R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

1

Thermon Announces

Acquisition of CCI Thermal

October 4th, 2017

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

2

Disclaimer

Cautionary Note Regarding Forward-Looking Statements

This presentation and related investor conference call and press release contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995 concerning Thermon, CCI, the proposed acquisition and other matters. All statements other than statements of historical fact

are forward-looking statements, including, among others, statements we make regarding the intended acquisition of CCI, future revenues, future earnings, future cash

flows, target leverage ratios, acquisition synergies, regulatory developments, market developments, new products and growth strategies, and the effects of any of the

foregoing on our future results of operations or financial conditions. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,”

“project,” “estimate,” “expect,” “may,” “should,” “will” and similar references to future periods.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which

are outside of the control of Thermon and CCI. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect and our actual

results and financial condition may differ materially from the views expressed today. Important factors that could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements include, among others, the following: (i) risks related to the acquisition of CCI, including integration risks

and failure to achieve the anticipated benefits of the acquisition; (ii) changes in laws and regulations applicable to our business model; and (iii) changes in market conditions

and receptivity to services and offerings; (iv) general economic conditions and cyclicality in the markets we serve; (v) future growth of energy and chemical processing capital

investments; (vi) our ability to deliver existing orders within our backlog; (iv) our ability to bid and win new contracts; (vii) competition from various other sources providing

similar products and services, or alternative technologies, to customers; (viii) changes in relevant currency exchange rates; (ix) potential liability related to our products as

well as the delivery of products and services; (x) our ability to comply with the complex and dynamic system of laws and regulations applicable to international operations;

(xi) our ability to protect data and thwart potential cyber attacks; (xii) a material disruption at any of our manufacturing facilities; (xiii) our dependence on subcontractors

and suppliers; (xiv) our ability to attract and retain qualified management and employees, particularly in our overseas markets; (xv) our ability to continue to generate

sufficient cash flow to satisfy our liquidity needs; (xvi) the extent to which federal, state, local and foreign governmental regulation of energy, chemical processing and power

generation products and services limits or prohibits the operation of our business; and (xvii) other factors discussed in more detail under the caption "Risk Factors" in our

Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the Securities and Exchange Commission on May 30, 2017. Any one of these factors or a

combination of these factors could materially affect our financial condition, results of operations and cash flows and could influence whether any forward-looking

statements contained in this release ultimately prove to be accurate.

Any forward-looking statement made by us in this press release and in the related conference call is based only on information currently available to us and speaks only as of

the date on which it is made. Our forward-looking statements are not guarantees of future performance and we undertake no obligation to publicly update any forward-

looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, unless we are

required to do so under applicable securities laws.

Non-GAAP Financial Measures

Disclosure in this release of "Adjusted EBITDA" and other "non-GAAP financial measures" as defined under the rules of the Securities and Exchange Commission (the "SEC"),

are intended as supplemental measures of our financial performance that are not required by, or presented in accordance with, U.S. generally accepted accounting

principles ("GAAP"). We believe these non-GAAP financial measures are meaningful to our investors to enhance their understanding of our financial performance and are

frequently used by securities analysts, investors and other interested parties. These non-GAAP financial measures should be considered in addition to, not as substitutes for

measures of financial performance reported in accordance with GAAP. For a description of how such non-GAAP financial measures reconcile to the most comparable GAAP

measure, please see the table below.

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

3

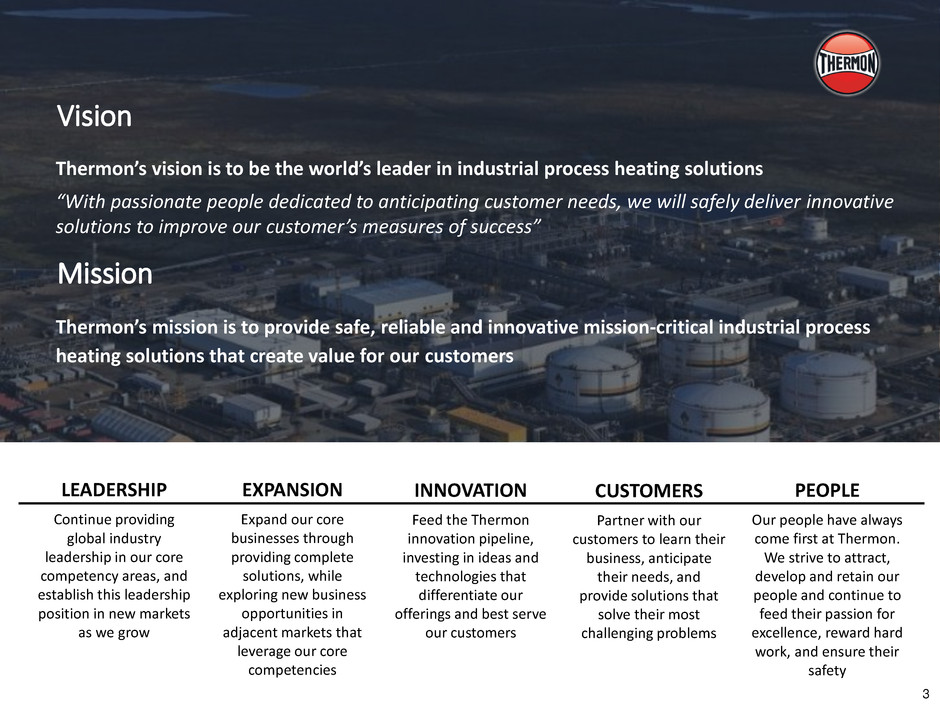

LEADERSHIP

Continue providing

global industry

leadership in our core

competency areas, and

establish this leadership

position in new markets

as we grow

EXPANSION

Expand our core

businesses through

providing complete

solutions, while

exploring new business

opportunities in

adjacent markets that

leverage our core

competencies

INNOVATION

Feed the Thermon

innovation pipeline,

investing in ideas and

technologies that

differentiate our

offerings and best serve

our customers

CUSTOMERS

Partner with our

customers to learn their

business, anticipate

their needs, and

provide solutions that

solve their most

challenging problems

PEOPLE

Our people have always

come first at Thermon.

