Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on April 19, 2011

Registration No. 333-172007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

THERMON GROUP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3629 | 27-2228185 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

100 Thermon Drive, San Marcos, Texas 78666, (512) 396-5801

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Rodney Bingham

President and Chief Executive Officer

Thermon Group Holdings, Inc.

100 Thermon Drive

San Marcos, Texas 78666

(512) 396-5801

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| with copies to: | ||

Robert L. Verigan Michael P. Heinz Sidley Austin LLP One South Dearborn Street Chicago, Illinois 60603 (312) 853-7000 |

Colin J. Diamond Jin K. Kim White & Case LLP 1155 Avenue of the Americas New York, New York 10036 (212) 819-8200 |

|

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated April 19, 2011

PROSPECTUS

10,000,000 Shares

Thermon Group Holdings, Inc.

Common Stock

This is the initial public offering of the common stock of Thermon Group Holdings, Inc. We are offering 4,000,000 shares of the common stock and the selling stockholders identified in this prospectus are offering 6,000,000 shares. We will not receive any proceeds from sale of shares held by the selling stockholders. No public market currently exists for our common stock.

Our common stock has been approved for listing on the New York Stock Exchange under the symbol "THR."

We anticipate that the initial public offering price will be between $12.00 and $14.00 per share.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 17 of this prospectus.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Price to the public |

$ | $ | |||||

Underwriting discounts and commissions |

$ | $ | |||||

Proceeds to us (before expenses) |

$ | $ | |||||

Proceeds to the selling stockholders (before expenses) |

$ | $ | |||||

We and certain of the selling stockholders have granted the underwriters the option to purchase up to 1,500,000 additional shares of common stock on the same terms and conditions as set forth above if the underwriters sell more than 10,000,000 shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2011.

| Barclays Capital | Jefferies |

| William Blair & Company | BMO Capital Markets | KeyBanc Capital Markets |

Prospectus dated , 2011

You should rely only on information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on behalf of us, or to which we have referred you. Neither we nor any of the selling stockholders has authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any of the shares of common stock offered hereby by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

Unless otherwise indicated, all information contained in this prospectus concerning the industry in general, including information regarding our market position and market share within our industry and expectations regarding future growth of sales in our industry, is based on management's estimates using internal data, data from industry related publications, consumer research and marketing studies and other externally obtained data. Industry and market data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption "Risk Factors" in this prospectus.

Through and including , 2011 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The following summary highlights selected information contained in this prospectus and may not contain all the information that may be important to you. You should read this entire prospectus, including the section entitled "Risk Factors," before making an investment decision. Unless otherwise specified or the context otherwise requires, references to "$" or "dollars" in this prospectus are to United States dollars, and the terms "we," "our," "us" and the "Company," as used in this prospectus, refer to Thermon Group Holdings, Inc. and its directly and indirectly owned subsidiaries as a combined entity.

Our Business

We are one of the largest providers of highly engineered thermal solutions for process industries. For over 50 years, we have served a diverse base of thousands of customers around the world in attractive and growing markets, including energy, chemical processing and power generation. We are a global leader and one of the few thermal solutions providers with a global footprint and a full suite of products (heating cables, tubing bundles and control systems) and services (design optimization, engineering, installation and maintenance services) required to deliver comprehensive solutions to complex projects. We serve our customers locally through a global network of sales and service professionals and distributors in more than 30 countries and through our four manufacturing facilities on three continents. These capabilities and longstanding relationships with some of the largest multinational energy, chemical processing, power and engineering, procurement and construction, or EPC, companies in the world have enabled us to diversify our revenue streams and opportunistically access high growth markets worldwide.

Our thermal solutions, also referred to as heat tracing, provide an external heat source to pipes, vessels and instruments for the purposes of freeze protection, temperature and flow maintenance and environmental monitoring. Customers typically purchase our products when constructing a new facility, which we refer to as Greenfield projects, or when performing maintenance, repair and operations on a facility's existing heat-traced pipes or upgrading or expanding a current facility, which we refer to collectively as MRO/UE. Our products are low in cost relative to the total cost of a typical processing facility, but critical to the safe and profitable operation of the facility.

Our customers' need for MRO/UE solutions provides us with an attractive recurring revenue stream. Customers typically use the incumbent heat tracing provider for MRO/UE projects to avoid complications and compatibility problems associated with switching providers. We typically begin to realize meaningful MRO/UE revenue from new Greenfield installations one to three years after completion of the project as customers begin to remove and replace our products during routine and preventative maintenance on in-line mechanical equipment, such as pipes and valves. As a result, our growth has been driven by new facility construction, as well as by servicing our continually growing base of solutions installed around the world, which we refer to as our installed base.

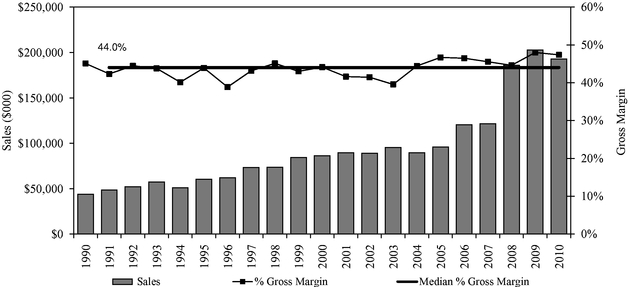

Our revenues have grown in 17 of the past 21 fiscal years, and our gross margins have averaged 44% over that period. In addition, we have generated significant growth in both revenue and profitability in recent years. Our revenue grew by 59% to $192.7 million for fiscal 2010 from $121.4 million for fiscal 2007, and gross profit grew by 65% to $91.3 million from $55.3 million over the same period. For the nine months ended December 31, 2010, we achieved revenue of $179.0 million, gross profit of $73.7 million, a net loss of $11.2 million and Adjusted EBITDA of $43.8 million and 71% of our revenues were generated outside of the United States. See note 9 to the "—Summary Historical and Pro Forma Consolidated Financial and Operating Data" table.

1

Our Industry

Alvarez & Marsal Private Equity Performance Improvement Group, LLC, or A&M, estimates that the market for industrial electric heat tracing is approximately $1 billion in annual revenues and estimates that it is growing its share of the overall heat tracing market as end users appear to continue to favor electric heat tracing solutions over steam heat tracing solutions for new installations. When revenues for steam heat tracing parts are included, A&M estimates the overall addressable market for heat tracing is approximately $2 billion in annual revenues. The industrial electric heat tracing industry is fragmented and consists of approximately 40 companies that typically only serve discrete local markets with manufactured products and provide a limited service offering. Large multinational companies drive the majority of spending for the types of major industrial facilities that require heat tracing, and we believe that they prefer providers who have a global footprint and a comprehensive suite of products and services.

The major end markets that drive demand for heat tracing include energy, petrochemical and power generation. We believe that there are attractive near- to medium-term trends in each of these end markets.

