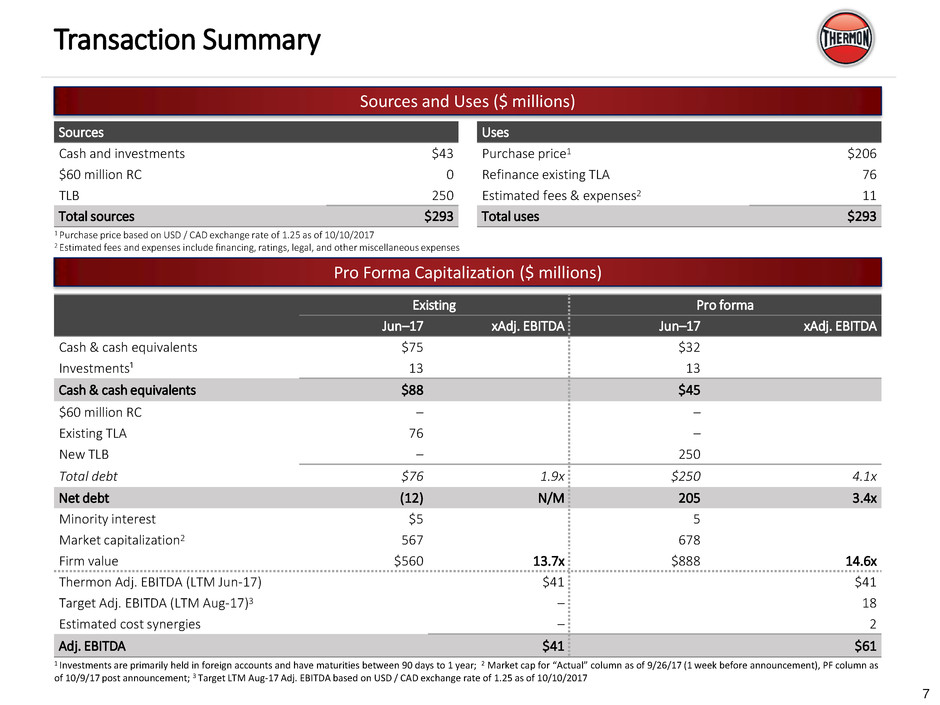

Transaction Summary

Sources and Uses ($ millions)

Pro Forma Capitalization ($ millions)

1 Purchase price based on USD / CAD exchange rate of 1.25 as of 10/10/2017

2 Estimated fees and expenses include financing, ratings, legal, and other miscellaneous expenses

Sources

Cash and investments $43

$60 million RC 0

TLB 250

Total sources $293

Uses

Purchase price1 $206

Refinance existing TLA 76

Estimated fees & expenses2 11

Total uses $293

1 Investments are primarily held in foreign accounts and have maturities between 90 days to 1 year; 2 Market cap for “Actual” column as of 9/26/17 (1 week before announcement), PF column as

of 10/9/17 post announcement; 3 Target LTM Aug-17 Adj. EBITDA based on USD / CAD exchange rate of 1.25 as of 10/10/2017

Existing Pro forma

Jun–17 xAdj. EBITDA Jun–17 xAdj. EBITDA

Cash & cash equivalents $75 $32

Investments¹ 13 13

Cash & cash equivalents $88 $45

$60 million RC – –

Existing TLA 76 –

New TLB – 250

Total debt $76 1.9x $250 4.1x

Net debt (12) N/M 205 3.4x

Minority interest $5 5

Market capitalization2 567 678

Firm value $560 13.7x $888 14.6x

Thermon Adj. EBITDA (LTM Jun-17) $41 $41

Target Adj. EBITDA (LTM Aug-17)3 – 18

Estimated cost synergies – 2

Adj. EBITDA $41 $61

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

8

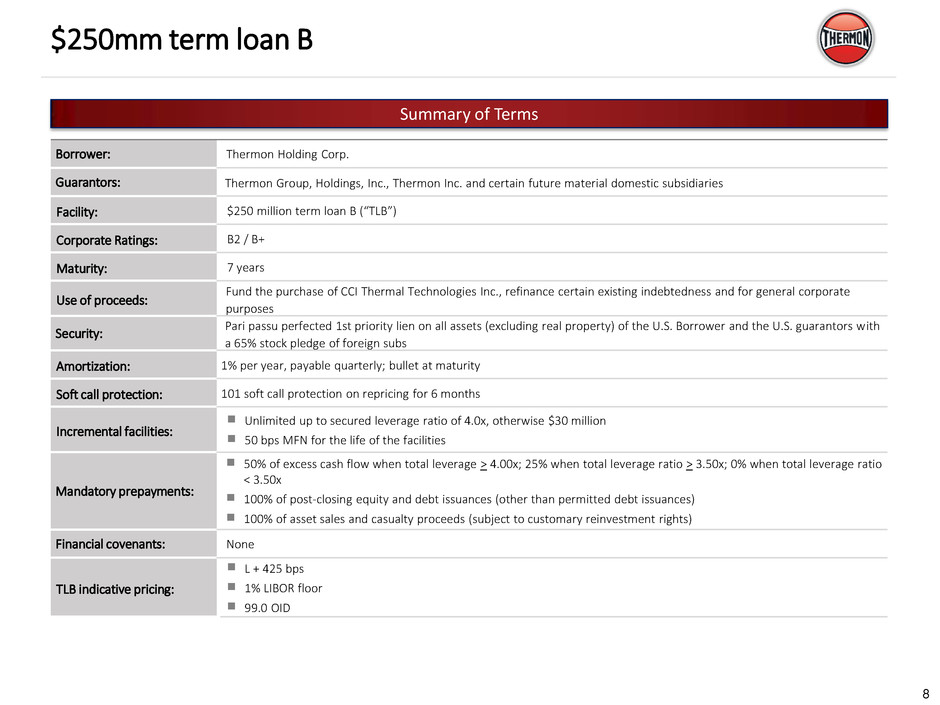

$250mm term loan B

Summary of Terms

Borrower: Thermon Holding Corp.

Guarantors: Thermon Group, Holdings, Inc., Thermon Inc. and certain future material domestic subsidiaries

Facility: $250 million term loan B (“TLB”)

Corporate Ratings: B2 / B+

Maturity: 7 years

Use of proceeds:

Fund the purchase of CCI Thermal Technologies Inc., refinance certain existing indebtedness and for general corporate

purposes

Security:

Pari passu perfected 1st priority lien on all assets (excluding real property) of the U.S. Borrower and the U.S. guarantors with

a 65% stock pledge of foreign subs

Amortization: 1% per year, payable quarterly; bullet at maturity

Soft call protection: 101 soft call protection on repricing for 6 months

Incremental facilities:

Unlimited up to secured leverage ratio of 4.0x, otherwise $30 million

50 bps MFN for the life of the facilities

Mandatory prepayments:

50% of excess cash flow when total leverage > 4.00x; 25% when total leverage ratio > 3.50x; 0% when total leverage ratio

< 3.50x

100% of post-closing equity and debt issuances (other than permitted debt issuances)

100% of asset sales and casualty proceeds (subject to customary reinvestment rights)

Financial covenants: None

TLB indicative pricing:

L + 425 bps

1% LIBOR floor

99.0 OID

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

9

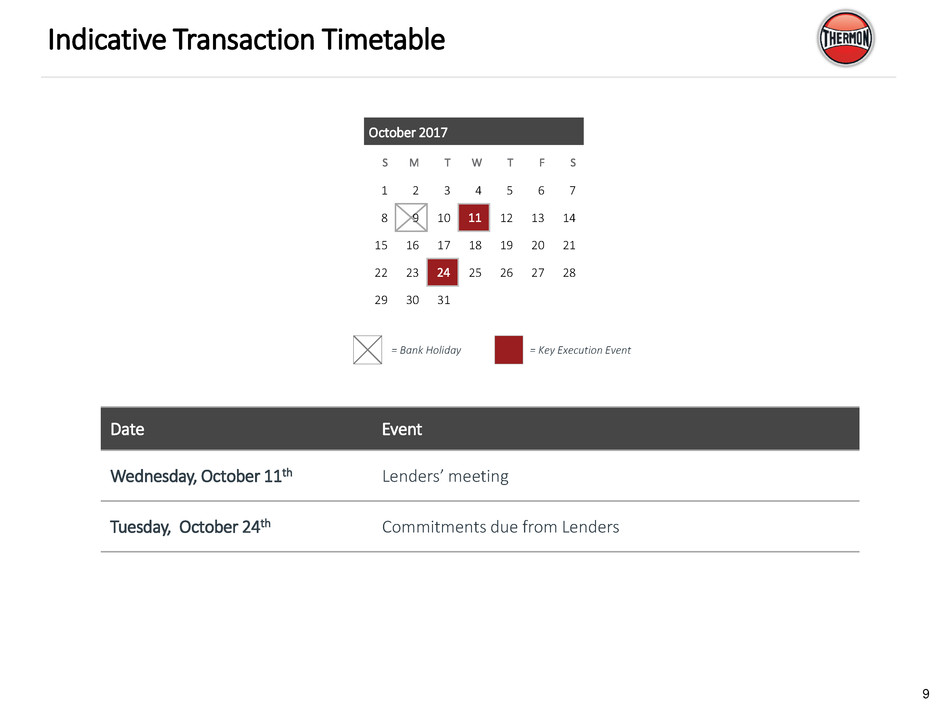

Indicative Transaction Timetable

October 2017

S M T W T F S

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30 31

Date Event

Wednesday, October 11th Lenders’ meeting

Tuesday, October 24th Commitments due from Lenders

= Bank Holiday = Key Execution Event

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

10

Growth opportunities into new end markets with significant natural gas market exposure

CCI Thermal is predominantly midstream focused in their oil and gas markets, which balances

Thermon’s focus in downstream and upstream

Robust Financial Profile & Performance

Strong normalized adjusted EBITDA margin of 29%; adjusted EBITDA of $24.3 million (avg. ’12-’17)1

Increases scale, size and is accretive to margins, FCF and EPS

Well-Positioned for Future Growth

Buying in a market trough and well positioned for recovery of oil and gas market

CCI Thermal has an $800 million addressable market which is highly fragmented, increasing Thermon’s current $1.5 billion addressable market by

over 50%

Opportunity to push CCI Thermal’s products across Thermon’s sales channels into new geographies

Potential for further end market diversification (semiconductor, pharma, etc.)

Established platform for growth via acquisition with pipeline of actionable M&A opportunities

Deep pipeline of new products (e.g. IoT, methane conversion, Blue Flame Technology)

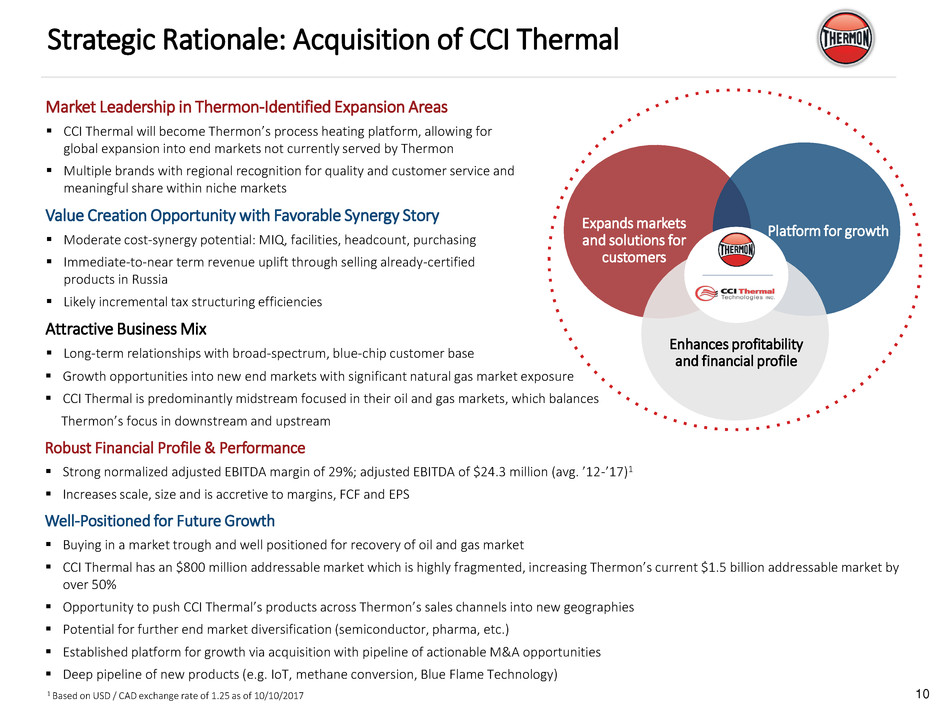

Strategic Rationale: Acquisition of CCI Thermal

Attractive Financial

Profile & Performance

Strong normalized adjusted EBITDA margin of 29%; adjusted EBITDA of $24.3 million (avg. ’12-’17)1

Increases scale, size and is accretive to margins, FCF and EPS

Market Leadership in

Thermon-Identified

Expansion Areas

CCI Thermal will become Thermon’s process heating platform, allowing for global expansion into

end markets not currently served by Thermon

Multiple brands with regional recognition for quality and customer service and meaningful share

within niche markets

Value Creation

Opportunity with

Favorable Synergy Story

Moderate cost-synergy potential: MIQ, facilities, headcount, purchasing

─ Cost synergies reduce purchase price by approximately 1.0x

Immediate-to-near term revenue uplift through selling already-certified products in Russia

Likely incremental tax structuring efficiencies

Attractive Business Mix

Long-term relationships with broad-spectrum, blue-chip customer base

Growth opportunities into new end markets with significant natural gas market exposure

CCI Thermal is predominantly midstream focused in their oil and gas markets, which balances

Thermon’s focus in downstream and upstream

Well-Positioned for

Future Growth

Buying in a market trough and well positioned for recovery of oil and gas market

CCI Thermal has an $800 million addressable market which is highly fragmented, increasing

Thermon’s current $1.5 billion addressable market by over 50%

Opportunity to push CCI Thermal’s products across Thermon’s sales channels into new geographies

Potential for further end market diversification (semiconductor, pharma, etc.)

