Use these links to rapidly review the document

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-181821

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement is not an offer to sell these securities, and neither we nor the selling stockholders are soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 18, 2012

Prospectus Supplement

(To Prospectus dated June 21, 2012)

8,000,000 Shares

Thermon Group Holdings, Inc.

Common Stock

The selling stockholders named in this prospectus supplement are offering 8,000,000 shares of our common stock. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

Our common stock is traded on the New York Stock Exchange under the symbol "THR." On September 17, 2012, the last reported sale price of our common stock on the New York Stock Exchange was $25.83 per share.

Investing in our common stock involves risks. See "Risk Factors" beginning on page S-14 of this prospectus supplement and page 4 of the accompanying prospectus. You should also consider the risk factors described in the documents we incorporate by reference into this prospectus supplement and the accompanying prospectus.

| |

Per Share | Total | ||||

|---|---|---|---|---|---|---|

Price to the public |

$ | $ | ||||

Underwriting discounts and commissions |

$ | $ | ||||

Proceeds to the selling stockholders (before expenses) |

$ | $ | ||||

The underwriters have an option to purchase up to an additional 1,200,000 shares from the selling stockholders, at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus supplement, to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about September , 2012.

Joint Book-Running Managers

| Barclays | Jefferies |

Co-Managers

| William Blair | BMO Capital Markets | KeyBanc Capital Markets |

Prospectus Supplement dated September , 2012

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock. The second part, the accompanying prospectus and the documents incorporated by reference therein, gives more general information about our common stock and other securities that we or the selling stockholders may offer from time to time, some of which may not apply to this offering. This prospectus supplement adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference therein. Generally, when we refer to the "prospectus" in this prospectus supplement we are referring to both parts combined. This prospectus incorporates by reference important business and financial information about us that is not included in or delivered with this prospectus.

You should rely only on the information incorporated or deemed to be incorporated by reference or provided in this prospectus supplement, in the accompanying prospectus or in any free writing prospectus filed by us with the Securities and Exchange Commission, or the SEC. If information in this prospectus supplement is inconsistent with the information in the accompanying prospectus or any documents incorporated by reference therein that were filed before the date of this prospectus supplement, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference therein, and you should rely on this prospectus supplement. Neither we, the selling stockholders nor the underwriters have authorized any person to provide you with any information or to make any representation that is different from, or in addition to, the information and representations contained in or incorporated or deemed to be incorporated by reference into this prospectus supplement, the accompanying prospectus or any free writing prospectus filed by us with the SEC. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and any free writing prospectus filed by us with the SEC is accurate as of the date of each such document only, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy by anyone in any jurisdiction in which such offer or solicitation is not authorized, or in which the person is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

Unless otherwise specified or the context otherwise requires, references to "$" or "dollars" in this prospectus supplement are to United States dollars, and the terms "Thermon," "we," "our," "us" and the "Company," as used in this prospectus supplement, refer to Thermon Group Holdings, Inc. and its directly and indirectly owned subsidiaries as a combined entity. Our fiscal year ends March 31, so references to a particular fiscal year are to the twelve months ended on March 31 of the given calendar year (e.g., "fiscal 2012" and "fiscal 2011" mean our fiscal years ended March 31, 2012 and March 31, 2011, respectively).

In this prospectus supplement, we rely on and refer to information regarding our industry from Alvarez & Marsal Private Equity Performance Improvement Group, LLC, or A&M; the U.S. Energy Information Administration, or the EIA; Wood Mackenzie Limited, or Wood Mackenzie, and the American Institute of Chemical Engineers. These organizations are not affiliated with us. We commissioned a report from A&M concerning the global heat tracing market, and the information attributed to A&M in this prospectus supplement appears in that report. A&M has consented to being named in this prospectus supplement and to all references to A&M and its report and the data contained therein appearing herein. The information attributed to EIA, Wood Mackenzie and the American Institute of Chemical Engineers cited in this prospectus supplement is publicly available; accordingly, we have not sought or received from such organizations consents to being named in this

ii

prospectus supplement. We believe this information is reliable, but we have not independently verified it. Unless otherwise indicated, all other information contained in this prospectus supplement concerning the industry in general, including information regarding our market position and market share within our industry and expectations regarding future growth of sales in our industry, is based on management's experience in the industry and our own evaluation of market conditions, as well as estimates using internal data and data from industry related publications and other externally obtained data. Market and industry data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements" in this prospectus supplement.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement includes forward-looking statements within the meaning of the U.S. federal securities laws in addition to historical information. These forward-looking statements are included throughout this prospectus supplement and the accompanying prospectus, including in the sections of this prospectus supplement entitled "Prospectus Supplement Summary" and "Risk Factors," and in the sections of the accompanying prospectus entitled "Market and Industry Data" and "Risk Factors," and include, without limitation, statements regarding our industry, business strategy, plans, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion, the words "anticipate," "assume," "believe," "budget," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "will," "future" and similar terms and phrases are intended to identify forward-looking statements in this prospectus supplement.

Forward-looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized or otherwise materially affect our financial condition, results of operations and cash flows. These forward-looking statements include but are not limited to statements regarding: (i) our plans to strategically pursue emerging growth opportunities in diverse regions and across industry sectors; (ii) our plans to secure more new facility, or Greenfield, project bids; (iii) our ability to generate more facility maintenance, repair and operations or upgrades or expansions, or MRO/UE, revenue from our existing and future installed base; (iv) our ability to timely deliver backlog; (v) our ability to respond to new market developments and technological advances; (vi) our expectations regarding energy consumption and demand in the future and its impact on our future results of operations; (vii) our plans to develop strategic alliances with major customers and suppliers; (viii) our expectations that our revenues will continue to increase; (ix) our belief in the sufficiency of our cash flows to meet our needs for the next year; and (x) our anticipated benefits from the recently completed expansion of our principal manufacturing facility in San Marcos, Texas.

Actual events, results and outcomes may differ materially from our expectations due to a variety of factors. Although it is not possible to identify all of these factors, they include, among others, (i) general economic conditions and cyclicality in the markets we serve; (ii) future growth of energy and chemical processing capital investments; (iii) changes in relevant currency exchange rates; (iv) our ability to comply with the complex and dynamic system of laws and regulations applicable to international operations; (v) a material disruption at any of our manufacturing facilities; (vi) our dependence on subcontractors and suppliers; (vii) our ability to obtain standby letters of credit, bank guarantees or performance bonds required to bid on or secure certain customer contracts; (viii) competition from various other sources providing similar heat tracing products and services, or other alternative technologies, to customers; (ix) our ability to attract and retain qualified management

iii

and employees, particularly in our overseas markets; (x) our ability to continue to generate sufficient cash flow to satisfy our liquidity needs; and (xi) the extent to which federal, state, local and foreign governmental regulation of energy, chemical processing and power generation products and services limits or prohibits the operation of our business. Any one of these factors or a combination of these factors could materially affect our future results of operations and could influence whether any forward-looking statements contained in this prospectus supplement ultimately prove to be accurate. See also "Risk Factors" included elsewhere in this prospectus supplement for information regarding the additional factors that have impacted or may impact our business and operations.