2

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors:

We have access to attractive high growth sectors of our global addressable market. We have a network of sales and service professionals and distributors in more than 30 countries and a manufacturing footprint that includes four facilities on three continents. This footprint allows us to diversify our revenue streams and opportunistically access the most attractive regions and sub-sectors of our markets. For example, growing demand for energy is pushing the search for resources to increasingly harsh cold weather countries, including Canada and Russia, where demand for our products is magnified, and strong petrochemical demand in China and India has led to a shift in chemical production to the Asia-Pacific region. We have a strong, established local presence in each of these markets.

We are a global market leader. We believe that we are the second largest industrial electric heat tracing company in the world, significantly larger than our next largest competitor and one of only a few solutions providers with a comprehensive suite of products and services, global capabilities and local on-site presence. Over our 56-year history, we have developed an installed base operated by thousands of customers and long-standing relationships with some of the largest companies in the world that drive the spending decisions for the major facilities that require our products. We believe these multinational companies prefer providers with our scale, global presence and comprehensive product and service offering.

Our highly engineered solutions are "mission critical" to our customers. Reliable thermal solutions are critical to the safe and profitable operation of our customers' facilities. These facilities are often complex, with numerous classified areas that are inherently hazardous and where product safety concerns are paramount. Therefore, we believe that our customers consider safety, reliability and customer service to be the most important purchase criteria for our products. We are a leader in the national and international standards setting process for the heat tracing industry and hold leadership positions on numerous industry standards development organizations.

Our favorable business model positions us to achieve attractive financial results. The following features of our business model contribute to our attractive financial results:

3

of Greenfield project construction, and therefore, historically, purchase orders have rarely been cancelled.

Our management team has a proven track record. Our senior management team averages approximately 22 years of experience with us and is responsible for growing Thermon through a variety of business cycles, building our global platform and developing our reputation for quality and reliability in the heat tracing industry. Our senior management and key employees will continue to have a significant equity stake in Thermon following this offering.

Our Growth Strategy

Our business strategy is designed to capitalize on our competitive strengths. Key elements of our strategy include:

Capitalize on our leading market position to continue pursuing organic growth opportunities. Our primary growth engine has traditionally been organic expansion. We will continue to focus on strategically building the necessary global sales infrastructure to expand our footprint in high growth markets. We believe that this footprint and our local presence are attractive to our customers and differentiate us from other industry participants. We expect to continue to pursue growth opportunities in emerging markets and across industry sectors in the future.

Leverage our installed base to expand our recurring revenue stream. Once the MRO/UE cycle begins, we typically realize MRO/UE revenues, which are typically higher margin than Greenfield revenues, over the life of each installation. As we continue to grow our large, global installed base with new Greenfield projects, we expect to generate incremental MRO/UE revenues related to these new projects. Since the beginning of fiscal 2008 through December 31, 2010, we estimate that we have realized approximately $290 million in revenues from Greenfield projects, which represents a meaningful opportunity for us to create MRO/UE revenues in the future.

Drive growth through alliances with major customers and suppliers. We have developed strategic alliances with other industry participants in order to enhance our growth opportunities, and we are a "pre-qualified" heat tracing provider for several of our key customers. These relationships provide us with an advantage in identifying and bidding for new Greenfield and MRO/UE projects, and we intend to target additional opportunities with suppliers of complementary products that will allow us to take mutual advantage of our customer relationships and enhance our cross-selling opportunities.

Continue to offer solutions that support evolving environmental applications. A portion of our recent growth has been driven by the use of our products in alternative energy initiatives, including carbon capture, thermal solar and coal gasification facilities. In addition, our products help our customers monitor their facilities' environmental or other regulatory compliance. We intend to continue to focus on driving growth by providing solutions that address our customers' evolving environmental application needs.

Selectively pursue investment opportunities.

4

by augmenting our geographic footprint, broadening our product offerings, expanding our technological capabilities and capitalizing on potential operating synergies.

Risk Factors

There are a number of risks related to our business, this offering and our common stock that you should consider before you decide to participate in this offering. You should carefully consider all the information presented in the section entitled "Risk Factors" in this prospectus. Some of the principal risks related to our business include the following:

These and other risks are more fully described in the section entitled "Risk Factors" in this prospectus. If any of these risks actually occur, they could materially harm our business, prospects, financial condition and results of operations. In this event, you could lose part or all of your investment in our common stock offered hereby.

5

Recent Developments

While we have not finalized our results of operations for the fourth quarter of fiscal 2011 or full fiscal year 2011, the following preliminary and unaudited information reflects our estimates with respect to such results based on currently available information.

We currently expect sales of between $58 million and $60 million for the fourth quarter of fiscal 2011 and between $237 million and $239 million for full fiscal year 2011, compared to sales of $49.8 million and $192.7 million for the fourth quarter of fiscal 2010 and full fiscal year 2010, respectively. The estimated increase in sales for the fourth quarter of fiscal 2011 was primarily the result of increased demand for our core thermal products and services. We currently expect income before provision for income taxes of between $1.1 million and $3.1 million for the fourth quarter of fiscal 2011 and a loss before provision for income taxes between $(26.7) million and $(24.7) million for full fiscal year 2011, compared to income before provision for income taxes of $5.9 million and $32.9 million for the fourth quarter of fiscal 2010 and full fiscal year 2010, respectively. Income before provision for income taxes for the fourth quarter of fiscal 2011 was positively affected by the estimated increase in sales on comparable operating expenses that reflect some efficiency from fixed costs when compared to the fourth quarter of fiscal 2010, but those effects were largely offset by the factors discussed below.

Our estimated results of operations for the fourth quarter of fiscal 2011 and full fiscal year 2011 were significantly impacted by the effects of the Acquisition referred to below. See "—Our Principal Stockholder." We estimate that amortization of intangible assets, including cost of sales adjustment will be $2.9 million in the fourth quarter of fiscal 2011 and $25.9 million for the full fiscal year 2011, compared to $0.6 million and $2.4 million for the fourth quarter of fiscal 2010 and full fiscal year 2010, respectively. The increase in intangible amortization expense over prior periods is due to purchase price accounting expense related to the Acquisition. We recognized transaction expenses related to the Acquisition of $0.5 million and $22.1 million in the fourth quarter of fiscal 2011 and full fiscal year 2011, respectively; similar expenses in fiscal 2010 totaled $1.0 million, $0.7 million of which was recognized in the fourth quarter of fiscal 2010. As a result of the issuance of $210.0 million aggregate principal amount of our senior secured notes used to partially finance the Acquisition, our interest expense also increased substantially. We estimate interest expense of $5.7 million and $29.0 million in the fourth quarter of 2011 and full fiscal year 2011, respectively. In fiscal 2010, interest expense totaled $1.8 million and $7.4 million for the fourth quarter and full fiscal year 2010, respectively. Our management fees also increased as a result of the Acquisition to an estimated $0.5 million and $2.0 million for the fourth quarter of 2011 and full fiscal year 2011, respectively, from $0.2 million and $0.9 million for the fourth quarter of 2010 and full fiscal year 2010, respectively. Excluding these items that were significantly affected by the Acquisition, we estimate that our income before provision for income taxes for the fourth quarter of fiscal 2011 would be between $10.7 million and $12.7 million and for full fiscal year 2011 would be between $52.3 million and $54.3 million. For additional discussion regarding factors impacting fiscal year 2011 results of operations prior to the fourth quarter, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Nine Months Ended December 31, 2010 (Combined) Compared to the Nine Months Ended December 31, 2009 (Non-GAAP)."