We strive to attract,

develop and retain our

people and continue to

feed their passion for

excellence, reward hard

work, and ensure their

safety

Thermon’s vision is to be the world’s leader in industrial process heating solutions

“With passionate people dedicated to anticipating customer needs, we will safely deliver innovative

solutions to improve our customer’s measures of success”

Thermon’s mission is to provide safe, reliable and innovative mission-critical industrial process

heating solutions that create value for our customers

Vision

Mission

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

4

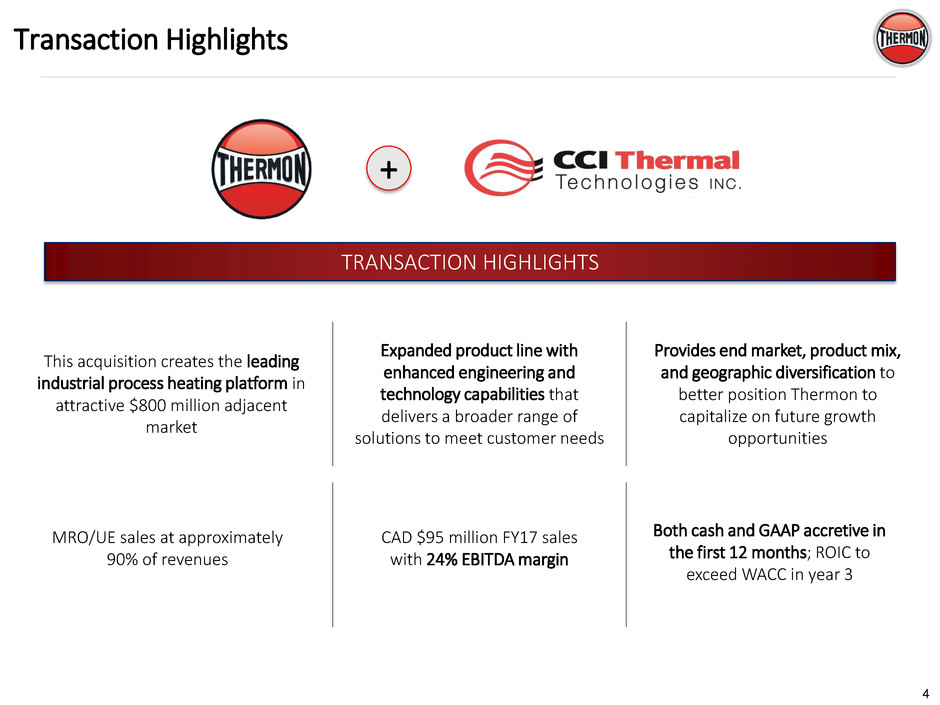

Transaction Highlights

TRANSACTION HIGHLIGHTS

This acquisition creates the leading

industrial process heating platform in

attractive $800 million adjacent

market

Provides end market, product mix,

and geographic diversification to

better position Thermon to

capitalize on future growth

opportunities

CAD $95 million FY17 sales

with 24% EBITDA margin

Both cash and GAAP accretive in

the first 12 months; ROIC to

exceed WACC in year 3

Expanded product line with

enhanced engineering and

technology capabilities that

delivers a broader range of

solutions to meet customer needs

+

MRO/UE sales at approximately

90% of revenues

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

5

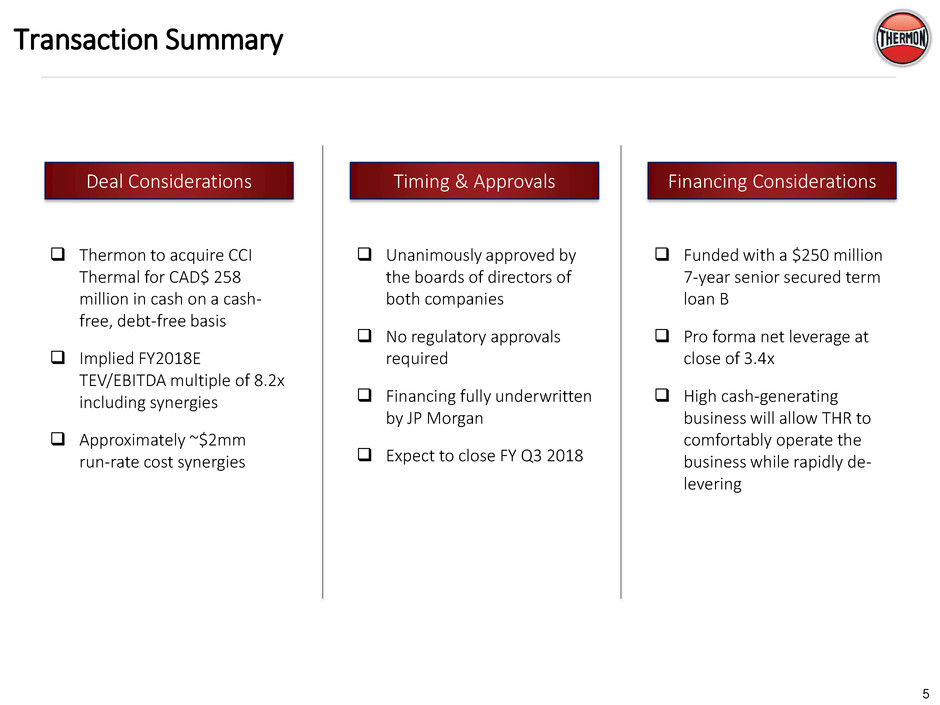

Transaction Summary

Thermon to acquire CCI

Thermal for CAD$ 258

million in cash on a cash-

free, debt-free basis

Implied FY2018E

TEV/EBITDA multiple of 8.2x

including synergies

Approximately ~$2mm

run-rate cost synergies

Deal Considerations Timing & Approvals Financing Considerations

Unanimously approved by

the boards of directors of

both companies

No regulatory approvals

required

Financing fully underwritten

by JP Morgan

Expect to close FY Q3 2018

Funded with a $250 million

7-year senior secured term

loan B

Pro forma net leverage at

close of 3.4x

High cash-generating

business will allow THR to

comfortably operate the

business while rapidly de-

levering

Deal Co si erations Timing & Appr vals Financing si erations

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

6

Compelling Strategic and Financial Benefit

Expands markets and solutions for customers

CCI Thermal will strengthen our industrial process heating

business, providing a platform for expansion and growth