Our forward-looking statements are not guarantees of future performance, and actual results and future performance may differ materially from those suggested in any forward-looking statements. We do not intend to update these statements unless we are required to do so under applicable securities laws.

iv

The following summary highlights selected information from this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein and may not contain all the information that may be important to you. This prospectus supplement and the accompanying prospectus include or incorporate by reference information about this offering, our business and our financial and operating data. You should read this entire prospectus supplement and the accompanying prospectus, including the sections entitled "Risk Factors," beginning on page S-14 of this prospectus supplement and page 4 of the accompanying prospectus, as well as the information incorporated by reference therein, including our financial statements and the related notes, before making an investment decision.

We are one of the largest providers of highly engineered thermal solutions for process industries. For almost 60 years, we have served a diverse base of thousands of customers around the world in attractive and growing markets, including energy, chemical processing and power generation. We are a global leader and one of the few thermal solutions providers with a global footprint and a full suite of products (heating cables, tubing bundles and control systems) and services (design optimization, engineering, installation and maintenance services) required to deliver comprehensive solutions to complex projects. We serve our customers locally through a global network of sales and service professionals and distributors in more than 30 countries and through our four manufacturing facilities on three continents. These capabilities and longstanding relationships with some of the largest multinational energy, chemical processing, power and engineering, procurement and construction, or EPC, companies in the world have enabled us to diversify our revenue streams and opportunistically access high growth markets worldwide. For fiscal 2012, approximately 66% of our revenues were generated outside of the United States.

Our thermal solutions, also referred to as heat tracing, provide an external heat source to pipes, vessels and instruments for the purposes of freeze protection, temperature and flow maintenance, environmental monitoring, and surface snow and ice melting. Customers typically purchase our products when constructing a new facility, which we refer to as Greenfield projects, or when performing maintenance, repair and operations on a facility's existing heat-traced pipes or upgrading or expanding a current facility, which we refer to collectively as MRO/UE. A large processing facility may require our thermal solutions for a majority of its pipes, with the largest facilities containing hundreds of thousands of feet of heat-tracing cable and thousands of control points. Our products are low in cost relative to the total cost of a typical processing facility, but critical to the safe and profitable operation of the facility. These facilities are often complex, with numerous classified areas that are inherently hazardous and where product safety concerns are paramount. We believe that our strong brand and established reputation for safety, reliability and customer service are critical contributors to our customers' purchasing decisions.

Our customers' need for MRO/UE solutions provides us with an attractive recurring revenue stream. Customers typically use the incumbent heat tracing provider for MRO/UE projects to avoid complications and compatibility problems associated with switching providers. We typically begin to realize meaningful MRO/UE revenue from new Greenfield installations one to three years after completion of the project as customers begin to remove and replace our products during routine and preventative maintenance on in-line mechanical equipment, such as pipes and valves. As a result, our growth has been driven by new facility construction, as well as by servicing our continually growing base of solutions installed around the world, which we refer to as our installed base. Approximately 61% of our revenues for fiscal 2012 were derived from MRO/UE activities.

S-1

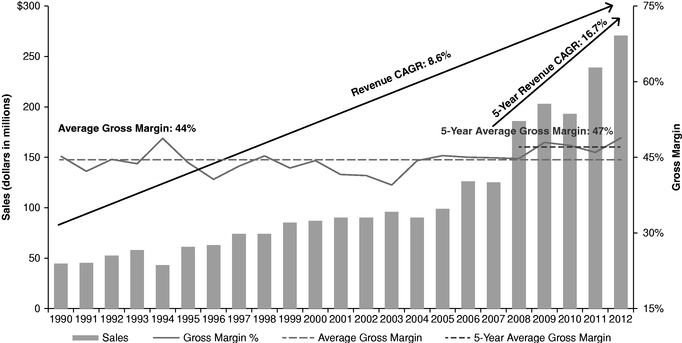

Our revenues have grown in 18 of the past 22 fiscal years, and our gross margins have averaged 44% over that period. In addition, we have generated significant growth in both revenue and profitability in recent years. Our revenue grew by 46% to $270.5 million for fiscal 2012 from $185.8 million for fiscal 2008, and gross profit grew by 74.5% to $132.1 million from $75.7 million over the same period. For fiscal 2012, we achieved net income of $12.0 million and Adjusted EBITDA of $71.4 million. See note 8 to the "—Summary Historical Consolidated Financial and Operating Data" table. Our backlog grew by 51% to $117.3 million at June 30, 2012 from $77.5 million at March 31, 2008.

The following chart summarizes our sales, gross margins and median gross margins and provides the compound annual growth rate, or CAGR, for our revenues during the period from fiscal 1990 to fiscal 2012.

A&M estimates that the market for industrial electric heat tracing is approximately $1.2 billion in annual revenues and estimates that it is growing its share of the overall heat tracing market as end users appear to continue to favor electric heat tracing solutions over steam heat tracing solutions for new installations. When revenues for steam heat tracing parts are included, A&M estimates the overall addressable market for heat tracing to be approximately $2.6 billion in annual revenues. The industrial electric heat tracing industry is fragmented and consists of approximately 40 companies that typically only serve discrete local markets with manufactured products and provide a limited service offering. Heat tracing providers differentiate themselves through the quality and reputation of their products, the length and quality of their customer relationships and their ability to provide comprehensive solutions. Large multinational companies drive the majority of spending for the types of major industrial facilities that require heat tracing, and we believe that they prefer providers who have a global footprint and a comprehensive suite of products and services. We believe we are one of only a few companies that meet these criteria.

S-2

The major end markets that drive demand for heat tracing include energy, petrochemical and power generation. We believe that there are attractive near- to medium-term trends in each of these end markets.

We believe that the following strengths differentiate us from our competitors.

We have access to attractive high growth sectors of our global addressable market. We have a network of sales and service professionals and distributors in more than 30 countries and a manufacturing footprint that includes four facilities on three continents. This footprint allows us to diversify our revenue streams and opportunistically access the most attractive regions and sub-sectors of our markets. For example, growing demand for energy is pushing the search for resources to increasingly harsh cold weather countries, including Canada and Russia, where demand for our products is magnified, and strong petrochemical demand in China and India has led to a shift in

S-3

chemical production to the Asia-Pacific region. We have a strong, established local presence in each of these markets.

We are a global market leader. We believe that we are the second largest industrial electric heat tracing company in the world, significantly larger than our next largest competitor and one of only a few solutions providers with a comprehensive suite of products and services, global capabilities and local on-site presence. Over our 57-year history, we have developed an installed base operated by thousands of customers and long-standing relationships with some of the largest companies in the world that drive the spending decisions for the major facilities that require our products. We believe these multinational companies prefer providers with our scale, global presence and comprehensive product and service offering.