Established platform for growth via acquisition with pipeline of actionable M&A opportunities

Deep pipeline of new products (e.g. IoT, methane conversion, Blue Flame Technology)

1 Based on USD / CAD exchange rate of 1.25 as of 10/10/2017

Market Leadership in Thermon-Identified Expansion Areas

CCI Thermal will become Thermon’s process heating platform, allowing for

global expansion into end markets not currently served by Thermon

Multiple brands with regional recognition for quality and customer service and

meaningful share within niche markets

Value Creation Opportunity with Favorable Synergy Story

Moderate cost-synergy potential: MIQ, facilities, headcount, purchasing

Immediate-to-near term revenue uplift through selling already-certified

products in Russia

Likely incremental tax structuring efficiencies

Attractive Business Mix

Long-term relationships with broad-spectrum, blue-chip customer base

Platform for growth Expands markets

and solutions for

customers

Enhances profitability

and financial profile

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

11

Company and Industry Overview

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

12

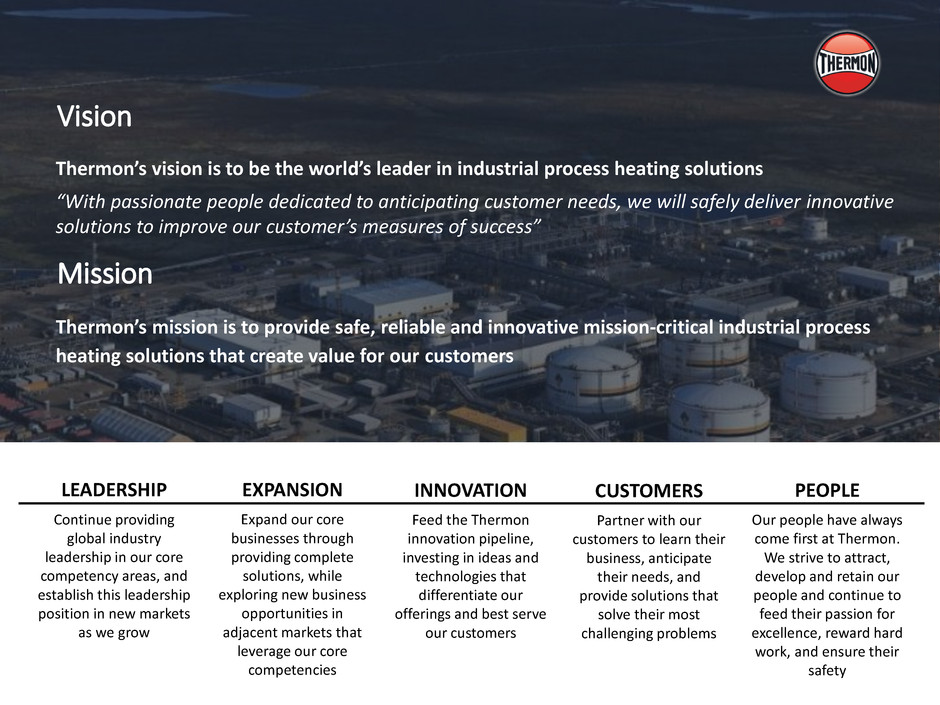

LEADERSHIP

Continue providing

global industry

leadership in our core

competency areas, and

establish this leadership

position in new markets

as we grow

EXPANSION

Expand our core

businesses through

providing complete

solutions, while

exploring new business

opportunities in

adjacent markets that

leverage our core

competencies

INNOVATION

Feed the Thermon

innovation pipeline,

investing in ideas and

technologies that

differentiate our

offerings and best serve

our customers

CUSTOMERS

Partner with our

customers to learn their

business, anticipate

their needs, and

provide solutions that

solve their most

challenging problems

PEOPLE

Our people have always

come first at Thermon.

We strive to attract,

develop and retain our

people and continue to

feed their passion for

excellence, reward hard

work, and ensure their

safety

Thermon’s vision is to be the world’s leader in industrial process heating solutions

“With passionate people dedicated to anticipating customer needs, we will safely deliver innovative

solutions to improve our customer’s measures of success”

Thermon’s mission is to provide safe, reliable and innovative mission-critical industrial process

heating solutions that create value for our customers

Vision

Mission

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

13

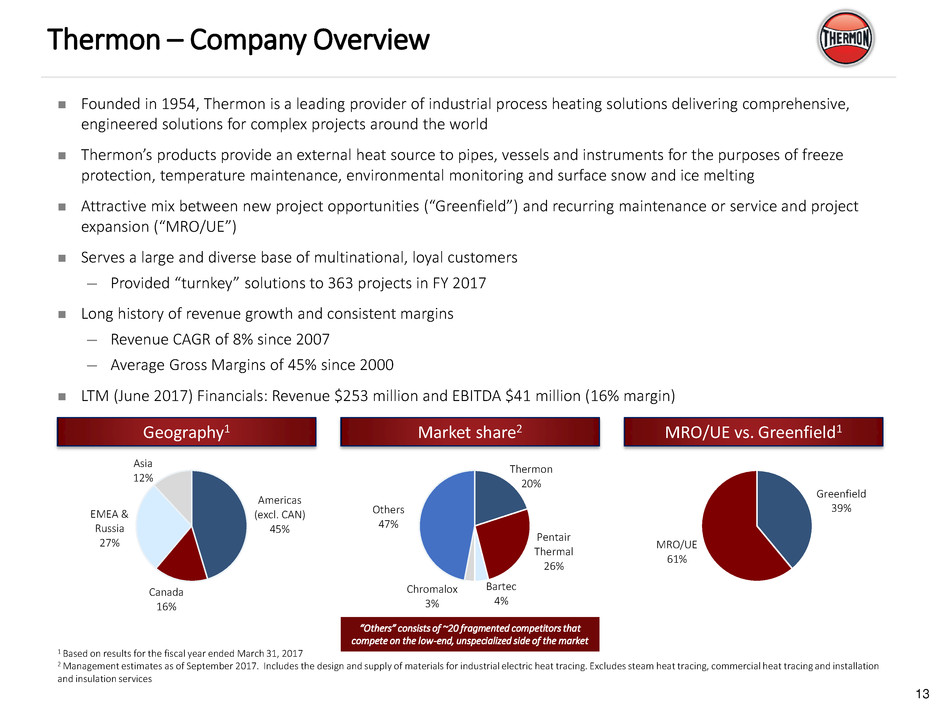

Thermon – Company Overview

Founded in 1954, Thermon is a leading provider of industrial process heating solutions delivering comprehensive,

engineered solutions for complex projects around the world

Thermon’s products provide an external heat source to pipes, vessels and instruments for the purposes of freeze

protection, temperature maintenance, environmental monitoring and surface snow and ice melting

Attractive mix between new project opportunities (“Greenfield”) and recurring maintenance or service and project

expansion (“MRO/UE”)

Serves a large and diverse base of multinational, loyal customers

─ Provided “turnkey” solutions to 363 projects in FY 2017

Long history of revenue growth and consistent margins

─ Revenue CAGR of 8% since 2007

─ Average Gross Margins of 45% since 2000

LTM (June 2017) Financials: Revenue $253 million and EBITDA $41 million (16% margin)

1 Based on results for the fiscal year ended March 31, 2017

2 Management estimates as of September 2017. Includes the design and supply of materials for industrial electric heat tracing. Excludes steam heat tracing, commercial heat tracing and installation

and insulation services

Americas

(excl. CAN)

45%

Canada

16%

EMEA &

Russia

27%

Asia

12%

Thermon

20%

Pentair

Thermal

26%

Bartec

4%

Chromalox

3%

Others

47%

Greenfield

39%

MRO/UE

61%

Geography1 Market share2 MRO/UE vs. Greenfield1

“Others” consists of ~20 fragmented competitors that

compete on the low-end, unspecialized side of the market

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

14

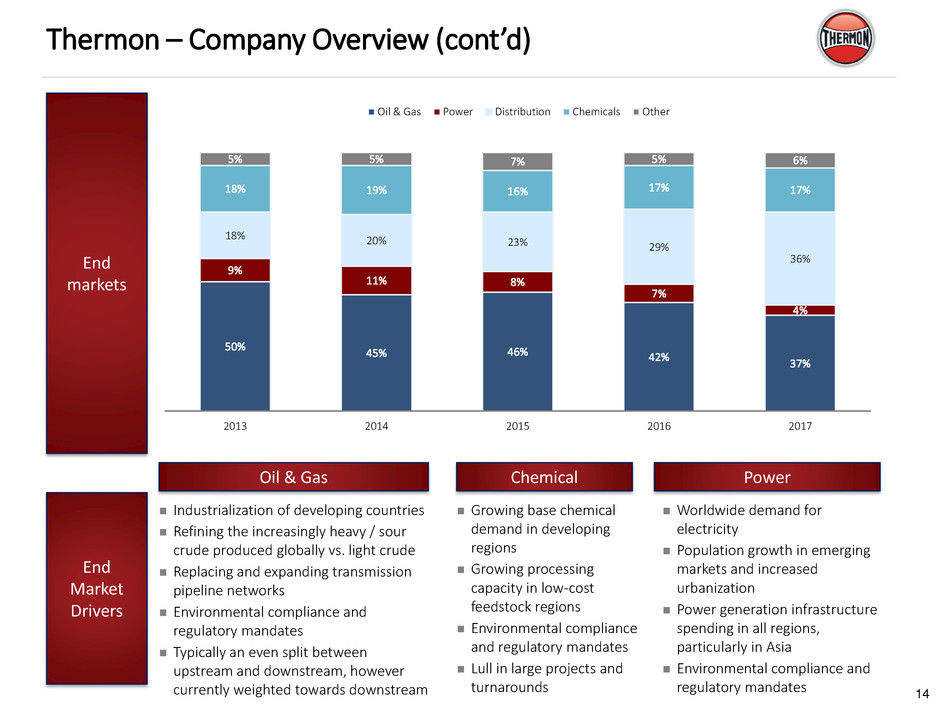

Thermon – Company Overview (cont’d)

Industrialization of developing countries

Refining the increasingly heavy / sour

crude produced globally vs. light crude

Replacing and expanding transmission

pipeline networks

Environmental compliance and

regulatory mandates

Typically an even split between

upstream and downstream, however

currently weighted towards downstream

Growing base chemical

demand in developing

regions

Growing processing

capacity in low-cost

feedstock regions

Environmental compliance

and regulatory mandates

Lull in large projects and

turnarounds

Worldwide demand for

electricity

Population growth in emerging

markets and increased

urbanization

Power generation infrastructure

spending in all regions,

particularly in Asia

Environmental compliance and

regulatory mandates

50%

45% 46% 42%

37%

9%

11% 8%

7%

4%

18% 20% 23% 29%

36%

18% 19% 16% 17% 17%

5% 5% 7% 5% 6%

2013 2014 2015 2016 2017

Oil & Gas Power Distribution Chemicals Other

End

Market

Drivers

End

markets

Oil & Gas Chemical Power

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

15

Thermon – Company Overview (cont’d)

Customer Overview

Commentary

Thermon serves a large and diverse base of multinational, loyal customers

─ Significant blue chip participation

Thermon has developed tremendous brand equity within the end markets being currently served, and is considered a premium