Strong brands in new product categories with

complementary blue chip industrial customer base

Diversifies end market exposure shifting mix toward natural

gas and adding rail, nuclear, transit

Platform for growth

Provides high quality, reliable products with best-in-class

customer service model

Introduces CCI Thermal’s products to new geographies

through Thermon global channels

Diversifies Thermon end markets through increasing natural

gas and power exposure, and introducing transit and rail to

our product mix

Enhances profitability and financial profile

Added scale with additional CAD$95 million FY17 sales

Strong LTM Adj. EBITDA margin of ~24%

Like Thermon, CCI is characterized by low capital intensity

and high margins; this acquisition improves free cash flow

and cash flow conversion

Platform for growth

Expands markets and

solutions for customers

Enhances profitability and

financial profile

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

7

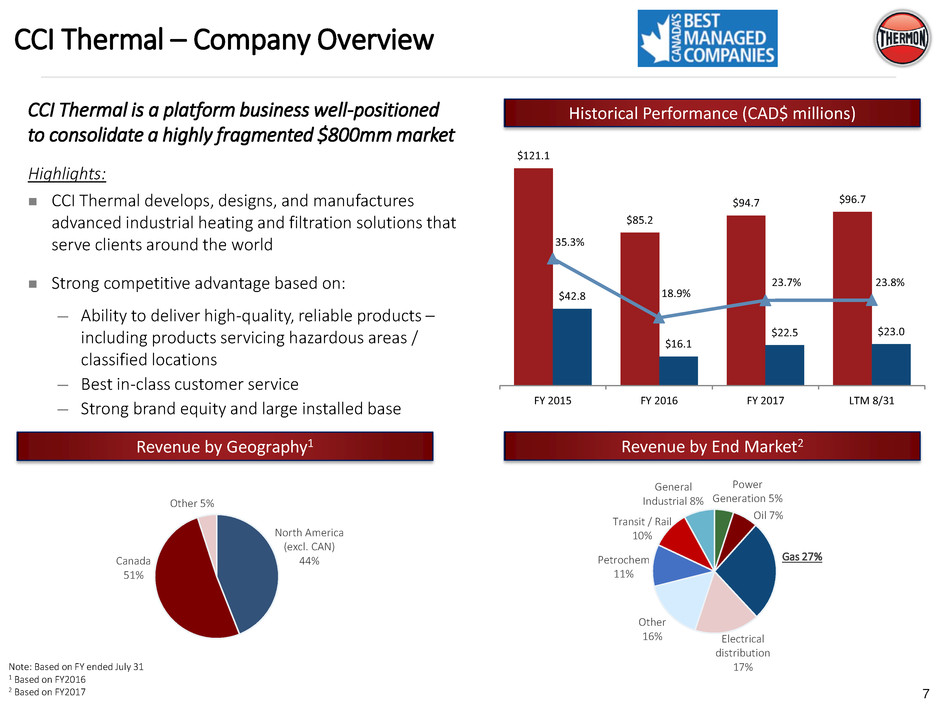

CCI Thermal is a platform business well-positioned

to consolidate a highly fragmented $800mm market

Highlights:

CCI Thermal develops, designs, and manufactures

advanced industrial heating and filtration solutions that

serve clients around the world

Strong competitive advantage based on:

─ Ability to deliver high-quality, reliable products –

including products servicing hazardous areas /

classified locations

─ Best in-class customer service

─ Strong brand equity and large installed base

Historical Performance (CAD$ millions)

CCI Thermal – Company Overview

Revenue by Geography1

North America

(excl. CAN)

44% Canada

51%

Other 5%

Note: Based on FY ended July 31

1 Based on FY2016

2 Based on FY2017

$121.1

$85.2

$94.7 $96.7

$42.8

$16.1

$22.5 $23.0

35.3%

18.9%

23.7% 23.8%

FY 2015 FY 2016 FY 2017 LTM 8/31

Gas 27%

Electrical

distribution

17%

Transit / Rail

10%

Power

Generation 5%

Other

16%

General

Industrial 8%

Petrochem

11%

Oil 7%

Revenue by End Market2

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

8

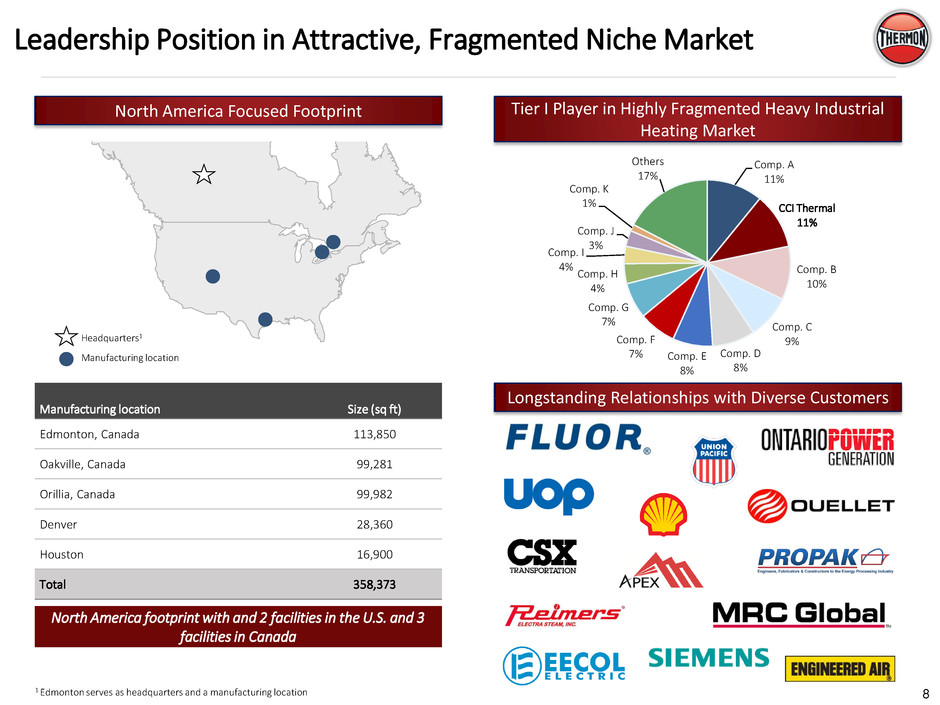

Comp. A

11%

CCI Thermal

11%

Comp. B

10%

Comp. C

9%

Comp. D

8%

Comp. E

8%

Comp. F

7%

Comp. G

7%

Comp. H

4%

Comp. I

4%

Comp. J

3%

Comp. K

1%

Others

17%

1 Edmonton serves as headquarters and a manufacturing location

North America Focused Footprint Tier I Player in Highly Fragmented Heavy Industrial