Our highly engineered solutions are mission critical to our customers. Reliable thermal solutions are critical to the safe and profitable operation of our customers' facilities. These facilities are often complex, with numerous classified areas that are inherently hazardous and where product safety concerns are paramount. Therefore, we believe that our customers consider safety, reliability and customer service to be the most important purchase criteria for our products. We are a leader in the national and international standards setting process for the heat tracing industry and hold leadership positions on numerous industry standards development organizations.

Our favorable business model positions us to achieve attractive financial results. The following features of our business model contribute to our attractive financial results:

S-4

Our management team has a proven track record. Our senior management team averages approximately 23 years of experience with us and is responsible for growing Thermon through a variety of business cycles, building our global platform and developing our reputation for quality and reliability in the heat tracing industry. Our senior management and key employees will continue to have a significant equity stake in Thermon following this offering.

Our business strategy is designed to capitalize on our competitive strengths and includes the following key elements.

Capitalize on our leading market position to continue pursuing organic growth opportunities. Our primary growth engine has traditionally been organic expansion. We will continue to focus on strategically building the necessary global sales infrastructure to expand our footprint in high growth markets. We believe that this footprint and our local presence are attractive to our customers and differentiate us from other industry participants. We expect to continue to pursue growth opportunities in emerging markets and across industry sectors in the future.

Leverage our installed base to expand our recurring revenue stream. Once the MRO/UE cycle begins, we typically realize MRO/UE revenues, which are typically higher margin than Greenfield revenues, over the life of each installation. As we continue to grow our large, global installed base with new Greenfield projects, we expect to generate incremental MRO/UE revenues related to these new projects. Since the beginning of fiscal 2008 through June 30, 2012, we estimate that we have realized approximately $440 million in revenues from Greenfield projects, which represents a meaningful opportunity for us to create MRO/UE revenues in the future.

Drive growth through alliances with major customers and suppliers. We have developed strategic alliances with other industry participants in order to enhance our growth opportunities, and we are a "pre-qualified" heat tracing provider for several of our key customers. These relationships provide us with an advantage in identifying and bidding for new Greenfield and MRO/UE projects, and we intend to target additional opportunities with suppliers of complementary products that will allow us to take mutual advantage of our customer relationships and enhance our cross-selling opportunities.

Continue to offer solutions that support evolving environmental applications. A portion of our recent growth has been driven by the use of our products in alternative energy initiatives, including carbon capture, thermal solar and coal gasification facilities. In addition, our products help our customers monitor their facilities' environmental or other regulatory compliance. We intend to continue to focus on driving growth by providing solutions that address our customers' evolving environmental application needs.

Selectively pursue value-added acquisitions. Given the fragmented nature of the heat tracing and related industries, we believe that there will be opportunities to pursue value-added acquisitions at attractive valuations in the future, including to augment our geographic footprint, broaden our product offerings, expand our technological capabilities and capitalize on potential operating synergies.

S-5

Risk Factors

There are a number of risks related to our business, this offering and our common stock that you should consider before you decide to participate in this offering. You should carefully consider all the information presented in the sections entitled "Risk Factors" in this prospectus supplement and the accompanying prospectus. Some of the principal risks related to our business include the following:

These and other risks are more fully described in the sections entitled "Risk Factors" beginning on page S-14 of this prospectus supplement and beginning on page 4 of the accompanying prospectus. If any of these risks actually occur, they could materially harm our business, prospects, financial condition and results of operations. In this event, you could lose part or all of your investment in our common stock offered hereby.

Our principal stockholder is CHS Capital LLC, or CHS. CHS is a Chicago-based private equity firm with 24 years of experience investing in the middle market. CHS partners with talented management teams to focus on accelerating growth and driving value creation through human capital enhancements, performance improvement actions and strategic growth initiatives. As of the date of this prospectus supplement, CHS has completed 76 platform investments and 307 add-on investments and has raised $2.9 billion of capital.

S-6

CHS acquired its interest in us in April 2010 in connection with the acquisition of a majority stake in us by an investor group led by entities affiliated with CHS and two other private equity firms, which we refer to collectively as our private equity sponsors. As of September 17, 2012, entities affiliated with CHS beneficially owned 30.7% of our outstanding shares of common stock and, after this offering, will beneficially own 14.9% of our outstanding shares of common stock (which would be decreased to 12.6% if the underwriters fully exercise their over-allotment option).

We are incorporated in Delaware and our corporate offices are located at 100 Thermon Drive, San Marcos, TX 78666. Our telephone number is (512) 396-5801. Our website address is www.thermon.com. None of the information on our website or any other website identified herein is part of this prospectus supplement or the accompanying prospectus and should not be considered part of this prospectus supplement or the accompanying prospectus.

S-7

| Common stock offered by selling stockholders | 8,000,000 shares | |

Common stock to be outstanding after this offering |

30,866,765 shares(1) |

|

Over-allotment option |

The underwriters have an option to purchase up to an additional 1,200,000 shares from the selling stockholders, at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of date of this prospectus supplement, to cover over-allotments, if any. |

|

Use of proceeds |

We will not receive any proceeds from the sale of the shares of common stock by the selling stockholders but we will be required to pay certain expenses related to this offering. See "Use of Proceeds." |

|

Dividend Policy |

We do not intend to pay dividends on our common stock in the foreseeable future. See "Price Range of Our Common Stock and Dividend Policy." |

|

Risk factors |

You should carefully review the information set forth in the sections entitled "Risk Factors" beginning on page S-14 of this prospectus supplement, beginning on page 4 of the accompanying prospectus and any documents incorporated by reference herein. See "Incorporation of Certain Documents by Reference." |

|

New York Stock Exchange symbol |

THR |

S-8

Summary Historical Consolidated Financial and Operating Data

The following tables set forth certain summary historical consolidated financial and operating data for the fiscal years ended March 31, 2010, March 31, 2011 and March 31, 2012 and the three months ended June 30, 2011 and 2012, and as of June 30, 2012. The data set forth below should be read in conjunction with the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our consolidated financial statements and the notes thereto contained in our Annual Report on Form 10-K for the fiscal year ended March 31, 2012 and our Quarterly Report on Form 10-Q for the three months ended June 30, 2012, each of which is incorporated by reference into this prospectus supplement. See "Incorporation of Certain Documents by Reference."

In this prospectus supplement, we have included summary historical financial and operating data of Thermon Group Holdings, Inc. as of June 30, 2012 and for the fiscal year ended March 31, 2012 and the period from May 1, 2010 through March 31, 2011 ("successor") and summary historical financial and operating data of Thermon Holdings, LLC for the fiscal year ended March 31, 2010 and for the period from April 1, 2010 through April 30, 2010 ("predecessor"). Concurrent with the consummation of the CHS Transactions on April 30, 2010, Thermon Holdings, LLC no longer owned any interest in us, and from May 1, 2010 we report the consolidated financial statements of Thermon Group Holdings, Inc. We do not anticipate that there would have been any material difference in our consolidated financial statements and notes thereto for the fiscal year ended March 31, 2010 and for the period from April 1, 2010 through April 30, 2010 had such statements been prepared for Thermon Group Holdings, Inc., except as it relates to purchase accounting in connection with the CHS Transactions.