brand

Longstanding Relationships with Diverse Customers

Thermon’s top 10 customers represented 21% of FY2017

revenues and no single customer represents more than 10% of

the Company’s total revenue

Loyal relationships with customers and strategic partners, some for 60+ years

$ (000’s) FY 2017 Revenue % FY 2017 Relationship

Customer 1 $15,445 6% 30 + Years

Customer 2 7,807 3% 50 + Years

Customer 3 6,599 2% < 10 Years

Customer 4 6,056 2% < 5 Years

Customer 5 5,326 2% 20 + Years

Customer 6 4,163 2% 10 + Years

Customer 7 3,215 1% < 5 Years

Customer 8 3,119 1% < 5 Years

Customer 9 2,952 1% < 5 Years

Customer 10 2,929 1% 20 + Years

Total $57,612 21%

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

16

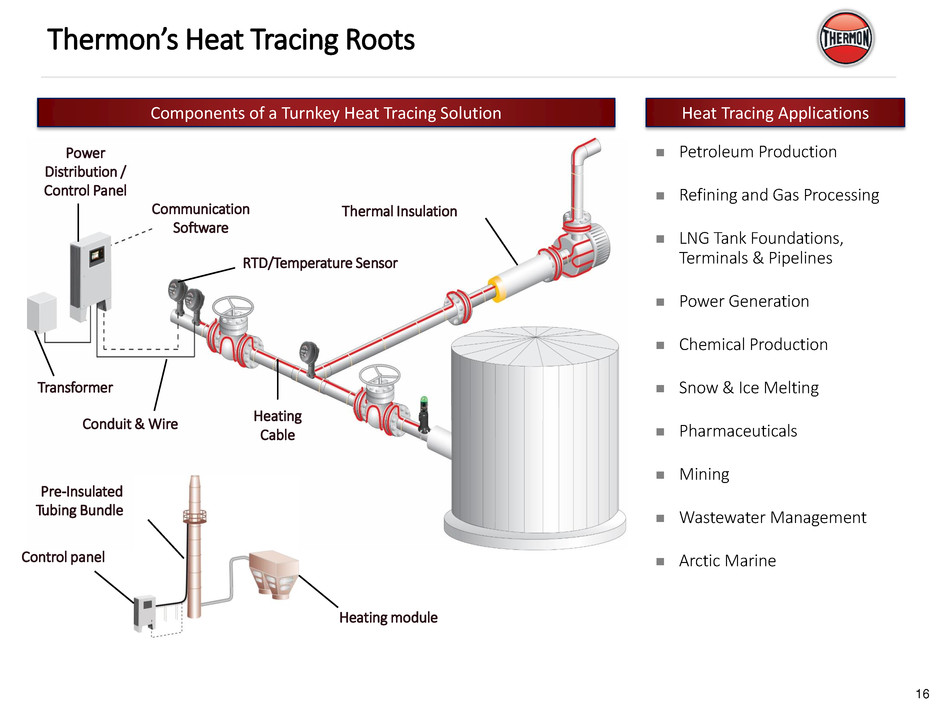

Thermon’s Heat Tracing Roots

Components of a Turnkey Heat Tracing Solution Heat Tracing Applications

Petroleum Production

Refining and Gas Processing

LNG Tank Foundations,

Terminals & Pipelines

Power Generation

Chemical Production

Snow & Ice Melting

Pharmaceuticals

Mining

Wastewater Management

Arctic Marine

Transformer

Power

Distribution /

Control Panel

Conduit & Wire Heating

Cable

RTD/Temperature Sensor

Thermal Insulation Communication

Software

Pre-Insulated

Tubing Bundle

Heating module

Control panel

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

17

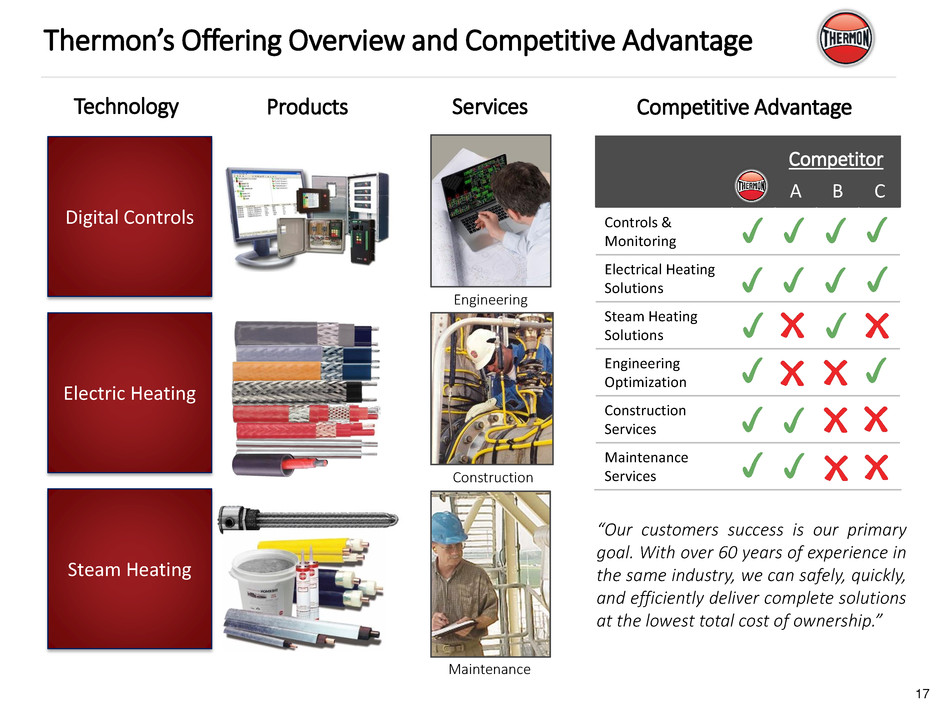

Thermon’s Offering Overview and Competitive Advantage

Products

Digital Controls

Electric Heating

Technology

Steam Heating

Services

Engineering

Construction

Maintenance

Competitive Advantage

A B C

Controls &

Monitoring

Electrical Heating

Solutions

Steam Heating

Solutions

Engineering

Optimization

Construction

Services

Maintenance

Services

“Our customers success is our primary

goal. With over 60 years of experience in

the same industry, we can safely, quickly,

and efficiently deliver complete solutions

at the lowest total cost of ownership.”

Longstanding Relationships with Diverse Customers

($ 000’s) FY 2017 Revenue % FY 2017 Relationship

Customer 1 $15,445 6% 30 + Years

Customer 2 7,807 3% 50 + Years

Customer 3 6,599 2% < 10 Years

Customer 4 6,056 2% < 5 Years

Customer 5 5,326 2% 20 + Years

Customer 6 4,163 2% 10 + Years

Customer 7 3,215 1% < 5 Years

Customer 8 3,119 1% < 5 Years

Customer 9 2,952 1% < 5 Years

Customer 10 2,929 1% 20 + Years

Total $57,612 21%

Competitor

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

18

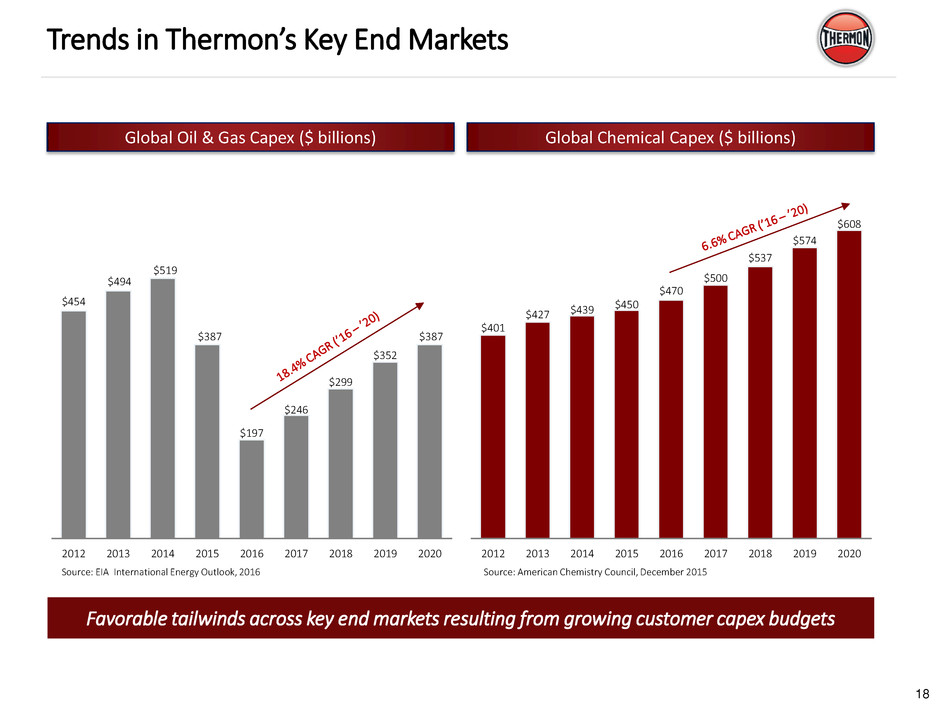

Trends in Thermon’s Key End Markets

Global Chemical Capex ($ billions) Global Oil & Gas Capex ($ billions)

$401

$427 $439

$450

$470

$500

$537

$574

$608

2012 2013 2014 2015 2016 2017 2018 2019 2020

$454

$494

$519

$387

$197

$246

$299

$352

$387

2012 2013 2014 2015 2016 2017 2018 2019 2020

Source: American Chemistry Council, December 2015 Source: EIA International Energy Outlook, 2016

Favorable tailwinds across key end markets resulting from growing customer capex budgets

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

19

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

20

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

21

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

22

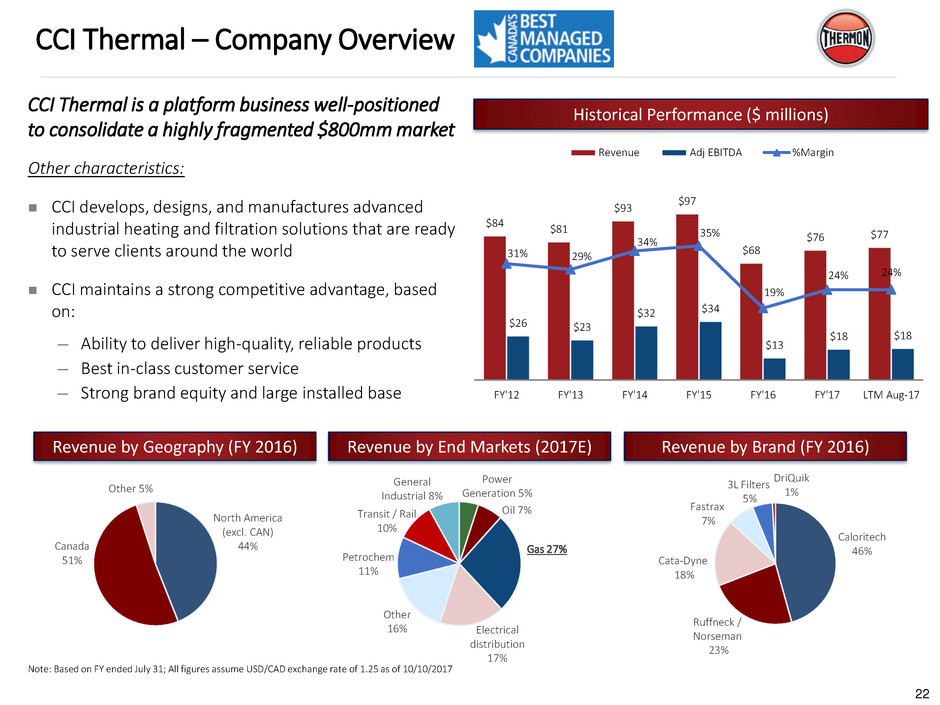

CCI Thermal – Company Overview

CCI Thermal is a platform business well-positioned

to consolidate a highly fragmented $800mm market

Other characteristics:

CCI develops, designs, and manufactures advanced

industrial heating and filtration solutions that are ready

to serve clients around the world

CCI maintains a strong competitive advantage, based

on:

─ Ability to deliver high-quality, reliable products

─ Best in-class customer service

─ Strong brand equity and large installed base

Revenue by Geography (FY 2016) Revenue by End Markets (2017E) Revenue by Brand (FY 2016)

$84

$81

$93

$97

$68

$76 $77

$26 $23

$32 $34

$13

$18 $18

31% 29%

34%

35%

19%

24% 24%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM Aug-17

Revenue Adj EBITDA %Margin

Historical Performance ($ millions)

3L Filters

5%

Ruffneck /

Norseman

23%

Fastrax

7%

Cata-Dyne

18%

Caloritech

46%

DriQuik

1%

North America

(excl. CAN)

44% Canada

51%

Other 5%

Note: Based on FY ended July 31; All figures assume USD/CAD exchange rate of 1.25 as of 10/10/2017

Gas 27%

Electrical

distribution

17%

Transit / Rail

10%

Power

Generation 5%

Other

16%

General

Industrial 8%

Petrochem

11%

Oil 7%

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

23

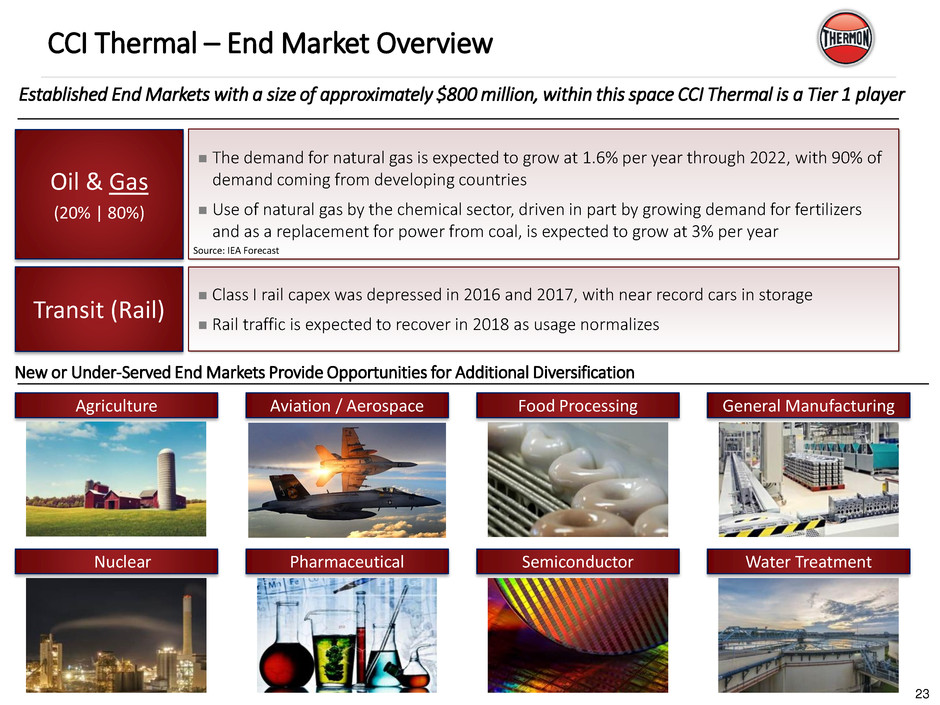

CCI Thermal – End Market Overview

The demand for natural gas is expected to grow at 1.6% per year through 2022, with 90% of

demand coming from developing countries

Use of natural gas by the chemical sector, driven in part by growing demand for fertilizers

and as a replacement for power from coal, is expected to grow at 3% per year

Class I rail capex was depressed in 2016 and 2017, with near record cars in storage

Rail traffic is expected to recover in 2018 as usage normalizes

Established End Markets with a size of approximately $800 million, within this space CCI Thermal is a Tier 1 player

New or Under-Served End Markets Provide Opportunities for Additional Diversification

Agriculture

Oil & Gas

(20% | 80%)

Transit (Rail)

Aviation / Aerospace Food Processing General Manufacturing

Nuclear Pharmaceutical Semiconductor Water Treatment

Source: IEA Forecast

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

24

0

1,000

2,000

3,000

4,000

5,000

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Rest of the world United States European Union

Russia Federation Middle East China

South East Asia India

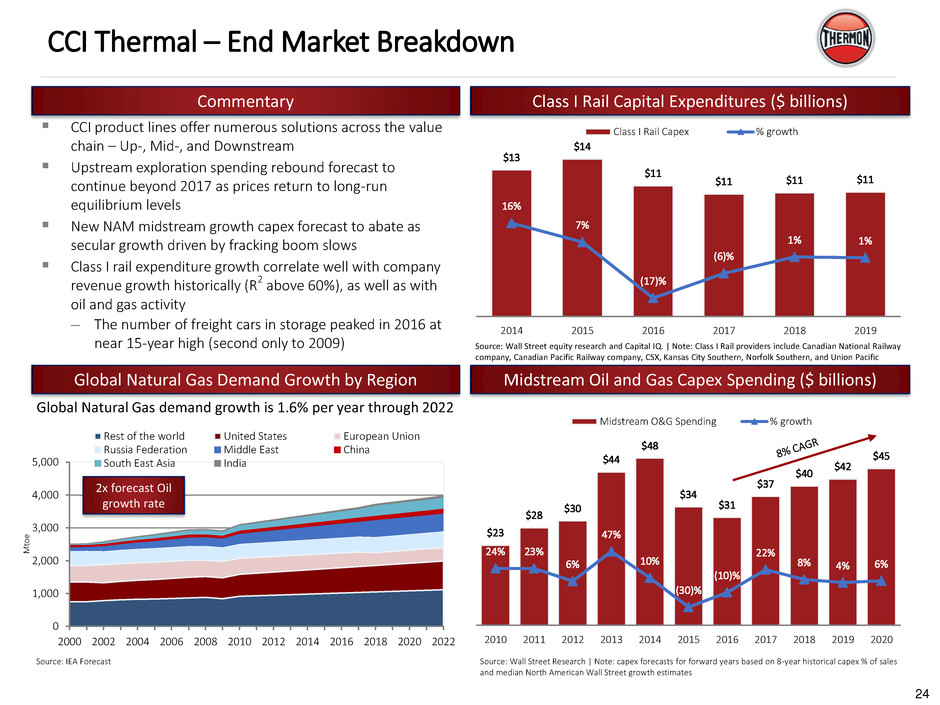

CCI Thermal – End Market Breakdown

$23

$28

$30

$44

$48

$34

$31

$37

$40 $42

$45

23.5%23.4%

6.0% 46.9%

10.4%

(29.8%)