Because we have not completed our closing processes, including our analysis of the potential impact of additional taxes arising from our receipt on March 31, 2011 of dividends from certain of our foreign subsidiaries in an aggregate amount of $34.3 million to be used to fund the redemption of $21.0 million aggregate principal amount of our senior secured notes scheduled to occur on April 29, 2011 and to pay certain transaction costs incurred in connection with this offering, we are not currently able to estimate our income tax benefit (expense) or net income (loss) for the fourth quarter of fiscal 2011. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Repatriation considerations." Although we are not able to estimate

6

those items at this time, we have not identified any unusual or unique events or trends that occurred during the fourth quarter of fiscal 2011 that might materially affect our results of operations for that quarter, other than those discussed above. We believe that the foregoing information about our sales and income before provision for income taxes, even when unaccompanied by information regarding our net income (loss) that is not yet available, is helpful to an investor's understanding of our performance and is a meaningful indicator for assessing our operating performance because it demonstrates our continued ability to capture organic growth opportunities and achieve attractive operating results.

We are currently in the process of preparing our audited consolidated financial statements as of and for the year ended March 31, 2011. These financial statements are not currently available and are not expected to be available and filed with the Securities and Exchange Commission until after the consummation of this offering. Estimates of financial results and position are inherently uncertain and subject to change, and adjustments may arise and actual results may differ materially from these estimates. Accordingly, you are cautioned not to place undue reliance on the estimates. This information is a summary of estimated financial data and should be read in conjunction with the "Risk Factors," "Selected Historical and Pro Forma Consolidated Financial and Operating Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our unaudited and audited consolidated financial statements and the accompanying notes appearing elsewhere in this prospectus.

Our Principal Stockholder

Our principal stockholder, CHS Capital LLC, or CHS, acquired its interest in us on April 30, 2010, which we refer to as the Acquisition. CHS beneficially owns 50% of our outstanding shares of common stock on a fully-diluted basis. Two other private equity firms also acquired stakes in us at the time of the Acquisition. We refer to CHS and such other firms collectively in this prospectus as our sponsors.

CHS is a Chicago-based private equity firm with 23 years of experience investing in the middle market. Targeting well-managed companies with enterprise values between $75 and $500 million, CHS partners with management teams to focus on accelerating growth, enhancing capabilities and resources and positioning companies for attractive exits. CHS has specialized expertise in the consumer and business services; distribution; and industrial, infrastructure and energy sectors and has completed 74 platform investments and 237 add-on investments. Founded in 1988, CHS has formed five private equity funds and has $2.3 billion of committed capital in active investment funds. CHS currently manages 16 portfolio investments with combined annual revenues in excess of $4.5 billion.

Our Corporate Information

We are incorporated in Delaware and our corporate offices are located at 100 Thermon Drive, San Marcos, TX 78666. Our telephone number is (512) 396-5801. Our website address is www.thermon.com. None of the information on our website or any other website identified herein is part of this prospectus or the registration statement of which it forms a part.

7

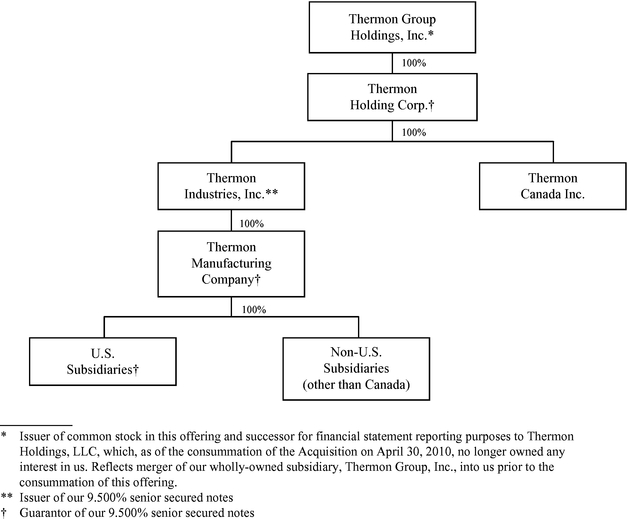

Our Organizational Chart

The following chart summarizes our corporate structure:

8

Total common stock offered |

10,000,000 shares | |

Common stock offered by us |

4,000,000 shares |

|

Common stock offered by selling stockholders |

6,000,000 shares |

|

Common stock to be outstanding after this offering |

28,933,407 shares |

|

Over-allotment option |

We and certain of the selling stockholders have granted the underwriters a 30-day option to purchase up to 1,425,098 and 74,902, respectively, of additional shares of our common stock to cover over-allotments, if any. |

|

Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $45.9 million (or approximately $63.1 million if the underwriters exercise their option to purchase additional shares of common stock in full), after deducting the underwriting discounts and commissions in connection with this offering and estimated offering expenses payable by us, based on an assumed offering price of $13.00 per share, the midpoint of the range set forth on the cover page of this prospectus. We expect to use $21.6 million of the net proceeds to prepay a portion of the $189.0 million principal amount of our 9.500% Senior Secured Notes that will be outstanding immediately prior to the consummation of this offering, which mature on May 1, 2017, which we refer to as our senior secured notes, and the balance for general corporate purposes. See "Use of Proceeds." |

|

|

We will not receive any proceeds from the shares sold by the selling stockholders. |

|

Risk factors |

You should carefully read the "Risk Factors" section of this prospectus for a discussion of factors that you should consider before deciding to invest in shares of our common stock. |

|

New York Stock Exchange symbol |

THR |

The number of shares of our common stock to be outstanding following this offering is based on 24,933,407 shares of our common stock outstanding as of the date of this prospectus, but excludes 5,660,488 shares of common stock reserved for issuance under our equity incentive plans, of which options to purchase 2,757,524 shares have been granted at a weighted average exercise price of $5.38 per share, all of which will vest and become exercisable upon the consummation of this offering.

Concurrently with the pricing of this offering, we intend to grant to our executive officers and certain other employees options to purchase 122,000 shares with an exercise price equal to the initial public offering price from the number of shares of common stock reserved for issuance under our equity incentive plans.