The presentation of fiscal 2011 includes the combined results of the predecessor and successor owners for fiscal 2011. We have presented the combination of these periods because it provides an easier-to-read discussion of the results of operations and provides the investor with information from which to analyze our financial results in a manner that is consistent with the way management reviews and analyzes our results of operations. In addition, the combined results provide investors with the most meaningful comparison between our results for prior and future periods. Please refer to note 2 to Item 6, "Selected Financial Data" and our historical consolidated financial statements and notes thereto for the year ended March 31, 2011 each contained in our Annual Report on Form 10-K for the fiscal year ended March 31, 2012, which is incorporated by reference into this prospectus supplement, for a separate presentation of the consolidated statement of operations data for the predecessor and successor periods.

In June 2011, the Financial Accounting Standards Board, or FASB, updated FASB ASC 220, Comprehensive Income (FASB ASC 220) that gives an entity the option to present total comprehensive income, the components of net income and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In either case, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. We have adopted ASC 220 effective April 1, 2012 and, in connection with adopting ASC 220, we have chosen to present the components of comprehensive income within a single statement of comprehensive income or loss. ASC 220 affects presentation and disclosure only and, therefore, our adoption of ASC 220 did not affect our results of operations as reported in our consolidated financial statements. The following table displays the retrospective application of these standards to periods presented in the financial statements included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2012, which is incorporated by reference herein.

In this prospectus supplement, the CHS Transactions refer collectively to the April 2010 equity investment in us by CHS, our other private equity sponsors and certain members of our management

S-9

team, the entry into our revolving credit facility, the repayment of amounts owed under, and the termination of, certain then-existing revolving credit and term loan facilities, the issuance of our senior secured notes and the application of the gross proceeds from the offering of our senior secured notes and the equity investment to complete the CHS Transactions and to pay related fees and expenses of these transactions.

| |

Predecessor | Predecessor/ Successor Combined (Non-GAAP)(1) |

Successor | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31, | Three Months Ended June 30, | ||||||||||||||

| |

2010 | 2011 | 2012 | 2011 | 2012 | |||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

|||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||

Consolidated Statement of Operations Data: |

||||||||||||||||

Sales |

$ | 192,713 | $ | 238,808 | $ | 270,515 | $ | 64,618 | $ | 67,213 | ||||||

Cost of sales |

101,401 | 129,093 | 138,400 | 32,629 | 33,874 | |||||||||||

Purchase accounting adjustments(2) |

— | 7,614 | — | — | — | |||||||||||

Gross profit |

$ | 91,312 | $ | 102,101 | 132,115 | 31,989 | 33,339 | |||||||||

Operating expenses: |

||||||||||||||||

Marketing, general and administrative and engineering expenses |

46,482 | 56,890 | 68,175 | 21,511 | 16,015 | |||||||||||

Management fees |

862 | 2,003 | 8,105 | 8,105 | — | |||||||||||

Amortization of intangible assets |

2,426 | 18,245 | 11,379 | 2,885 | 2,794 | |||||||||||

Income from operations |

$ | 41,542 | $ | 24,963 | $ | 44,456 | $ | (512 | ) | $ | 14,530 | |||||

Interest expense, net(3) |

(7,351 | ) | (29,581 | ) | (23,287 | ) | (7,329 | ) | (4,340 | ) | ||||||

Miscellaneous income (expense)(4) |

(1,285 | ) | (21,863 | ) | (1,671 | ) | (14 | ) | 44 | |||||||

Income (loss) from continuing operations before taxes |

$ | 32,906 | $ | (26,481 | ) | $ | 19,498 | $ | (7,855 | ) | $ | 10,234 | ||||

Income tax expense (benefit) |

13,966 | (11,274 | ) | 7,468 | (2,889 | ) | 3,634 | |||||||||

Net income (loss)(5) |

$ | 18,940 | (15,207 | ) | 12,030 | (4,966 | ) | 6,600 | ||||||||

Comprehensive income (loss): |

||||||||||||||||

Net income (loss) |

$ | 18,940 | $ | (15,207 | ) | $ | 12,030 | $ | (4,966 | ) | $ | 6,600 | ||||

Foreign currency translation adjustment |

6,520 | 9,455 | (6,517 | ) | 1,395 | (5,448 | ) | |||||||||

Other |

— | — | (152 | ) | — | — | ||||||||||

Comprehensive income (loss) |

$ | 25,460 | $ | (5,752 | ) | $ | 5,361 | $ | (3,571 | ) | $ | 1,152 | ||||

Net income per common share |

||||||||||||||||

Basic |

n/m | (5) | n/m | (5) | $ | 0.41 | $ | (0.18 | ) | $ | 0.22 | |||||

Diluted |

n/m | (5) | n/m | (5) | $ | 0.40 | $ | (0.18 | )(6) | $ | 0.21 | |||||

Weighted average shares used in computing net income per common share: |

||||||||||||||||

Basic |

n/m | (5) | n/m | (5) | 29,083,478 | 27,738,534 | 30,341,021 | |||||||||

Diluted |

n/m | (5) | n/m | (5) | 30,454,255 | 27,738,534 | (6) | 31,410,145 | ||||||||

Other Financial Data: |

||||||||||||||||

Adjusted EPS(7) |

$ | 0.85 | $ | 0.20 | $ | 0.23 | ||||||||||

Adjusted EBITDA(8) |

$ | 46,555 | $ | 57,666 | $ | 71,375 | $ | 17,866 | $ | 18,322 | ||||||

Capital expenditures |

1,587 | 1,799 | 8,883 | 2,379 | 1,268 | |||||||||||

Operating Data: |

||||||||||||||||

Backlog at end of period(9) |

$ | 82,459 | $ | 76,298 | $ | 117,748 | $ | 81,974 | $ | 117,311 | ||||||

S-10

| |

As of June 30 2012 | |||

|---|---|---|---|---|

| |

(unaudited) (dollars in thousands) |

|||

Balance Sheet Data: |

||||

Cash and cash equivalents |

$ | 13,630 | ||

Accounts receivable, net |

53,770 | |||

Inventories, net |

36,300 | |||

Total assets |

411,460 | |||

Total debt, including current portion |

130,914 | |||

Total shareholders' equity |

196,846 | |||

S-11

reported by other companies. The following table reconciles net income (loss) to Adjusted EPS for the periods presented in this table and elsewhere in this prospectus supplement.

| |

|

Three Months Ended June 30, |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31, 2012 |

|||||||||

| |

2011 | 2012 | ||||||||

| |

(in thousands, except per share data) |

|||||||||

Net income (loss) |

$ | 12,030 | $ | (4,966 | ) | $ | 6,600 | |||

Purchase accounting adjustment |

— | |||||||||

Acceleration of stock compensation in connection with IPO |

6,341 | 6,341 | — | |||||||

Management fees |

8,105 | 8,105 | — | |||||||

Premiums paid on partial redemptions of senior secured notes |

3,825 | 630 | — | |||||||

Expenses related to this prospectus |

— | — | 273 | |||||||

Acceleration of unamortized debt costs due to partial redemptions of senior secured notes |