(9.7%)

21.9%

8.3% 4.0%6.3%

-100%

-80%

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

$0

$10

$20

$30

$40

$50

$60

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Midstream Spend Growth

Global Natural Gas Demand Growth by Region Midstream Oil and Gas Capex Spending ($ billions)

Source: IEA Forecast Source: Wall Street Research | Note: capex forecasts for forward years based on 8-year historical capex % of sales

and median North American Wall Street growth estimates

Class I Rail Capital Expenditures ($ billions) Commentary

CCI product lines offer numerous solutions across the value

chain – Up-, Mid-, and Downstream

Upstream exploration spending rebound forecast to

continue beyond 2017 as prices return to long-run

equilibrium levels

New NAM midstream growth capex forecast to abate as

secular growth driven by fracking boom slows

Class I rail expenditure growth correlate well with company

revenue growth historically (R2 above 60%), as well as with

oil and gas activity

─ The number of freight cars in storage peaked in 2016 at

near 15-year high (second only to 2009)

Global Natural Gas demand growth is 1.6% per year through 2022

$12,781

$13,728

$11,399

$10,689 $10,790 $10,854

15.7%

7.4%

(17.0%)

(6.2%)

0.9% 0.6%

(20.0%)

(15.0%)

(10.0%)

(5.0%)

0.0%

5.0%

10.0%

15.0%

20.0%

CY2014 CY2015 CY2016 CY2017 CY2018 CY2019

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

Class I Rail CapEx Growth

$13

$14

$11

$11 $11 $11

16%

7%

(17)%

(6)%

1% 1%

2014 2015 2016 2017 2018 2019

Class I Rail Capex % growth

$23

$28

$30

$44

$48

$34

$31

$37

$40

$42

$45

24% 23%

6%

47%

10%

(30)%

(10)%

22%

8% 4% 6%

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Midstream O&G Spending % growth

2x forecast Oil

growth rate

Source: Wall Street equity research and Capital IQ. | Note: Class I Rail providers include Canadian National Railway

company, Canadian Pacific Railway company, CSX, Kansas City Southern, Norfolk Southern, and Union Pacific

Mt

o

e

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

25

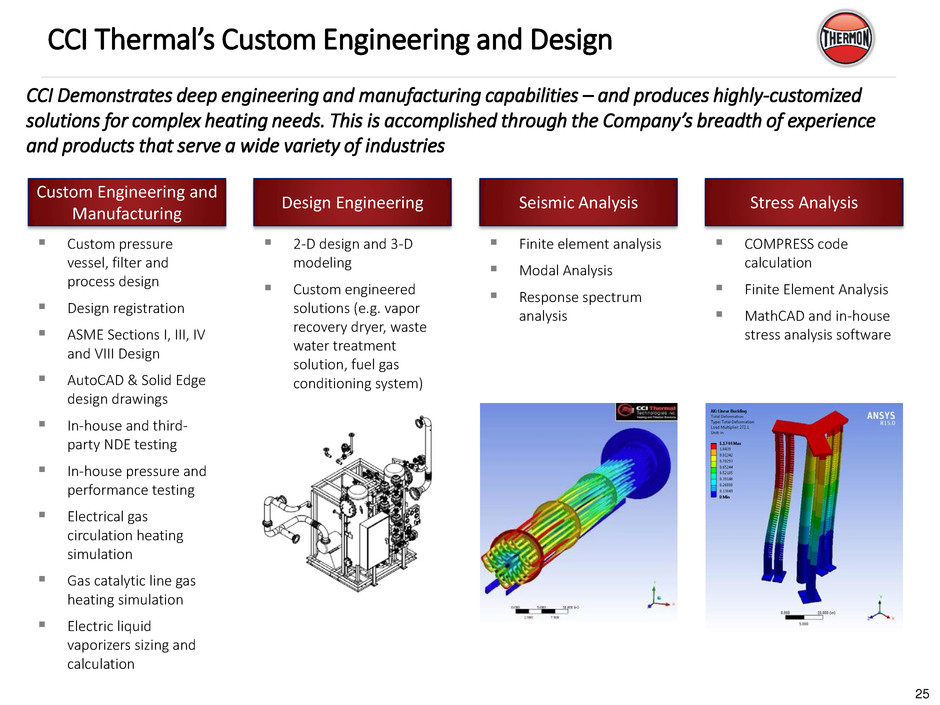

CCI Thermal’s Custom Engineering and Design

CCI Demonstrates deep engineering and manufacturing capabilities – and produces highly-customized

solutions for complex heating needs. This is accomplished through the Company’s breadth of experience

and products that serve a wide variety of industries

Custom pressure

vessel, filter and

process design

Design registration

ASME Sections I, III, IV

and VIII Design

AutoCAD & Solid Edge

design drawings

In-house and third-

party NDE testing

In-house pressure and

performance testing

Electrical gas

circulation heating

simulation

Gas catalytic line gas

heating simulation

Electric liquid

vaporizers sizing and

calculation

Custom Engineering and

Manufacturing

2-D design and 3-D

modeling

Custom engineered

solutions (e.g. vapor

recovery dryer, waste

water treatment

solution, fuel gas

conditioning system)

Design Engineering

Finite element analysis

Modal Analysis

Response spectrum

analysis

Seismic Analysis

COMPRESS code

calculation

Finite Element Analysis

MathCAD and in-house

stress analysis software

Stress Analysis

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

26

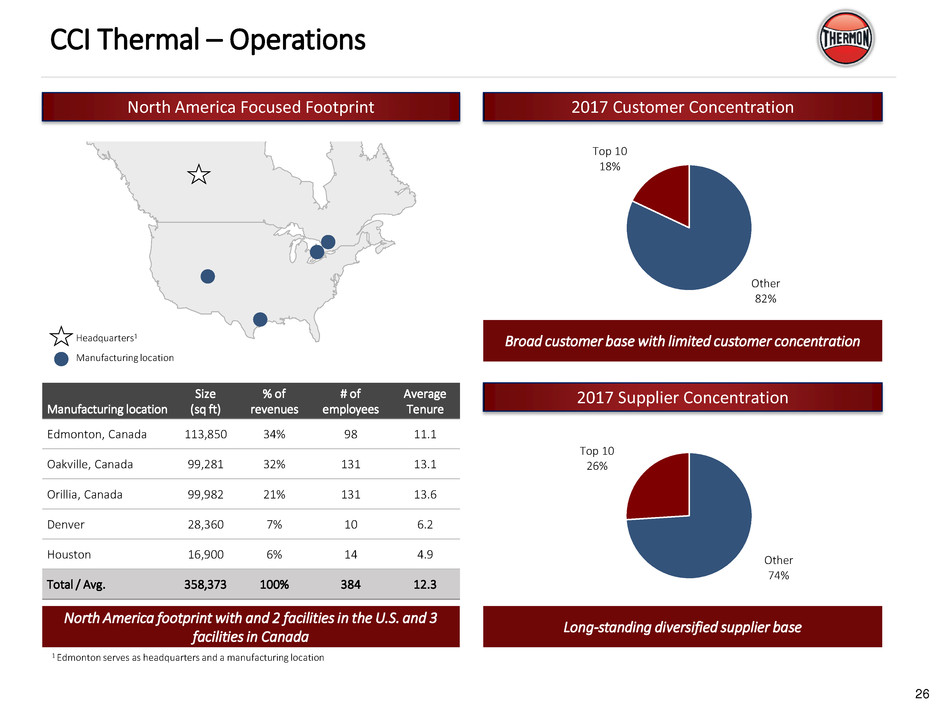

CCI Thermal – Operations

2017 Supplier Concentration

2017 Customer Concentration North America Focused Footprint

Broad customer base with limited customer concentration

Manufacturing location

Size

(sq ft)

% of

revenues

# of

employees

Average

Tenure

Edmonton, Canada 113,850 34% 98 11.1

Oakville, Canada 99,281 32% 131 13.1

Orillia, Canada 99,982 21% 131 13.6

Denver 28,360 7% 10 6.2

Houston 16,900 6% 14 4.9

Total / Avg. 358,373 100% 384 12.3

North America footprint with and 2 facilities in the U.S. and 3

facilities in Canada

Long-standing diversified supplier base

1 Edmonton serves as headquarters and a manufacturing location

Headquarters1

Manufacturing location

Other

82%

Top 10

18%

Other

74%

Top 10

26%

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

27

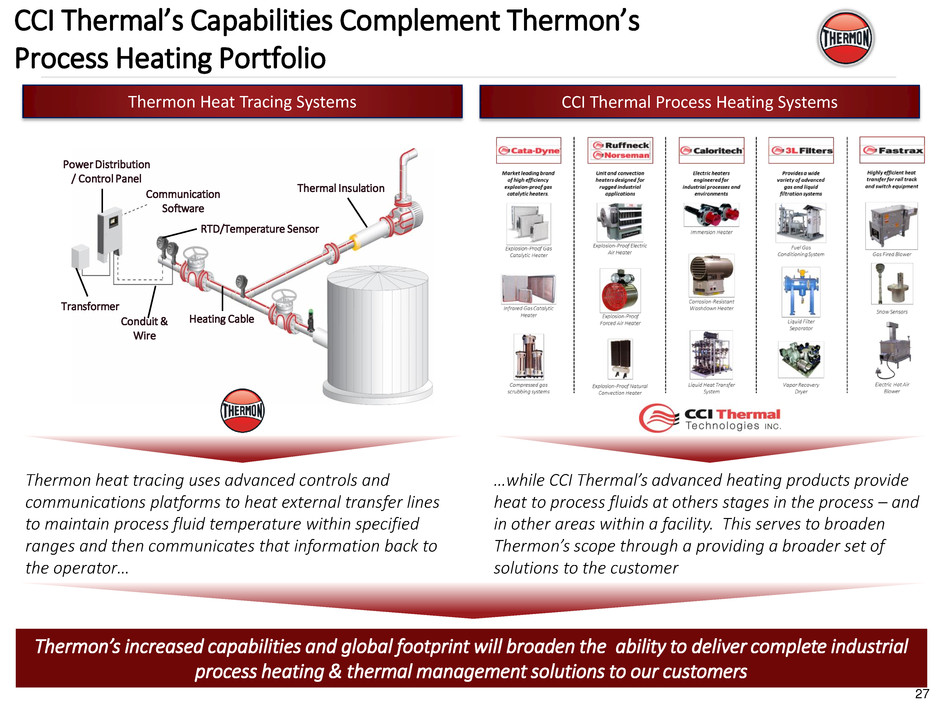

CCI Thermal’s Capabilities Complement Thermon’s

Process Heating Portfolio

Thermon’s increased capabilities and global footprint will broaden the ability to deliver complete industrial

process heating & thermal management solutions to our customers

Transformer

Power Distribution

/ Control Panel

Conduit &

Wire

Heating Cable

RTD/Temperature Sensor

Thermal Insulation

Communication

Software

Thermon Heat Tracing Systems CCI Thermal Process Heating Systems

Thermon heat tracing uses advanced controls and

communications platforms to heat external transfer lines

to maintain process fluid temperature within specified

ranges and then communicates that information back to

the operator…

…while CCI Thermal’s advanced heating products provide

heat to process fluids at others stages in the process – and

in other areas within a facility. This serves to broaden

Thermon’s scope through a providing a broader set of

solutions to the customer

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

28

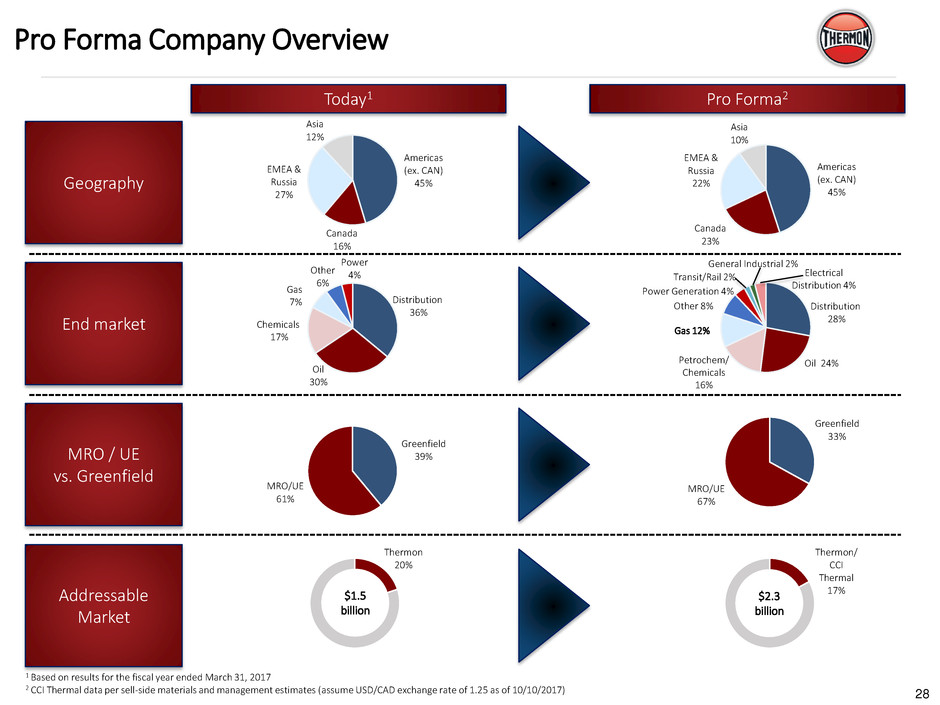

End market

MRO / UE

vs. Greenfield

Pro Forma Company Overview

Americas

(ex. CAN)

45%

Canada

16%

EMEA &

Russia

27%

Asia

12%

Greenfield

39%

MRO/UE

61%

Oil

30%

Other

6%

Power

4%

Americas

(ex. CAN)

45%

Canada

23%

EMEA &

Russia

22%

Asia

10%

Oil 24%

Gas 12%

Other 8%

1 Based on results for the fiscal year ended March 31, 2017

2 CCI Thermal data per sell-side materials and management estimates (assume USD/CAD exchange rate of 1.25 as of 10/10/2017)