9

Unless otherwise expressly stated or the context otherwise requires, all information in this prospectus gives effect to and assumes the following:

10

SUMMARY HISTORICAL AND PRO FORMA CONSOLIDATED FINANCIAL AND OPERATING DATA

The following tables set forth certain summary historical and pro forma consolidated financial and operating data for the fiscal years ended March 31, 2008, March 31, 2009 and March 31, 2010, for the nine months ended December 31, 2009 and December 31, 2010, and as of December 31, 2010, and certain pro forma financial information for the fiscal year ended March 31, 2010 and for the nine months ended December 31, 2009 and December 31, 2010. The data set forth below should be read in conjunction with the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Capitalization," "Unaudited Pro Forma Condensed Consolidated Financial Statements," and "Selected Historical and Pro Forma Consolidated Financial and Operating Data," each of which is contained elsewhere in this prospectus, and our consolidated financial statements and the notes thereto for the fiscal years ended March 31, 2008, March 31, 2009 and March 31, 2010 and for the nine months ended December 31, 2009 and December 31, 2010, each of which is contained elsewhere in this prospectus.

In this prospectus, we have included the condensed consolidated financial statements of Thermon Group Holdings, Inc. as of December 31, 2010 and for the period from May 1, 2010 through December 31, 2010 ("successor") and the condensed consolidated financial statements of Thermon Holdings, LLC for the fiscal years ended March 31, 2010 and March 31, 2009, for the period from August 30, 2007 through March 31, 2008, for the nine months ended December 31, 2009 ("predecessor"), and for the period from April 1, 2007 through August 29, 2007 ("pre-predecessor"). Concurrent with the consummation of the Acquisition on April 30, 2010, Thermon Holdings, LLC no longer owned any interest in us, and, beginning with the period from May 1, 2010 through December 31, 2010, we reported the consolidated financial statements of Thermon Group Holdings, Inc. We do not anticipate that there would have been any material difference in our consolidated financial statements and notes thereto for the fiscal years ended March 31, 2008, March 31, 2009 and March 31, 2010 and for the nine months ended December 31, 2009 had such statements been prepared for Thermon Group Holdings, Inc., except as it relates to purchase accounting in connection with the Acquisition.

The presentation of fiscal 2008 includes the combined results of the pre-predecessor and predecessor owners for fiscal 2008 and the predecessor and successor owners for the nine months ended December 31, 2010, respectively. We have presented the combination of these respective periods because it provides an easier-to-read discussion of the results of operations and provides the investor with information from which to analyze our financial results in a manner that is consistent with the way management reviews and analyzes our results of operations. In addition, the combined results provide investors with the most meaningful comparison between our results for prior and future periods. Please refer to notes 1 and 2 to the "Selected Historical and Pro Forma Consolidated Financial and Operating Data" table and our historical consolidated financial statements and notes thereto for the year ended March 31, 2008 and the nine months ended December 31, 2010 included elsewhere in this prospectus for a separate presentation of the results for the pre-predecessor and predecessor and predecessor and successor periods.

The summary unaudited pro forma data have been prepared to give effect to the CHS Transactions (as defined below), this offering and the application of the net proceeds therefrom as if they had occurred on April 1, 2009. Assumptions underlying the pro forma adjustments are described in the section entitled "Unaudited Pro Forma Condensed Consolidated Financial Statements—Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements" contained elsewhere in this prospectus. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. Please see "Unaudited Pro Forma Condensed Consolidated Financial Statements—Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements" for a more detailed discussion of how pro forma adjustments are presented in our unaudited pro forma

11

condensed consolidated financial statements. The unaudited pro forma condensed consolidated data is provided for informational purposes only. The summary unaudited pro forma data do not purport to represent what our results of operations actually would have been if the CHS Transactions, this offering and the application of the net proceeds therefrom had occurred at any date, nor do such data purport to project the results of operations for any future period.

As used in this prospectus, the CHS Transactions refer collectively to the equity investment in us by CHS, our other sponsors and certain members of our management team, the entry into our revolving credit facility, the repayment of amounts owed under, and the termination of, certain then-existing revolving credit and term loan facilities, the issuance of our senior secured notes and the application of the gross proceeds from the offering of our senior secured notes and the equity investment to complete the Acquisition and to pay related fees and expenses of these transactions.

| |

Pre-Predecessor/ Predecessor Combined (Non-GAAP)(1) |

Predecessor | Predecessor/ Successor Combined (Non-GAAP)(2) |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31, | Nine Months Ended December 31, | |||||||||||||||

| |

2008 | 2009 | 2010 | 2009 | 2010 | ||||||||||||

| |

(dollars in thousands, except share and per share data) |

||||||||||||||||

Consolidated Statement of Operations Data: |

|||||||||||||||||

Sales |

$ | 185,811 | $ | 202,755 | $ | 192,713 | $ | 142,905 | $ | 178,968 | |||||||

Cost of sales |

102,946 | 105,456 | 101,401 | 73,966 | 97,723 | ||||||||||||

Purchase accounting adjustments(3) |

7,146 | — | — | — | 7,519 | ||||||||||||

Gross profit |

$ | 75,719 | $ | 97,299 | $ | 91,312 | $ | 68,939 | $ | 73,726 | |||||||

Operating expenses: |

|||||||||||||||||

Marketing, general and administrative and engineering expenses |

46,569 | 48,982 | 46,481 | 33,099 | 40,078 | ||||||||||||

Management fees |

475 | 825 | 862 | 671 | 1,412 | ||||||||||||

Amortization of intangible assets |

6,716 | 6,627 | 2,426 | 1,803 | 15,341 | ||||||||||||

Income from operations |

$ | 21,959 | $ | 40,865 | $ | 41,543 | $ | 33,366 | $ | 16,895 | |||||||

Interest expense, net |

(8,207 | ) | (9,531 | ) | (7,351 | ) | (5,516 | ) | (23,323) | (4) | |||||||

Gain/(loss) on disposition of PP&E |

(116 | ) | (18 | ) | (1 | ) | — | — | |||||||||

Miscellaneous income/(expense)(5) |

(12,937 | ) | (3,120 | ) | (1,285 | ) | (881 | ) | (21,306 | ) | |||||||

Income (loss) from continuing operations before taxes |

$ | 699 | $ | 28,196 | $ | 32,906 | $ | 26,969 | $ | (27,734 | ) | ||||||

Income tax benefit (expense) |

(21,712 | ) | (1,795 | ) | (13,966 | ) | (12,241 | ) | 16,507 | ||||||||

Net income (loss)(6) |

$ | (21,013 | ) | $ | 26,401 | $ | 18,940 | $ | 14,728 | $ | (11,227 | ) | |||||

12

| |

Pre-Predecessor/ Predecessor Combined (Non-GAAP)(1) |

Predecessor | Predecessor/ Successor Combined (Non-GAAP)(2) |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31, | Nine Months Ended December 31, | |||||||||||||||