3,096 | 1,871 | 871 | |||||||

Tax effect of financial adjustments |

(7,500 | ) | (5,982 | ) | (401 | ) | ||||

Adjusted net income |

$ | 25,897 | $ | 5,999 | $ | 7,343 | ||||

Weighted average fully-diluted common shares |

30,454 | 29,285 | (a) | 31,410 | ||||||

Adjusted EPS |

$ | 0.85 | $ | 0.20 | (a) | $ | 0.23 | |||

S-12

titled measures reported by other companies. The following table reconciles net income (loss) to Adjusted EBITDA for the periods presented in this table and elsewhere in this prospectus supplement.

| |

Predecessor | Predecessor/ Successor Combined (Non-GAAP) |

Successor | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31, | Three Months Ended June 30, |

||||||||||||||

| |

2010 | 2011 | 2012 | 2011 | 2012 | |||||||||||

| |

(dollars in thousands) |

|||||||||||||||

Net income (loss) |

$ | 18,940 | $ | (15,207 | ) | $ | 12,030 | $ | (4,966 | ) | $ | 6,600 | ||||

Interest expense, net |

7,351 | 29,581 | 23,287 | 7,329 | 4,340 | |||||||||||

Income tax expense |

13,966 | (11,274 | ) | 7,468 | (2,889 | ) | 3,634 | |||||||||

Depreciation and amortization expense |

4,424 | 27,930 | 13,971 | 3,946 | 3,417 | |||||||||||

Stock-based compensation expense |

— | 1,939 | 6,514 | 6,341 | 58 | |||||||||||

CHS Transactions expenses(a) |

309 | 22,694 | — | — | — | |||||||||||

Other transaction expenses(b) |

703 | — | — | — | 273 | |||||||||||

Management fees(c) |

862 | 2,003 | 8,105 | 8,105 | — | |||||||||||

Adjusted EBITDA |

$ | 46,555 | $ | 57,666 | $ | 71,375 | $ | 17,866 | $ | 18,322 | ||||||

S-13

Investing in our common stock involves substantial risks. In addition to the other information in this prospectus supplement, you should consider carefully the following risk factors before investing in our common stock. Additional risks and uncertainties that are not yet identified, or that we think are immaterial, may also materially harm our business, financial condition, results of operation or prospects and could result in a complete loss of your investment. We cannot assure you that any of the events discussed in the risk factors below, or other risks, will not occur. If they do, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment. Certain statements in "Risk Factors" are forward-looking statements. See "Cautionary Statement Regarding Forward-Looking Statements" elsewhere in this prospectus supplement.

Risks Related to Our Business and Industry

The markets we serve are subject to general economic conditions and cyclical demand, which could harm our business and lead to significant shifts in our results of operations from quarter to quarter that make it difficult to project long-term performance.

Our operating results have been and may in the future be adversely affected by general economic conditions and the cyclical pattern of certain industries in which our customers and end users operate. Demand for our products and services depends in large part upon the level of capital and maintenance expenditures by many of our customers and end users, in particular those in the energy, chemical processing and power generation industries, and firms that design and construct facilities for these industries. These customers' expenditures historically have been cyclical in nature and vulnerable to economic downturns. Prolonged periods of little or no economic growth could decrease demand for oil and gas which, in turn, could result in lower demand for our products and a negative impact on our results of operations and cash flows. In addition, this historically cyclical demand may lead to significant shifts in our results of operations from quarter to quarter, which limits our ability to make accurate long-term predictions about our future performance.

A sustained downturn in the energy industry, due to oil and gas prices decreasing or otherwise, could decrease demand for some of our products and services, which could materially and adversely affect our business, financial condition and results of operations.

A significant portion of our revenue historically has been generated by end-users in the upstream oil and gas markets. The businesses of most of our customers in the energy industry are, to varying degrees, cyclical and historically have experienced periodic downturns. Profitability in the energy industry is highly sensitive to supply and demand cycles and commodity prices, which historically have been volatile, and our customers in this industry historically have tended to delay large capital projects, including expensive maintenance and upgrades, during industry downturns. Customer project delays may limit our ability to realize value from our backlog as expected and cause fluctuations in the timing or the amount of revenue earned and the profitability of our business in a particular period. In addition, such delays may lead to significant fluctuations in results of operations from quarter to quarter, making it difficult to predict our financial performance on a quarterly basis.

Demand for a significant portion of our products and services depends upon the level of capital expenditure by companies in the energy industry, which depends, in part, on energy prices. Prices of oil and gas have been very volatile over the past four years, with significant increases until achieving historic highs in July 2008, followed immediately by a steep decline through 2009 and moderate increases from 2010 to early 2012. A sustained downturn in the capital expenditures of our customers, whether due to a decrease in the market price of oil and gas or otherwise, may delay projects, decrease demand for our products and services and cause downward pressure on the prices we charge, which, in

S-14

turn, could have a material adverse effect on our business, financial condition and results of operations. Such downturns, including the perception that they might continue, could have a significant negative impact on the market price of our common stock.

As a global business, we are exposed to economic, political and other risks in a number of countries, which could materially reduce our revenues, profitability or cash flows or materially increase our liabilities. If we are unable to continue operating successfully in one or more foreign countries, it may have a material adverse effect on our business and financial condition.

For fiscal 2012, approximately 66% of our revenues were generated outside of the United States, and approximately 35% were generated outside North America. In addition, one of our key growth strategies is to continue to expand our global footprint in emerging and high growth markets around the world, although we may not be successful in expanding our international business.

Conducting business outside the United States is subject to additional risks, including the following:

One or more of these factors could prevent us from successfully expanding our presence in international markets, could have a material adverse effect on our revenues, profitability or cash flows or cause an increase in our liabilities. We may not succeed in developing and implementing policies and strategies to counter the foregoing factors effectively in each location where we do business.

A failure to deliver our backlog on time could affect our future sales and profitability and our relationships with our customers, and if we were to experience a material amount of modifications or cancellations of orders, our sales could be negatively impacted.

Our backlog is comprised of the portion of firm signed purchase orders or other written contractual commitments received from customers that we have not recognized as revenue. The dollar amount of backlog as of June 30, 2012 was $117.3 million. The timing of our recognition of revenue out of our backlog is subject to a variety of factors that may cause delays, many of which, including fluctuations in our customers' delivery schedules, are beyond our control. Such delays may lead to significant fluctuations in results of operations from quarter to quarter, making it difficult to predict

S-15

our financial performance on a quarterly basis. For example, a delay in the completion of a large Greenfield project resulted in approximately several million dollars in revenue attributable to such project being realized in the quarter ended September 30, 2010, which was one quarter later than expected. Further, while we have historically experienced few order cancellations and the amount of order cancellations has not been material compared to our total contract volume, if we were to experience a significant amount of cancellations of or reductions in purchase orders, it would reduce our backlog and, consequently, our future sales and results of operations.