Today1 Pro Forma2

Geography

Addressable

Market

Greenfield

33%

MRO/UE

67%

Distribution

36%

Petrochem/

Chemicals

16%

Distribution

28%

General Industrial 2%

Transit/Rail 2%

Power Generation 4%

Electrical

Distribution 4%

Chemicals

17%

Gas

7%

Thermon

20%

Thermon/

CCI

Thermal

17% $1.5

billion

$2.3

billion

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

29

Key Credit Highlights

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

30

Key Credit Highlights

CCI Thermal is an attractive addition to the existing Thermon platform

Attractive mix between Greenfield and recurring business

Highly engineered, mission critical solutions

Global footprint that provides access to high-growth markets worldwide

Robust and consistent free cash flow

1

2

3

4

5

Evidence of business stabilization at Thermon 6

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

31

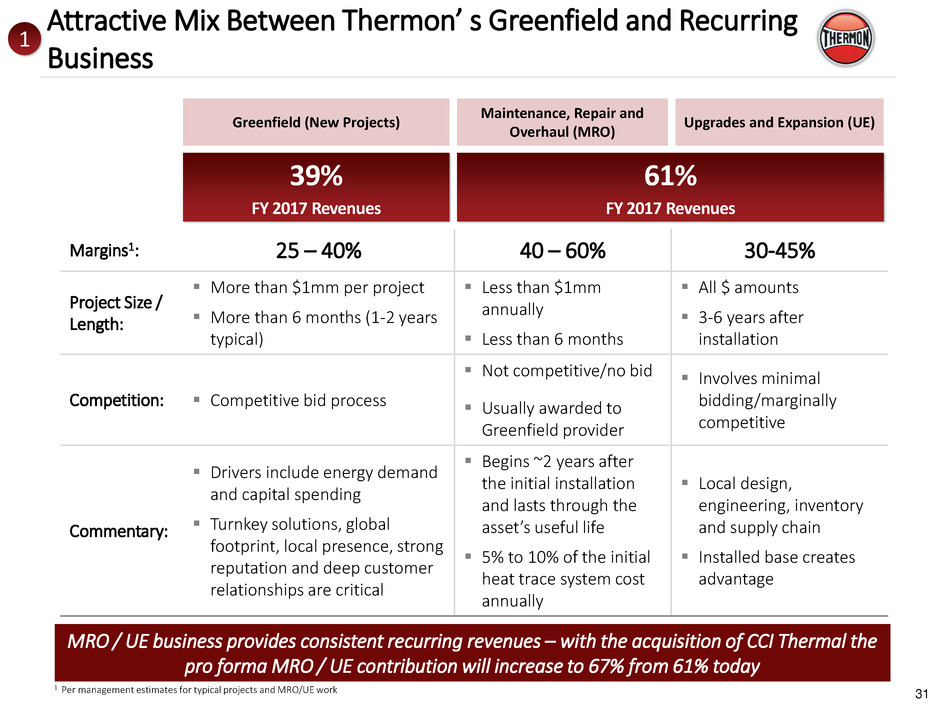

Margins1: 25 – 40% 40 – 60% 30-45%

Project Size /

Length:

More than $1mm per project

More than 6 months (1-2 years

typical)

Less than $1mm

annually

Less than 6 months

All $ amounts

3-6 years after

installation

Competition: Competitive bid process

Not competitive/no bid

Usually awarded to

Greenfield provider

Involves minimal

bidding/marginally

competitive

Commentary:

Drivers include energy demand

and capital spending

Turnkey solutions, global

footprint, local presence, strong

reputation and deep customer

relationships are critical

Begins ~2 years after

the initial installation

and lasts through the

asset’s useful life

5% to 10% of the initial

heat trace system cost

annually

Local design,

engineering, inventory

and supply chain

Installed base creates

advantage

Greenfield (New Projects)

Maintenance, Repair and

Overhaul (MRO)

Upgrades and Expansion (UE)

MRO / UE business provides consistent recurring revenues – with the acquisition of CCI Thermal the

pro forma MRO / UE contribution will increase to 67% from 61% today

39%

FY 2017 Revenues

61%

FY 2017 Revenues

1

Attractive Mix Between Thermon’ s Greenfield and Recurring

Business

1 Per management estimates for typical projects and MRO/UE work

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

32

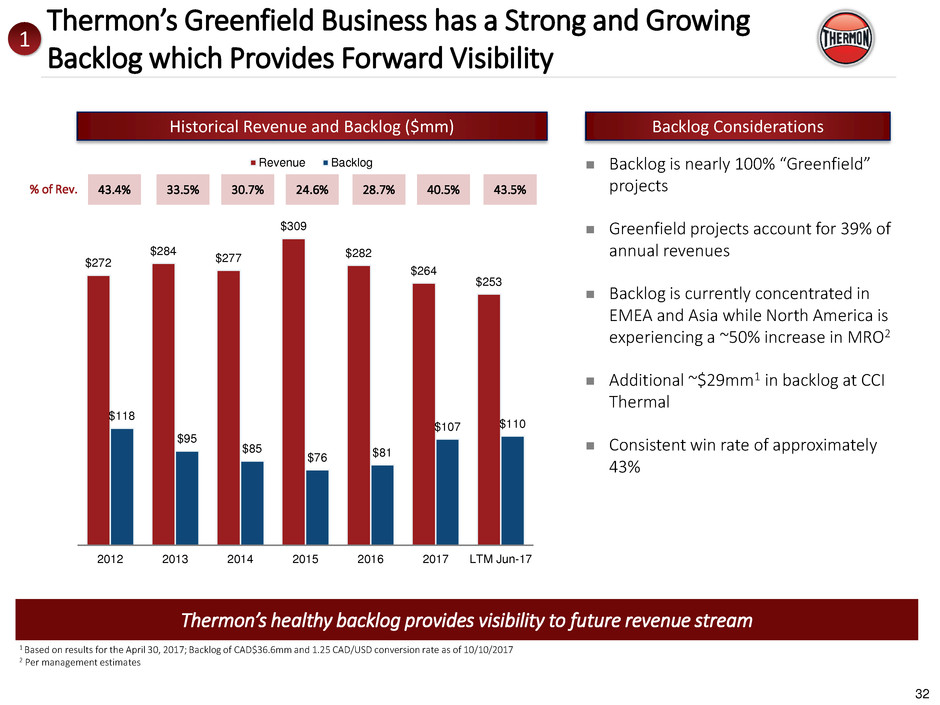

$272

$284

$277

$309

$282

$264

$253

$118

$95

$85

$76 $81

$107 $110

2012 2013 2014 2015 2016 2017 LTM Jun-17

Revenue Backlog

43.4% 33.5% 30.7% 24.6% 28.7% 40.5% 43.5% % of Rev.

Backlog is nearly 100% “Greenfield”

projects

Greenfield projects account for 39% of

annual revenues

Backlog is currently concentrated in

EMEA and Asia while North America is

experiencing a ~50% increase in MRO2

Additional ~$29mm1 in backlog at CCI

Thermal

Consistent win rate of approximately

43%

1 Based on results for the April 30, 2017; Backlog of CAD$36.6mm and 1.25 CAD/USD conversion rate as of 10/10/2017

2 Per management estimates

Thermon’s healthy backlog provides visibility to future revenue stream

Historical Revenue and Backlog ($mm) Backlog Considerations

1

Thermon’s Greenfield Business has a Strong and Growing

Backlog which Provides Forward Visibility

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

33

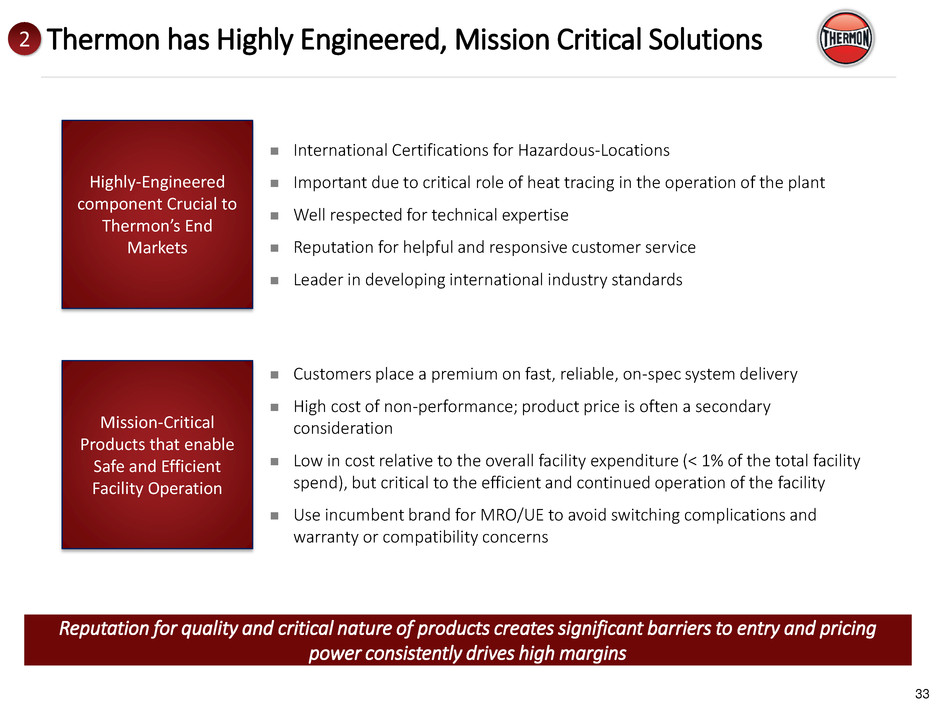

Reputation for quality and critical nature of products creates significant barriers to entry and pricing

power consistently drives high margins

International Certifications for Hazardous-Locations

Important due to critical role of heat tracing in the operation of the plant

Well respected for technical expertise

Reputation for helpful and responsive customer service

Leader in developing international industry standards

Customers place a premium on fast, reliable, on-spec system delivery

High cost of non-performance; product price is often a secondary

consideration

Low in cost relative to the overall facility expenditure (< 1% of the total facility

spend), but critical to the efficient and continued operation of the facility

Use incumbent brand for MRO/UE to avoid switching complications and

warranty or compatibility concerns

Highly-Engineered

component Crucial to

Thermon’s End

Markets

Mission-Critical

Products that enable

Safe and Efficient

Facility Operation

2 Thermon has Highly Engineered, Mission Critical Solutions

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

34

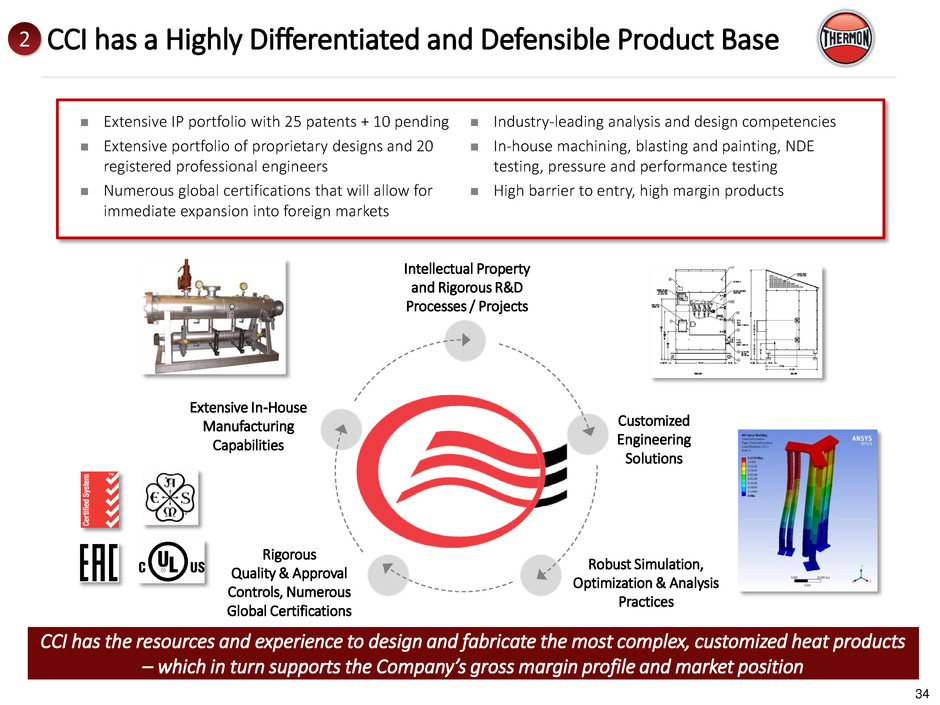

Extensive IP portfolio with 25 patents + 10 pending

Extensive portfolio of proprietary designs and 20

registered professional engineers

Numerous global certifications that will allow for

immediate expansion into foreign markets

Industry-leading analysis and design competencies

In-house machining, blasting and painting, NDE

testing, pressure and performance testing

High barrier to entry, high margin products

Customized

Engineering

Solutions

Intellectual Property

and Rigorous R&D

Processes / Projects

Rigorous

Quality & Approval

Controls, Numerous

Global Certifications

Robust Simulation,

Optimization & Analysis

Practices

Extensive In-House

Manufacturing

Capabilities

CCI has the resources and experience to design and fabricate the most complex, customized heat products