Heating Market

Longstanding Relationships with Diverse Customers

Leadership Position in Attractive, Fragmented Niche Market

Manufacturing location Size (sq ft)

Edmonton, Canada 113,850

Oakville, Canada 99,281

Orillia, Canada 99,982

Denver 28,360

Houston 16,900

Total 358,373

North America footprint with and 2 facilities in the U.S. and 3

facilities in Canada

Headquarters1

Manufacturing location

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

9

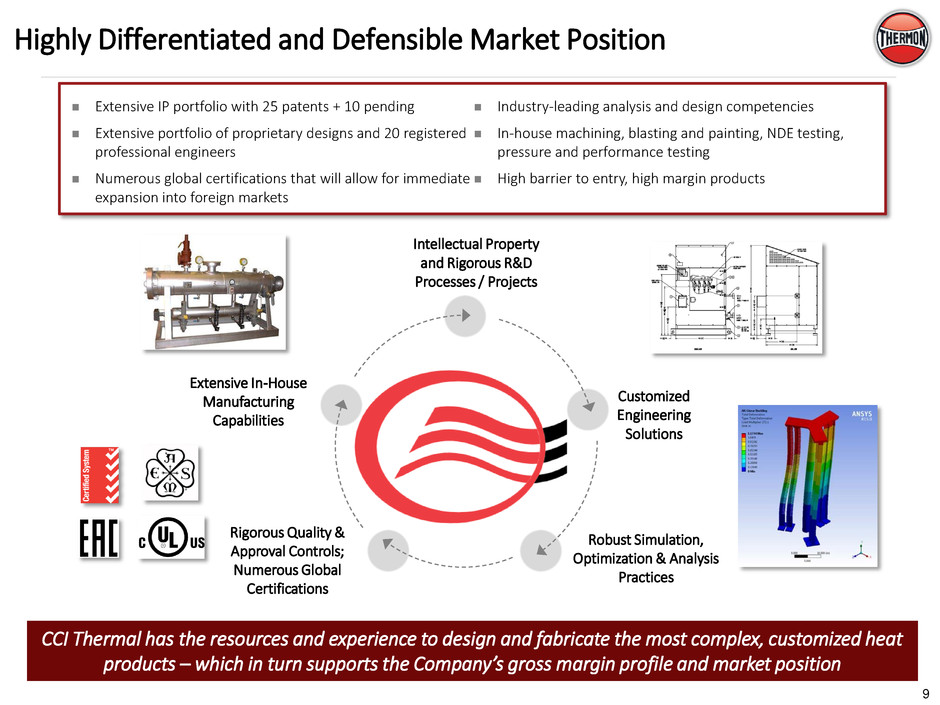

Extensive IP portfolio with 25 patents + 10 pending

Extensive portfolio of proprietary designs and 20 registered

professional engineers

Numerous global certifications that will allow for immediate

expansion into foreign markets

Industry-leading analysis and design competencies

In-house machining, blasting and painting, NDE testing,

pressure and performance testing

High barrier to entry, high margin products

Customized

Engineering

Solutions

Intellectual Property

and Rigorous R&D

Processes / Projects

Rigorous Quality &

Approval Controls;

Numerous Global

Certifications

Robust Simulation,

Optimization & Analysis

Practices

Extensive In-House

Manufacturing

Capabilities

CCI Thermal has the resources and experience to design and fabricate the most complex, customized heat

products – which in turn supports the Company’s gross margin profile and market position

Highly Differentiated and Defensible Market Position

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

10

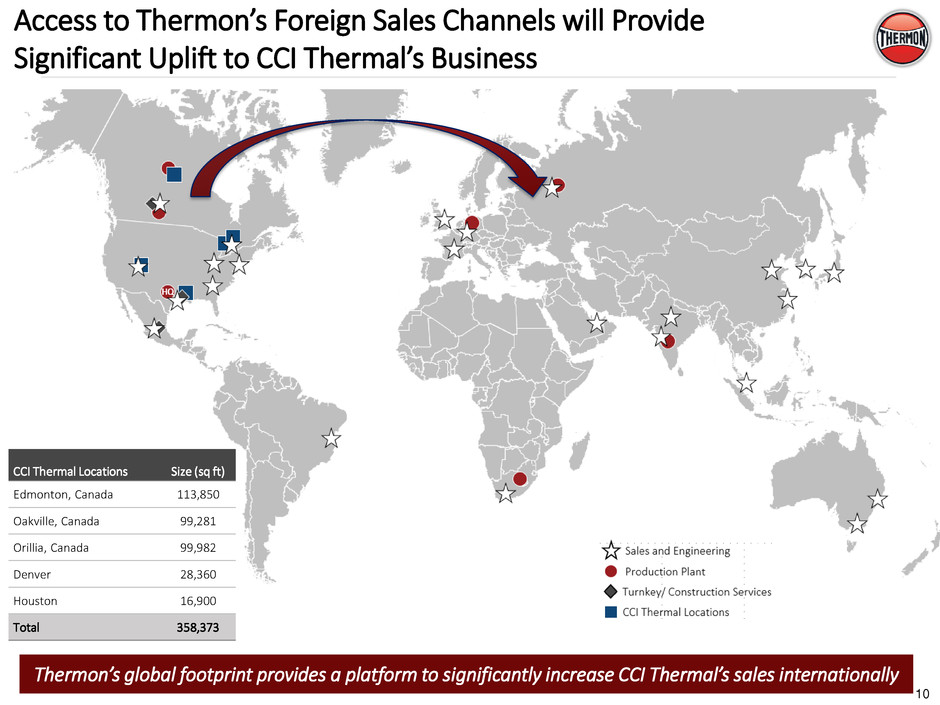

Thermon’s global footprint provides a platform to significantly increase CCI Thermal’s sales internationally

Access to Thermon’s Foreign Sales Channels will Provide

Significant Uplift to CCI Thermal’s Business

CCI Thermal Locations Size (sq ft)