Our ability to meet customer delivery schedules for our backlog is dependent on a number of factors including, but not limited to, access to raw materials, an adequate and capable workforce, engineering expertise for certain projects, sufficient manufacturing capacity and, in some cases, our reliance on subcontractors. The availability of these factors may in some cases be subject to conditions outside of our control. A failure to deliver in accordance with our performance obligations may result in financial penalties and damage to existing customer relationships, our reputation and a loss of future bidding opportunities, which could cause the loss of future business and could negatively impact our financial performance.

Our future revenue depends in part on our ability to bid and win new contracts. Our failure to effectively obtain future contracts could adversely affect our profitability.

Our future revenue and overall results of operations require us to successfully bid on new contracts and, in particular, contracts for large Greenfield projects, which are frequently subject to competitive bidding processes. Our revenue from major projects depends in part on the level of capital expenditures in our principal end markets, including the energy, chemical processing and power generation industries. The number of such projects we win in any year fluctuates, and is dependent upon the number of projects available and our ability to bid successfully for such projects. Contract proposals and negotiations are complex and frequently involve a lengthy bidding and selection process, which is affected by a number of factors, such as competitive position, market conditions, financing arrangements and required governmental approvals. For example, a client may require us to provide a bond or letter of credit to protect the client should we fail to perform under the terms of the contract. If negative market conditions arise, or if we fail to secure adequate financial arrangements or required governmental approvals, we may not be able to pursue particular projects, which could adversely affect our profitability.

We may be unable to compete successfully in the highly competitive markets in which we operate.

We operate in competitive domestic and international markets and compete with highly competitive domestic and international manufacturers and service providers. The fragmented nature of the industrial electric heat tracing industry, which consists of approximately 40 companies, makes the market for our products and services highly competitive. A number of our direct and indirect competitors are major multinational corporations, some of which have substantially greater technical, financial and marketing resources than us, and additional competitors may enter these markets. Our competitors may develop products that are superior to our products, develop methods of more efficiently and effectively providing products and services, or adapt more quickly than we do to new technologies or evolving customer requirements. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced sales and earnings.

Volatility in currency exchange rates may adversely affect our financial condition, results of operations or cash flows.

We may not be able to effectively manage our exchange rate and/or currency transaction risks. Volatility in currency exchange rates may decrease our revenues and profitability, adversely affect our

S-16

liquidity and impair our financial condition. While we have entered into hedging instruments to manage our exchange rate risk as it relates to certain intercompany balances with certain of our foreign subsidiaries, these hedging activities do not eliminate this exchange rate risk, nor do they reduce risk associated with total foreign sales.

Our non-U.S. subsidiaries generally sell their products and services in the local currency, but obtain a significant amount of their products from our facilities located in another country, primarily the United States, Canada or Europe. In particular, significant fluctuations in the Canadian Dollar, the Russian Ruble, the Euro or the Pound Sterling against the U.S. Dollar could adversely affect our results of operations. We also bid for certain foreign projects in U.S. Dollars or Euros. If the U.S. Dollar or Euro strengthens relative to the value of the local currency, we may be less competitive in bidding for those projects. See Item 7A, "Quantitative and Qualitative Disclosures about Market Risk" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2012, which is incorporated by reference herein, for additional information regarding our foreign currency exposure relating to operations.

In order to meet our global cash management needs, we often transfer cash between the United States and foreign operations and sometimes between foreign entities. In addition, our debt service requirements are primarily in U.S. Dollars and a substantial portion of our cash flow is generated in foreign currencies, and we may need to repatriate cash to the United States in order to meet our U.S. debt service obligations, including on our senior secured notes. These transfers of cash expose us to currency exchange rate risks, and significant changes in the value of the foreign currencies relative to the U.S. Dollar could limit our ability to meet our debt obligations, including under our senior secured notes, and impair our financial condition.

Because our consolidated financial results are reported in U.S. Dollars, and we generate a substantial amount of our sales and earnings in other currencies, the translation of those results into U.S. Dollars can result in a significant decrease in the amount of those sales and earnings. In addition, fluctuations in currencies relative to the U.S. Dollar may make it more difficult to perform period-to-period comparisons of our reported results of operations.

Due to the nature of our business, we may be liable for damages based on product liability claims. We are also exposed to potential indemnity claims from customers for losses due to our work or if our employees are injured performing services.

We face a risk of exposure to claims in the event that the failure, use or misuse of our products results, or is alleged to result, in death, bodily injury, property damage or economic loss. Although we maintain quality controls and procedures, we cannot be sure that our products will be free from defects. If any of our products prove to be defective, we may be required to replace the product. In addition, we may be required to recall or redesign such products, which could result in significant unexpected costs. Some of our products contain components manufactured by third parties, which may also have defects. In addition, if we are installing our products, we may be subject to claims that our installation caused damage or loss. Our products are often installed in our customers' or end users' complex and capital intensive facilities in inherently hazardous or dangerous industries, including energy, chemical processing and power generation, where the potential liability from risk of loss could be substantial. Although we currently maintain product liability coverage, which we believe is adequate for the continued operation of our business, we cannot be certain that this insurance coverage will continue to be available to us at a reasonable cost or, if available, will be adequate to cover any potential liabilities. With respect to components manufactured by third-party suppliers, the contractual indemnification that we seek from our third-party suppliers may be insufficient to cover claims made against us. In the event that we do not have adequate insurance or contractual indemnification, product liabilities could have a material adverse effect on our business, financial condition or results of operations.

S-17

Under our customer contracts, we often indemnify our customers from damages and losses they incur due to our work or services performed by us, as well as for losses our customers incur due to any injury or loss of life suffered by any of our employees or our subcontractor's personnel occurring on our customer's property. Many, but not all, of our customer contracts include provisions designed to limit our potential liability by excluding consequential damages and lost profits from our indemnity obligations. However, substantial indemnity claims may exceed the amount of insurance we maintain and could have a material adverse effect on our reputation, business, financial condition or results of operations.

A material disruption at any of our manufacturing facilities could adversely affect our results of operations.

If operations at any of our manufacturing facilities were to be disrupted as a result of significant equipment failures, natural disasters, power outages, fires, explosions, terrorism, adverse weather conditions, labor disputes or other reasons, we may be unable to fill customer orders and otherwise meet customer demand for our products, which could adversely affect our financial performance. For example, our marketing and research & development buildings, located on the same campus as our corporate headquarters and primary manufacturing facility in San Marcos, Texas, were destroyed by a tornado in January 2007.

Interruptions in production, in particular at our manufacturing facilities in San Marcos, Texas, or Calgary, Canada, at which we manufacture the majority of our products, could increase our costs and reduce our sales. Any interruption in production capability could require us to make substantial capital expenditures to fill customer orders, which could negatively affect our profitability and financial condition. We maintain property damage insurance that we believe to be adequate to provide for reconstruction of facilities and equipment, as well as business interruption insurance to mitigate losses resulting from any production interruption or shutdown caused by an insured loss. However, any recovery under our insurance policies may not offset the lost sales or increased costs that may be experienced during the disruption of operations, which could adversely affect our financial performance.