| |

2008 | 2009 | 2010 | 2009 | 2010 | ||||||||||||

| |

(dollars in thousands, except share and per share data) |

||||||||||||||||

Pro Forma Statement of Operations Data:(7) |

|||||||||||||||||

Net income (loss) |

$ | 18,940 | $ | 14,728 | $ | (11,227 | ) | ||||||||||

Pro forma adjustments to net income (loss): |

|||||||||||||||||

Purchase accounting adjustment |

— | — | 7,519 | ||||||||||||||

Management fees |

750 | 563 | 1,396 | ||||||||||||||

Amortization of purchase intangibles |

(9,057 | ) | (6,809 | ) | 6,729 | ||||||||||||

Net interest expense |

(10,984 | ) | (8,182 | ) | 9,384 | ||||||||||||

CHS Transactions costs |

309 | — | 21,605 | ||||||||||||||

Tax effect of adjustments |

6,643 | 5,050 | (16,322 | ) | |||||||||||||

Pro forma net income (loss) |

$ | 6,601 | $ | 5,350 | $ | 19,084 | |||||||||||

Pro forma net income per share |

|||||||||||||||||

Basic |

$ | 0.23 | $ | 0.19 | $ | 0.66 | |||||||||||

Diluted |

$ | 0.22 | $ | 0.18 | $ | 0.63 | |||||||||||

Pro forma weighted average shares outstanding |

|||||||||||||||||

Basic |

28,887,987 | 28,887,987 | 28,887,987 | ||||||||||||||

Diluted |

30,477,028 | 30,477,028 | 30,477,028 | ||||||||||||||

Other Financial Data: |

|||||||||||||||||

Adjusted gross margin(8) |

44.6 | % | 48.0 | % | 47.4 | % | 48.2 | % | 45.4 | % | |||||||

Adjusted EBITDA(9) |

$ | 38,023 | $ | 48,322 | $ | 46,555 | $ | 36,379 | $ | 43,772 | |||||||

Capital expenditures |

5,315 | 2,708 | 1,587 | 976 | 1,246 | ||||||||||||

Operating Data: |

|||||||||||||||||

Backlog at end of period(10) |

$ | 77,497 | $ | 66,779 | $ | 82,459 | $ | 79,473 | $ | 79,749 | |||||||

| |

As of December 31, 2010 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(11) | |||||

| |

(dollars in thousands) |

||||||

Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 35,201 | $ | 30,444 | |||

Accounts receivable, net |

47,073 | 47,073 | |||||

Inventories, net |

27,600 | 27,600 | |||||

Total assets |

434,061 | 428,568 | |||||

Total debt, including current portion |

210,000 | 168,000 | |||||

Total shareholders' equity |

121,062 | 157,569 | |||||

13

equity. This resulted in additional amortization expense, interest expense and tax expense for the period from August 30, 2007 through March 31, 2008 ("predecessor") as compared to the period from April 1, 2007 through August 29, 2007 ("pre-predecessor"). Except for purchase accounting adjustments, the results for the two combined periods are comparable. Therefore, we believe that combining the two periods into a single period for comparative purposes gives the most clarity for the users of this financial information. Please refer to note 1 to the "Selected Historical and Pro Forma Consolidated Financial and Operating Data" table and our historical consolidated financial statements and notes thereto for the year ended March 31, 2008 included elsewhere in this prospectus for a separate presentation of the results for the pre-predecessor and predecessor periods in accordance with U.S. generally accepted accounting principles, which we refer to as GAAP.

14

the weighted average shares outstanding for the pre-predecessor, predecessor and successor periods.

15

| |

Pre-Predecessor/ Predecessor Combined (Non-GAAP) |

Predecessor | Predecessor/ Successor Combined (Non-GAAP) |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended March 31, | Nine Months Ended December 31, | |||||||||||||||

| |

2008 | 2009 | 2010 | 2009 | 2010 | ||||||||||||

| |

(dollars in thousands) |

||||||||||||||||

Net income (loss) |

$ | (21,013 | ) | $ | 26,401 | $ | 18,940 | $ | 14,728 | $ | (11,227 | ) | |||||

Interest expense, net |

8,207 | 9,531 | 7,351 | 5,516 | 23,323 | ||||||||||||

Income tax expense |

21,712 | 1,795 | 13,966 | 12,241 | (16,507 | ) | |||||||||||

Depreciation and amortization expense |

15,892 | 8,497 | 4,424 | 3,223 | 24,432 | ||||||||||||

Stock-based compensation expense |

— | — | — | — | 734 | ||||||||||||

Audax Transaction expenses(a) |

8,820 | — | — | — | — | ||||||||||||

CHS Transactions expenses(b) |

— | — | 309 | — | 21,605 | ||||||||||||

Other sale transaction expenses(c) |

— | 1,273 | — | — | — | ||||||||||||

Other auction transaction expenses(d) |

— | — | 703 | — | — | ||||||||||||

Non-recurring employee bonus(e) |

3,930 | — | — | — | — | ||||||||||||

Management fees(f) |

475 | 825 | 862 | 671 | 1,412 | ||||||||||||

Adjusted EBITDA |

$ | 38,023 | $ | 48,322 | $ | 46,555 | $ | 36,379 | $ | 43,772 | |||||||

16

Investing in our common stock involves substantial risks. In addition to the other information in this prospectus, you should carefully consider the following risk factors before investing in our common stock. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also materially adversely affect our business, financial condition or results of operations. We cannot assure you that any of the events discussed in the risk factors below, or other risks, will not occur. If they do, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment. Certain statements in "Risk Factors" are forward-looking statements. See "Forward-Looking Statements" elsewhere in this prospectus.

Risks Related to Our Business and Industry

The markets we serve are subject to general economic conditions and cyclical demand, which could harm our business and lead to significant shifts in our results of operations from quarter to quarter that make it difficult to project long-term performance.

Our operating results have been and may in the future be adversely affected by general economic conditions and the cyclical pattern of certain industries in which our customers and end users operate. Demand for our products and services depends in large part upon the level of capital and maintenance expenditures by many of our customers and end users, in particular those in the energy, chemical processing and power generation industries, and firms that design and construct facilities for these industries. These customers' expenditures historically have been cyclical in nature and vulnerable to economic downturns. Prolonged periods of little or no economic growth could decrease demand for oil and gas which, in turn, could result in lower demand for our products and a negative impact on our results of operations and cash flows. In addition, this historically cyclical demand may lead to significant shifts in our results of operations from quarter to quarter, which limits our ability to make accurate long-term predictions about our future performance.

A sustained downturn in the energy industry, due to oil and gas prices decreasing or otherwise, could decrease demand for some of our products and services, which could materially and adversely affect our business, financial condition and results of operations.

A significant portion of our revenue historically has been generated by end-users in the upstream oil and gas markets. The businesses of most of our customers in the energy industry are, to varying degrees, cyclical and historically have experienced periodic downturns. Profitability in the energy industry is highly sensitive to supply and demand cycles and commodity prices, which historically have been volatile, and our customers in this industry historically have tended to delay large capital projects, including expensive maintenance and upgrades, during industry downturns. Customer project delays may limit our ability to realize value from our backlog as expected and cause fluctuations in the timing or the amount of revenue earned and the profitability of our business in a particular period. In addition, such delays may lead to significant fluctuations in results of operations from quarter to quarter, making it difficult to predict our financial performance on a quarterly basis.