– which in turn supports the Company’s gross margin profile and market position

2 CCI has a Highly Differentiated and Defensible Product Base

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

35

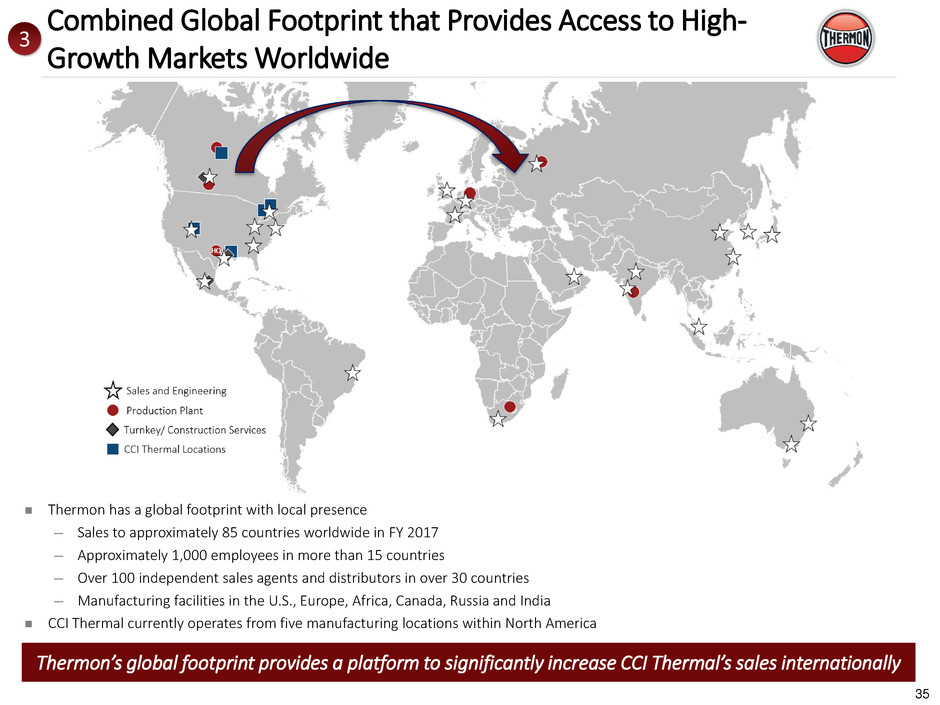

Thermon has a global footprint with local presence

─ Sales to approximately 85 countries worldwide in FY 2017

─ Approximately 1,000 employees in more than 15 countries

─ Over 100 independent sales agents and distributors in over 30 countries

─ Manufacturing facilities in the U.S., Europe, Africa, Canada, Russia and India

CCI Thermal currently operates from five manufacturing locations within North America

Thermon’s global footprint provides a platform to significantly increase CCI Thermal’s sales internationally

3

Combined Global Footprint that Provides Access to High-

Growth Markets Worldwide

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

36

Extensive IP portfolio:

─ 17 Canadian patents

─ 8 U.S. patents

─ 10 patent applications pending

7 major globally recognized brands

─ Cata-Dyne, Ruffneck, Norseman, Caloritech, 3L Filters,

Fastrax, DriQuiks

Trade secrets and know-how

─ Non-patented proprietary designs and technological

methods, keeping this competitive information private

─ 20 registered professional engineers

Source: Per CCI management

1 YTD 2017 defined as August 1, 2016 through March 31, 2017; Assumes USD/CAD exchange rate of 1.25 as of 10/10/2017

($k) YTD Mar-2017¹ % YTD Mar-17 Relationship

Customer 1 $2,186 3.9% 10+ years

Customer 2 1,568 2.8% 10+ years

Customer 3 1,193 2.1% 20+ years

Customer 4 990 1.8% 20+ years

Customer 5 960 1.7% 15+ years

Customer 6 884 1.6% 20+ years

Customer 7 819 1.5% 25+ years

Customer 8 692 1.2% 30+ years

Customer 9 593 1.1% 30+ years

Customer 10 536 1.0% 20+ years

Top 10 customers $10,424 18.6%

Strong Financial Track Record

Extensive IP Portfolio and R&D

Tier 1 Player in Highly Fragmented Market

Longstanding Relationships with Diverse Customers

4

CCI Thermal is an attractive addition to the existing Thermon

platform

$84 $81

$93 $97

$68

$76 $77

$26 $23

$32 $34

$13

$18 $18

31% 29%

34%

35%

19%

24%

24%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM Aug-17

Revenue Adj EBITDA %Margin

Note: Assumes USD/CAD exchange rate of 1.25 as of 10/10/2017

Vulcanic

11%

CCI Thermal

11%

Watlow

10%

Elmess

9%

Gaumer

Process

8%

Chromalox

8%

DFI

7%

ExHEat

7%

Nibe

4%

Indeeco

4%

Sains

3%

Zoppas

1%

Others

17%

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

37

Thermon’s Revenue Growth and Consistent Margins Since 2007

15%

30%

45%

60%

75%

$0

$50

$100

$150

$200

$250

$300

$350

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Sales Gross Margin % Average Gross Margin % (Since 2000)

Note: Results for fiscal years ended March 31. Gross margin results for fiscal years ended March 31, 2006 and 2011 exclude non-cash purchase accounting adjustments of $7.1 million and $7.6

million related to the Audax and CHS private equity transactions, respectively. The mean gross margin of 45.5% represents historic data since 2000

1 Adjusted for one-time financing cost of $12.9 million associated with the Audax transaction

2 Related to one-time financing costs associated with the CHS Transactions and increased levels of indebtedness incurred in connection with the issuance of $210.0 million of senior secured notes

2007 2008 1 2009 2010 2011 2012 2 2013 2014 2015 2016 2017

LTM June-

17

EBITDA Margin 16.0% 20.9% 23.4% 23.3% 23.9% 26.2% 25.5% 26.8% 27.0% 23.2% 16.4% 16.1%

Free cash flow $7.4 $7.5 $22.5 $22.3 $63.7 $3.6 $39.6 $39.1 $44.0 $38.6 $18.1 $29.5

5 Robust and Consistent Free Cash Flow

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

38

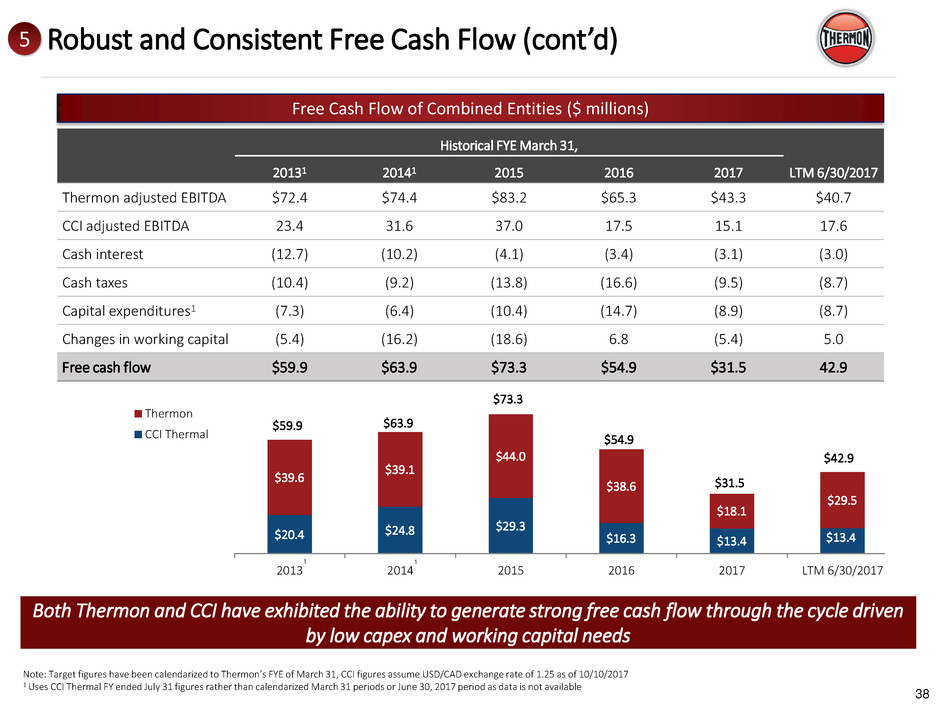

Free Cash Flow of Combined Entities ($ millions)

Both Thermon and CCI have exhibited the ability to generate strong free cash flow through the cycle driven

by low capex and working capital needs

$20.4 $24.8

$29.3

$16.3 $13.4 $13.4

$39.6

$39.1

$44.0

$38.6

$18.1

$29.5

2013 2014 2015 2016 2017 LTM 6/30/2017

Thermon

CCI Thermal

Historical FYE March 31,

LTM 6/30/2017 20131 20141 2015 2016 2017

Thermon adjusted EBITDA $72.4 $74.4 $83.2 $65.3 $43.3 $40.7

CCI adjusted EBITDA 23.4 31.6 37.0 17.5 15.1 17.6

Cash interest (12.7) (10.2) (4.1) (3.4) (3.1) (3.0)

Cash taxes (10.4) (9.2) (13.8) (16.6) (9.5) (8.7)

Capital expenditures1 (7.3) (6.4) (10.4) (14.7) (8.9) (8.7)

Changes in working capital (5.4) (16.2) (18.6) 6.8 (5.4) 5.0

Free cash flow $59.9 $63.9 $73.3 $54.9 $31.5 42.9

Historical FYE March 31,

LTM 6/30/2017 2013 2014 2015 2016 2017

Thermon adjusted EBITDA $72.4 $74.4 $83.2 $65.3 $43.3 $40.7

Cash interest (12.7) (10.1) (4.1) (3.4) (3.1) (3.0)

Cash taxes (10.4) (9.1) (13.7) (15.5) (9.3) (8.5)

Capital expenditures (6.3) (3.4) (6.1) (12.6) (8.4) (8.2)

Changes in working capital (3.4) (12.7) (15.4) 4.8 (6.9) 4.2

Free cash flow $39.6 $39.1 $44.0 $38.7 $15.6 $25.2

Note: Target figures have been calendarized to Thermon’s FYE of March 31, CCI figures assume USD/CAD exchange rate of 1.25 as of 10/10/2017

1 Uses CCI Thermal FY ended July 31 figures rather than calendarized March 31 periods or June 30, 2017 period as data is not available

$59.9 $63.9

$73.3

$54.9

$31.5

$42.9

1 1

5 Robust and Consistent Free Cash Flow (cont’d)

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

39

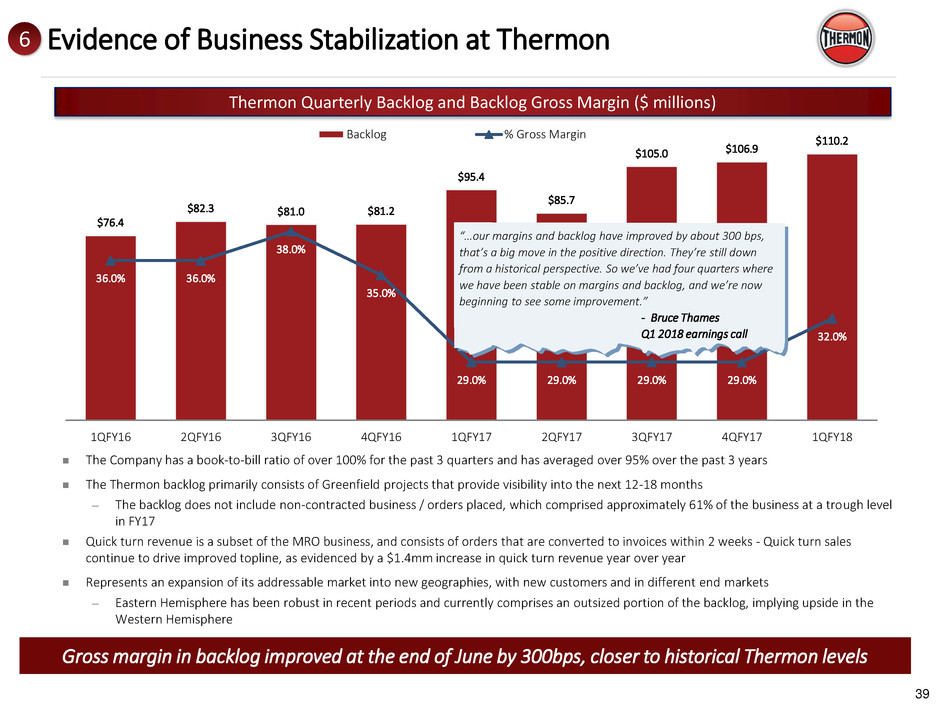

Gross margin in backlog improved at the end of June by 300bps, closer to historical Thermon levels

$76.4

$82.3 $81.0 $81.2

$95.4

$85.7

$105.0 $106.9

$110.2

36.0% 36.0%

38.0%

35.0%

29.0% 29.0% 29.0% 29.0%

32.0%

1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17 1QFY18

Backlog % Gross Margin

Thermon Quarterly Backlog and Backlog Gross Margin ($ millions)

The Company has a book-to-bill ratio of over 100% for the past 3 quarters and has averaged over 95% over the past 3 years

The Thermon backlog primarily consists of Greenfield projects that provide visibility into the next 12-18 months

─ The backlog does not include non-contracted business / orders placed, which comprised approximately 61% of the business at a trough level

in FY17

Quick turn revenue is a subset of the MRO business, and consists of orders that are converted to invoices within 2 weeks - Quick turn sales

continue to drive improved topline, as evidenced by a $1.4mm increase in quick turn revenue year over year

Represents an expansion of its addressable market into new geographies, with new customers and in different end markets

─ Eastern Hemisphere has been robust in recent periods and currently comprises an outsized portion of the backlog, implying upside in the

Western Hemisphere

“…our margins and backlog have improved by about 300 bps,

that’s a big move in the positive direction. They’re still down

from a historical perspective. So we’ve had four quarters where

we have been stable on margins and backlog, and we’re now

beginning to see some improvement.”

- Bruce Thames

Q1 2018 earnings call

“This backlog reduced margin has been very consistent from Q1,

Q2, Q3 and Q4 at 29%. So this is kind of the environment that

we have lived with for the last 365 days. And we have not seen

any further erosion in that number since 5 quarters now.”