Edmonton, Canada 113,850

Oakville, Canada 99,281

Orillia, Canada 99,982

Denver 28,360

Houston 16,900

Total 358,373

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

11

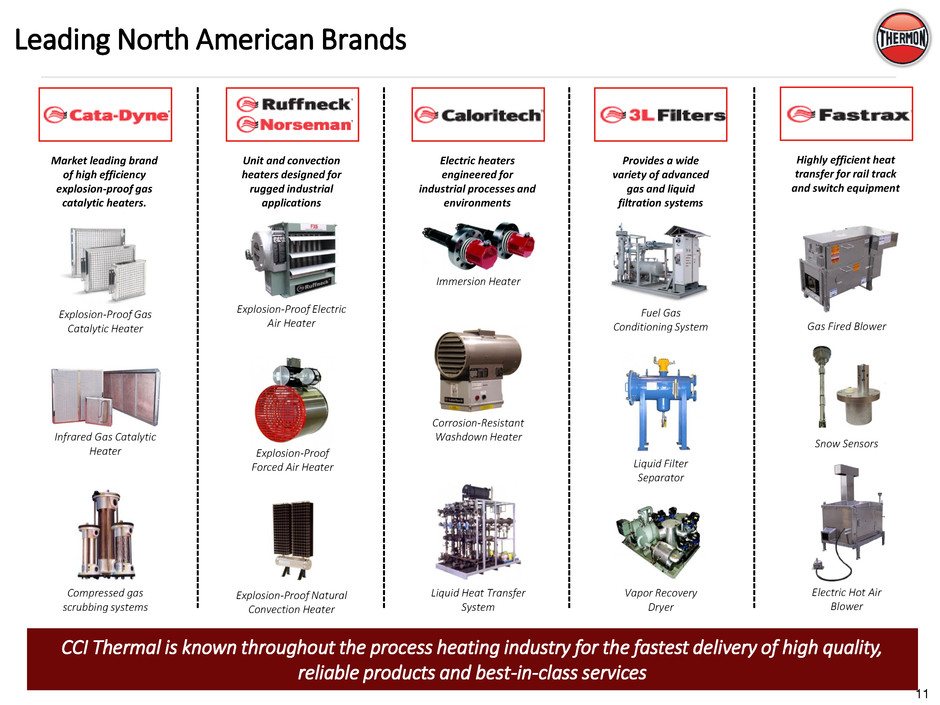

Leading North American Brands

CCI Thermal is known throughout the process heating industry for the fastest delivery of high quality,

reliable products and best-in-class services

Highly efficient heat

transfer for rail track

and switch equipment

Gas Fired Blower

Electric Hot Air

Blower

Snow Sensors

Provides a wide

variety of advanced

gas and liquid

filtration systems

Fuel Gas

Conditioning System

Liquid Filter

Separator

Vapor Recovery

Dryer

Electric heaters

engineered for

industrial processes and

environments

Immersion Heater

Corrosion-Resistant

Washdown Heater

Liquid Heat Transfer

System

Unit and convection

heaters designed for

rugged industrial

applications

Explosion-Proof

Forced Air Heater

Explosion-Proof Natural

Convection Heater

Explosion-Proof Electric

Air Heater

Market leading brand

of high efficiency

explosion-proof gas

catalytic heaters.

Explosion-Proof Gas

Catalytic Heater

Infrared Gas Catalytic

Heater

Compressed gas

scrubbing systems

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

12

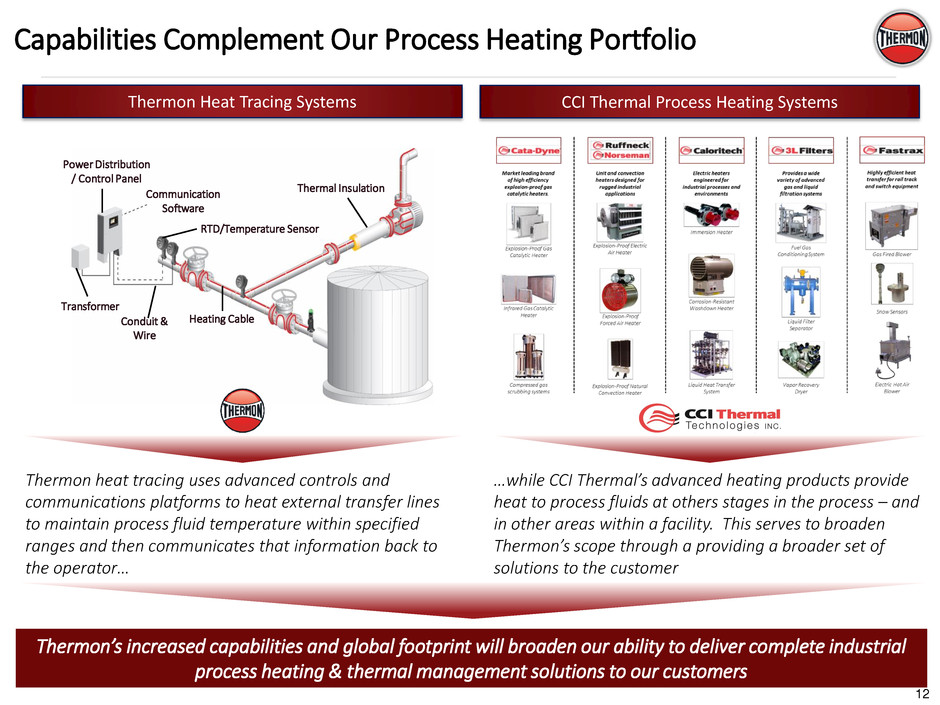

Capabilities Complement Our Process Heating Portfolio

Thermon’s increased capabilities and global footprint will broaden our ability to deliver complete industrial