Our international operations and non-U.S. subsidiaries are subject to a variety of complex and continually changing laws and regulations and, in particular, export control regulations.

Due to the international scope of our operations, we are subject to a complex system of laws and regulations, including regulations issued by the U.S. Department of Justice, or the DOJ, the SEC, the Internal Revenue Service, or the IRS, Customs and Border Protection, the Bureau of Industry and Security, or BIS, the Office of Antiboycott Compliance, or OAC, and the Office of Foreign Assets Control, or OFAC, as well as the counterparts of these agencies in foreign countries. While we believe we are in material compliance with these regulations and maintain programs intended to achieve compliance, we may currently or may in the future be in violation of these regulations. In 2009, we entered into settlement agreements with BIS and OFAC, and in 2010, we entered into a settlement agreement with OAC, in each case with respect to matters we voluntarily disclosed to such agencies.

Any alleged or actual violations may subject us to government scrutiny, investigation and civil and criminal penalties and may limit our ability to export our products or provide services outside the United States. Additionally, we cannot predict the nature, scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which existing laws might be administered or interpreted.

In addition, our geographically widespread operations, coupled with our relatively smaller offices in many countries and our reliance on third party subcontractors, suppliers and manufacturers in the completion of our projects, make it more difficult to oversee and ensure that all our offices and

S-18

employees comply with our internal policies and control procedures. We have in the past experienced employee theft, although the amounts involved have not been material, and we cannot assure you that we can ensure compliance with our internal control policies and procedures.

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar foreign anti-corruption laws.

The U.S. Foreign Corrupt Practices Act, which we refer to as the FCPA, and similar foreign anti-corruption laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value to influence foreign government officials for the purpose of obtaining or retaining business or obtaining an unfair advantage. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws, with more frequent voluntary self-disclosures by companies, aggressive investigations and enforcement proceedings by both the DOJ and the SEC resulting in record fines and penalties, increased enforcement activity by non-U.S. regulators, and increases in criminal and civil proceedings brought against companies and individuals. Because many of our customers and end users are involved in infrastructure construction and energy production, they are often subject to increased scrutiny by regulators. Our internal policies mandate compliance with these anti-corruption laws. We operate in many parts of the world that are recognized as having governmental corruption problems to some degree and where strict compliance with anti-corruption laws may conflict with local customs and practices. Our continued operation and expansion outside the United States, including in developing countries, could increase the risk of such violations in the future. Despite our training and compliance programs, we cannot assure you that our internal control policies and procedures always will protect us from unauthorized reckless or criminal acts committed by our employees or agents. In the event that we believe or have reason to believe that our employees or agents have or may have violated applicable anti-corruption laws, including the FCPA, we may be required to investigate or have outside counsel investigate the relevant facts and circumstances, which can be expensive and require significant time and attention from senior management. Violations of these laws may result in severe criminal or civil sanctions, which could disrupt our business and result in a material adverse effect on our reputation, business, results of operations or financial condition.

Our dependence on subcontractors could adversely affect our results of operations.

We often rely on third party subcontractors as well as third party suppliers and manufacturers to complete our projects. To the extent that we cannot engage subcontractors or acquire supplies or materials, our ability to complete a project in a timely fashion or at a profit may be impaired. If the amount we are required to pay for these goods and services exceeds the amount we have estimated in bidding for fixed-price contracts, we could experience losses on these contracts. In addition, if a subcontractor or supplier is unable to deliver its services or materials according to the negotiated contract terms for any reason, including the deterioration of its financial condition or over-commitment of its resources, we may be required to purchase the services or materials from another source at a higher price. This may reduce the profit to be realized or result in a loss on a project for which the services or materials were needed.

We may lose money on fixed-price contracts, and we are exposed to liquidated damages risks in many of our customer contracts.

We often agree to provide products and services under fixed-price contracts, including our turnkey solutions. Under these contracts, we are typically responsible for all cost overruns, other than the amount of any cost overruns resulting from requested changes in order specifications. Our actual costs and any gross profit realized on these fixed-price contracts could vary from the estimated costs on which these contracts were originally based. This may occur for various reasons, including errors in estimates or bidding, changes in availability and cost of labor and raw materials and unforeseen

S-19

technical and logistical challenges, including with managing our geographically widespread operations and use of third party subcontractors, suppliers and manufacturers in many countries. These variations and the risks inherent in our projects may result in reduced profitability or losses on projects. Depending on the size of a project, variations from estimated contract performance could have a material adverse impact on our operating results. In addition, many of our customer contracts, including fixed-price contracts, contain liquidated damages provisions in the event that we fail to perform our obligations thereunder in a timely manner or in accordance with the agreed terms, conditions and standards.

If we lose our senior management or other key employees, our business may be adversely affected.

Our ability to successfully operate and grow our global business and implement our strategies is largely dependent on the efforts, abilities and services of our senior management and other key employees. If we lose the services of our senior management or other key employees and are unable to find qualified replacements with comparable experience in the industry, our business could be negatively affected. Our future success will also depend on, among other factors, our ability to attract and retain qualified personnel, such as engineers and other skilled labor, and in particular management and skilled employees for our foreign operations.

Our business strategy includes acquiring smaller, value-added companies and making investments that complement our existing business. These acquisitions and investments could be unsuccessful or consume significant resources, which could adversely affect our operating results.

Acquisitions and investments may involve cash expenditures, debt incurrence, operating losses and expenses that could have a material adverse effect on our financial condition and operating results. Acquisitions involve numerous other risks, including:

We have limited experience in acquiring or integrating other businesses or making investments or undertaking joint ventures with others. It may be difficult for us to complete transactions quickly and to integrate acquired operations efficiently into our current business operations. Any acquisitions or investments may ultimately harm our business or financial condition, as such acquisitions may not be successful and may ultimately result in impairment charges.

We are subject to numerous environmental and health and safety laws and regulations, as well as potential environmental liabilities, which may require us to make substantial expenditures.

Our operations and properties are subject to a variety of federal, state, local and foreign environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the management and disposal of hazardous substances or wastes, the cleanup of contaminated sites and workplace health and safety. As an owner or operator of real property, or generator of waste, we could become subject to liability for environmental contamination, regardless of whether we caused such contamination. Certain environmental laws, including the Comprehensive Environmental Response, Compensation, and Liability Act, impose joint and several liability for cleanup costs, without regard to fault, on persons who have disposed of or released hazardous substances into the environment. In addition, we could become liable to third parties for damages resulting from the disposal or release of hazardous substances into the environment. Some of our operations require

S-20

environmental permits and controls to prevent and reduce air and water pollution, and these permits are subject to modification, renewal and revocation by issuing authorities. From time to time, we could be subject to requests for information, notices of violation, and/or investigations initiated by environmental regulatory agencies relating to our operations and properties. Violations of environmental and health and safety laws can result in substantial penalties, civil and criminal sanctions, permit revocations, and facility shutdowns. Environmental and health and safety laws may change rapidly and have tended to become more stringent over time. As a result, we could incur costs for past, present, or future failure to comply with all environmental and health and safety laws and regulations. In addition, we could become subject to potential regulations concerning the emission of greenhouse gases, and while the effect of such future regulations cannot be determined at this time, they could require us to incur substantial costs in order to achieve and maintain compliance. In the ordinary course of business, we may be held responsible for any environmental damages we may cause to our customers' premises.