Demand for a significant portion of our products and services depends upon the level of capital expenditure by companies in the energy industry, which depends, in part, on energy prices. Prices of oil and gas have been very volatile over the past three years, with significant increases until achieving historic highs in July 2008, followed immediately by a steep decline through 2009 and a moderate increase throughout 2010. A sustained downturn in the capital expenditures of our customers, whether due to a decrease in the market price of oil and gas or otherwise, may delay projects, decrease demand for our products and services and cause downward pressure on the prices we charge, which, in turn, could have a material adverse effect on our business, financial condition and results of operations. Such

17

downturns, including the perception that they might continue, could have a significant negative impact on the market price of our common stock.

As a global business, we are exposed to economic, political and other risks in a number of countries, which could materially reduce our revenues, profitability or cash flows or materially increase our liabilities. If we are unable to continue operating successfully in one or more foreign countries, it may have a material adverse effect on our business and financial condition.

For fiscal 2010, approximately 66% of our revenues were generated by outside of the United States, and approximately 40% were generated outside North America. In addition, one of our key growth strategies is to continue to expand our global footprint in emerging and high growth markets around the world, although we may not be successful in expanding our international business.

Conducting business outside the United States is subject to additional risks, including the following:

One or more of these factors could prevent us from successfully expanding our presence in international markets, could have a material adverse effect on our revenues, profitability or cash flows or cause an increase in our liabilities. We may not succeed in developing and implementing policies and strategies to counter the foregoing factors effectively in each location where we do business.

A failure to deliver our backlog on time could affect our future sales and profitability and our relationships with our customers, and if we were to experience a material amount of modifications or cancellations of orders, our sales could be negatively impacted.

Our backlog is comprised of the portion of firm signed purchase orders or other written contractual commitments received from customers that we have not recognized as revenue. The dollar amount of backlog as of December 31, 2010 was $79.7 million. The timing of our recognition of revenue out of our backlog is subject to a variety of factors that may cause delays, many of which, including fluctuations in our customers' delivery schedules, are beyond our control. Such delays may lead to significant fluctuations in results of operations from quarter to quarter, making it difficult to predict our financial performance on a quarterly basis. For example, a delay in the completion of a

18

large Greenfield project resulted in approximately several million dollars in revenue attributable to such project being realized in the quarter ended September 30, 2010, which was one quarter later than expected. Further, while we have historically experienced few order cancellations and the amount of order cancellations has not been material compared to our total contract volume, if we were to experience a significant amount of cancellations of or reductions in purchase orders, it would reduce our backlog and, consequently, our future sales and results of operations.

Our ability to meet customer delivery schedules for our backlog is dependent on a number of factors including, but not limited to, access to raw materials, an adequate and capable workforce, engineering expertise for certain projects, sufficient manufacturing capacity and, in some cases, our reliance on subcontractors. For example, we are currently evaluating the expansion of our principal manufacturing facility in San Marcos, Texas, which we expect will serve our production capacity needs at that location for at least five years based on our current business plan. We cannot, however, provide any assurance that such expansion will be undertaken in a timely fashion, or at all, or that we will realize the gain in capacity we expect. The availability of these factors may in some cases be subject to conditions outside of our control. A failure to deliver in accordance with our performance obligations may result in financial penalties and damage to existing customer relationships, our reputation and a loss of future bidding opportunities, which could cause the loss of future business and could negatively impact our financial performance.

Our future revenue depends in part on our ability to bid and win new contracts. Our failure to effectively obtain future contracts could adversely affect our profitability.

Our future revenue and overall results of operations require us to successfully bid on new contracts and, in particular, contracts for large Greenfield projects, which are frequently subject to competitive bidding processes. For example, for fiscal 2010, approximately 17% of our revenue consisted of designing, engineering, supplying and/or installing equipment for large Greenfield projects pursuant to competitive bids. Our revenue from major projects depends in part on the level of capital expenditures in our principal end markets, including the energy, chemical processing and power generation industries. The number of such projects we win in any year fluctuates, and is dependent upon the number of projects available and our ability to bid successfully for such projects. Contract proposals and negotiations are complex and frequently involve a lengthy bidding and selection process, which is affected by a number of factors, such as competitive position, market conditions, financing arrangements and required governmental approvals. For example, a client may require us to provide a bond or letter of credit to protect the client should we fail to perform under the terms of the contract. If negative market conditions arise, or if we fail to secure adequate financial arrangements or required governmental approvals, we may not be able to pursue particular projects, which could adversely affect our profitability.

We may be unable to compete successfully in the highly competitive markets in which we operate.

We operate in competitive domestic and international markets and compete with highly competitive domestic and international manufacturers and service providers. The fragmented nature of the industrial electric heat tracing industry, which consists of approximately 40 companies, makes the market for our products and services highly competitive. A number of our direct and indirect competitors are major multinational corporations, some of which have substantially greater technical, financial and marketing resources than us, and additional competitors may enter these markets. Our competitors may develop products that are superior to our products, develop methods of more efficiently and effectively providing products and services, or adapt more quickly than we do to new technologies or evolving customer requirements. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced sales and earnings.

19

Volatility in currency exchange rates may adversely affect our financial condition, results of operations or cash flows.

We may not be able to effectively manage our exchange rate and/or currency transaction risks. Volatility in currency exchange rates may decrease our revenues and profitability, adversely affect our liquidity and impair our financial condition. We have not historically entered into hedging instruments to manage our exchange rate risk.

Our non-U.S. subsidiaries generally sell their products and services in the local currency, but obtain a significant amount of their products from our facilities located in another country, primarily the United States, Canada or Europe. In particular, significant fluctuations in the Canadian Dollar, the Russian Ruble, the Euro or the Pound Sterling against the U.S. Dollar could adversely affect our results of operations. We also bid for certain foreign projects in U.S. Dollars or Euros. If the U.S. Dollar or Euro strengthens relative to the value of the local currency, we may be less competitive in bidding for those projects. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures about Market Risk" for additional information regarding our foreign currency exposure relating to operations.

In order to meet our global cash management needs, we often transfer cash between the United States and foreign operations and sometimes between foreign entities. In addition, our debt service requirements are primarily in U.S. Dollars and a substantial portion of our cash flow is generated in foreign currencies, and we may need to repatriate cash to the United States in order to meet our U.S. debt service obligations, including on our senior secured notes. These transfers of cash expose us to currency exchange rate risks, and significant changes in the value of the foreign currencies relative to the U.S. Dollar could limit our ability to meet our debt obligations, including under our senior secured notes, and impair our financial condition.

Because our consolidated financial results are reported in U.S. Dollars, and we generate a substantial amount of our sales and earnings in other currencies, the translation of those results into U.S. Dollars can result in a significant decrease in the amount of those sales and earnings. In addition, fluctuations in currencies relative to the U.S. Dollar may make it more difficult to perform period-to-period comparisons of our reported results of operations.

Due to the nature of our business, we may be liable for damages based on product liability claims. We are also exposed to potential indemnity claims from customers for losses due to our work or if our employees are injured performing services.