process heating & thermal management solutions to our customers

Transformer

Power Distribution

/ Control Panel

Conduit &

Wire

Heating Cable

RTD/Temperature Sensor

Thermal Insulation

Communication

Software

Thermon Heat Tracing Systems CCI Thermal Process Heating Systems

Thermon heat tracing uses advanced controls and

communications platforms to heat external transfer lines

to maintain process fluid temperature within specified

ranges and then communicates that information back to

the operator…

…while CCI Thermal’s advanced heating products provide

heat to process fluids at others stages in the process – and

in other areas within a facility. This serves to broaden

Thermon’s scope through a providing a broader set of

solutions to the customer

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

13

20%

80%

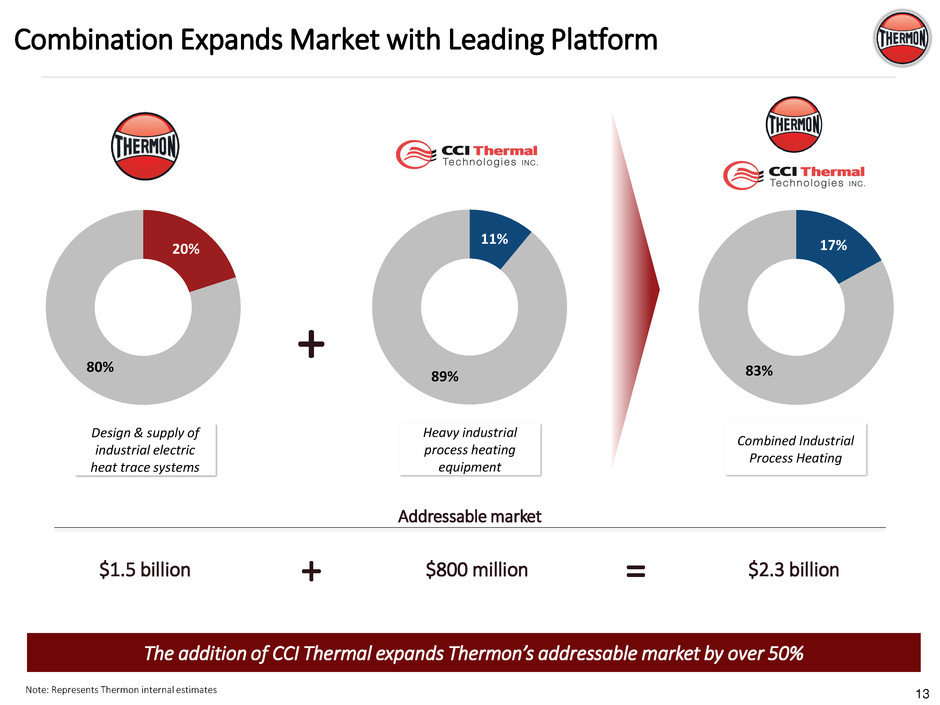

Combination Expands Market with Leading Platform

Note: Represents Thermon internal estimates

11%

89%

17%

83%

+

$1.5 billion

Addressable market

$800 million $2.3 billion + =

The addition of CCI Thermal expands Thermon’s addressable market by over 50%

Design & supply of

industrial electric

heat trace systems

Heavy industrial

process heating

equipment

Combined Industrial

Process Heating

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

14

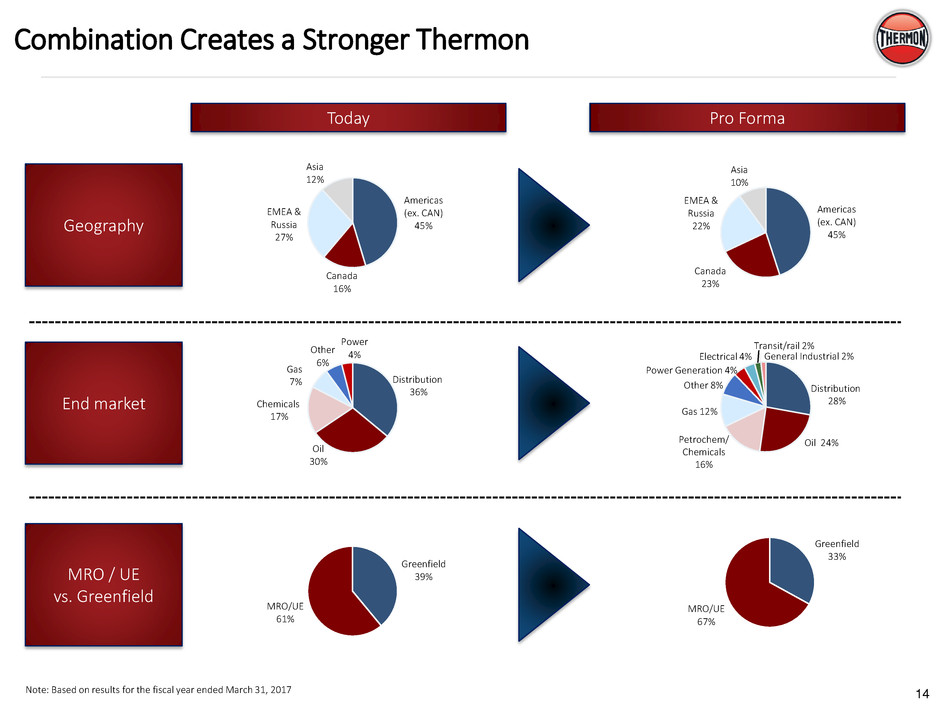

Americas

(ex. CAN)

45%

Canada

16%

EMEA &

Russia

27%

Asia

12%

Americas

(ex. CAN)