Additional liabilities related to taxes or potential tax adjustments could adversely impact our financial results, financial condition and cash flow.

We are subject to tax and related obligations in the jurisdictions in which we operate or do business, including state, local, federal and foreign taxes. The taxing rules of the various jurisdictions in which we operate or do business often are complex and subject to varying interpretations. Tax authorities may challenge tax positions that we take or historically have taken, and may assess taxes where we have not made tax filings or may audit the tax filings we have made and assess additional taxes, as they have done from time to time in the past. Some of these assessments may be substantial, and also may involve the imposition of substantial penalties and interest. Significant judgment is required in evaluating our tax positions and in establishing appropriate reserves. The resolutions of our tax positions are unpredictable. The payment of substantial additional taxes, penalties or interest resulting from any assessments could materially and adversely impact our results of operations, financial condition and cash flow.

Even though we have increased and may in the future increase our repatriation of cash earned by our non-U.S. subsidiaries to fund one-time redemptions of our outstanding senior secured notes or other extraordinary corporate events in the United States, we will leave a portion of such cash outside the United States as permanently reinvested earnings and profits. Accordingly, our current estimated annual effective tax rate is based on partial, and not full, repatriation of cash earned by our non-U.S. subsidiaries. If we underestimate our need for repatriated cash, or our needs change, significant tax adjustments may result.

The obligations associated with being a public company require significant resources and management attention.

Due to our being a public company with listed equity securities and Thermon Holding Corp., our direct wholly-owned subsidiary, which we refer to as THC, having SEC-registered debt securities, we are required to comply with certain laws, regulations and requirements, including the requirements of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, certain corporate governance provisions of the Sarbanes-Oxley Act of 2002, which we refer to as the Sarbanes-Oxley Act, related regulations of the SEC and requirements of the NYSE. Complying with these statutes, regulations and requirements occupies a significant amount of time of our board of directors and management and results in significant legal, accounting and other expenses. We maintain, and will continue to maintain, internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations as a public company. However, the measures we take may not be sufficient to satisfy our obligations. In addition, we cannot predict or estimate the amount of additional costs incurred in order to comply with these requirements.

S-21

Section 404 of the Sarbanes-Oxley Act requires annual management assessments and attestation by our independent registered public accounting firm of the effectiveness of our internal control over financial reporting. During fiscal 2012, we completed our required annual management assessment of the effectiveness of our internal control over financial reporting for filing with the SEC. For fiscal 2013, in addition to the management assessment, we will have to file an attestation by our independent registered public accounting firm of the effectiveness of our internal control over financial reporting with the SEC. In connection with the implementation of the necessary procedures and practices related to internal control over financial reporting, we or our independent registered public accounting firm may identify deficiencies that we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. If we fail to comply with Section 404, or if we or our independent registered public accounting firm identify and report a material weakness, it may affect the reliability of our internal control over financial reporting, which could adversely affect the market price of our common stock and subject us to sanctions or investigations by the NYSE, the SEC or other regulatory authorities, which would require additional financial and management resources.

Our current or future indebtedness could impair our financial condition and reduce the funds available to us for other purposes. Our debt agreements impose certain operating and financial restrictions, with which failure to comply could result in an event of default that could adversely affect our results of operations.

We have substantial indebtedness. At June 30, 2012, THC had $118.1 million outstanding in senior secured notes. Our senior secured notes accrue interest at a fixed rate of 9.500%, payable in cash semi-annually on May 1 and November 1 of each year until May 2017. If our cash flows and capital resources are insufficient to fund the interest payments on our senior secured notes and other debt service obligations and keep us in compliance with the covenants under our debt agreements or to fund our other liquidity needs, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We cannot ensure that we would be able to take any of these actions, that these actions would permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, which may impose significant operating and financial restrictions on us and could adversely affect our ability to finance our future operations or capital needs; obtain standby letters of credit, bank guarantees or performance bonds required to bid on or secure certain customer contracts; make strategic acquisitions or investments or enter into alliances; withstand a future downturn in our business or the economy in general; engage in business activities, including future opportunities, that may be in our interest; and plan for or react to market conditions or otherwise execute our business strategies.

If we cannot make scheduled payments on our debt, or if we breach any of the covenants in debt agreements, we will be in default and, as a result, our debt holders could declare all outstanding principal and interest to be due and payable, the lenders under our revolving credit facility could terminate their commitments to lend us money and foreclose against the assets securing our borrowings, and we could be forced into bankruptcy or liquidation.

In addition, we and certain of our subsidiaries may incur significant additional indebtedness, including additional secured indebtedness. Although the terms of our debt agreements contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of qualifications and exceptions, and additional indebtedness incurred in compliance with these restrictions could be significant. Incurring additional indebtedness could increase the risks associated with our substantial indebtedness, including our ability to service our indebtedness.

S-22

A significant portion of our business is conducted through foreign subsidiaries and our failure to generate sufficient cash flow from these subsidiaries, or otherwise repatriate or receive cash from these subsidiaries, could result in our inability to repay our indebtedness.

Approximately 66% of our fiscal 2012 revenues were generated outside of the United States. While we have been able to meet the regular interest payment obligations on our senior secured notes to date from cash generated through our U.S. operations and expect to be able to continue to do so in the future, we may seek to repatriate cash for other uses, and our ability to withdraw cash from foreign subsidiaries will depend upon the results of operations of these subsidiaries and may be subject to legal, contractual or other restrictions and other business considerations. Our foreign subsidiaries may enter into financing arrangements that limit their ability to make loans or other payments to fund payments of our debt. In particular, to the extent our foreign subsidiaries incur additional indebtedness, the ability of our foreign subsidiaries to provide us with cash may be limited. In addition, dividend and interest payments to us from our foreign subsidiaries may be subject to foreign withholding taxes, which could reduce the amount of funds we receive from our foreign subsidiaries. Dividends and other distributions from our foreign subsidiaries may also be subject to fluctuations in currency exchange rates and legal and other restrictions on repatriation, which could further reduce the amount of funds we receive from our foreign subsidiaries.

In general, when an entity in a foreign jurisdiction repatriates cash to the United States, the amount of such cash is treated as a dividend taxable at current U.S. tax rates. Accordingly, upon the distribution of cash to us from our foreign subsidiaries, we will be subject to U.S. income taxes. Although foreign tax credits may be available to reduce the amount of the additional tax liability, these credits may be limited based on our tax attributes. Therefore, to the extent that we must use cash generated in foreign jurisdictions, there may be a cost associated with repatriating cash to the United States.

We rely heavily on trade secrets to gain a competitive advantage in the market and the unenforceability of our nondisclosure agreements may adversely affect our operations.