- Jay Peterson

Q4 2017 earnings call

6 Evidence of Business Stabilization at Thermon

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

40

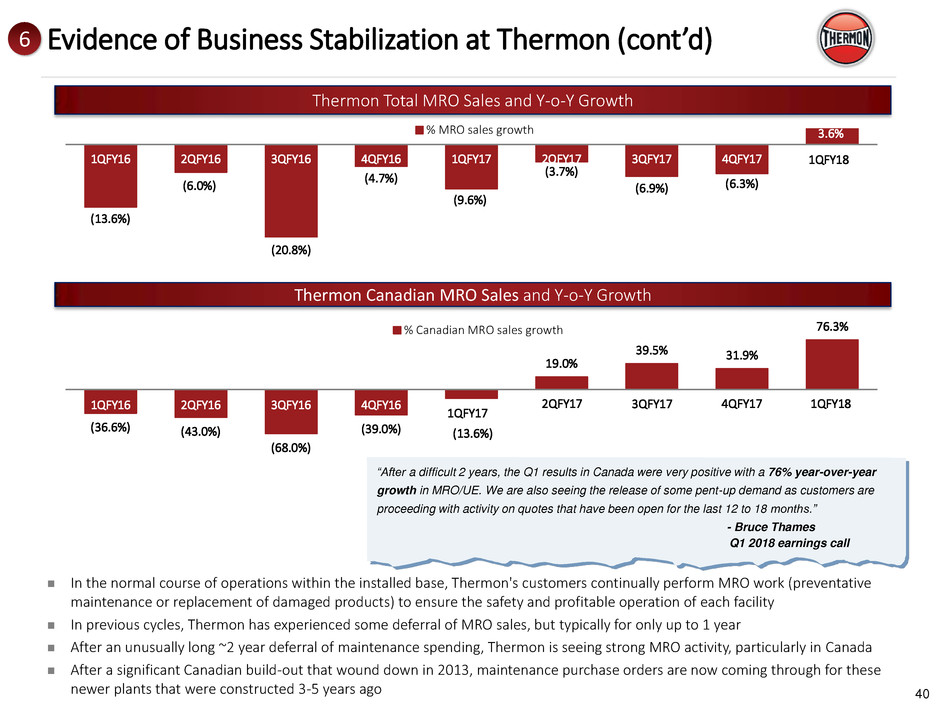

(13.6%)

(6.0%)

(20.8%)

(4.7%)

(9.6%)

(3.7%)

(6.9%) (6.3%)

3.6%

1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17 1QFY18

% MRO sales growth

1QFY18

Thermon Total MRO Sales and Y-o-Y Growth

In the normal course of operations within the installed base, Thermon's customers continually perform MRO work (preventative

maintenance or replacement of damaged products) to ensure the safety and profitable operation of each facility

In previous cycles, Thermon has experienced some deferral of MRO sales, but typically for only up to 1 year

After an unusually long ~2 year deferral of maintenance spending, Thermon is seeing strong MRO activity, particularly in Canada

After a significant Canadian build-out that wound down in 2013, maintenance purchase orders are now coming through for these

newer plants that were constructed 3-5 years ago

“After a difficult 2 years, the Q1 results in Canada were very positive with a 76% year-over-year

growth in MRO/UE. We are also seeing the release of some pent-up demand as customers are

proceeding with activity on quotes that have been open for the last 12 to 18 months.”

- Bruce Thames

Q1 2018 earnings call

Thermon Canadian MRO Sales and Y-o-Y Growth

6 Evidence of Business Stabilization at Thermon (cont’d)

(36.6%) (43.0%)

(68.0%)

(39.0%)

19.0%

39.5% 31.9%

76.3%

1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17 1QFY18

% Canadian MRO sales growth

FY1 FY1 FY1 FY1

1QFY17

(13.6%)

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

41

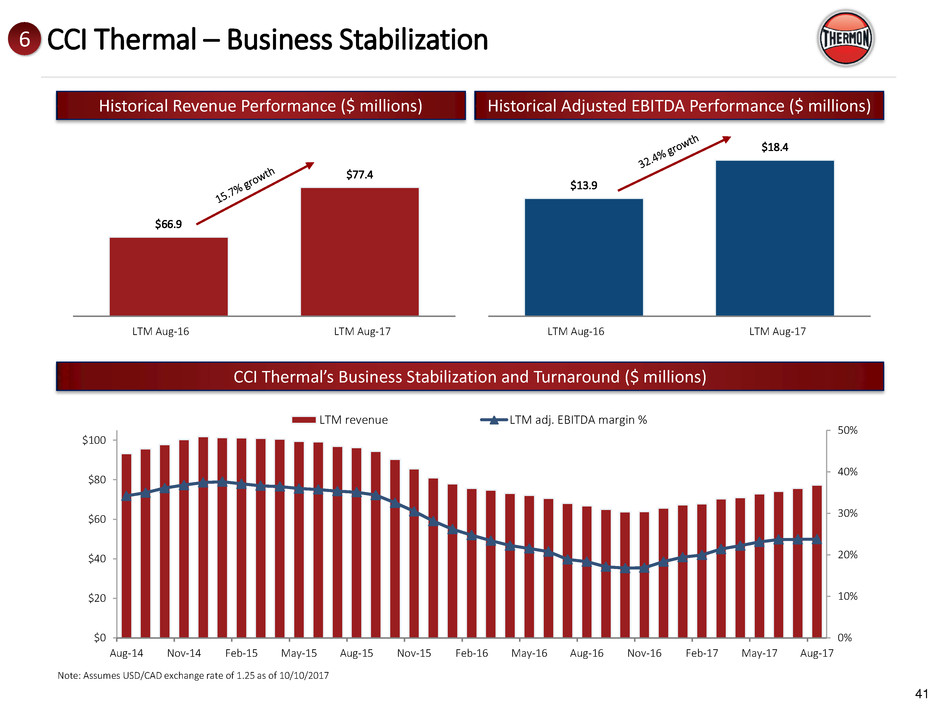

CCI Thermal – Business Stabilization

CCI Thermal’s Business Stabilization and Turnaround ($ millions)

0%

10%

20%

30%

40%

50%

$0

$20

$40

$60

$80

$100

Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 Feb-16 May-16 Aug-16 Nov-16 Feb-17 May-17 Aug-17

LTM revenue LTM adj. EBITDA margin %

$66.9

$77.4

LTM Aug-16 LTM Aug-17

Historical Revenue Performance ($ millions) Historical Adjusted EBITDA Performance ($ millions)

$13.9

$18.4

LTM Aug-16 LTM Aug-17

6

Note: Assumes USD/CAD exchange rate of 1.25 as of 10/10/2017

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

42

Historical Financial Performance

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

43

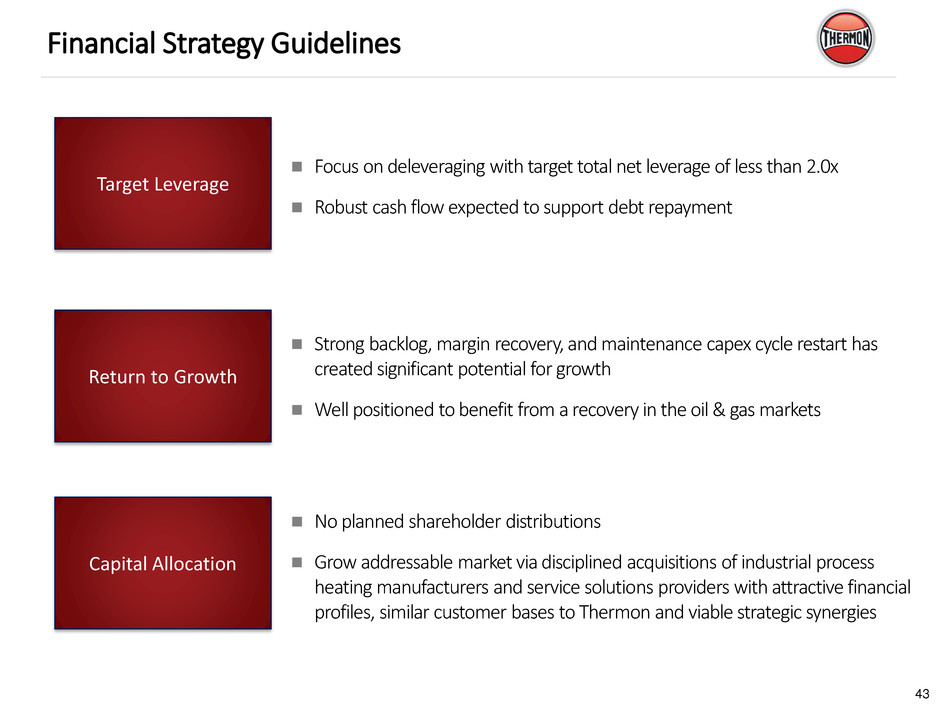

Financial Strategy Guidelines

Focus on deleveraging with target total net leverage of less than 2.0x

Robust cash flow expected to support debt repayment

Strong backlog, margin recovery, and maintenance capex cycle restart has

created significant potential for growth

Well positioned to benefit from a recovery in the oil & gas markets

No planned shareholder distributions

Grow addressable market via disciplined acquisitions of industrial process

heating manufacturers and service solutions providers with attractive financial

profiles, similar customer bases to Thermon and viable strategic synergies

Target Leverage

Return to Growth

Capital Allocation

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

44

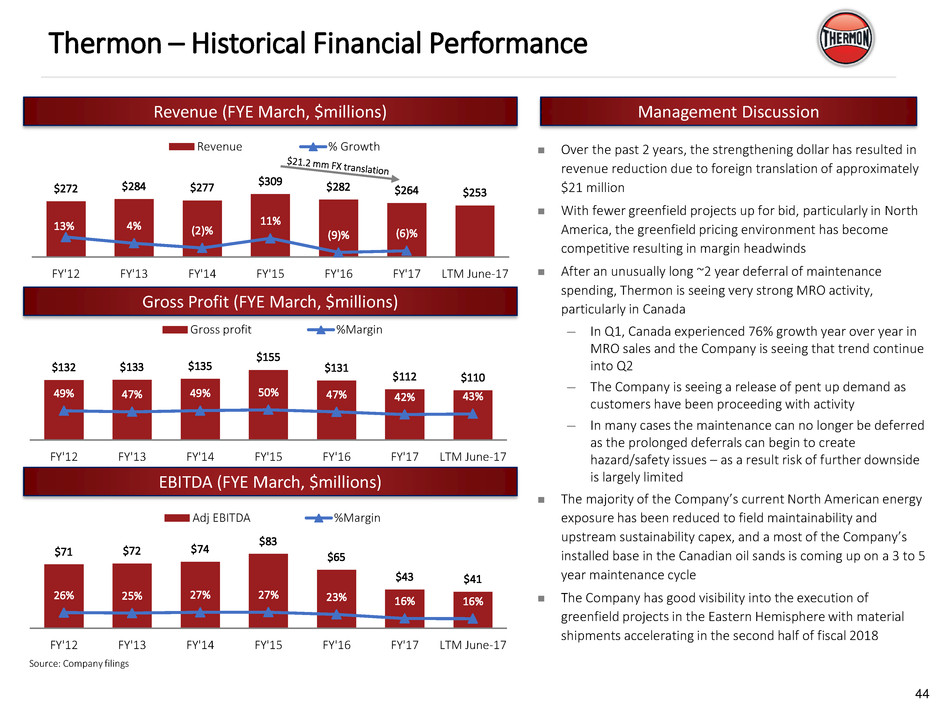

Thermon – Historical Financial Performance

Revenue (FYE March, $millions) Management Discussion

$132 $133 $135

$155

$131

$112 $110

49% 47% 49% 50% 47% 42% 43%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM June-17

Gross profit %Margin

Gross Profit (FYE March, $millions)

$272 $284 $277

$309 $282 $264 $253

13% 4% (2)%

11%

(9)% (6)%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM June-17

Revenue % Growth

EBITDA (FYE March, $millions)

$71 $72 $74

$83

$65

$43 $41

26% 25% 27% 27% 23% 16% 16%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM June-17

Adj EBITDA %Margin

Over the past 2 years, the strengthening dollar has resulted in

revenue reduction due to foreign translation of approximately

$21 million

With fewer greenfield projects up for bid, particularly in North

America, the greenfield pricing environment has become

competitive resulting in margin headwinds

After an unusually long ~2 year deferral of maintenance

spending, Thermon is seeing very strong MRO activity,

particularly in Canada

─ In Q1, Canada experienced 76% growth year over year in

MRO sales and the Company is seeing that trend continue

into Q2

─ The Company is seeing a release of pent up demand as

customers have been proceeding with activity

─ In many cases the maintenance can no longer be deferred

as the prolonged deferrals can begin to create

hazard/safety issues – as a result risk of further downside

is largely limited

The majority of the Company’s current North American energy

exposure has been reduced to field maintainability and

upstream sustainability capex, and a most of the Company’s

installed base in the Canadian oil sands is coming up on a 3 to 5

year maintenance cycle

The Company has good visibility into the execution of

greenfield projects in the Eastern Hemisphere with material

shipments accelerating in the second half of fiscal 2018

Source: Company filings

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

45

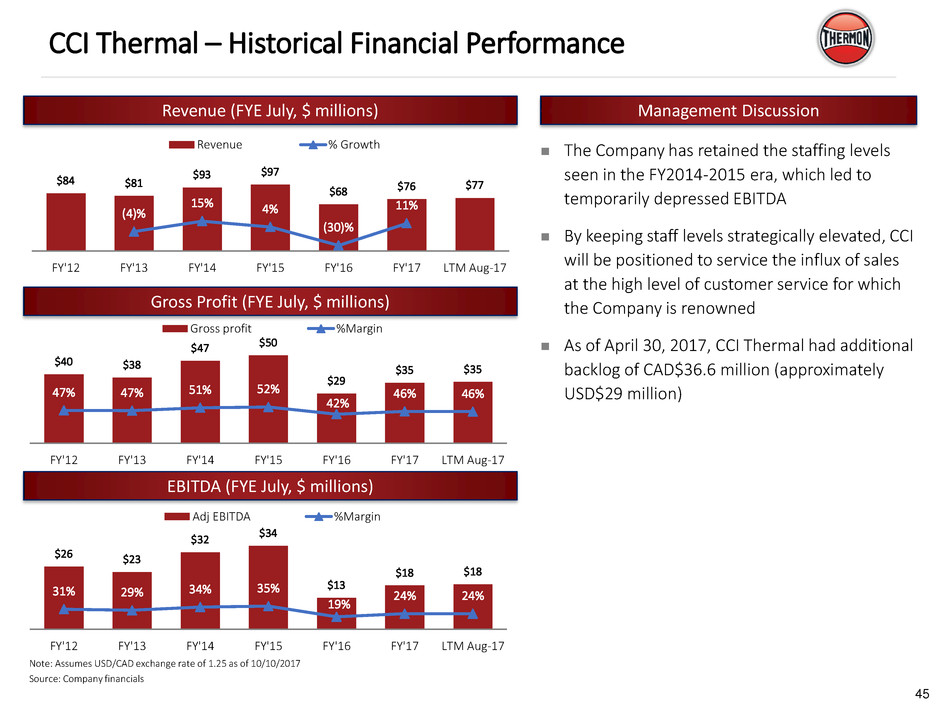

The Company has retained the staffing levels

seen in the FY2014-2015 era, which led to

temporarily depressed EBITDA

By keeping staff levels strategically elevated, CCI

will be positioned to service the influx of sales

at the high level of customer service for which

the Company is renowned

As of April 30, 2017, CCI Thermal had additional

backlog of CAD$36.6 million (approximately

USD$29 million)