45%

Canada

23%

EMEA &

Russia

22%

Asia

10%

Geography

End market

Oil

30%

Other

6%

Power

4%

Oil 24%

Gas 12%

Other 8%

Distribution

36%

Petrochem/

Chemicals

16%

Distribution

28%

General Industrial 2%

Transit/rail 2%

Power Generation 4%

Electrical 4%

Chemicals

17%

Gas

7%

Combination Creates a Stronger Thermon

Note: Based on results for the fiscal year ended March 31, 2017

Today Pro Forma

MRO / UE

vs. Greenfield

Greenfield

39%

MRO/UE

61%

Greenfield

33%

MRO/UE

67%

Addressable

Market

Thermon

100%

Thermon

65%

CCI

Thermal

35%

$1.5

billion

$2.3

billion

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

15

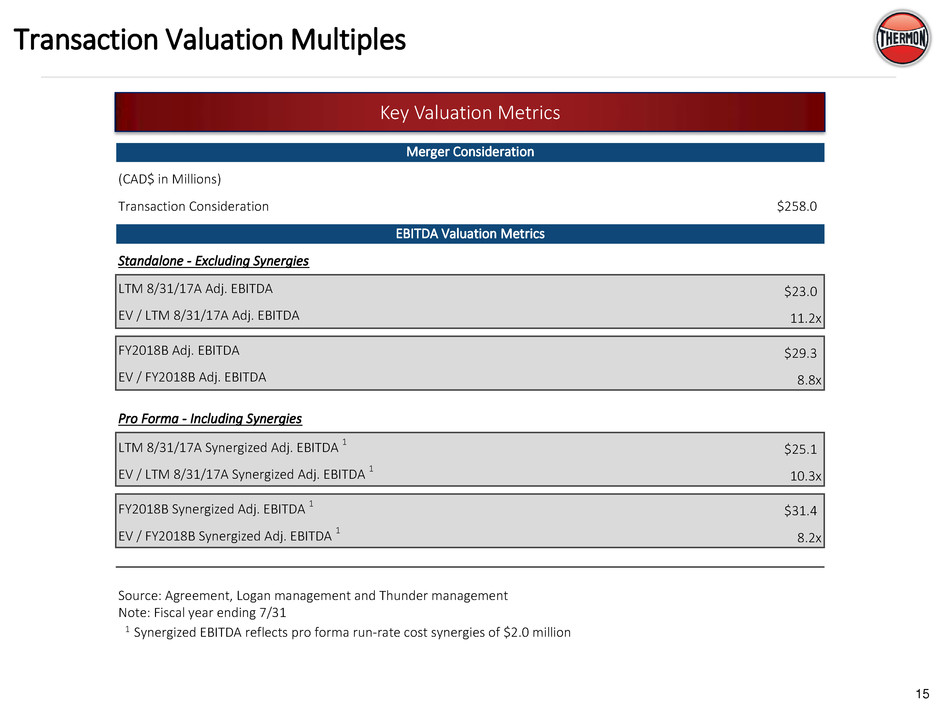

Transaction Valuation Multiples

Key Valuation Metrics

Merger Consideration

(CAD$ in Millions)

Transaction Consideration $258.0

EBITDA Valuation Metrics

Standalone - Excluding Synergies

LTM 8/31/17A Adj. EBITDA $23.0

EV / LTM 8/31/17A Adj. EBITDA 11.2x

FY2018B Adj. EBITDA $29.3

EV / FY2018B Adj. EBITDA 8.8x

Pro Forma - Including Synergies

LTM 8/31/17A Synergized Adj. EBITDA

1

$25.1

EV / LTM 8/31/17A Synergized Adj. EBITDA 1 10.3x

FY2018B Synergized Adj. EBITDA 1 $31.4

EV / FY2018B Synergized Adj. EBITDA

1

8.2x

Source: Agreement, Logan management and Thunder management

Note: Fiscal year ending 7/31

1 Synergized EBITDA reflects pro forma run-rate cost synergies of $2.0 million

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

16

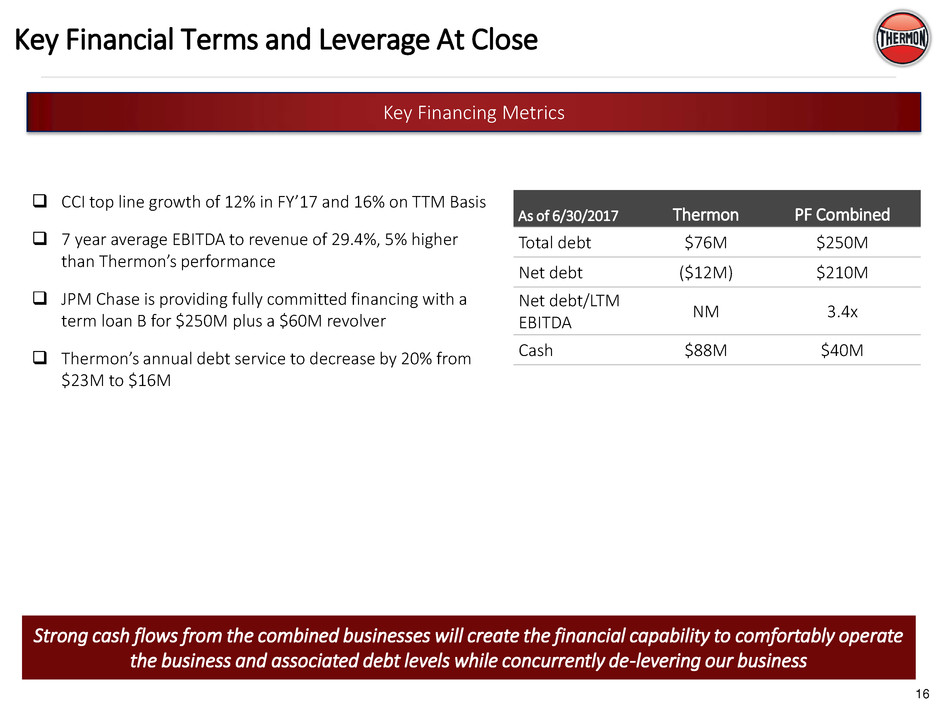

Key Financial Terms and Leverage At Close

CCI top line growth of 12% in FY’17 and 16% on TTM Basis

7 year average EBITDA to revenue of 29.4%, 5% higher

than Thermon’s performance

JPM Chase is providing fully committed financing with a

term loan B for $250M plus a $60M revolver

Thermon’s annual debt service to decrease by 20% from

$23M to $16M

Key Financing Metrics

Strong cash flows from the combined businesses will create the financial capability to comfortably operate

the business and associated debt levels while concurrently de-levering our business