We face a risk of exposure to claims in the event that the failure, use or misuse of our products results, or is alleged to result, in death, bodily injury, property damage or economic loss. Although we maintain quality controls and procedures, we cannot be sure that our products will be free from defects. If any of our products prove to be defective, we may be required to replace the product. In addition, we may be required to recall or redesign such products, which could result in significant unexpected costs. Some of our products contain components manufactured by third parties, which may also have defects. In addition, if we are installing our products, we may be subject to claims that our installation caused damage or loss. Our products are often installed in our customers' or end users' complex and capital intensive facilities in inherently hazardous or dangerous industries, including energy, chemical processing and power generation, where the potential liability from risk of loss could be substantial. Although we currently maintain product liability coverage, which we believe is adequate for the continued operation of our business, we cannot be certain that this insurance coverage will continue to be available to us at a reasonable cost or, if available, will be adequate to cover any potential liabilities. With respect to components manufactured by third-party suppliers, the contractual indemnification that we seek from our third-party suppliers may be insufficient to cover claims made against us. In the event that we do not have adequate insurance or contractual indemnification, product

20

liabilities could have a material adverse effect on our business, financial condition or results of operations.

Under our customer contracts, we often indemnify our customers from damages and losses they incur due to our work or services performed by us, as well as for losses our customers incur due to any injury or loss of life suffered by any of our employees or our subcontractor's personnel occurring on our customer's property. Many, but not all, of our customer contracts include provisions designed to limit our potential liability by excluding consequential damages and lost profits from our indemnity obligations. However, substantial indemnity claims may exceed the amount of insurance we maintain and could have a material adverse affect on our reputation, business, financial condition or results of operations.

A material disruption at any of our manufacturing facilities could adversely affect our results of operations.

If operations at any of our manufacturing facilities were to be disrupted as a result of significant equipment failures, natural disasters, power outages, fires, explosions, terrorism, adverse weather conditions, labor disputes or other reasons, we may be unable to fill customer orders and otherwise meet customer demand for our products, which could adversely affect our financial performance. For example, our marketing and research & development buildings, located on the same campus as our corporate headquarters and primary manufacturing facility in San Marcos, Texas, were destroyed by a tornado in January 2007.

Interruptions in production, in particular at our manufacturing facilities in San Marcos, Texas, or Calgary, Canada, at which we manufacture the majority of our products, could increase our costs and reduce our sales. Any interruption in production capability could require us to make substantial capital expenditures to fill customer orders, which could negatively affect our profitability and financial condition. We maintain property damage insurance that we believe to be adequate to provide for reconstruction of facilities and equipment, as well as business interruption insurance to mitigate losses resulting from any production interruption or shutdown caused by an insured loss. However, any recovery under our insurance policies may not offset the lost sales or increased costs that may be experienced during the disruption of operations, which could adversely affect our financial performance.

Our international operations and non-U.S. subsidiaries are subject to a variety of complex and continually changing laws and regulations and, in particular, export control regulations.

Due to the international scope of our operations, we are subject to a complex system of laws and regulations, including regulations issued by the U.S. Department of Justice, or the DOJ, the SEC, the Internal Revenue Service, or the IRS, Customs and Border Protection, or CBP, the Bureau of Industry and Security, or BIS, the Office of Antiboycott Compliance, or OAC, and the Office of Foreign Assets Control, or OFAC, as well as the counterparts of these agencies in foreign countries. While we believe we are in material compliance with these regulations and maintain programs intended to achieve compliance, we may currently or may in the future be in violation of these regulations. In 2009, we entered into settlement agreements with BIS and OFAC, and in 2010, we entered into a settlement agreement with OAC, in each case with respect to matters we voluntarily disclosed to such agencies.

Any alleged or actual violations may subject us to government scrutiny, investigation and civil and criminal penalties and may limit our ability to export our products or provide services outside the United States. Additionally, we cannot predict the nature, scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which existing laws might be administered or interpreted.

21

In addition, our geographically widespread operations, coupled with our relatively smaller offices in many countries and our reliance on third party subcontractors, suppliers and manufacturers in the completion of our projects, make it more difficult to oversee and ensure that all our offices and employees comply with our internal policies and control procedures. We have in the past experienced employee theft, although the amounts involved have not been material, and we cannot assure you that we can ensure compliance with our internal control policies and procedures.

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar foreign anti-corruption laws.

The U.S. Foreign Corrupt Practices Act, which we refer to as the FCPA, and similar foreign anti-corruption laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value to influence foreign government officials for the purpose of obtaining or retaining business or obtaining an unfair advantage. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws, with more frequent voluntary self-disclosures by companies, aggressive investigations and enforcement proceedings by both the DOJ and the SEC resulting in record fines and penalties, increased enforcement activity by non-U.S. regulators, and increases in criminal and civil proceedings brought against companies and individuals. Because many of our customers and end users are involved in infrastructure construction and energy production, they are often subject to increased scrutiny by regulators. Our internal policies mandate compliance with these anti-corruption laws. We operate in many parts of the world that are recognized as having governmental corruption problems to some degree and where strict compliance with anti-corruption laws may conflict with local customs and practices. Our continued operation and expansion outside the United States, including in developing countries, could increase the risk of such violations in the future. Despite our training and compliance programs, we cannot assure you that our internal control policies and procedures always will protect us from unauthorized reckless or criminal acts committed by our employees or agents. In the event that we believe or have reason to believe that our employees or agents have or may have violated applicable anti-corruption laws, including the FCPA, we may be required to investigate or have outside counsel investigate the relevant facts and circumstances, which can be expensive and require significant time and attention from senior management. Violations of these laws may result in severe criminal or civil sanctions, which could disrupt our business and result in a material adverse effect on our reputation, business, results of operations or financial condition.

Our dependence on subcontractors could adversely affect our results of operations.

We often rely on third party subcontractors as well as third party suppliers and manufacturers to complete our projects. To the extent that we cannot engage subcontractors or acquire supplies or materials, our ability to complete a project in a timely fashion or at a profit may be impaired. If the amount we are required to pay for these goods and services exceeds the amount we have estimated in bidding for fixed-price contracts, we could experience losses on these contracts. In addition, if a subcontractor or supplier is unable to deliver its services or materials according to the negotiated contract terms for any reason, including the deterioration of its financial condition or over-commitment of its resources, we may be required to purchase the services or materials from another source at a higher price. This may reduce the profit to be realized or result in a loss on a project for which the services or materials were needed.

We may lose money on fixed-price contracts, and we are exposed to liquidated damages risks in many of our customer contracts.

We often agree to provide products and services under fixed-price contracts, including our turnkey solutions. Under these contracts, we are typically responsible for all cost overruns, other than the amount of any cost overruns resulting from requested changes in order specifications. Our actual costs

22

and any gross profit realized on these fixed-price contracts could vary from the estimated costs on which these contracts were originally based. This may occur for various reasons, including errors in estimates or bidding, changes in availability and cost of labor and raw materials and unforeseen technical and logistical challenges, including with managing our geographically widespread operations and use of third party subcontractors, suppliers and manufacturers in many countries. These variations and the risks inherent in our projects may result in reduced profitability or losses on projects. Depending on the size of a project, variations from estimated contract performance could have a material adverse impact on our operating results. In addition, many of our customer contracts, including fixed-price contracts, contain liquidated damages provisions in the event that we fail to perform our obligations thereunder in a timely manner or in accordance with the agreed terms, conditions and standards.