Management Discussion

$40 $38

$47 $50

$29

$35 $35

47% 47% 51% 52%

42%

46% 46%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM Aug-17

Gross profit %Margin

$26 $23

$32

$34

$13

$18 $18

31% 29% 34% 35%

19%

24% 24%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM Aug-17

Adj EBITDA %Margin

$84 $81

$93 $97

$68 $76

$77

(4)%

15% 4%

(30)%

11%

FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 LTM Aug-17

Revenue % Growth

Revenue (FYE July, $ millions)

Gross Profit (FYE July, $ millions)

EBITDA (FYE July, $ millions)

Note: Assumes USD/CAD exchange rate of 1.25 as of 10/10/2017

CCI Thermal – Historical Financial Performance

Source: Company financials

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

47

Appendix

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

48

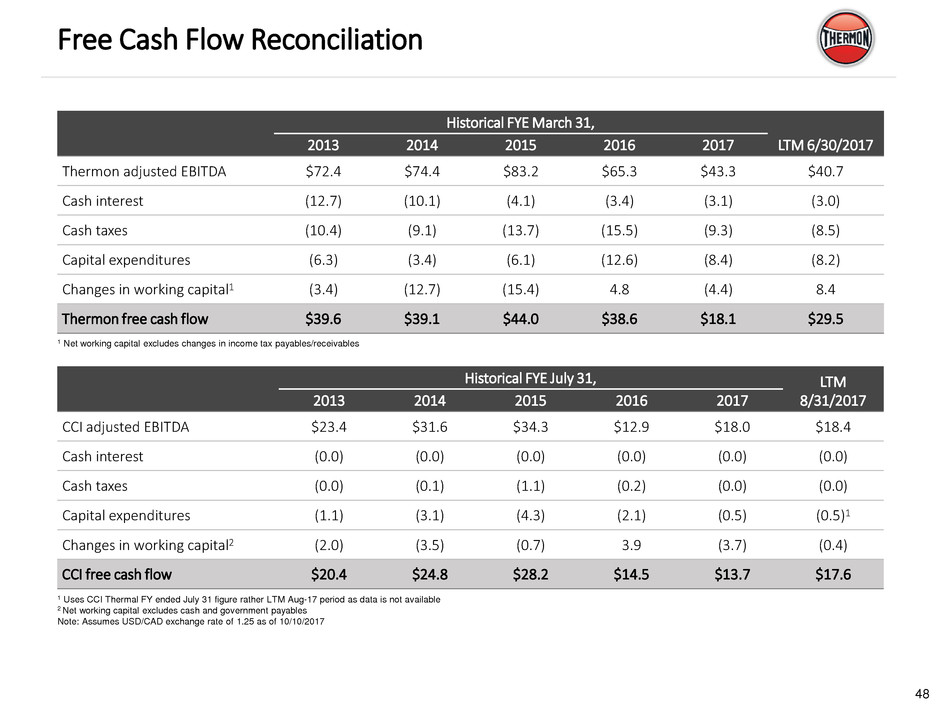

Free Cash Flow Reconciliation

Historical FYE March 31,

LTM 6/30/2017 2013 2014 2015 2016 2017

Thermon adjusted EBITDA $72.4 $74.4 $83.2 $65.3 $43.3 $40.7

Cash interest (12.7) (10.1) (4.1) (3.4) (3.1) (3.0)

Cash taxes (10.4) (9.1) (13.7) (15.5) (9.3) (8.5)

Capital expenditures (6.3) (3.4) (6.1) (12.6) (8.4) (8.2)

Changes in working capital1 (3.4) (12.7) (15.4) 4.8 (4.4) 8.4

Thermon free cash flow $39.6 $39.1 $44.0 $38.6 $18.1 $29.5

Historical FYE July 31, LTM

8/31/2017 2013 2014 2015 2016 2017

CCI adjusted EBITDA $23.4 $31.6 $34.3 $12.9 $18.0 $18.4

Cash interest (0.0) (0.0) (0.0) (0.0) (0.0) (0.0)

Cash taxes (0.0) (0.1) (1.1) (0.2) (0.0) (0.0)

Capital expenditures (1.1) (3.1) (4.3) (2.1) (0.5) (0.5)1

Changes in working capital2 (2.0) (3.5) (0.7) 3.9 (3.7) (0.4)

CCI free cash flow $20.4 $24.8 $28.2 $14.5 $13.7 $17.6

1 Uses CCI Thermal FY ended July 31 figure rather LTM Aug-17 period as data is not available

2 Net working capital excludes cash and government payables

Note: Assumes USD/CAD exchange rate of 1.25 as of 10/10/2017

1 Net working capital excludes changes in income tax payables/receivables

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

49

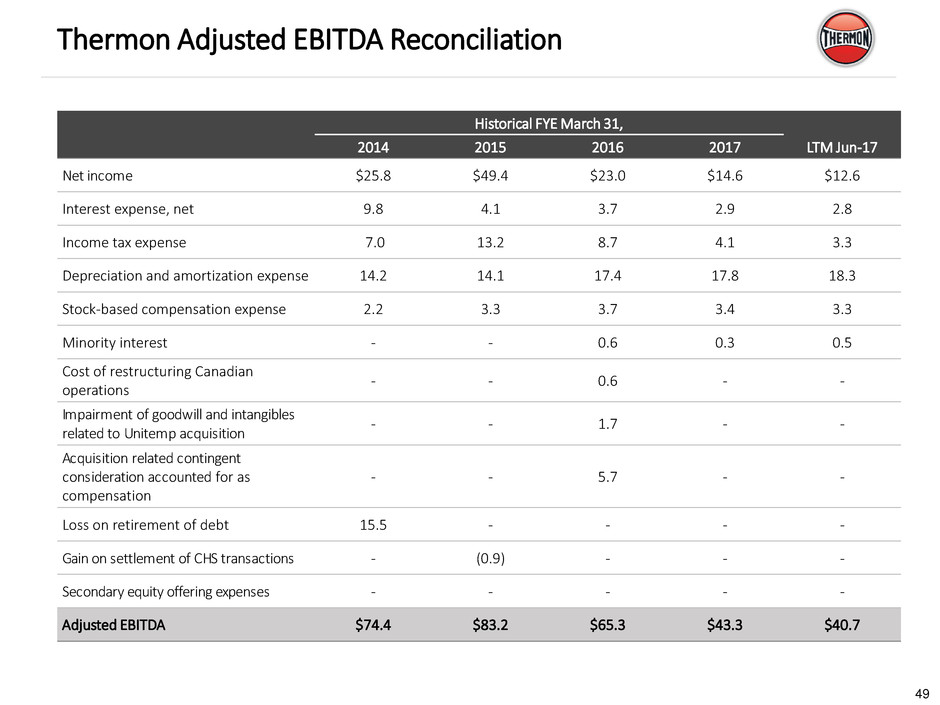

Thermon Adjusted EBITDA Reconciliation

Historical FYE March 31,

LTM Jun-17 2014 2015 2016 2017

Net income $25.8 $49.4 $23.0 $14.6 $12.6

Interest expense, net 9.8 4.1 3.7 2.9 2.8

Income tax expense 7.0 13.2 8.7 4.1 3.3

Depreciation and amortization expense 14.2 14.1 17.4 17.8 18.3

Stock-based compensation expense 2.2 3.3 3.7 3.4 3.3

Minority interest - - 0.6 0.3 0.5

Cost of restructuring Canadian

operations

- - 0.6 - -

Impairment of goodwill and intangibles

related to Unitemp acquisition

- - 1.7 - -

Acquisition related contingent

consideration accounted for as

compensation

- - 5.7 - -

Loss on retirement of debt 15.5 - - - -

Gain on settlement of CHS transactions - (0.9) - - -

Secondary equity offering expenses - - - - -

Adjusted EBITDA $74.4 $83.2 $65.3 $43.3 $40.7

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

50

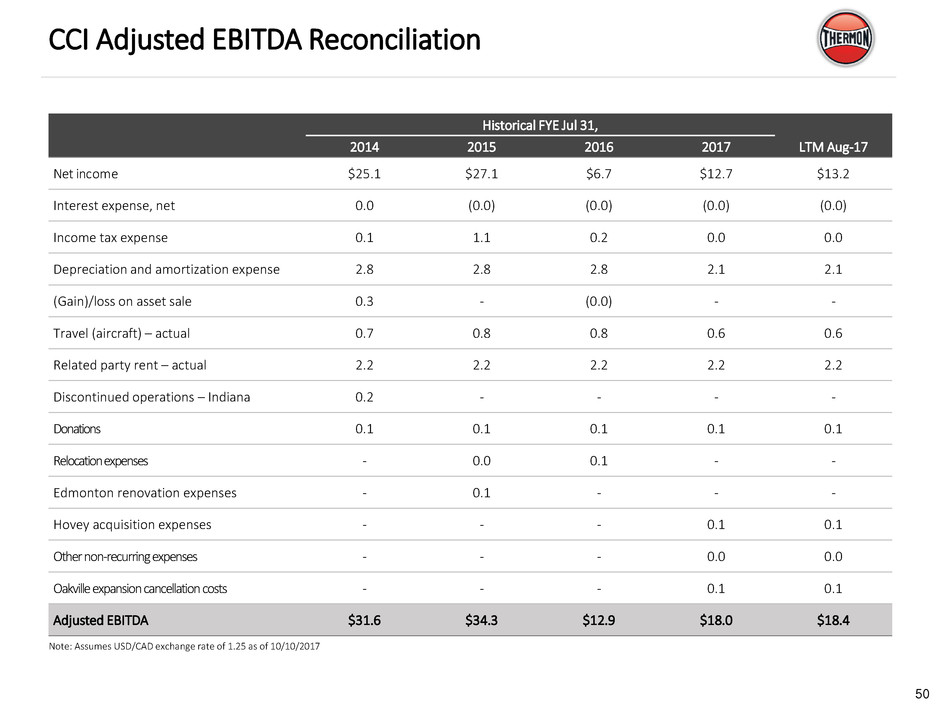

CCI Adjusted EBITDA Reconciliation

Historical FYE Jul 31,

LTM Aug-17 2014 2015 2016 2017

Net income $25.1 $27.1 $6.7 $12.7 $13.2

Interest expense, net 0.0 (0.0) (0.0) (0.0) (0.0)

Income tax expense 0.1 1.1 0.2 0.0 0.0

Depreciation and amortization expense 2.8 2.8 2.8 2.1 2.1

(Gain)/loss on asset sale 0.3 - (0.0) - -

Travel (aircraft) – actual 0.7 0.8 0.8 0.6 0.6

Related party rent – actual 2.2 2.2 2.2 2.2 2.2

Discontinued operations – Indiana 0.2 - - - -

Donations 0.1 0.1 0.1 0.1 0.1

Relocation expenses - 0.0 0.1 - -

Edmonton renovation expenses - 0.1 - - -

Hovey acquisition expenses - - - 0.1 0.1

Other non-recurring expenses - - - 0.0 0.0

Oakville expansion cancellation costs - - - 0.1 0.1

Adjusted EBITDA $31.6 $34.3 $12.9 $18.0 $18.4

Note: Assumes USD/CAD exchange rate of 1.25 as of 10/10/2017

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

51

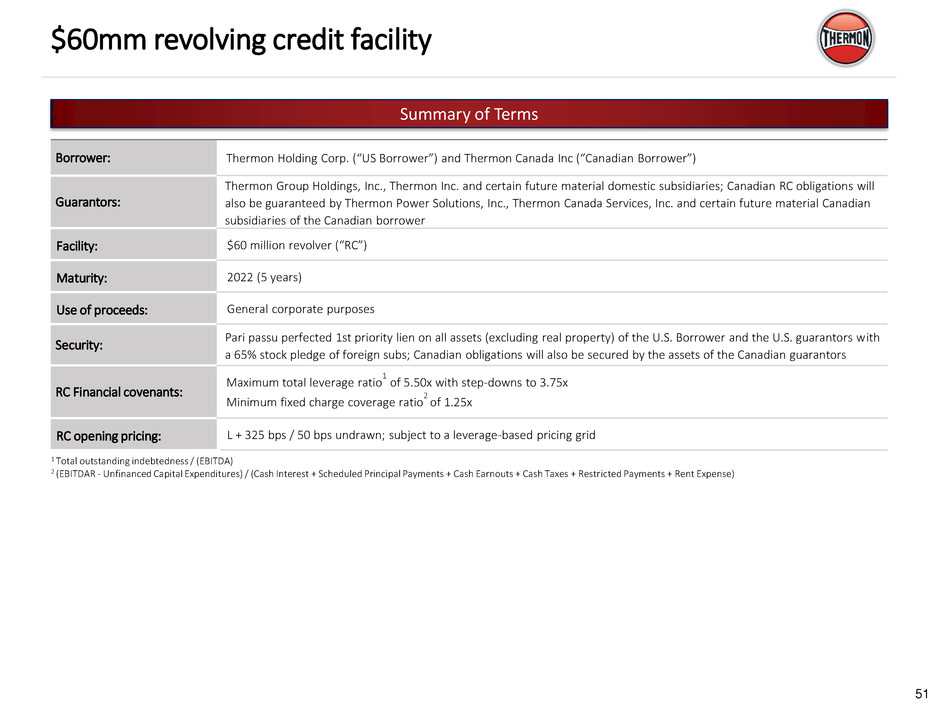

$60mm revolving credit facility

Summary of Terms

1 Total outstanding indebtedness / (EBITDA)

2 (EBITDAR - Unfinanced Capital Expenditures) / (Cash Interest + Scheduled Principal Payments + Cash Earnouts + Cash Taxes + Restricted Payments + Rent Expense)

Borrower: Thermon Holding Corp. (“US Borrower”) and Thermon Canada Inc (“Canadian Borrower”)

Guarantors:

Thermon Group Holdings, Inc., Thermon Inc. and certain future material domestic subsidiaries; Canadian RC obligations will

also be guaranteed by Thermon Power Solutions, Inc., Thermon Canada Services, Inc. and certain future material Canadian

subsidiaries of the Canadian borrower

Facility: $60 million revolver (“RC”)

Maturity: 2022 (5 years)

Use of proceeds: General corporate purposes

Security:

Pari passu perfected 1st priority lien on all assets (excluding real property) of the U.S. Borrower and the U.S. guarantors with

a 65% stock pledge of foreign subs; Canadian obligations will also be secured by the assets of the Canadian guarantors

RC Financial covenants:

Maximum total leverage ratio

1

of 5.50x with step-downs to 3.75x

Minimum fixed charge coverage ratio

2

of 1.25x

RC opening pricing: L + 325 bps / 50 bps undrawn; subject to a leverage-based pricing grid