As of 6/30/2017 Thermon PF Combined

Total debt $76M $250M

Net debt ($12M) $210M

Net debt/LTM

EBITDA

NM 3.4x

Cash $88M $40M

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

17

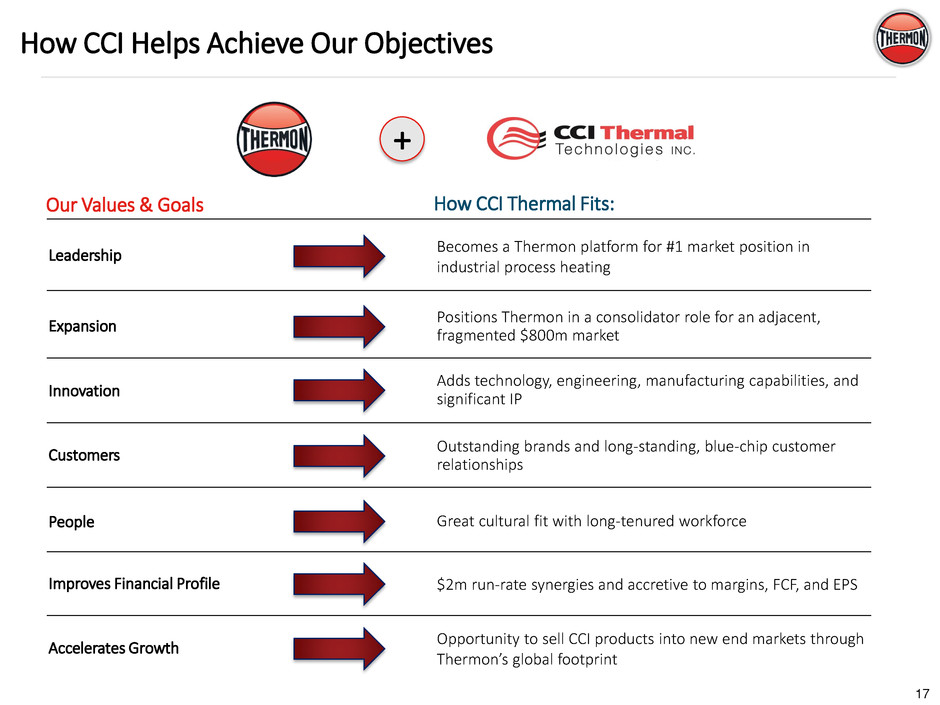

How CCI Helps Achieve Our Objectives

Customers

Leadership

Expansion

Innovation

People

Improves Financial Profile

Becomes a Thermon platform for #1 market position in

industrial process heating

Positions Thermon in a consolidator role for an adjacent,

fragmented $800m market

Adds technology, engineering, manufacturing capabilities, and

significant IP

Great cultural fit with long-tenured workforce

Outstanding brands and long-standing, blue-chip customer

relationships

$2m run-rate synergies and accretive to margins, FCF, and EPS

Accelerates Growth

Opportunity to sell CCI products into new end markets through

Thermon’s global footprint

+

Our Values & Goals How CCI Thermal Fits:

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

18

18

R 226

G 35

B 26

R 255

G 255

B 255

R 00

G 00

B 00

R 239

G 66

B 67

R 199

G 33

B 39

R 154

G 29

B 32

R 207

G 205

B 206

R 160

G 158

B 159

R 70

G 70

B 71

R 15

G 72

B 120

R 21

G 93

B 160

R 58

G 135

B 193

19

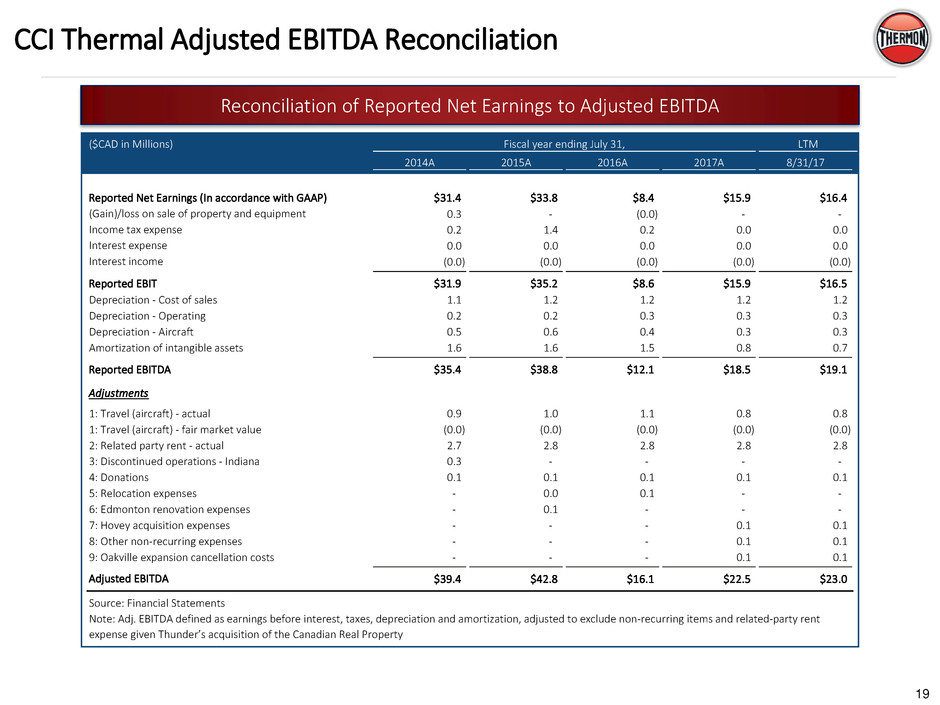

CCI Thermal Adjusted EBITDA Reconciliation

Reconciliation of Reported Net Earnings to Adjusted EBITDA

($CAD in Millions) Fiscal year ending July 31, LTM

2014A 2015A 2016A 2017A 8/31/17

Reported Net Earnings (In accordance with GAAP) $31.4 $33.8 $8.4 $15.9 $16.4

(Gain)/loss on sale of property and equipment 0.3 - (0.0) - -

Income tax expense 0.2 1.4 0.2 0.0 0.0

Interest expense 0.0 0.0 0.0 0.0 0.0

Interest income (0.0) (0.0) (0.0) (0.0) (0.0)

Reported EBIT $31.9 $35.2 $8.6 $15.9 $16.5

Depreciation - Cost of sales 1.1 1.2 1.2 1.2 1.2

Depreciation - Operating 0.2 0.2 0.3 0.3 0.3

Depreciation - Aircraft 0.5 0.6 0.4 0.3 0.3

Amortization of intangible assets 1.6 1.6 1.5 0.8 0.7

Reported EBITDA $35.4 $38.8 $12.1 $18.5 $19.1

Adjustments

1: Travel (aircraft) - actual 0.9 1.0 1.1 0.8 0.8

1: Travel (aircraft) - fair market value (0.0) (0.0) (0.0) (0.0) (0.0)

2: Related party rent - actual 2.7 2.8 2.8 2.8 2.8

3: Discontinued operations - Indiana 0.3 - - - -

4: Donations 0.1 0.1 0.1 0.1 0.1

5: Relocation expenses - 0.0 0.1 - -

6: Edmonton renovation expenses - 0.1 - - -

7: Hovey acquisition expenses - - - 0.1 0.1

8: Other non-recurring expenses - - - 0.1 0.1

9: Oakville expansion cancellation costs - - - 0.1 0.1

Adjusted EBITDA $39.4 $42.8 $16.1 $22.5 $23.0

Source: Financial Statements

Note: Adj. EBITDA defined as earnings before interest, taxes, depreciation and amortization, adjusted to exclude non-recurring items and related-party rent

expense given Thunder’s acquisition of the Canadian Real Property