If we lose our senior management or other key employees, our business may be adversely affected.

Our ability to successfully operate and grow our global business and implement our strategies is largely dependent on the efforts, abilities and services of our senior management and other key employees. If we lose the services of our senior management or other key employees and are unable to find qualified replacements with comparable experience in the industry, our business could be negatively affected. Our future success will also depend on, among other factors, our ability to attract and retain qualified personnel, such as engineers and other skilled labor, and in particular management and skilled employees for our foreign operations.

Our business strategy includes acquiring smaller, value-added companies and making investments that complement our existing business. These acquisitions and investments could be unsuccessful or consume significant resources, which could adversely affect our operating results.

Acquisitions and investments may involve cash expenditures, debt incurrence, operating losses and expenses that could have a material adverse effect on our financial condition and operating results. Acquisitions involve numerous other risks, including:

We have limited experience in acquiring or integrating other businesses or making investments or undertaking joint ventures with others. It may be difficult for us to complete transactions quickly and to integrate acquired operations efficiently into our current business operations. Any acquisitions or investments may ultimately harm our business or financial condition, as such acquisitions may not be successful and may ultimately result in impairment charges.

We are subject to numerous environmental and health and safety laws and regulations, as well as potential environmental liabilities, which may require us to make substantial expenditures.

Our operations and properties are subject to a variety of federal, state, local and foreign environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the management and disposal of hazardous substances or wastes, the cleanup of contaminated sites and workplace health and safety. As an owner or operator of real property, or generator of waste, we could become subject to liability for environmental contamination, regardless of whether we caused such contamination. Certain environmental laws, including the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, impose joint and several liability for cleanup

23

costs, without regard to fault, on persons who have disposed of or released hazardous substances into the environment. In addition, we could become liable to third parties for damages resulting from the disposal or release of hazardous substances into the environment. Some of our operations require environmental permits and controls to prevent and reduce air and water pollution, and these permits are subject to modification, renewal and revocation by issuing authorities. From time to time, we could be subject to requests for information, notices of violation, and/or investigations initiated by environmental regulatory agencies relating to our operations and properties. Violations of environmental and health and safety laws can result in substantial penalties, civil and criminal sanctions, permit revocations, and facility shutdowns. Environmental and health and safety laws may change rapidly and have tended to become more stringent over time. As a result, we could incur costs for past, present, or future failure to comply with all environmental and health and safety laws and regulations. In addition, we could become subject to potential regulations concerning the emission of greenhouse gases, and while the effect of such future regulations cannot be determined at this time, they could require us to incur substantial costs in order to achieve and maintain compliance. In the ordinary course of business, we may be held responsible for any environmental damages we may cause to our customers' premises.

Additional liabilities related to taxes or potential tax adjustments could adversely impact our financial results, financial condition and cash flow.

We are subject to tax and related obligations in the jurisdictions in which we operate or do business, including state, local, federal and foreign taxes. The taxing rules of the various jurisdictions in which we operate or do business often are complex and subject to varying interpretations. Tax authorities may challenge tax positions that we take or historically have taken, and may assess taxes where we have not made tax filings or may audit the tax filings we have made and assess additional taxes, as they have done from time to time in the past. Some of these assessments may be substantial, and also may involve the imposition of substantial penalties and interest. In particular, in the years eligible for future audit, we consummated certain significant business transactions that we treated or intend to treat as not resulting in immediate gain for income tax purposes. Significant judgment is required in evaluating our tax positions and in establishing appropriate reserves. The resolutions of our tax positions are unpredictable. The payment of substantial additional taxes, penalties or interest resulting from any assessments could materially and adversely impact our results of operations, financial condition and cash flow.

Even though we have increased and may in the future increase our repatriation of cash earned by our non-U.S. subsidiaries to fund one-time redemptions of our outstanding senior secured notes or other extraordinary corporate events in the United States, we will leave a portion of such cash outside the United States as permanently reinvested earnings and profits. Accordingly, our current estimated annual effective tax rate is based on partial, and not full, repatriation of cash earned by our non-U.S. subsidiaries. If we underestimate our need for repatriated cash, or our needs change, significant tax adjustments may result.

We have anticipated the need for a valuation reserve against deferred tax assets that are expected to arise this year as we repatriate earnings to fund one-time redemptions of our outstanding senior secured notes in the United States. We expect the deferred tax asset to arise from limitations on our ability to recover the foreign taxes paid on repatriated earnings. This calculation is complex and we may have underestimated or overestimated the need for a valuation reserve and significant tax adjustments may result.

24

The obligations associated with being a public company will require significant resources and management attention.

As a public company with listed equity securities, we will need to comply with new laws, regulations and requirements, including the requirements of the Securities Exchange Act of 1934, as amended, which we refer to the Exchange Act, certain corporate governance provisions of the Sarbanes-Oxley Act of 2002, which we refer to as the Sarbanes-Oxley Act, related regulations of the SEC and requirements of the New York Stock Exchange, which we refer to as the NYSE, with which we were not required to comply as a private company. Complying with these statutes, regulations and requirements will occupy a significant amount of time of our board of directors and management and will significantly increase our legal, accounting and other expenses. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires, among other things, that we establish and maintain effective internal controls and procedures for financial reporting. Furthermore, the need to establish the corporate infrastructure demanded of a public company may divert management's attention from implementing our growth strategy, which could prevent us from improving our business, results of operations and financial condition. We have made, and will continue to make, changes to our internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations as a public company. However, the measures we take may not be sufficient to satisfy our obligations. In addition, we cannot predict or estimate the amount of additional costs we may incur in order to comply with these requirements.

Section 404 of the Sarbanes-Oxley Act requires annual management assessments and attestation by our independent registered public accounting firm of the effectiveness of our internal control over financial reporting. Starting with the annual report for the fiscal year ending March 31, 2012, we will be required to file an annual management assessment of the effectiveness of our internal control over financial reporting with the SEC. For the fiscal year ending March 31, 2013, in addition to the management assessment, we will have to file an attestation by our independent registered public accounting firm of the effectiveness of our internal control over financial reporting with the SEC. In connection with the implementation of the necessary procedures and practices related to internal control over financial reporting, we or our independent registered public accounting firm may identify deficiencies that we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. If we fail to comply with Section 404, or if we or our independent registered public accounting firm identify and report a material weakness, it may affect the reliability of our internal control over financial reporting, which could adversely affect the market price of our common stock and subject us to sanctions or investigations by the NYSE, the SEC or other regulatory authorities, which would require additional financial and management resources.

Our current or future indebtedness could impair our financial condition and reduce the funds available to us for other purposes. Our debt agreements impose certain operating and financial restrictions, with which failure to comply could result in an event of default that could adversely affect our results of operations.